We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Benefits of topping up

smallzoo2

Posts: 363 Forumite

I'm a bit confused about the top ups

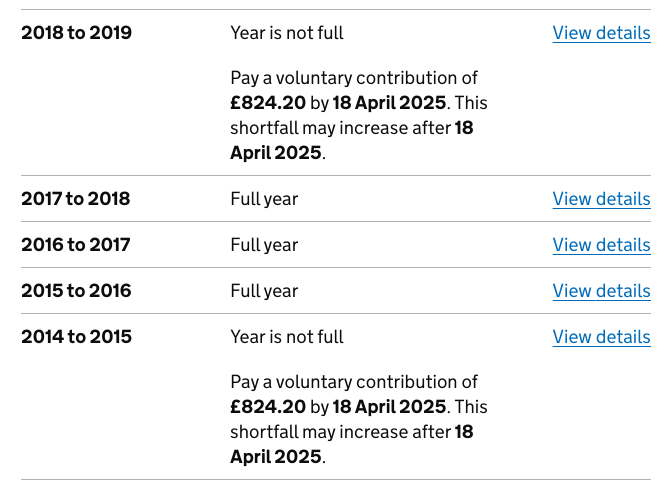

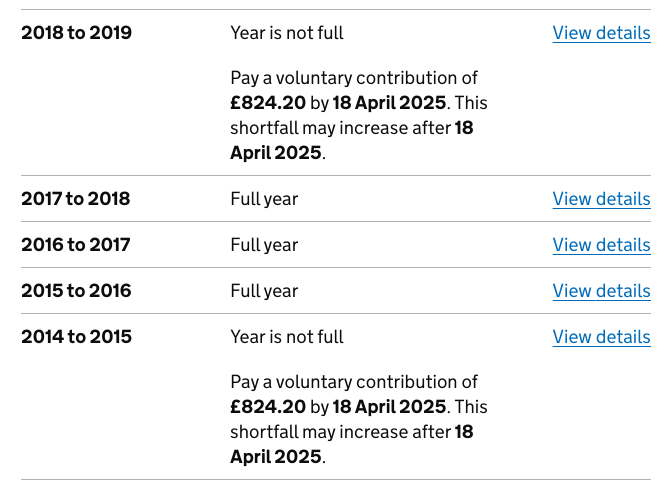

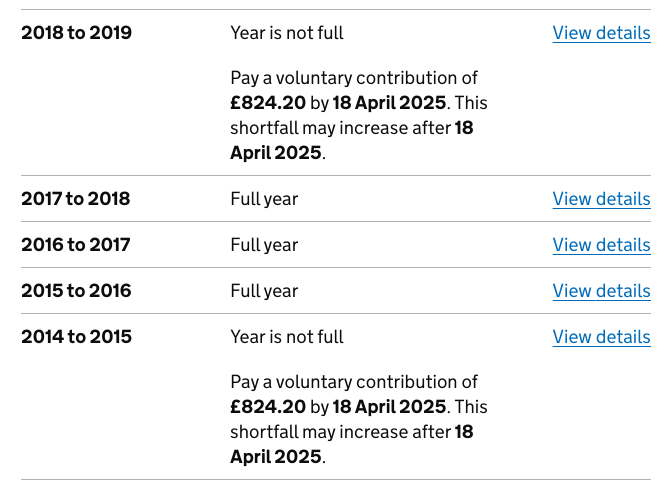

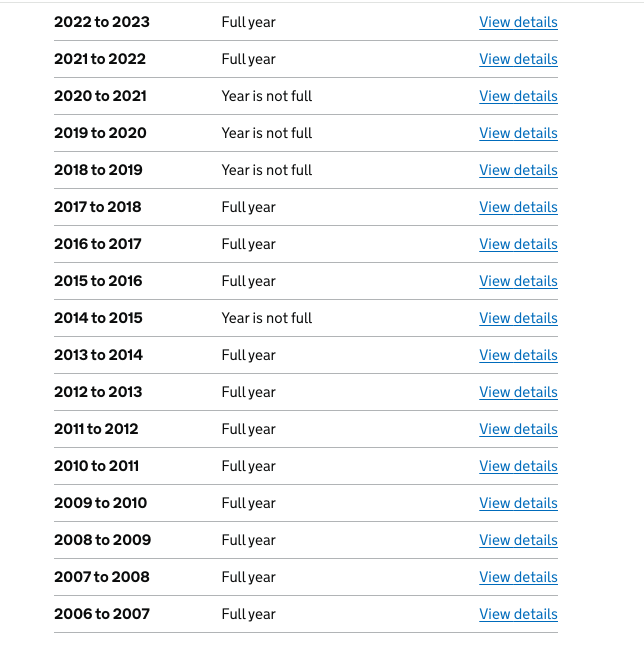

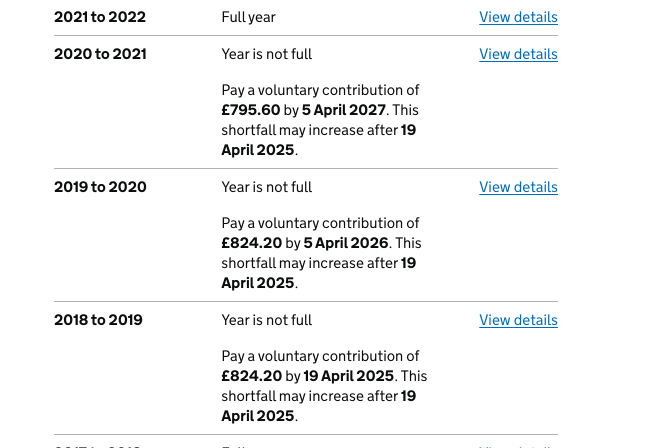

I was 66 in jan 2024 so already claiming a state pension. I looked up on the gov website and its says that I had a shortfall in two years that have to be topped up before 5th april 2025 BUT it doesnt say what affect that will have on my pension

How do I know just how much extra this would pay me... am I missing something ?

I was 66 in jan 2024 so already claiming a state pension. I looked up on the gov website and its says that I had a shortfall in two years that have to be topped up before 5th april 2025 BUT it doesnt say what affect that will have on my pension

How do I know just how much extra this would pay me... am I missing something ?

0

Comments

-

Maybe, maybe not.smallzoo2 said:I'm a bit confused about the top ups

I was 66 in jan 2024 so already claiming a state pension. I looked up on the gov website and its says that I had a shortfall in two years that have to be topped up before 5th april 2025 BUT it doesnt say what affect that will have on my pension

How do I know just how much extra this would pay me... am I missing something ?

But we are.

How much is your current weekly State Pension for a start.0 -

£209

thanks0 -

18-19 will add £6.32 per week. What 14-15 will add, if anything at all, is dependent on a number of factors.How many full NI years 15-16 and earlier ?

How many full NI years 16-17 and later ?

Were you in a contracted-out pension scheme ?0 -

This is my full record

I have bee a software contractor on anf off for many years and some years employed. I am currently employed paye 4 days a week0 -

So forget about 14-15. 2 of those post 2016 years will take you to the full £221.20, one will add £6.32 and the second up to £5.88 depending on if there are any pence after that £209. You need to get a call booked now. Request a call back to pay voluntary National Insurance contributions - GOV.UK The only urgency is that 19-20 and 20-21 will increase in price to £923 from April, other than that you have until April 2026 to pay for 19-20.

0 -

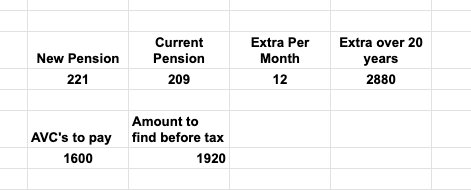

Sorry to question this... I did some maths

Based on your figures then over 20 years I would make an extra £2880... ( although isnt that before tax )

In order to find the first two AVC's you mention to take it up to 221 I would have to raid one of my small pensions and because I have already taken the tax free amount out then I would have to take out £1920 to get the £1600 AVC's

So. am I correct in saying that for all this hassle I would only earn about an extra £900 over 20 years ?

0 -

£209 to £221 is £12 per week, £624 pa so the £1620 will be recouped gross in 2.6 years. To get £1620 from your taxable pension would need £2025 withdrawing so the £499 net additional pension would cover that in 4 years. Pay that £9.60 per week net pension back into a personal pension and that £2025 will be repaid in 39 months.0

-

As at @molerat says the extra £12 is per week not per month.smallzoo2 said:Sorry to question this... I did some maths

Based on your figures then over 20 years I would make an extra £2880... ( although isnt that before tax )

In order to find the first two AVC's you mention to take it up to 221 I would have to raid one of my small pensions and because I have already taken the tax free amount out then I would have to take out £1920 to get the £1600 AVC's

So. am I correct in saying that for all this hassle I would only earn about an extra £900 over 20 years ?

If you thought your State Pension was £209 per month then this thread will have made you an extremely happy bunny as you will now be getting 4.33 times as much State pension as you were expecting to get when you first posted 😉

And that's before the extra £12/week is added on!

That £12/week is worth £12,480 over 20 years. However because of the triple lock the actual amount will be far more than that once the annual inflation increases are added each year.

The extra £12/week will be worth £12.49 or £12.50/week in 2025-26.0 -

oops... sorry !Dazed_and_C0nfused said:

As at @molerat says the extra £12 is per week not per month.smallzoo2 said:Sorry to question this... I did some maths

Based on your figures then over 20 years I would make an extra £2880... ( although isnt that before tax )

In order to find the first two AVC's you mention to take it up to 221 I would have to raid one of my small pensions and because I have already taken the tax free amount out then I would have to take out £1920 to get the £1600 AVC's

So. am I correct in saying that for all this hassle I would only earn about an extra £900 over 20 years ?

If you thought your State Pension was £209 per month then this thread will have made you an extremely happy bunny as you will now be getting 4.33 times as much State pension as you were expecting to get when you first posted 😉

And that's before the extra £12/week is added on!

That £12/week is worth £12,480 over 20 years. However because of the triple lock the actual amount will be far more than that once the annual inflation increases are added each year.

The extra £12/week will be worth £12.49 or £12.50/week in 2025-26.0 -

I asked my previous accountant who I used in those years and he said the NI was paid so I would have to talk to NI advisors in HMRC and ask why... I see a long conversstion coming !0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards