We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help double checking this IHT calc please?

Snookie12cat

Posts: 805 Forumite

in Cutting tax

I am not sure if I am posting in the right place, but it seemed appropriate.

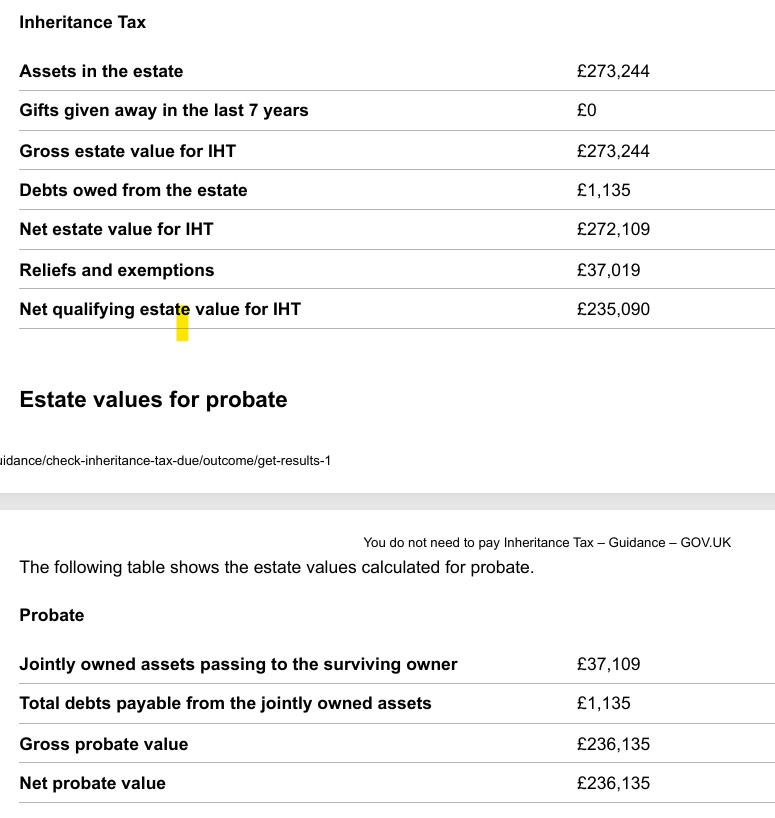

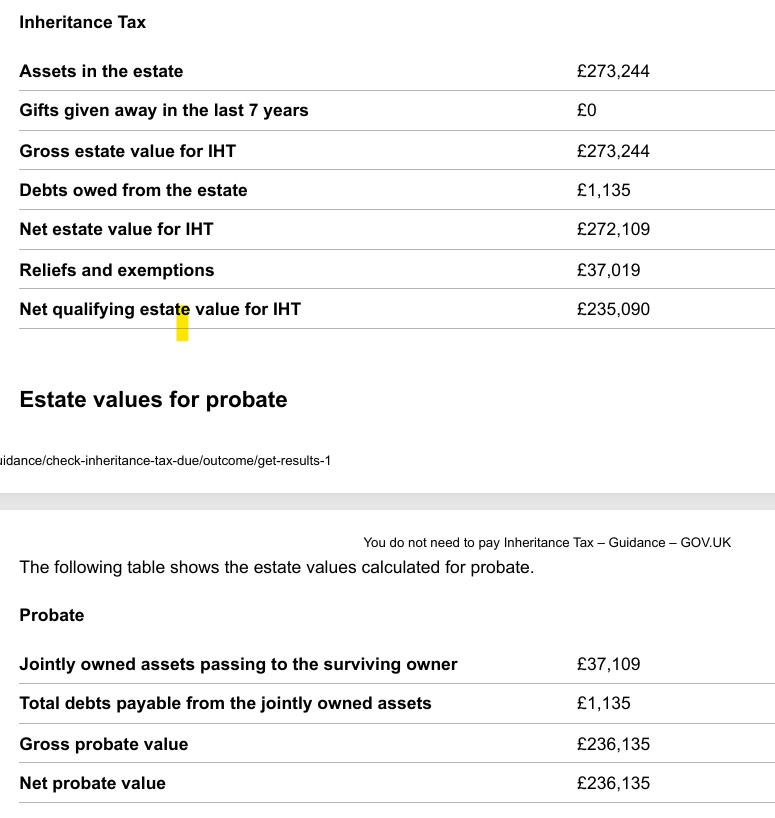

I am completing the Gov.Uk cal on whether IHT is due and amounts for probate. I belive its all done correctly, but can someone just make sure the figures look right - should probate net and gross value be the same?

My dads house share TIC left to children - £225k

Money in bank, his half - left to wife - £37k roughly

Sale of his car - £11k, money given to wife.

Funeral costs - 100% cost - £1135.

That's all he has. Just wanted a second opinion before I submit for probate.

Under "jointly owned assets passing to surviving owner", I just inputted his share of the money in the joint account as he has nothing else jointly owned. That might be the only question I wasn't 100% on.

I am completing the Gov.Uk cal on whether IHT is due and amounts for probate. I belive its all done correctly, but can someone just make sure the figures look right - should probate net and gross value be the same?

My dads house share TIC left to children - £225k

Money in bank, his half - left to wife - £37k roughly

Sale of his car - £11k, money given to wife.

Funeral costs - 100% cost - £1135.

That's all he has. Just wanted a second opinion before I submit for probate.

Under "jointly owned assets passing to surviving owner", I just inputted his share of the money in the joint account as he has nothing else jointly owned. That might be the only question I wasn't 100% on.

0

Comments

-

Does the will give your mother the right to reside in the property? If it does legal ownership goes into an immediate post death interest trust, and your mother becomes the beneficial owner. This means his share of the house does not use any of his NRB and is covered by spousal exemption.0

-

Ok. Yes it does. Kind of and I say this because the will states she can live in the house, sell it and buy something else BUT if it is at a lesser value than the current house the money is to be distributed to the children if there is any excess immediately, not on her death. So in essence is she buys a house for £300k, then the other £150k is to be paid out to kids immediately.Keep_pedalling said:Does the will give your mother the right to reside in the property? If it does legal ownership goes into an immediate post death interest trust, and your mother becomes the beneficial owner. This means his share of the house does not use any of his NRB and is covered by spousal exemption.

How does that work under IPDT, especially if she sells the house?0 -

It does not quite work like that as your mother owns the half the house in her own right. So if the house is worth £450k and she downsized to one worth £300k then her £225K share would pay the bulk of it and the remaining £75k from the trust . The remainder can be distributed to the children ( there would of cause be buying and selling costs to be deducted)

The alternative option the will could have made would have been to keep the released equity in trust with mum being entitled to the interest.1 -

Ok, so is this too difficult for me to do myself? Is it worth getting a professional to look this over?Keep_pedalling said:It does not quite work like that as your mother owns the half the house in her own right. So if the house is worth £450k and she downsized to one worth £300k then her £225K share would pay the bulk of it and the remaining £75k from the trust . The remainder can be distributed to the children ( there would of cause be buying and selling costs to be deducted)

The alternative option the will could have made would have been to keep the released equity in trust with mum being entitled to the interest.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards