We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Looking for pension and retirement advice - in unusual circumstances

Comments

-

I completely agree. Personally, I could never do HMO and am quite happy having a good relationship with my tenants who've been there the last 8 years. If ever they have a problem, I make sure it's sorted out ASAP. Their quality of life matters to me, which is why HMO is not a possibility - despite the potentially huge returns. The cost to me would be greater.Yes, I wouldn't recommend starting a BTL today. Doing HMO type thing would not be for me as it makes things a lot more complicated and I like dealing with a single tenant which is why I just have the one bed flat. The OP has options and selling up and investing might give them better returns, but that depends on the housing markets relative to the stock and fixed income markets and HMO might be too much trouble and when you're 55 "trouble" is a big factor.

I think developing the property with a loft conversion to increase the value and rental income is a good way forwards. Both in terms of long-term income for me during retirement, and inheritance.

Incidentally, I've just got off the phone with Scottish Widows, and told them about my circumstances having cashed in my pension when I turned 55. They said that because I went for full encashment (I knew I'd done some research before cashing it in, but couldn't recall the terminology) and not drawdown or partial encashment I didn't trigger MPAA.

So, the 60k annual allowance limit still applies to me as it does everyone. This means if I were to max it out each year that's 600k over the next 10 years before retirement, which honestly is more than enough. Due to the nature of my business there would be some months where I might not have 5k to put away, but I could make up any shortfall from the other business.

Hypothetically, if I were to retire with 600k stashed away in a pension, the maximum state pension of £11,541.90 p.a. plus a monthly income (using today's rental value) of £2500 per month, I think (hope!) I'd be able to live out my last days very comfortably. And this, like all of us I'd imagine, was all I wanted to know - in terms of what's possible.

Thanks to everyone who's contributed. Much appreciated.0 -

Sounds like you have it worked out in your head now, which is clearly a good thing.

Having said that there does seem to be an awful lot of 'if's' with your plan and is does seem quite aspirational.

Trying not to be critical or judgemental but you're no further forward than 13 years ago. In fact you could argue that you're in a worse position because you withdrew what pension provision you did have and you haven't replaced it and you're now 13 years closer to retirement. And yet you're now glibly talking about around £72k retirement income (£30k rental, £30k drawdown and £12k SP) when, AFAIK, you don't have anything saved up thus far?

13 years ago you admitted that you had some 'catching up' to do. I feel that you might just be kidding yourself a little and you may need to address some harsh realities.

IMHO and as I said, not meant to be judgemental.1 -

As is often the case on MSE, we rarely get the full picture and are drip-feed information as a thread progresses.jimi_man said:Sounds like you have it worked out in your head now, which is clearly a good thing.

Having said that there does seem to be an awful lot of 'if's' with your plan and is does seem quite aspirational.

Trying not to be critical or judgemental but you're no further forward than 13 years ago. In fact you could argue that you're in a worse position because you withdrew what pension provision you did have and you haven't replaced it and you're now 13 years closer to retirement. And yet you're now glibly talking about around £72k retirement income (£30k rental, £30k drawdown and £12k SP) when, AFAIK, you don't have anything saved up thus far?

13 years ago you admitted that you had some 'catching up' to do. I feel that you might just be kidding yourself a little and you may need to address some harsh realities.

IMHO and as I said, not meant to be judgemental.

It's all too easy to come to a conclusion (I'm as guilty as anyone).

You do make a valid point though. As an example - extend in to the loft, to increase rent from £18-£30k.

That sounds like a reasonable plan but no mention of the £100k needed to fund the extension.

What's changed so that all of this is now possible, where it wasn't before?

On first glance, it does seem quite aspirational...

0 -

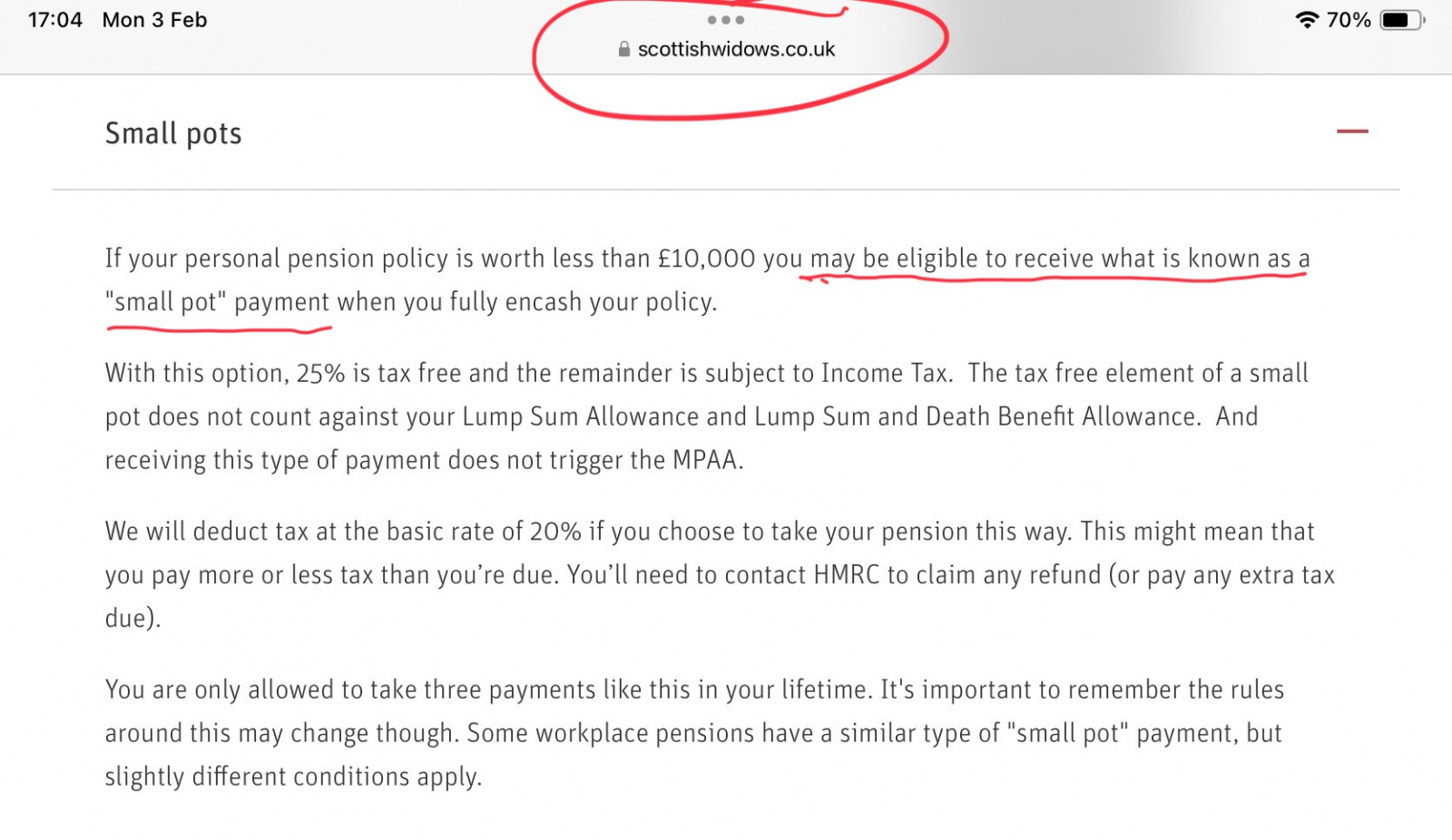

Presumably it was £10,000 or less and taken SPECIFICALLY under the small pot regulations?general_piffle said:Yes, I wouldn't recommend starting a BTL today. Doing HMO type thing would not be for me as it makes things a lot more complicated and I like dealing with a single tenant which is why I just have the one bed flat. The OP has options and selling up and investing might give them better returns, but that depends on the housing markets relative to the stock and fixed income markets and HMO might be too much trouble and when you're 55 "trouble" is a big factor.

Incidentally, I've just got off the phone with Scottish Widows, and told them about my circumstances having cashed in my pension when I turned 55. They said that because I went for full encashment (I knew I'd done some research before cashing it in, but couldn't recall the terminology) and not drawdown or partial encashment I didn't trigger MPAA.

So, the 60k annual allowance limit still applies to me as it does everyone. This means if I were to max it out each year that's 600k over the next 10 years before retirement, which honestly is more than enough. Due to the nature of my business there would be some months where I might not have 5k to put away, but I could make up any shortfall from the other business.

Otherwise the MPAA of £10,000 pension contributions does apply to you.0 -

It also depends on the type of pension, not every pension is the same.FIREDreamer said:

Presumably it was £10,000 or less and taken SPECIFICALLY under the small pot regulations?general_piffle said:Yes, I wouldn't recommend starting a BTL today. Doing HMO type thing would not be for me as it makes things a lot more complicated and I like dealing with a single tenant which is why I just have the one bed flat. The OP has options and selling up and investing might give them better returns, but that depends on the housing markets relative to the stock and fixed income markets and HMO might be too much trouble and when you're 55 "trouble" is a big factor.

Incidentally, I've just got off the phone with Scottish Widows, and told them about my circumstances having cashed in my pension when I turned 55. They said that because I went for full encashment (I knew I'd done some research before cashing it in, but couldn't recall the terminology) and not drawdown or partial encashment I didn't trigger MPAA.

So, the 60k annual allowance limit still applies to me as it does everyone. This means if I were to max it out each year that's 600k over the next 10 years before retirement, which honestly is more than enough. Due to the nature of my business there would be some months where I might not have 5k to put away, but I could make up any shortfall from the other business.

Otherwise the MPAA of £10,000 pension contributions does apply to you.0 -

@[Deleted User], some inheritance will cover the cost of developing the property, but the loft conversion will be nothing near 100k, more like half that from doing some research.

@jimi_man, you say "not meant to be judgemental" but I'm sure you realise that's how it comes across. I don't believe I've been 'glib' as you put it, which as I'm sure you're aware means to be insincere and shallow. I'm actually a lot further on than 13 years ago, but not through a pension, mostly through success in business. Through hard work.

Yes, it might sound aspirational but as you've both conceded you don't know all of the information and the forum being what it is, it's not really possible to share everything. Nor would it be appropriate on a public forum. I was looking for ideas - and I believe I have some good ones now. Thanks.0 -

Did you get that in writing? If they are wrong, it is you that will have to deal with the consequences.general_piffle said:

<snip>Yes, I wouldn't recommend starting a BTL today. Doing HMO type thing would not be for me as it makes things a lot more complicated and I like dealing with a single tenant which is why I just have the one bed flat. The OP has options and selling up and investing might give them better returns, but that depends on the housing markets relative to the stock and fixed income markets and HMO might be too much trouble and when you're 55 "trouble" is a big factor.

Incidentally, I've just got off the phone with Scottish Widows, and told them about my circumstances having cashed in my pension when I turned 55. They said that because I went for full encashment (I knew I'd done some research before cashing it in, but couldn't recall the terminology) and not drawdown or partial encashment I didn't trigger MPAA.

<snip>1 -

If it was a DC pension with an insurance company then unless it specified a SMALL POT method when you cashed it in, then you have invoked MPAA I’m afraid.general_piffle said:

It also depends on the type of pension, not every pension is the same.FIREDreamer said:

Presumably it was £10,000 or less and taken SPECIFICALLY under the small pot regulations?general_piffle said:Yes, I wouldn't recommend starting a BTL today. Doing HMO type thing would not be for me as it makes things a lot more complicated and I like dealing with a single tenant which is why I just have the one bed flat. The OP has options and selling up and investing might give them better returns, but that depends on the housing markets relative to the stock and fixed income markets and HMO might be too much trouble and when you're 55 "trouble" is a big factor.

Incidentally, I've just got off the phone with Scottish Widows, and told them about my circumstances having cashed in my pension when I turned 55. They said that because I went for full encashment (I knew I'd done some research before cashing it in, but couldn't recall the terminology) and not drawdown or partial encashment I didn't trigger MPAA.

So, the 60k annual allowance limit still applies to me as it does everyone. This means if I were to max it out each year that's 600k over the next 10 years before retirement, which honestly is more than enough. Due to the nature of my business there would be some months where I might not have 5k to put away, but I could make up any shortfall from the other business.

Otherwise the MPAA of £10,000 pension contributions does apply to you.

Did they apply the BR tax code on the taxable element? This is the default tax rate applied to a small pot, regardless of any tax actually due.

A £10,000 small pot encashment looks like this (Hargreaves Lansdown) …

0 -

And the tax consequences will be severe as well.MeteredOut said:

Did you get that in writing? If they are wrong, it is you that will have to deal with the consequences.general_piffle said:

<snip>Yes, I wouldn't recommend starting a BTL today. Doing HMO type thing would not be for me as it makes things a lot more complicated and I like dealing with a single tenant which is why I just have the one bed flat. The OP has options and selling up and investing might give them better returns, but that depends on the housing markets relative to the stock and fixed income markets and HMO might be too much trouble and when you're 55 "trouble" is a big factor.

Incidentally, I've just got off the phone with Scottish Widows, and told them about my circumstances having cashed in my pension when I turned 55. They said that because I went for full encashment (I knew I'd done some research before cashing it in, but couldn't recall the terminology) and not drawdown or partial encashment I didn't trigger MPAA.

<snip>

Note … “may be eligible” so may not have been the default method.

Have you got a schedule from them with the figures they calculated?

0 -

Glib was probably the wrong word I agree, and I’ll take that back. And as you say we don’t know everything. As long as you have some ideas then that’s the main thing - but you surely must realise that your plans do sound a little pie in the sky to people on here, especially if they don’t know all the information. I’ve found that the people who benefit most on here are the ones who are transparent about everything.general_piffle said:@[Deleted User], some inheritance will cover the cost of developing the property, but the loft conversion will be nothing near 100k, more like half that from doing some research.

@jimi_man, you say "not meant to be judgemental" but I'm sure you realise that's how it comes across. I don't believe I've been 'glib' as you put it, which as I'm sure you're aware means to be insincere and shallow. I'm actually a lot further on than 13 years ago, but not through a pension, mostly through success in business. Through hard work.

Yes, it might sound aspirational but as you've both conceded you don't know all of the information and the forum being what it is, it's not really possible to share everything. Nor would it be appropriate on a public forum. I was looking for ideas - and I believe I have some good ones now. Thanks.But still, I hope it works out for and you’re not on here in 13 years asking about pensions again!! 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards