We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Pension Performance with a default Aviva fund

Comments

-

I was split 94% on the Av MyM fund and 6% on a very poorly performing bonds fund that I was being life-styled into where the performance is pants at 1% last year.Although do note, that bonds have just gone through a negative cycle and are coming out of it. Equities have gone through a very positive cycle and could be ripe for a negative.The performance is like a pancake and isn't even keeping pace with inflation. I cannot afford to let this continue.It won't continue like that. That isnt how investments work.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

It can be a minefield, which is why the vast majority of people in work placed pensions don't mess around with the fund selections. I'd imagine many don't even know they have the option. I have helped two people this week to access their portal for the first time and they have been in the scheme 4 years. They are never going to question which fund selection they have.

Regardless of which fund you are in it is not for the faint hearted to check it daily. Even on a low risk, modestly performing fund (i.e. a target date fund a couple of years before planned retirement age) and £100k balance it swings hundreds of pounds a day. I switched funds once and it started going up and down £1k a day and it felt too much like gambling.

0

0 -

Oh yes, mine swings by ten's of thousand sometimes which is not surprising; a stock market wobble of 2-3% equates to tens of thousands of "losses" on a sizeable pot. Conversely it is very satisfying to watch them come storming back.

I still feel I can do better on the small fund that I have.0 -

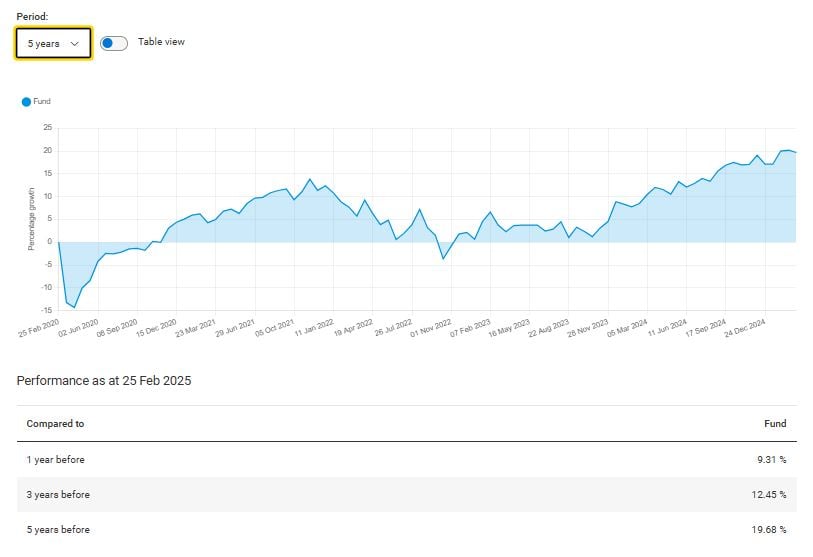

My workplace DC scheme is with Aviva, I took the decision to transfer my fund from a previous employers scheme several years ago. The majority of the fund is invested in the default MFF Growth S6 fund. Seems to be doing okay at an average of 7% per annum over the last 5 years. Risk rating of 4, 75% equities and the rest bonds, properties and a bit of cash. I decided to take on a bit more risk last year so have stopped contributing to that fund and diverted contributions to the Aviva pensions global equity S6 fund. Risk rating 5, 100% equities. This has averaged 10.7% per annum over 5 years. My rationale was that as I'm in my mid 40's I could take on a bit more risk at this stage. Probably should have employed this strategy a decade ago but didn't really pay much attention to the default funds asset allocation and performance vs my age etc..1

-

Exactly. We tend to become aware of these things when it's too late. At least you have done it now, whilst in your 40's. Had I done similar with my DC pot it could be worth millions instead of high six figures. Still might be yetPaellaParaMi said:My workplace DC scheme is with Aviva, I took the decision to transfer my fund from a previous employers scheme several years ago. The majority of the fund is invested in the default MFF Growth S6 fund. Seems to be doing okay at an average of 7% per annum over the last 5 years. Risk rating of 4, 75% equities and the rest bonds, properties and a bit of cash. I decided to take on a bit more risk last year so have stopped contributing to that fund and diverted contributions to the Aviva pensions global equity S6 fund. Risk rating 5, 100% equities. This has averaged 10.7% per annum over 5 years. My rationale was that as I'm in my mid 40's I could take on a bit more risk at this stage. Probably should have employed this strategy a decade ago but didn't really pay much attention to the default funds asset allocation and performance vs my age etc.. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards