We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Calculation Confusion

RedBalloon

Posts: 1,481 Forumite

Overpaying Mortgage:

Halifax

Currently £99,958 at 4.49% for 19 years

Overpayment allowed for yr = £10,021

Monthly payment - £650

Am I better overpaying in small lumps throughout the year (to make up the £10,021) to 'save on interest' immediately (term only gets adjusted at the end of the year)

or

Just pay the full £10,021 at the end of this year and shorten the term then? (currently savings not much different at 4.85%)

I'd prefer the latter, but not sure if I'd miss interest savings during the year?

Halifax

Currently £99,958 at 4.49% for 19 years

Overpayment allowed for yr = £10,021

Monthly payment - £650

Am I better overpaying in small lumps throughout the year (to make up the £10,021) to 'save on interest' immediately (term only gets adjusted at the end of the year)

or

Just pay the full £10,021 at the end of this year and shorten the term then? (currently savings not much different at 4.85%)

I'd prefer the latter, but not sure if I'd miss interest savings during the year?

"Buy me, Lady", said the frock, "and I will make you into a BEAUTIFUL & WHOLE & COMPLETE human being".

"Do not be silly", said the Man, "for a frock alone cannot do that".

"True", said the Lady, "I will have the shoes and the bag as well".

:rotfl:

0

Comments

-

I'm pretty sure the interest is calculated daily, so the earlier you overpay, the less interest is added to the balance. This works even if they reduce your monthly payments as a result of overpayments. Not sure if they do this during the year.

Are you sure they will adjust the term, not the monthly payments at the end of the year?1 -

Interest is calculated daily and charged monthly. The sooner the capital balance owed is reduced. The greater the saving will be.1

-

Halifax don’t change the term - lots of posts on here about that.Overpaying now means you pay less interest immediately.1

-

Thanks everyone for your help.

Edi81 said:Halifax don’t change the term - lots of posts on here about that.Overpaying now means you pay less interest immediately.

Hopefully they will still let me shorten the term at the end of the year when they 'recalculate'.

I've now read a few posts on here. People don't seem happy.

I'm not sure why, if the above is the case, why people are unhappy that the term isn't immediately shortened - any idea?"Buy me, Lady", said the frock, "and I will make you into a BEAUTIFUL & WHOLE & COMPLETE human being"."Do not be silly", said the Man, "for a frock alone cannot do that"."True", said the Lady, "I will have the shoes and the bag as well".:rotfl:0 -

Because they believe it will have a material impact when in the vast majority of cases it will not. Unless you have funds to overpay by more than your 10% allowance every year it makes no difference.I'm not sure why, if the above is the case, why people are unhappy that the term isn't immediately shortened - any idea?I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.2 -

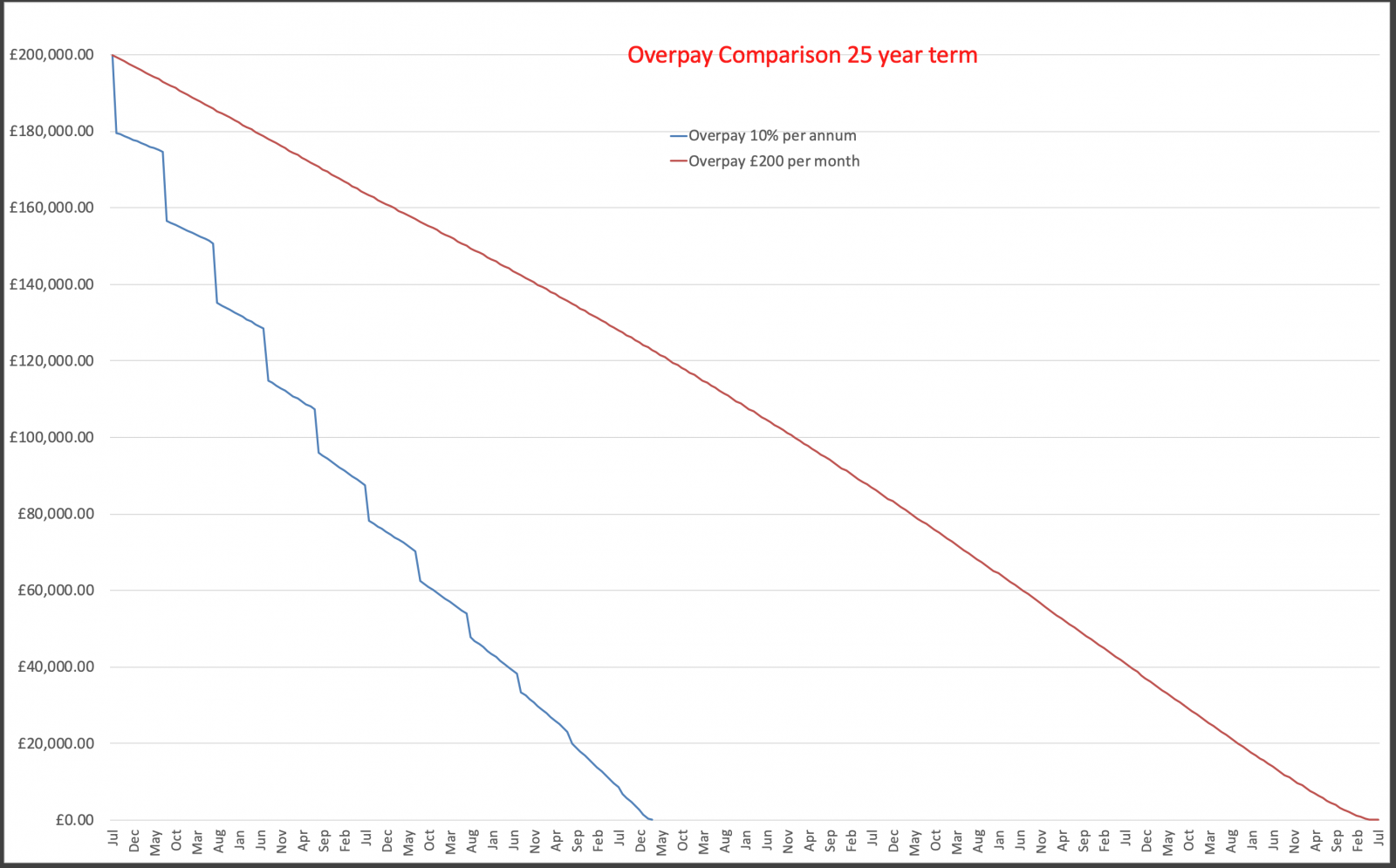

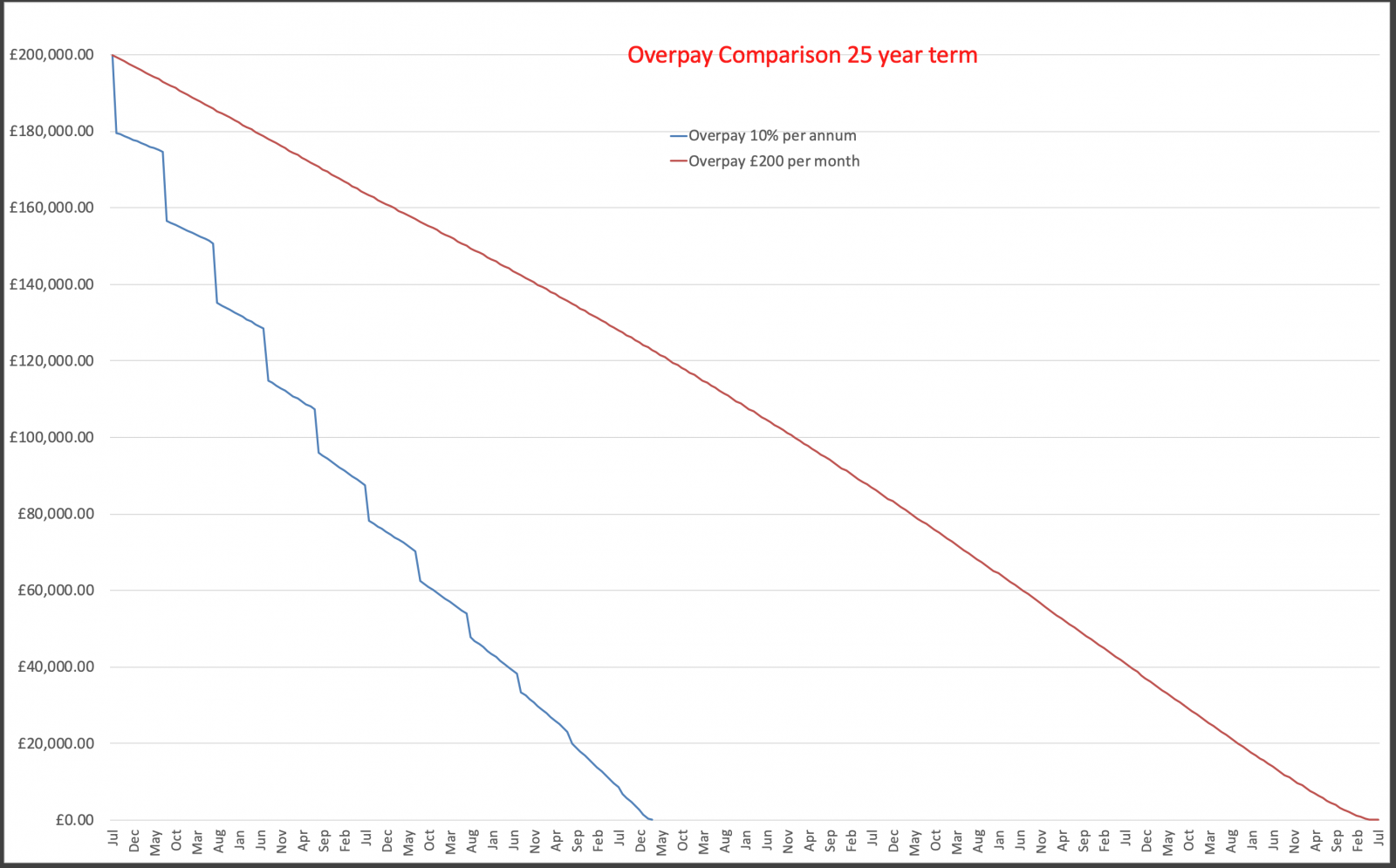

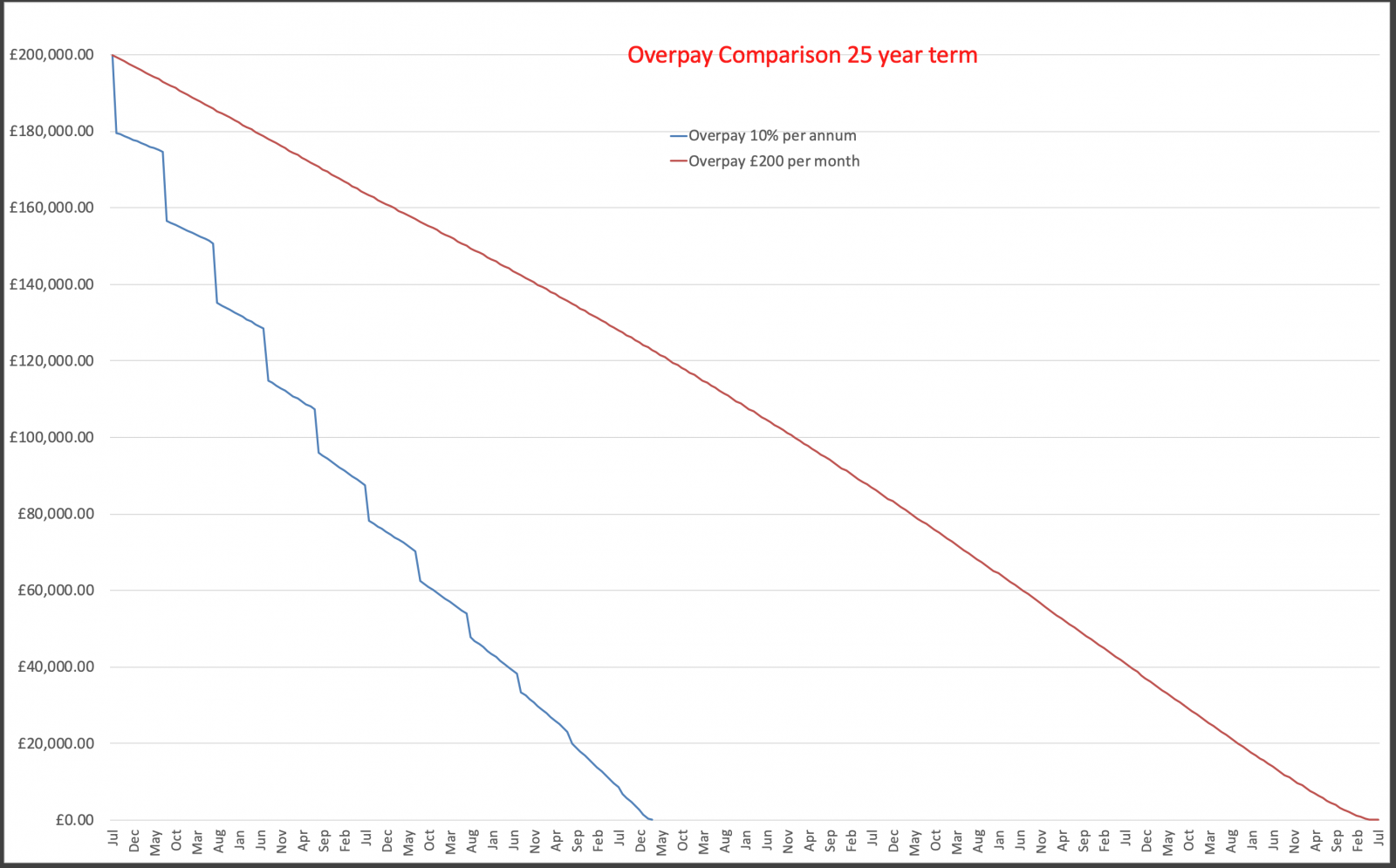

Let's not mislead people by pigeon holing their financial situation. If you do overpay regularly by the 10% per year and get the loan term shortened it does save you money. It can save you a lot of money.amnblog said:

Because they believe it will have a material impact when in the vast majority of cases it will not. Unless you have funds to overpay by more than your 10% allowance every year it makes no difference.I'm not sure why, if the above is the case, why people are unhappy that the term isn't immediately shortened - any idea?

The fact that many might not have the surplus cash and are not able to sustain this overpayment doesn't alter that fact.

Although this is not my mortgage it does demonstrate the difference that shortening the term can have. Yes it is extreme and not everybody can do this but it appears Halifax are inhibiting this for many.

I am quite happy with a slightly modified blue line with a bubble to pay when the current 5yr fix finishes and an expectation to pay around £6.5k in interest a saving of around £24K.

I also view overpayments as reducing the tax I must pay, money I do not have to earn another 22k per year in payments and 24k to cover interest means I do not have to pay tax on it.

And I can then focus or a better measure of wealth, freedom and leisure time!

It is overall financial health that enables that perspective but sometimes we have to look beyond the cash.Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!0 -

Very nice - but I believe you misread my post. My point was that not shortening the mortgage term on overpayment does not have a material effect for most borrowers, clearly overpayments do.BikingBud said:

Let's not mislead people by pigeon holing their financial situation. If you do overpay regularly by the 10% per year and get the loan term shortened it does save you money. It can save you a lot of money.amnblog said:

Because they believe it will have a material impact when in the vast majority of cases it will not. Unless you have funds to overpay by more than your 10% allowance every year it makes no difference.I'm not sure why, if the above is the case, why people are unhappy that the term isn't immediately shortened - any idea?

The fact that many might not have the surplus cash and are not able to sustain this overpayment doesn't alter that fact.

Although this is not my mortgage it does demonstrate the difference that shortening the term can have. Yes it is extreme and not everybody can do this but it appears Halifax are inhibiting this for many.

I am quite happy with a slightly modified blue line with a bubble to pay when the current 5yr fix finishes and an expectation to pay around £6.5k in interest a saving of around £24K.

I also view overpayments as reducing the tax I must pay, money I do not have to earn another 22k per year in payments and 24k to cover interest means I do not have to pay tax on it.

And I can then focus or a better measure of wealth, freedom and leisure time!

It is overall financial health that enables that perspective but sometimes we have to look beyond the cash.I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.1 -

Hoenir said:Interest is calculated daily and charged monthly. The sooner the capital balance owed is reduced. The greater the saving will be.

I'm going to call them again today to check.

My savings pay 4.85% interest monthly, so still trying to work out if it would be better to overpay with 4.49% mortgage interest, if that is daily/monthly - or put it into savings until the 'annual recalculation'.

I could do with some graphs! "Buy me, Lady", said the frock, "and I will make you into a BEAUTIFUL & WHOLE & COMPLETE human being"."Do not be silly", said the Man, "for a frock alone cannot do that"."True", said the Lady, "I will have the shoes and the bag as well".:rotfl:0

"Buy me, Lady", said the frock, "and I will make you into a BEAUTIFUL & WHOLE & COMPLETE human being"."Do not be silly", said the Man, "for a frock alone cannot do that"."True", said the Lady, "I will have the shoes and the bag as well".:rotfl:0 -

Is that 4.85% per annum ? Compounding 4.85% a month would result in a much higher figure.RedBalloon said:Hoenir said:Interest is calculated daily and charged monthly. The sooner the capital balance owed is reduced. The greater the saving will be.

I'm going to call them again today to check.

My savings pay 4.85% interest monthly, so still trying to work out if it would be better to overpay with 4.49% mortgage interest, if that is daily/monthly - or put it into savings until the 'annual recalculation'.

I could do with some graphs!

As matters stand you are better off retaining the money in savings. If the savings aren't taxable. At a 20% tax rate 4.85% nets down to 3,88% after tax.

Halifax aren't going to give you advice as to what to do0 -

Double negative and double speak.amnblog said:

Very nice - but I believe you misread my post. My point was that not shortening the mortgage term on overpayment does not have a material effect for most borrowers, clearly overpayments do.BikingBud said:

Let's not mislead people by pigeon holing their financial situation. If you do overpay regularly by the 10% per year and get the loan term shortened it does save you money. It can save you a lot of money.amnblog said:

Because they believe it will have a material impact when in the vast majority of cases it will not. Unless you have funds to overpay by more than your 10% allowance every year it makes no difference.I'm not sure why, if the above is the case, why people are unhappy that the term isn't immediately shortened - any idea?

The fact that many might not have the surplus cash and are not able to sustain this overpayment doesn't alter that fact.

Although this is not my mortgage it does demonstrate the difference that shortening the term can have. Yes it is extreme and not everybody can do this but it appears Halifax are inhibiting this for many.

I am quite happy with a slightly modified blue line with a bubble to pay when the current 5yr fix finishes and an expectation to pay around £6.5k in interest a saving of around £24K.

I also view overpayments as reducing the tax I must pay, money I do not have to earn another 22k per year in payments and 24k to cover interest means I do not have to pay tax on it.

And I can then focus or a better measure of wealth, freedom and leisure time!

It is overall financial health that enables that perspective but sometimes we have to look beyond the cash.

I think we are in the same space, small overpayment and then reducing subsequent payments to sustain original loan period will minimise benefit.

That is my whole point that Halifax appear to be enforcing that position.

Either way I feel that regulars on this board have their own ideal and others that come with a lower level of understanding seeking advice might not get some of the nuance or indeed the options that might better suit their longer term financial health.

But we should provide the facts, underpinned by the maths, including where necessary providing the knowledge to challenge their lenders, to enable them to make the decisions.Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards