We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help with 25/26 tax code assessment

mistryjayesh

Posts: 17 Forumite

in Cutting tax

Hi

I have just been notified that my 25-26 tax code is available and has changed drastically.

I have just been notified that my 25-26 tax code is available and has changed drastically.

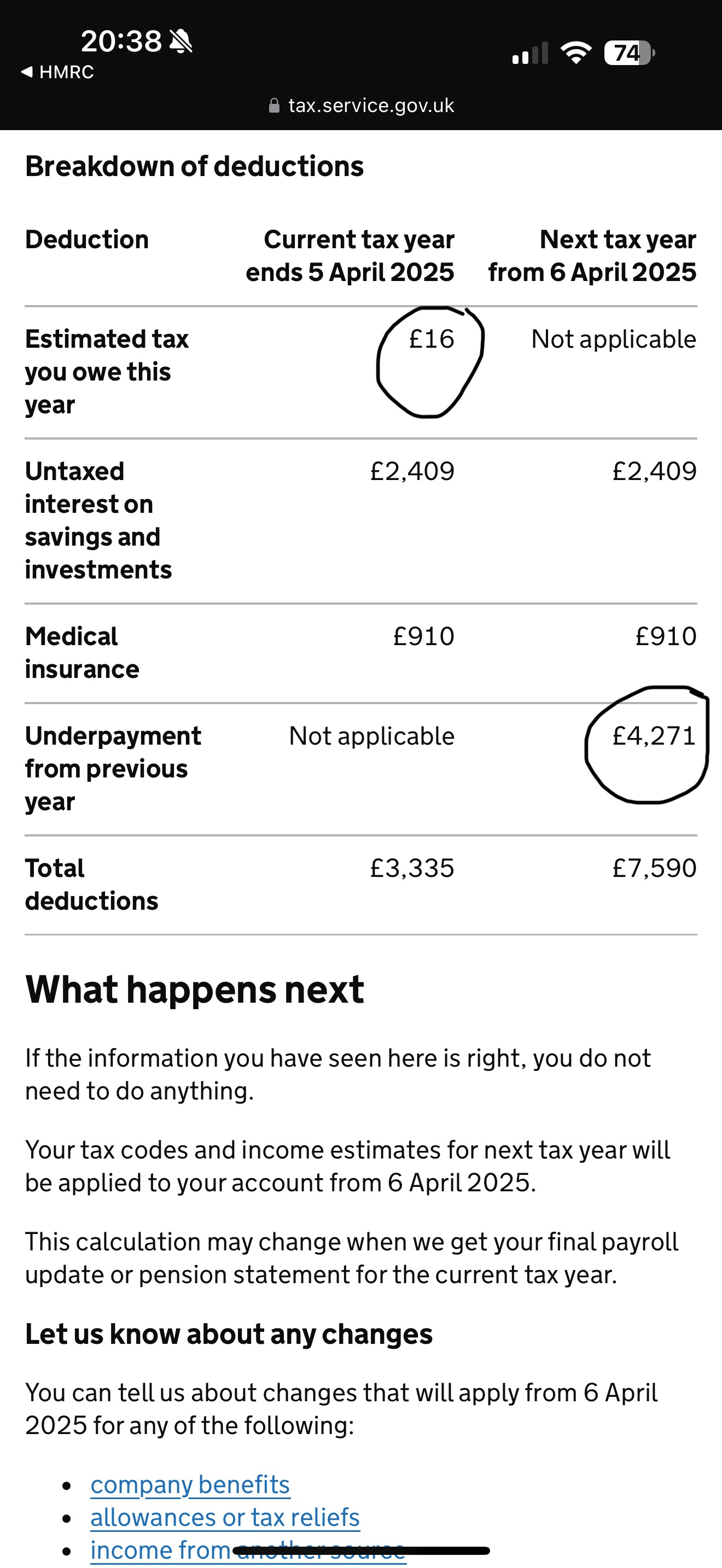

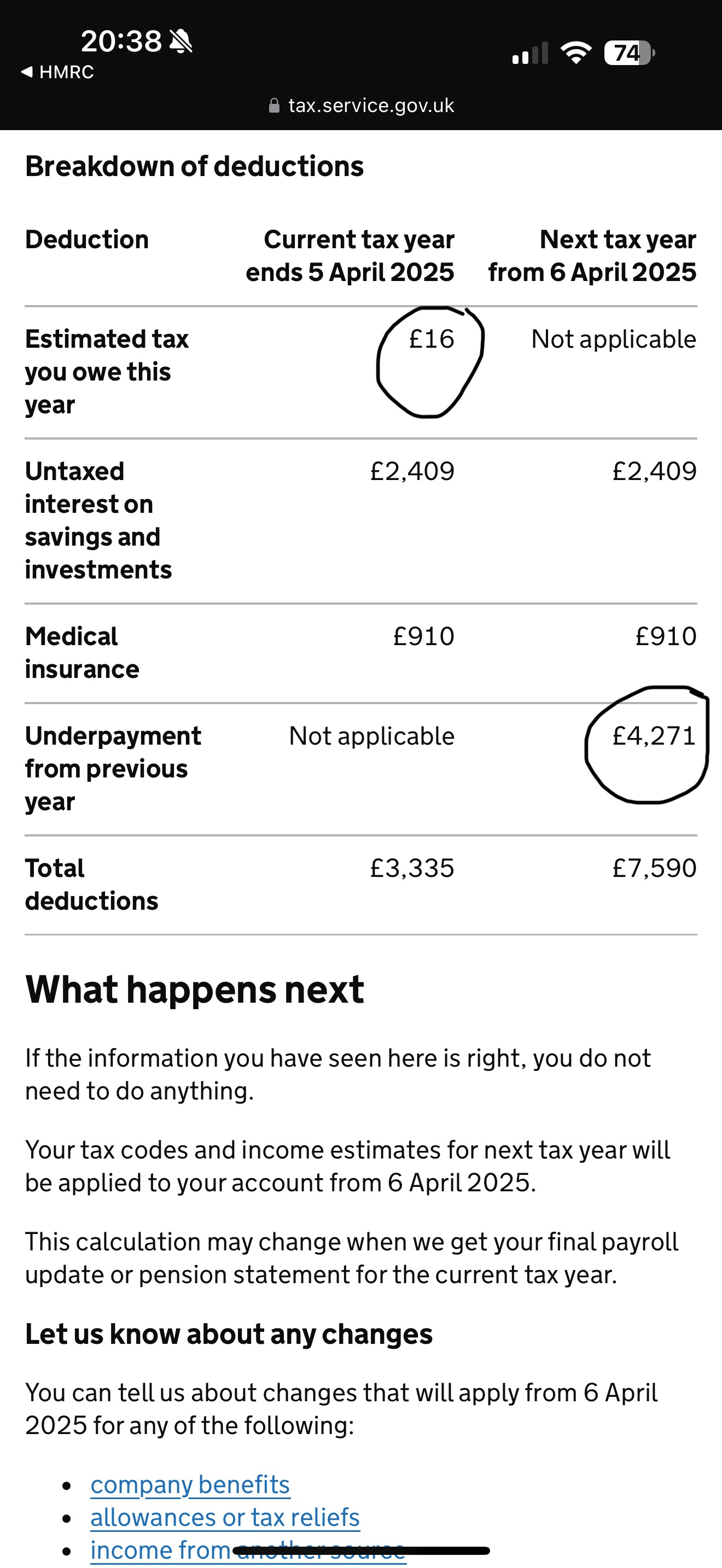

See photo attached

so for 25-26 tax year it says I owe £4271 from previous year but in current tax year is says I only owe £16 so my question is where has that figure come from?

so for 25-26 tax year it says I owe £4271 from previous year but in current tax year is says I only owe £16 so my question is where has that figure come from?

Any help is appreciated

0

Comments

-

That isn't £4,271 that you owe.

It is a (badly worded) tax code deduction of £4,271 which is needed so you will pay £854 extra tax. Or maybe more than £854 if you aren't a straightforward basic rate payer.

If you use the web version you might be able to see more information, particularly relating to your current tax code or a calculation for 2023-24, either of which will probably help understand the tax owed.

Details of your expected pay for 2025-26 will help understand what the £4,271 is trying to collect.1 -

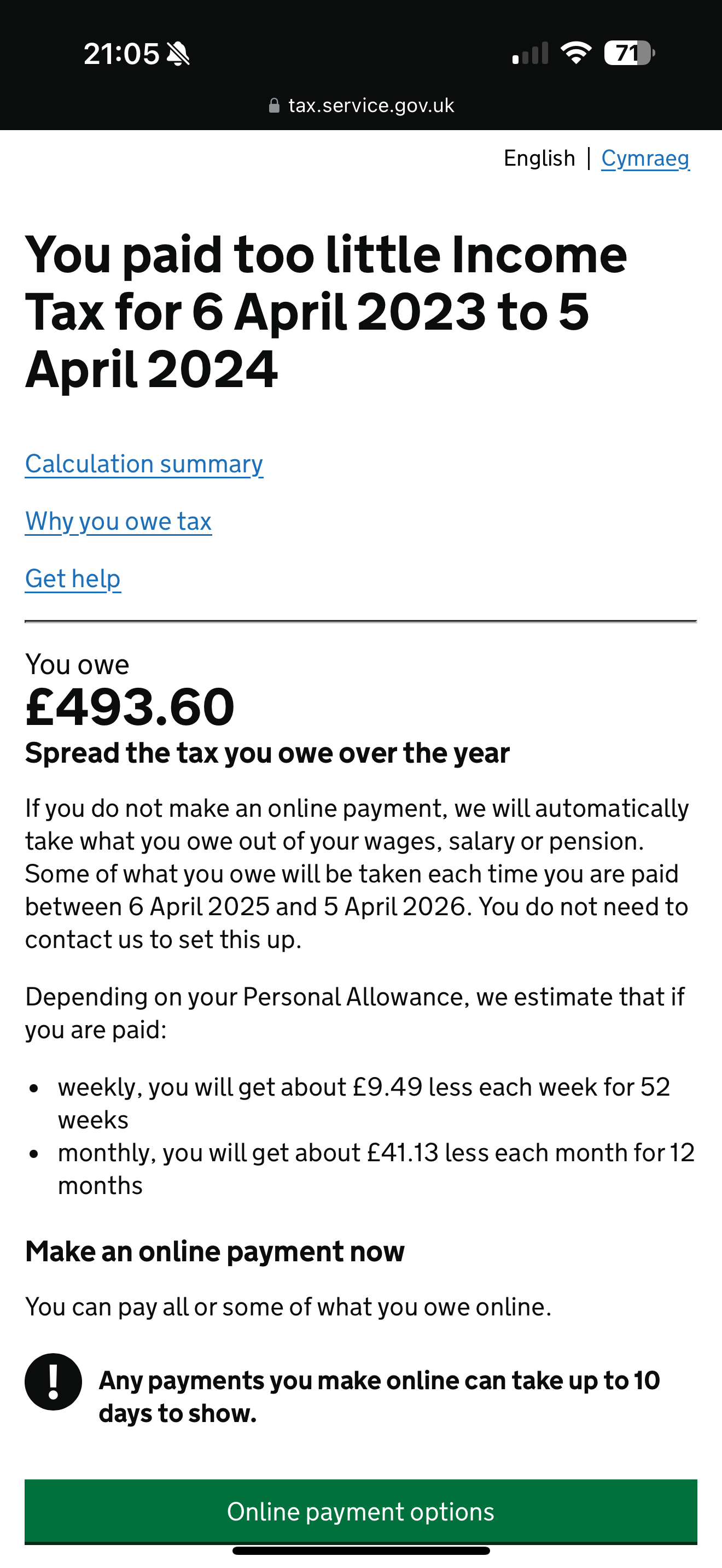

I have just had a look and for 2023/2024 it shows this -

and for 2024-2025 it says I have around £2409 of untaxed interest

does that sound right?

Also if I call them up do I have the option to settle any outstanding tax and my tax code can be adjusted?

0 -

So I think what is likely to have happened is,

1. You owe £493.60 for 2023-24.

2. You owe £360+ for 2024-25 (this is just an estimate)

A small part of what you owe for 2024-25 is being collected via your tax code for 2024-25 (that is what the £16 relates to).

Everything else is being collected via your 2025-26 tax code, hence the £4,271 deduction.

You can definitely pay the £493.60 and get that out of the way and have an improved tax code for 2025-26.

Personally I wouldn't pay anything for 2024-25 until knowing the final position. It could be you have paid too much (likely if your untaxed interest in 2024-25 is less than it was in 2023-24).3 -

Thank you appreciate the advise, if I pay the £493 online which it appears I can will my tax code change quite soon to reflect this?Dazed_and_C0nfused said:So I think what is likely to have happened is,

1. You owe £493.60 for 2023-24.

2. You owe £360+ for 2024-25 (this is just an estimate)

A small part of what you owe for 2024-25 is being collected via your tax code for 2024-25 (that is what the £16 relates to).

Everything else is being collected via your 2025-26 tax code, hence the £4,271 deduction.

You can definitely pay the £493.60 and get that out of the way and have an improved tax code for 2025-26.

Personally I wouldn't pay anything for 2024-25 until knowing the final position. It could be you have paid too much (likely if your untaxed interest in 2024-25 is less than it was in 2023-24).

0 -

I haven't done that myself so not 100% sure but I would expect a new code within a week or two.mistryjayesh said:

Thank you appreciate the advise, if I pay the £493 online which it appears I can will my tax code change quite soon to reflect this?Dazed_and_C0nfused said:So I think what is likely to have happened is,

1. You owe £493.60 for 2023-24.

2. You owe £360+ for 2024-25 (this is just an estimate)

A small part of what you owe for 2024-25 is being collected via your tax code for 2024-25 (that is what the £16 relates to).

Everything else is being collected via your 2025-26 tax code, hence the £4,271 deduction.

You can definitely pay the £493.60 and get that out of the way and have an improved tax code for 2025-26.

Personally I wouldn't pay anything for 2024-25 until knowing the final position. It could be you have paid too much (likely if your untaxed interest in 2024-25 is less than it was in 2023-24).

Certainly in plenty of time for the first payday in the new tax year starting on 6 April3 -

Thank you appreciate the help1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards