We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Mileage Tax relief help

Comments

-

I'm at £2200 at the minute, what happens if I'm over £2500? I've not seen anything about this unless I overlooked it.Dazed_and_C0nfused said:Given it is now March why would you want to have to all this twice 🤔

Just wait until you have all the details to 5 April and then submit your claim. Assuming it is for no more than £2,500 of expenses.0 -

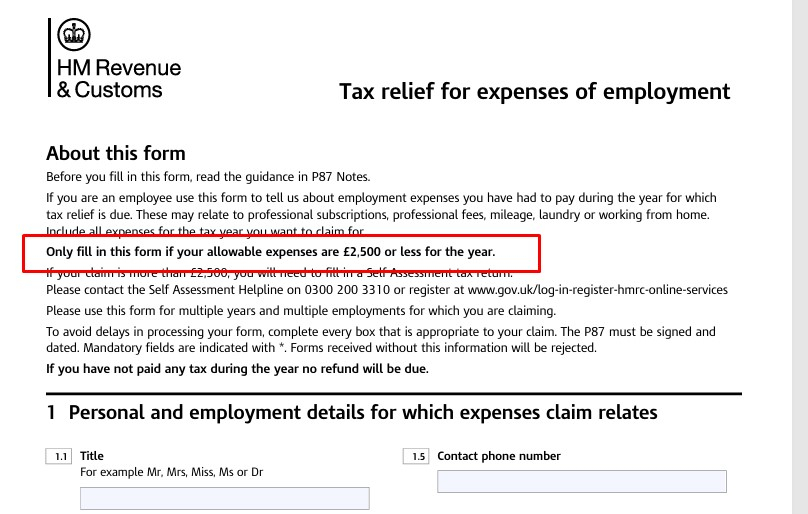

as it says on the webpage and the form, if total expenses are >£2,500 you can only claim via a self assessment tax returnBaggi0_ said:

I'm at £2200 at the minute, what happens if I'm over £2500? I've not seen anything about this unless I overlooked it.Dazed_and_C0nfused said:Given it is now March why would you want to have to all this twice 🤔

Just wait until you have all the details to 5 April and then submit your claim. Assuming it is for no more than £2,500 of expenses.

if you want to avoid being in tax return territory then don't claim too much!

Claim tax relief for your job expenses by post - GOV.UK

0 -

Although at the moment you actually have to provide more information outside of Self Assessment, which is a novelty!Bookworm105 said:

as it says on the webpage and the form, if total expenses are >£2,500 you can only claim via a self assessment tax returnBaggi0_ said:

I'm at £2200 at the minute, what happens if I'm over £2500? I've not seen anything about this unless I overlooked it.Dazed_and_C0nfused said:Given it is now March why would you want to have to all this twice 🤔

Just wait until you have all the details to 5 April and then submit your claim. Assuming it is for no more than £2,500 of expenses.

if you want to avoid being in tax return territory then don't claim too much!

Claim tax relief for your job expenses by post - GOV.UK 0

0 -

Ah OK, thanks. I was looking at the online one and it doesn't state that on there for some reason.Bookworm105 said:as it says on the webpage and the form, if total expenses are >£2,500 you can only claim via a self assessment tax return

if you want to avoid being in tax return territory then don't claim too much!

Claim tax relief for your job expenses by post - GOV.UK

https://www.gov.uk/tax-relief-for-employees

Thanks for letting me know.0 -

It does mention it once you get into the online version. But it's not really clear why this isn't called out earlier.Baggi0_ said:

Ah OK, thanks. I was looking at the online one and it doesn't state that on there for some reason.Bookworm105 said:as it says on the webpage and the form, if total expenses are >£2,500 you can only claim via a self assessment tax return

if you want to avoid being in tax return territory then don't claim too much!

Claim tax relief for your job expenses by post - GOV.UK

https://www.gov.uk/tax-relief-for-employees

Thanks for letting me know.0 -

Another question.

It's looking like I'm going to be over 10,000 miles by April 5th and seeing as I'm getting over what would be the reduced rate of 25p from my employer already, should I just stop recording my mileages in my log after 10,000 miles or carry on for transparency but not calculate that into it when I submit it and pay the tax that it says in the online form?If your employer pays you more than the approved amount of Mileage Allowance Relief you’ll have to pay tax on the difference.Is omitting it to not pay the tax even legal or is this common practice to stop at 10,000 miles?0 -

No - you include all mileage and reimbursement.Baggi0_ said:Another question.

It's looking like I'm going to be over 10,000 miles by April 5th and seeing as I'm getting over what would be the reduced rate of 25p from my employer already, should I just stop recording my mileages in my log after 10,000 miles or carry on for transparency but not calculate that into it when I submit it and pay the tax that it says in the online form?If your employer pays you more than the approved amount of Mileage Allowance Relief you’ll have to pay tax on the difference.Is omitting it to not pay the tax even legal or is this common practice to stop at 10,000 miles?How would HMRC know that you receive 25p per mile over 10000 and not, for example, 10p or 45p?0 -

Do employers tell HMRC how much they've paid in mileage expenses for each employee? If they do, HMRC will know if you're fiddling the numbers![Deleted User] said:No - you include all mileage and reimbursement.How would HMRC know that you receive 25p per mile over 10000 and not, for example, 10p or 45p?N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.0 -

Employer are subject to inspections of PAYE records periodically.QrizB said:

Do employers tell HMRC how much they've paid in mileage expenses for each employee? If they do, HMRC will know if you're fiddling the numbers![Deleted User] said:No - you include all mileage and reimbursement.How would HMRC know that you receive 25p per mile over 10000 and not, for example, 10p or 45p?You would also be required to provide full records in the event of any HMRC query.0 -

do you mean not claim any mileage over 10,000 from your employer?Baggi0_ said:Another question.

It's looking like I'm going to be over 10,000 miles by April 5th and seeing as I'm getting over what would be the reduced rate of 25p from my employer already, should I just stop recording my mileages in my log after 10,000 miles or carry on for transparency but not calculate that into it when I submit it and pay the tax that it says in the online form?If your employer pays you more than the approved amount of Mileage Allowance Relief you’ll have to pay tax on the difference.Is omitting it to not pay the tax even legal or is this common practice to stop at 10,000 miles?

or do you mean take the money from the employer but not declare it to HMRC ?

if your employer pays >25ppm after 10,000 miles then they are i) a very generous employer and ii) you would have a tax liability on that money which would of course net off with your tax refund due on the first 10,000 miles leaving you with a smaller tax refund.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards