We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Annuity quotes - don't understand

Comments

-

Does the spouse have medical conditions that result in an enhanced annuity being quoted vs a single life with no medical conditions resulting in a standard lifetime annuity?squirrelpie said:

Yes, I understand all that. But how can a joint life quote be better than a single life quote for one of the couple?dunstonh said:Why are our ages relevant to my question?Age is one of the most important pricing points. And with 100% spouse, they will look at the longest life expectancy from both of you vs single life where it is just your life expectancy.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

I thought you said it made the quote worse. "Then I did one with just my own life to see how much it would improve, but the result was worse than the 50% joint rate!"squirrelpie said:I am male and my wife is female. I'm not including any guarantees or anything. I selected RPI inflation protection. My wife has several health conditions, but I don't see why taking her off the quote would make the quote better. Why are our ages relevant to my question?I haven't yet got quotes from an alternative source. I was hoping to understand the reason before I did.

Having a health condition can improve the annuity rate. A quote for a healthy person will presumably be worse than for a couple where one has a health condition (though I am guessing there)

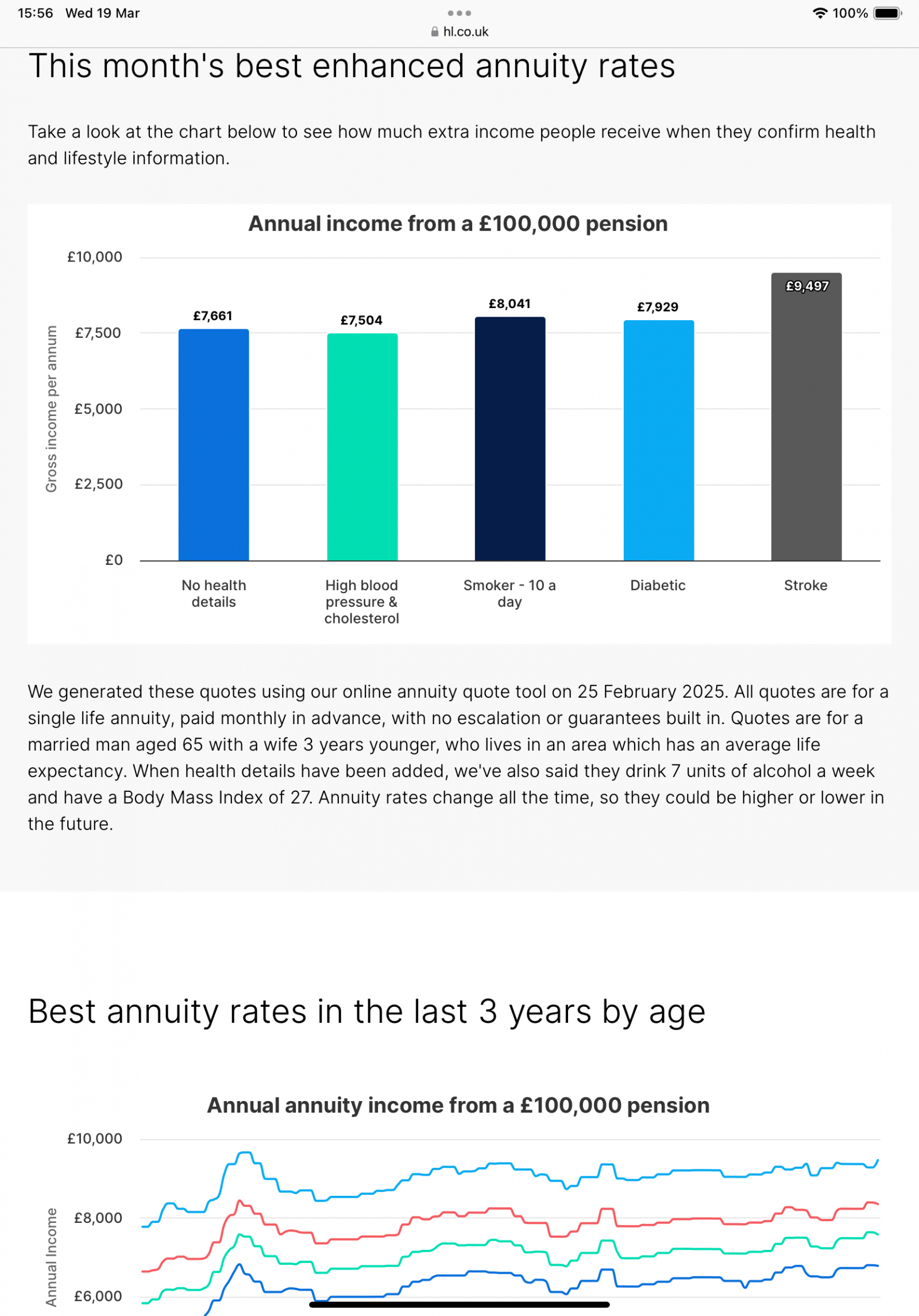

I agree that you would think covering two people would be more expensive than one but if you look at the best annuity rates on HL's site there are some places where a joint life is cheaper than a single (albeit with different pension increases and only at certain ages.)1 -

You get less annuity income if you suffer from high blood pressure and cholesterol!

Presumably because your health is being monitored which should improve your longevity. ure

ure

1 -

You get less annuity income if you suffer from high blood pressure and cholesterol!In those rare scenarios, you would not apply for the enhanced lifetime annuity but instead go with the standard lifetime annuity rate. So, HL's scenario wouldn't happen in real life (although theoretically it could if the person didn't realise they could revert to standard terms)

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Sorry, yes a typo in the latter post. I was right the first time!DRS1 said:

I thought you said it made the quote worse. "Then I did one with just my own life to see how much it would improve, but the result was worse than the 50% joint rate!"squirrelpie said:I am male and my wife is female. I'm not including any guarantees or anything. I selected RPI inflation protection. My wife has several health conditions, but I don't see why taking her off the quote would make the quote better. Why are our ages relevant to my question?I haven't yet got quotes from an alternative source. I was hoping to understand the reason before I did.

Having a health condition can improve the annuity rate. A quote for a healthy person will presumably be worse than for a couple where one has a health condition (though I am guessing there)

I agree that you would think covering two people would be more expensive than one but if you look at the best annuity rates on HL's site there are some places where a joint life is cheaper than a single (albeit with different pension increases and only at certain ages.)

0 -

Yes, I think you're right. I was hung up on the idea that a quote on joint lives must be worse than a single, but that came from thinking about 100% continuance rates. If I think about the 50% continuance rate and if they think she'll die before me then they will pay less than paying 100% over my lifetime. Obvious really, once you know!DRS1 said:

I thought you said it made the quote worse. "Then I did one with just my own life to see how much it would improve, but the result was worse than the 50% joint rate!"squirrelpie said:I am male and my wife is female. I'm not including any guarantees or anything. I selected RPI inflation protection. My wife has several health conditions, but I don't see why taking her off the quote would make the quote better. Why are our ages relevant to my question?I haven't yet got quotes from an alternative source. I was hoping to understand the reason before I did.

Having a health condition can improve the annuity rate. A quote for a healthy person will presumably be worse than for a couple where one has a health condition (though I am guessing there)

I agree that you would think covering two people would be more expensive than one but if you look at the best annuity rates on HL's site there are some places where a joint life is cheaper than a single (albeit with different pension increases and only at certain ages.)

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards