We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Good morning!

This is not a boast, I simply thought it would make you all laugh...

My 5th December Principality maturity from an Issue 4 to another Issue 4 has gone through with no problems so I now have four but..... I can't remember where I asked the other £1000 to go to and I can't find it anywhere!!

I'm sure it will turn up at some point but note to self - when giving maturity instructions, write note to self!!

Have a lovely day everyone, stay safe and warm,

xx

8 -

...odder still - despite the secure message telling me otherwise, my issue 3 has morphed into a funded issue 4.flaneurs_lobster said:

Principality have clearly listened to me - my two O/S maturity instructions have been rumbled. My 8 RS will soon be down to 6.flaneurs_lobster said:

...and if you could write that out in Java (or at least pseudocode) just to help PrinBS implement the fix a bit quicker that'd be kind...Oh dear. Can you talk us through how you entered the instructions which led to this. Did your instructions generate a "sent" secure message? Where did you instruct the funds coming out at maturity to go to (internal or external account?)9 -

I got confirmation of my maturity instructions by post. Post is painfully slow in my area though, so the letter arrived several days after maturity.CricketLady said:Good morning!

This is not a boast, I simply thought it would make you all laugh...

My 5th December Principality maturity from an Issue 4 to another Issue 4 has gone through with no problems so I now have four but..... I can't remember where I asked the other £1000 to go to and I can't find it anywhere!!

I'm sure it will turn up at some point but note to self - when giving maturity instructions, write note to self!!

Have a lovely day everyone, stay safe and warm,

xx3 -

Principality

My maturity has gone through as planned, my last Issue 3 to a 2nd Christmas 2026. Hold 4 Issue 4s too.

Never had a secure message, always online maturity instructions on a weekend wearing a green jumper!

3 -

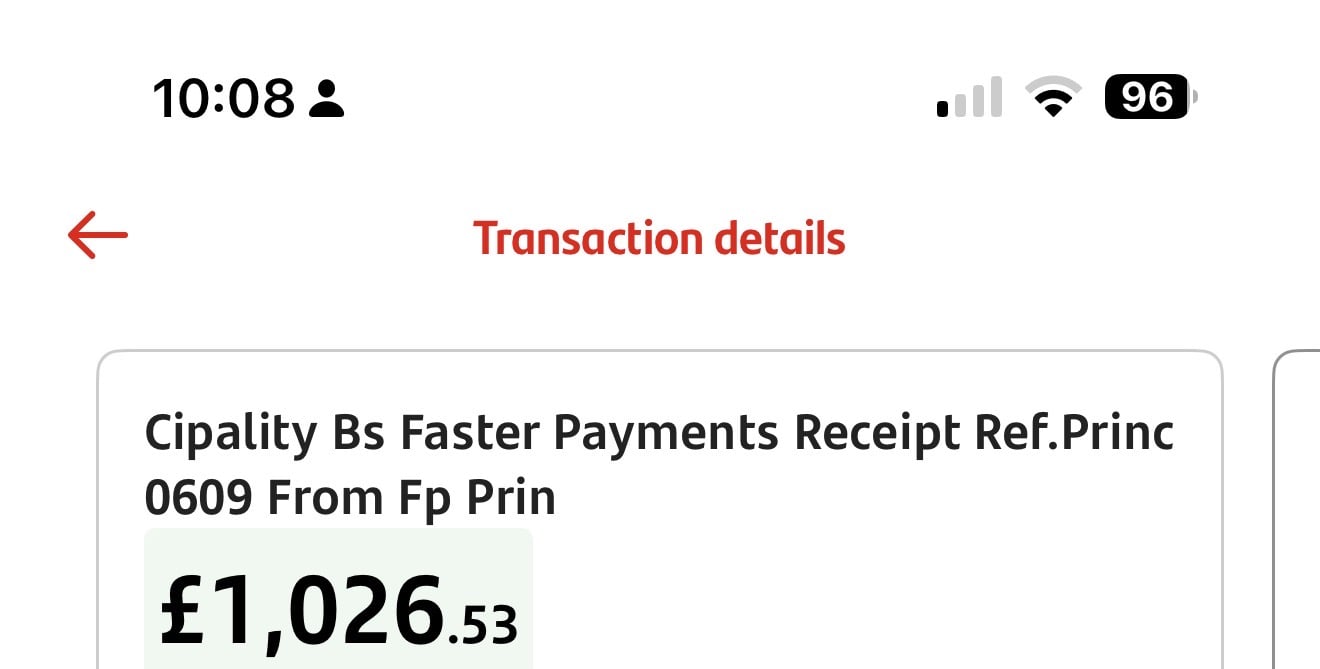

Anyone else noticed the hip new name for Principality in their maturity payouts? BTW, I now have 7 Issue 4.

6 -

My next go is for an account maturing 28th December definitely doing that maturity outside of hours, if that works that's definitely the key to thingsDizzycap said:jameseonline said:Not sure if I like this getting rumbled talk, Principality maturity options allowed us to have extra accounts etc, it's been allowed for some time now, they could have closed loophole or whatever at any time. People haven't really broken any rules because Principality didn't enforce their own rules, now it appears they are.

Also if anyone has any other accounts coming to an end It might be worth trying giving instructions outside of opening hours, which is what I'm going to do & what I was doing up until the other day.Principality have actioned my maturity instruction this morning for another 6 month RS; making a total holding of 4, without a problem. From memory, this maturity option was actioned late at night and obviously out of office hours.I have another 2 Principality accounts maturing soon and I hope to convert these into another 2 Christmas RS; should they still be available, making a total holding of 4, and again, I will be actioning maturity instructions late at night simply because it's the only time I have some peace & quiet Whilst I'm aware that some have experienced issues both now and in the past with not having maturity instructions actioned, I'm really at a loss to why? Principality's system allows the various maturity options from a drop down menu and it's not as though we have to input the maturing account type we want?!

Whilst I'm aware that some have experienced issues both now and in the past with not having maturity instructions actioned, I'm really at a loss to why? Principality's system allows the various maturity options from a drop down menu and it's not as though we have to input the maturing account type we want?! Whilst I was also beginning to wonder whether Principality have X amount of accounts available for each account offering, that certainly doesn't make sense when some are told, "Sorry, you already have this account so can't have another", whilst the majority have their maturity instructions actioned

Whilst I was also beginning to wonder whether Principality have X amount of accounts available for each account offering, that certainly doesn't make sense when some are told, "Sorry, you already have this account so can't have another", whilst the majority have their maturity instructions actioned

0

0 -

Already a thread here:Born2Save_3 said:Lloyds Online showing all LBG accounts now.I logged in a couple of hours ago and noticed that all my Lloyds Banking Group (LBG) (Lloyds, Bank of Scotland and Halifax) accounts were shown, including all the RS I have with LBG. This is the first time I've seen this in the Lloyds portal.

https://forums.moneysavingexpert.com/discussion/6636486/lloyds-and-halifax-co-servicing/p11 -

Principality opened a new reg saver 4 today after my reg saver 3 matured.I have one reg saver 3 left.I always use option 2 at maturity, out of working hours and online.So four reg saver 4's and 1 reg saver 3.My healthy habits saver matures 21/12/25.So Not sure if I will get another Christmas saver 2026 or another reg saver 4.3

-

Could someone please be so kind and remind me how the temporary "raiding" of a full (£5,000.00) NatWest/RBS Digital Regular Saver works? Am I right in thinking that I can withdraw the full amount and replace it in full as long as it's in the same calendar month? E.g. could I withdraw £5,000.00 on Fri 02/01/2026 and return it in full on Fri 30/01/2026. Of course I understand I would lose out on interest but want to avoid the need of having to fill it up again by £150/month. (not including interest/round ups/rewards)0

-

Yes, that's how you would do it. I've never withdrawn and replaced the full £5000, but often do it with £1000+, and it's always worked (i.e. no rejected payments). I always return it in separate transactions of £150 each to be on the safe side, but I don't know if this is necessary.Chaykin said:Could someone please be so kind and remind me how the temporary "raiding" of a full (£5,000.00) NatWest/RBS Digital Regular Saver works? Am I right in thinking that I can withdraw the full amount and replace it in full as long as it's in the same calendar month? E.g. could I withdraw £5,000.00 on Fri 02/01/2026 and return it in full on Fri 30/01/2026. Of course I understand I would lose out on interest but want to avoid the need of having to fill it up again by £150/month. (not including interest/round ups/rewards)2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards