We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Explain Gilts/Bonds to me like I am 5 years old please?

Comments

-

Unfortunately I can't keep up with the 5 year old explanation of gilts.Secret2ndAccount said:

TR56 is priced at 55.8 If you hold it for 31 years you will make 78% which annualises at 1.9%. This will be increased by inflation, so inflation + 1.9%. It pays 0.125% annualy so there's inflation + 2%. Very little tax to pay since the coupon is very small.SouthCoastBoy said:But can I get rpi +2% from a gilt, after charges? I've been looking at the gilt prices plus running interest and I don't see such returns?

If you hold the gilt outside an isa or pension you will also need to pay tax on the interest don't you, so no different to holding cash outside an isa?

I could buy this for a fiver on iWeb, and hold it for free.

Returns are only guaranteed if you hold for 31 years, though you would likely be able to sell earlier and get approximately the expected returns, plus/minus market conditions

Short term - 0-2 yr maturities only pay inflation + 1ish. Perhaps only worth it if you are a higher rate tax payer, or have a substantial amount to invest.

Using your TR56 example which I think is this https://www.londonstockexchange.com/stock/TR56/united-kingdom/company-page. I assume TR56 is different from T56 gilts

The pricing seems to vary around 60 (is this pence?) plus ot minus around 10 - so between 50 and 70. This seems to have been dropping, so I can't see where the "gain" is. Also the coupon rate seems to be 0.125%? If so, I can't see where the inflationary income comes from.

I appreciate that I have likely totally misunderstood this so please go easy on me. Just starting to try and learn about gilts.0 -

Generally speaking there is only 1 UK Gov ILG maturing each year. Use https://lategenxer.streamlit.app/Gilt_Ladder, input your desired income and start date (select Index_linked on the advanced menu) and it will show you what is available and suggest which to buy to meet your goal.tigerspill said:

If you don't mind me asking, which ILGs did you go for?GenX0212 said:I took the plunge and started converting my two smaller dc pots into index linked gilts as of today. This will guarantee ~£14k on top of my DB pension of £13.5k until SP kicks in. My main pot of £610k+ is staying invested in stocks and shares.1 -

After reading some of the varied explanations in this thread I have concluded the 5 year old in question is likely a candidate for mensa membership.7

-

Unfortunately I can't keep up with the 5 year old explanation of gilts. ...

Let’s start with conventional gilts – we will cover index linking in a minute:

Conventional Gilts

I am holding a plastic bag containing 100 £1 coins. If you were going to buy it from me, you might reasonably expect to pay me £100. However, there’s a twist. You have to pay me today, but you don’t get the bag of coins for three years. Now you won’t pay me £100 any more. Maybe £90? No, that’s too much. Nobody bites, so I drop the price to £86 and it sells. It’s a market – that’s why the prices fluctuate. What is fixed is the £100 payout, and the date it will occur. Could be a few months or 40 years, but it’s clear up front.

Most people like to see some return on their money before the end date, so we tweak the rules again. Instead of £86, I charge you £90, but agree to pay you £2 per year until the end date (£2 fixed – not dependent on whether you paid £86 or £90 or £100. They call it coupon, not interest). There might be a different gilt available that cost £103, but paid £5 per year. Some people might be happy to take a capital loss (£3) in exchange for the high payout rate. For tax reasons, many people prefer a low coupon (which might be taxable) and a larger capital gain which is tax free.

Index Linked

Index linked gilts work the same way but with a bonus. They don’t pay out £100. They pay out £100 plus inflation, calculated from the issue date to the end date of the gilt. In the case of a 30+ year gilt like TR56, it will pay out maybe £300 at the end – the index linking adds up…

So the gain comes from paying less than £100, and receiving back £100. The index linking results in receiving more than £100. The coupon, for many people is just a few pennies along the way, though there are gilts paying 5% or more if that’s what you want.

Don’t worry too much about the pence / £ thing. It’s a bit confusing because these things come in packs of 100. You pretty quickly realise that it often doesn’t matter whether you are talking pence or £.

TR56 and T56 are two different products, though both are Index Linked Gilts. TR56 is good to hold in taxable accounts since it pays almost no coupon. T56 pays out more than 5% so is best held in a SIPP or ISA for most people. Both expire some time in 2056.

16 -

tigerspill said:

Unfortunately I can't keep up with the 5 year old explanation of gilts.Secret2ndAccount said:

TR56 is priced at 55.8 If you hold it for 31 years you will make 78% which annualises at 1.9%. This will be increased by inflation, so inflation + 1.9%. It pays 0.125% annualy so there's inflation + 2%. Very little tax to pay since the coupon is very small.SouthCoastBoy said:But can I get rpi +2% from a gilt, after charges? I've been looking at the gilt prices plus running interest and I don't see such returns?

If you hold the gilt outside an isa or pension you will also need to pay tax on the interest don't you, so no different to holding cash outside an isa?

I could buy this for a fiver on iWeb, and hold it for free.

Returns are only guaranteed if you hold for 31 years, though you would likely be able to sell earlier and get approximately the expected returns, plus/minus market conditions

Short term - 0-2 yr maturities only pay inflation + 1ish. Perhaps only worth it if you are a higher rate tax payer, or have a substantial amount to invest.

Using your TR56 example which I think is this https://www.londonstockexchange.com/stock/TR56/united-kingdom/company-page. I assume TR56 is different from T56 gilts

The pricing seems to vary around 60 (is this pence?) plus ot minus around 10 - so between 50 and 70. This seems to have been dropping, so I can't see where the "gain" is. Also the coupon rate seems to be 0.125%? If so, I can't see where the inflationary income comes from.

I appreciate that I have likely totally misunderstood this so please go easy on me. Just starting to try and learn about gilts.

This page here gives pricing in a straightforward format:- UK Gilt Prices and Yields

At the top left hand side there are two buttons to switch between conventional and index linked gilts. Click on the Index-linked one.

Scrolling down you find TR56. Follow it along and there are two prices £55.77 and £85.827. The first is theoretical pricing - the second is what you would actually pay to buy one today. That includes accrued index-linking and the interest accrued since the last interest payment. Next to that is the exciting bit, currently 2.059%. That means if you hold it until it matures in 2056 you will get 2.059% pa - not flat - but in excess of inflation. Click on the little arrow next to the interest and you'll get a whole page on TR56 with charts of pricing etc.

If you intend to hold it to maturity, rather than trade it, the price fluctuations don't matter.4 -

Thank you for this - really helpful. This now gives me enough (I think) to try an mak sense of some of the other pages linked. Though I will likely have some more questionsSecret2ndAccount said:Unfortunately I can't keep up with the 5 year old explanation of gilts. ...Let’s start with conventional gilts – we will cover index linking in a minute:

Conventional Gilts

I am holding a plastic bag containing 100 £1 coins. If you were going to buy it from me, you might reasonably expect to pay me £100. However, there’s a twist. You have to pay me today, but you don’t get the bag of coins for three years. Now you won’t pay me £100 any more. Maybe £90? No, that’s too much. Nobody bites, so I drop the price to £86 and it sells. It’s a market – that’s why the prices fluctuate. What is fixed is the £100 payout, and the date it will occur. Could be a few months or 40 years, but it’s clear up front.

Most people like to see some return on their money before the end date, so we tweak the rules again. Instead of £86, I charge you £90, but agree to pay you £2 per year until the end date (£2 fixed – not dependent on whether you paid £86 or £90 or £100. They call it coupon, not interest). There might be a different gilt available that cost £103, but paid £5 per year. Some people might be happy to take a capital loss (£3) in exchange for the high payout rate. For tax reasons, many people prefer a low coupon (which might be taxable) and a larger capital gain which is tax free.

Index Linked

Index linked gilts work the same way but with a bonus. They don’t pay out £100. They pay out £100 plus inflation, calculated from the issue date to the end date of the gilt. In the case of a 30+ year gilt like TR56, it will pay out maybe £300 at the end – the index linking adds up…

So the gain comes from paying less than £100, and receiving back £100. The index linking results in receiving more than £100. The coupon, for many people is just a few pennies along the way, though there are gilts paying 5% or more if that’s what you want.

Don’t worry too much about the pence / £ thing. It’s a bit confusing because these things come in packs of 100. You pretty quickly realise that it often doesn’t matter whether you are talking pence or £.

TR56 and T56 are two different products, though both are Index Linked Gilts. TR56 is good to hold in taxable accounts since it pays almost no coupon. T56 pays out more than 5% so is best held in a SIPP or ISA for most people. Both expire some time in 2056.

0

0 -

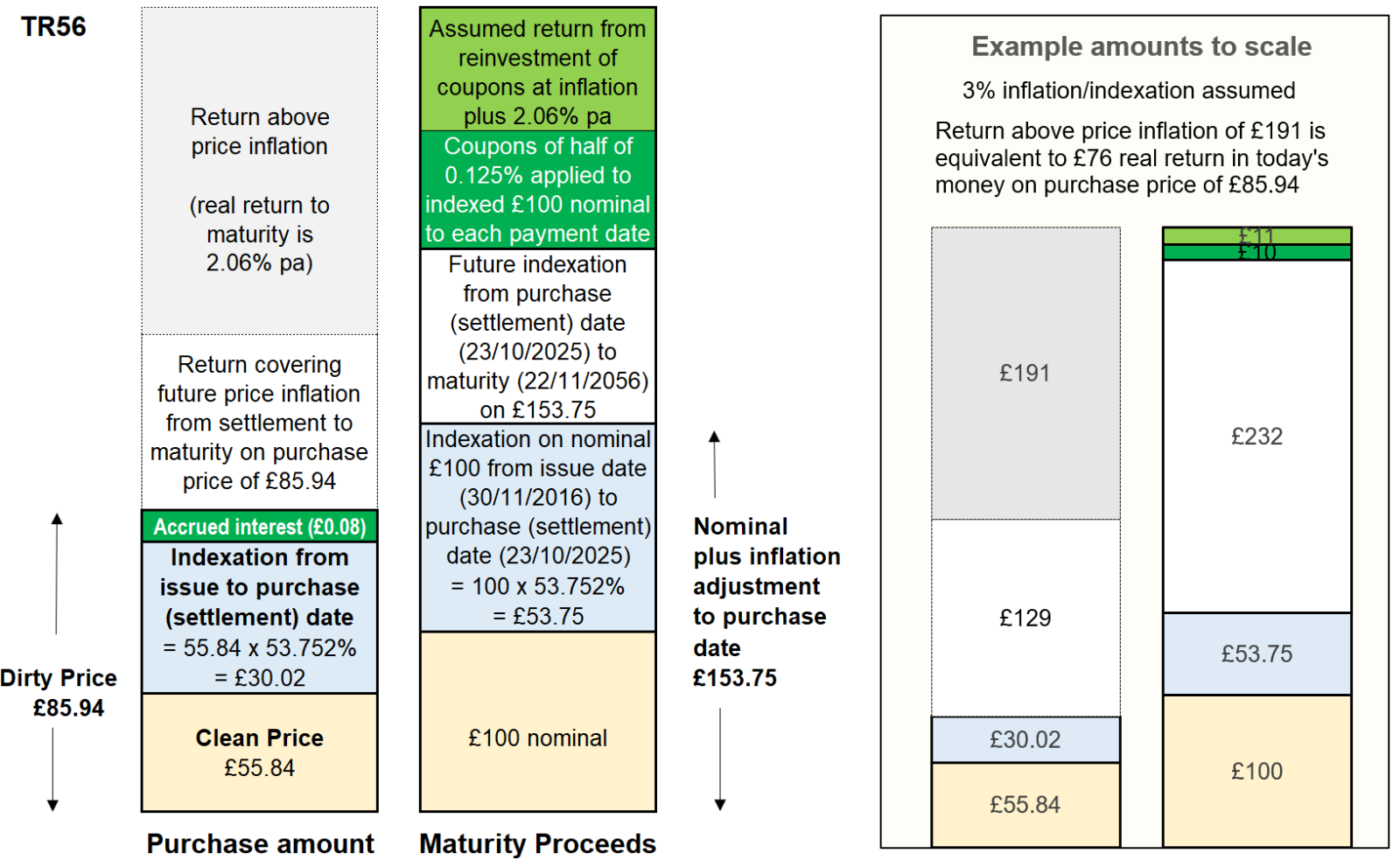

Using the example of TR56 above the image below diagramatically shows what is happening if you buy £100 nominal of this index linked gilt (based on yesterdays closing price). Note that while you are buying £100 nominal there has already been some indexation (i.e. inflation increase) of £53.75 since it was issued. The clean price you may see quoted (£55.84 in this example) doesn't take into account the indexation which has occurred so far while the dirty price that you actually pay (£85.94 in this example) does take into account the indexation to date as well as the accrued interest since the last coupon on 22nd May.

I came, I saw, I melted3

I came, I saw, I melted3 -

Thanks for that great explanation!Secret2ndAccount said:Unfortunately I can't keep up with the 5 year old explanation of gilts. ...Let’s start with conventional gilts – we will cover index linking in a minute:

Conventional Gilts

I am holding a plastic bag containing 100 £1 coins. If you were going to buy it from me, you might reasonably expect to pay me £100. However, there’s a twist. You have to pay me today, but you don’t get the bag of coins for three years. Now you won’t pay me £100 any more. Maybe £90? No, that’s too much. Nobody bites, so I drop the price to £86 and it sells. It’s a market – that’s why the prices fluctuate. What is fixed is the £100 payout, and the date it will occur. Could be a few months or 40 years, but it’s clear up front.

Most people like to see some return on their money before the end date, so we tweak the rules again. Instead of £86, I charge you £90, but agree to pay you £2 per year until the end date (£2 fixed – not dependent on whether you paid £86 or £90 or £100. They call it coupon, not interest). There might be a different gilt available that cost £103, but paid £5 per year. Some people might be happy to take a capital loss (£3) in exchange for the high payout rate. For tax reasons, many people prefer a low coupon (which might be taxable) and a larger capital gain which is tax free.

Index Linked

Index linked gilts work the same way but with a bonus. They don’t pay out £100. They pay out £100 plus inflation, calculated from the issue date to the end date of the gilt. In the case of a 30+ year gilt like TR56, it will pay out maybe £300 at the end – the index linking adds up…

So the gain comes from paying less than £100, and receiving back £100. The index linking results in receiving more than £100. The coupon, for many people is just a few pennies along the way, though there are gilts paying 5% or more if that’s what you want.

Don’t worry too much about the pence / £ thing. It’s a bit confusing because these things come in packs of 100. You pretty quickly realise that it often doesn’t matter whether you are talking pence or £.

TR56 and T56 are two different products, though both are Index Linked Gilts. TR56 is good to hold in taxable accounts since it pays almost no coupon. T56 pays out more than 5% so is best held in a SIPP or ISA for most people. Both expire some time in 2056.

So another question. So if the gilts sit in a SIPP why not just buy T56 and sod all the other gilts? 5% is very respectable income, especially if you have a lot invested. It easily accommodates the 4% rule. Why doesn't everyone just do that? Inflation risk? Maybe, but historically the average inflation rate is a lot less than 5% - nearer two - three percent. Obviously, there is a very real reason why people don't that I don't follow and my level of gilt iliteracy!

I can see that holding TR56 is more of a problem since you wouldn't get any income for 31 years, just the maturity of the gilt delta from what you paid.1 -

I would think that nobody over 55 is going to be buying TR56, it just doesn’t make sense unless there’s a particular ‘niche’ reason for doing so. You will either not be around to see it mature or be at the end of your life with a big chunk of cash.

I see buying a long Gilt like T56 as similar to a flat annuity but with flexibility as it can be sold or even inherited in a Sipp. It won’t be worth much in 2056 though.At 60 I won’t be going that far out, I may consider 2040 maturity, 2045 at the very latest.

Not really sure tbh.

I have a small ladder from 2034-38 in conventional gilts averaging at 4.2% coupons which will give me almost £3K a year x 5. I’ll probably gift the income to my Grandson as he will be leaving school in 2036 and it will use my gifting allowance, if it’s not abolished by the current Govt.2 -

Historically, since late 1931 (when the UK left the gold standard) annualised inflation has been about 4.5% so closer to 5% than the current target of 2%.MetaPhysical said:

Thanks for that great explanation!Secret2ndAccount said:Unfortunately I can't keep up with the 5 year old explanation of gilts. ...Let’s start with conventional gilts – we will cover index linking in a minute:

Conventional Gilts

I am holding a plastic bag containing 100 £1 coins. If you were going to buy it from me, you might reasonably expect to pay me £100. However, there’s a twist. You have to pay me today, but you don’t get the bag of coins for three years. Now you won’t pay me £100 any more. Maybe £90? No, that’s too much. Nobody bites, so I drop the price to £86 and it sells. It’s a market – that’s why the prices fluctuate. What is fixed is the £100 payout, and the date it will occur. Could be a few months or 40 years, but it’s clear up front.

Most people like to see some return on their money before the end date, so we tweak the rules again. Instead of £86, I charge you £90, but agree to pay you £2 per year until the end date (£2 fixed – not dependent on whether you paid £86 or £90 or £100. They call it coupon, not interest). There might be a different gilt available that cost £103, but paid £5 per year. Some people might be happy to take a capital loss (£3) in exchange for the high payout rate. For tax reasons, many people prefer a low coupon (which might be taxable) and a larger capital gain which is tax free.

Index Linked

Index linked gilts work the same way but with a bonus. They don’t pay out £100. They pay out £100 plus inflation, calculated from the issue date to the end date of the gilt. In the case of a 30+ year gilt like TR56, it will pay out maybe £300 at the end – the index linking adds up…

So the gain comes from paying less than £100, and receiving back £100. The index linking results in receiving more than £100. The coupon, for many people is just a few pennies along the way, though there are gilts paying 5% or more if that’s what you want.

Don’t worry too much about the pence / £ thing. It’s a bit confusing because these things come in packs of 100. You pretty quickly realise that it often doesn’t matter whether you are talking pence or £.

TR56 and T56 are two different products, though both are Index Linked Gilts. TR56 is good to hold in taxable accounts since it pays almost no coupon. T56 pays out more than 5% so is best held in a SIPP or ISA for most people. Both expire some time in 2056.

So another question. So if the gilts sit in a SIPP why not just buy T56 and sod all the other gilts? 5% is very respectable income, especially if you have a lot invested. It easily accommodates the 4% rule. Why doesn't everyone just do that? Inflation risk? Maybe, but historically the average inflation rate is a lot less than 5% - nearer two - three percent. Obviously, there is a very real reason why people don't that I don't follow and my level of gilt iliteracy!

I can see that holding TR56 is more of a problem since you wouldn't get any income for 31 years, just the maturity of the gilt delta from what you paid.

So, the effects of inflation on a 5% nominal income stream could be severe, e.g., a decade of inflation at the average rate would reduce the initial 5% income to about 3.2% in real terms. More importantly, it is sequence of inflation that determines the effect since a period of high inflation at the beginning of retirement has more of an effect than towards the end.

But otherwise, holding a single or small number of gilts and living off the coupons is a realistic possibility (some of the earliest gilts in the 18th and 19th centuries were somewhat confusingly called 'annuities', e.g., Jane Austen's novels often convert wealth to income on the basis of holding 5% gilts/annuities), is less complex than a gilt ladder, and leaves the principal untouched, at least in nominal terms. Of course, the index linked alternative (e.g., TR49) only provides inflation protected income from coupons worth 1.875*100/95.04=2% of principal but would mature at a value of 100/95.04 (there are currently no other long-term ILGs with coupons greater than 1.25%).

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards