We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Do I really need an IFA to draw my pension?

Comments

-

Transactional advice is one off or ad-hoc. You pay for that piece of work only and nothing else thereafter.quantum said:

What and how do you mean please?wjr4 said:

You can pay for transactional financial advice.quantum said:

Yes that would be good. Not sure on £70k who'd be interested...wjr4 said:

Find a company that charges a fixed fee based on the work, not a percentage, especially not a percentage without a cap!Qyburn said:

That was what put us off. All we knew is that they typically wanted a 3% fee for reviewing our pensions, saving and drawing up a retirement plan. Plus some confident waffle about us saving at least that much in tax. It's a shame they don't offer staged advice, initially explanatory discussions for a few hundred (or even a couple of thousand) so you can see how you get on. Rather than having to blindly chuck nearly £20k to them and hope it works out well.Cobbler_tone said:

So in a nutshell, there is absolutely no way of knowing if a small IFA is going to do a good job for you?

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Is this actually available?dunstonh said:

Transactional advice is one off or ad-hoc. You pay for that piece of work only and nothing else thereafter.quantum said:

What and how do you mean please?wjr4 said:

You can pay for transactional financial advice.quantum said:

Yes that would be good. Not sure on £70k who'd be interested...wjr4 said:

Find a company that charges a fixed fee based on the work, not a percentage, especially not a percentage without a cap!Qyburn said:

That was what put us off. All we knew is that they typically wanted a 3% fee for reviewing our pensions, saving and drawing up a retirement plan. Plus some confident waffle about us saving at least that much in tax. It's a shame they don't offer staged advice, initially explanatory discussions for a few hundred (or even a couple of thousand) so you can see how you get on. Rather than having to blindly chuck nearly £20k to them and hope it works out well.Cobbler_tone said:

So in a nutshell, there is absolutely no way of knowing if a small IFA is going to do a good job for you?0 -

Every IFA should offer it. Ongoing servicing is optional and cannot be mandated by the advice firm. It may not be offered by FAs within their business model.quantum said:

Is this actually available?dunstonh said:

Transactional advice is one off or ad-hoc. You pay for that piece of work only and nothing else thereafter.quantum said:

What and how do you mean please?wjr4 said:

You can pay for transactional financial advice.quantum said:

Yes that would be good. Not sure on £70k who'd be interested...wjr4 said:

Find a company that charges a fixed fee based on the work, not a percentage, especially not a percentage without a cap!Qyburn said:

That was what put us off. All we knew is that they typically wanted a 3% fee for reviewing our pensions, saving and drawing up a retirement plan. Plus some confident waffle about us saving at least that much in tax. It's a shame they don't offer staged advice, initially explanatory discussions for a few hundred (or even a couple of thousand) so you can see how you get on. Rather than having to blindly chuck nearly £20k to them and hope it works out well.Cobbler_tone said:

So in a nutshell, there is absolutely no way of knowing if a small IFA is going to do a good job for you?I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Good suggestions here 👍ian16527 said:

If its a DB pension it would be best to contact your pension. They will give you the answers you are after. I think most of the answers on this thread were based on you having a DC pension. I think this was because you stated a pension pot value.quantum said:

Yes indeed that's what I was told by Pensionwise. He said that was very good. I just need to make a decision on the option. I'm not sure if once you've chosen whether there's flexibility if situations change... 🤷wjr4 said:

That’s a defined benefit pension.quantum said:My biggest pot options...

1. Max cash sum and reduced Pension

2. Annual Pension, no Cash lump

2a. Max Cash Sum and additional bridging pension payable till State Pension Date (I'm 62 and therefore it's 67).

2b An additional bridging pension payable till SPD and no cash sum

3. Transfer Value

When you get the figures from your pension admin come back and post them on here to see if its a good deal with regards to Tax free cash and monthly figures.

Once you take your DB pension then this is what you get other than yearly increases if that's in your scheme, for life

@quantum - contact the pension company for more information.

I would clarify whether it is reduced by taking it now rather than later - for example, I have a small local authority DB pension, and I was able to take it at age 60 - waiting until I was 62 would have given me no more money, so made no sense putting it off. In my case, I didn’t desperately need a cash lump sum, so took the smallest amount allowed with the maximum pension - effectively your option 2.

That said, with your struggle to find work, it sounds like you need to start taking it.

Return with some numbers and people will likely offer helpful suggestions.

I would also ask whether you NEED a cash lump sum. If not, then *usually* taking a larger pension makes sense.

Options 2a and 2b are interesting.

I may have missed it in the thread, but have you been on the Government Gateway site to check you qualify for the maximum State Pension?

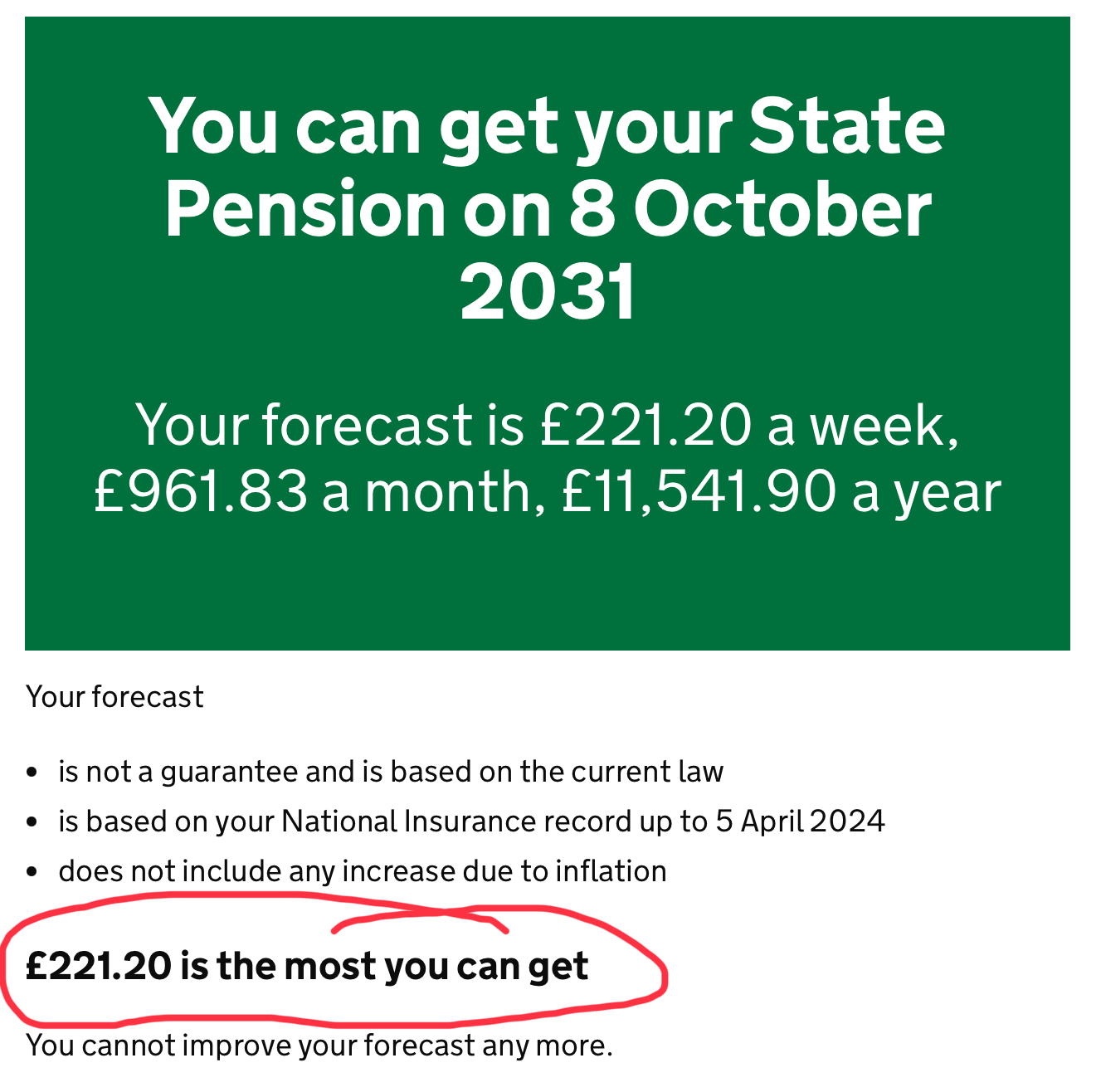

Check the forecast, and also the number below - highlighted here:

(sorry, no idea how to shrink that image, it won’t let me click & drag on my iPad🙄)

Let us know how you get on!Plan for tomorrow, enjoy today!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards