We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Yes - well spotted. Spreadsheet updated. Another 35p gained on "interest on the interest".Bobblehat said:

Great spreadsheet .... a query though about a minor possible correction! Wouldn't the amount going into the easy access feeder (for funds of one of the second 6 month RS accounts), include the interest of the first matured RS? So £750 + £19.69 after the first payment to the 2nd 6 month RS? Makes a small extra addition advantage?clairec666 said:

A clever spreadsheet, you say...chris_the_bee said:

Principality BSallegro120 said:

I've picked 6 months this time. Can't remember what tipped the scale, but it wasn't a simple decision to make. Last year I picked Christmas.rallycurve said:Principality BS

Regarding the renewal of a matured RS, would it be better to renew to an additional 6 month regular saver at 7.50% (£200 pm) or go with an additional Christmas regular saver at 6.50% (£150pm) but lasting for a full year?

I am assuming it'll be possible to have multiple Christmas RS too via maturity instructions

If in 6 months time the 6 Months RS will be still available at the same rate and the maturity scheme is still going, then 6M was the right decision to make. Otherwise, Christmas looks more attractive because of its length.

Interest on 2 X 6MRS (if still available in 6 months time) would be approx £54, whereas interest from a Christmas RS would be £63.37. However, if the proceeds of the fist 6MRS, £1,027 [(6*200)-200 for reinvest in 2nd 6MRS] were invested at say 4.5%, this would result in an extra £23.10 making the 2 X 6MRS more attractive. Perhaps someone with a clever spreadsheet could confirm or otherwise.

https://docs.google.com/spreadsheets/d/1n50F6t5Jsb3kpjSVxP7HwvaoLDi0a0-IjllulAmxrGE/edit?usp=sharing

I rustled this up a while ago in response to a previous debate. I've set all deposits to £150 in order to make a direct comparison between the 6 month and Christmas accounts.

I'm making the assumption that a) the interest rate for the 6 month account hasn't dropped by the time you renew, and b) you can get yourself an extra one on maturity (i.e. if there's a new issue)

Assuming also that you don't have an initial lump sum deposit, and the £150 comes from income each month.

After 6 months the "excess" is put into an easy-access account for drip-feeding. I've set this bar quite low at 3.5% for this particular example. (Currently my drip-feeding accounts are all 5.5% regular savers which I can't fully fund, so my figures work out even better!)

Anyway, the conclusion is that 6 month RS + dripfeeding wins, in this scenario anyway.1 -

I've still to pop up to Stafford to take money out of my Regular Saver there. I'll see if I can pop into Manchester on my way back (although the T&Cs aren't clear if we can take money out online after maturity)...Born2Save_3 said:Chaykin said:Newcastle BS / Manchester BS Festive RSs:Who knows - maybe they will put up QR codes in branches? Yes please, if anyone comes across a QR code, please take a photo or use a scanning app to convert to a URL. This would be very helpful to many people here.After all it is unfair to local people who work night shift all of the time, or people who are immuno compromised and are clinically extremely vulnerable to airborne viruses; and there's many more valid cases why visiting a local branch may not be practical or even life threatening.I consider myself to be a male feminist. Is that allowed?1

Yes please, if anyone comes across a QR code, please take a photo or use a scanning app to convert to a URL. This would be very helpful to many people here.After all it is unfair to local people who work night shift all of the time, or people who are immuno compromised and are clinically extremely vulnerable to airborne viruses; and there's many more valid cases why visiting a local branch may not be practical or even life threatening.I consider myself to be a male feminist. Is that allowed?1 -

Principality hacks aside, are decent maturity options really a thing? In my 5 or so years doing this I've not known a particularly of a particularly strong maturity offer; at best they're in line with rates openly available.

That being said pretty much all our money is sat in either our LISAs or regular savers; I appreciate once you have a little more than we do to play with you'll have filled up all the 5+% reg savers, filled up your ISA allowance(s) then maybe the fixed term maturity options are more interesting - perhaps I'm just not remembering the options that wouldn't work for us presently.

No great love lost for MHBS here, leaving £1 with them just in case but they've been a bit of a pain to deal with and they are behind the keenest in the market with their newer options.0 -

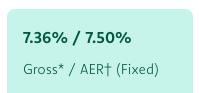

Can add one other thing? Interest calculations for the 6 Month Regular should use the AER not the Gross interest rate, i.e 7.36% not 7.5%. My calculations of previous versions of the 6 Month Regular Saver using the AER give interest correct to the exact amount paid into the account. I know it won't make much difference but it will narrow the gap between the two types of account. Great table non the less, as with all prediction tables assumptions have to be made as the exact details of the account and deposits are only known after the account is completed.clairec666 said:

A clever spreadsheet, you say...chris_the_bee said:

Principality BSallegro120 said:

I've picked 6 months this time. Can't remember what tipped the scale, but it wasn't a simple decision to make. Last year I picked Christmas.rallycurve said:Principality BS

Regarding the renewal of a matured RS, would it be better to renew to an additional 6 month regular saver at 7.50% (£200 pm) or go with an additional Christmas regular saver at 6.50% (£150pm) but lasting for a full year?

I am assuming it'll be possible to have multiple Christmas RS too via maturity instructions

If in 6 months time the 6 Months RS will be still available at the same rate and the maturity scheme is still going, then 6M was the right decision to make. Otherwise, Christmas looks more attractive because of its length.

Interest on 2 X 6MRS (if still available in 6 months time) would be approx £54, whereas interest from a Christmas RS would be £63.37. However, if the proceeds of the fist 6MRS, £1,027 [(6*200)-200 for reinvest in 2nd 6MRS] were invested at say 4.5%, this would result in an extra £23.10 making the 2 X 6MRS more attractive. Perhaps someone with a clever spreadsheet could confirm or otherwise.

https://docs.google.com/spreadsheets/d/1n50F6t5Jsb3kpjSVxP7HwvaoLDi0a0-IjllulAmxrGE/edit?usp=sharing

I rustled this up a while ago in response to a previous debate. I've set all deposits to £150 in order to make a direct comparison between the 6 month and Christmas accounts.

I'm making the assumption that a) the interest rate for the 6 month account hasn't dropped by the time you renew, and b) you can get yourself an extra one on maturity (i.e. if there's a new issue)

Assuming also that you don't have an initial lump sum deposit, and the £150 comes from income each month.

After 6 months the "excess" is put into an easy-access account for drip-feeding. I've set this bar quite low at 3.5% for this particular example. (Currently my drip-feeding accounts are all 5.5% regular savers which I can't fully fund, so my figures work out even better!)

Anyway, the conclusion is that 6 month RS + dripfeeding wins, in this scenario anyway.

I tried a similar table using the £150pm and £200pm values and the accounts are surprising similar. My assumptions were all months of equal length, the 6 month interest rate does not drop (as above), and I ignored the extra account at maturity. I conversely assume there was an initial deposit of £2000 (to cover both regular savers to the max) which was held in an EA as it was drip feed into the regular savers.

With EA @ 3.5% the Christmas Regular wins by £1.78 but with EA @ 4.5% the 6 Month Regular Saver wins £1.10.

3 -

The Maturity Winter Regular Saver was the only Principality account to have required a maturing Christmas Regular Saver from the previous year, though in practice it was listed on their website and an application would go through even if you didn't hold the required account.WillPS said:Principality hacks aside, are decent maturity options really a thing? In my 5 or so years doing this I've not known a particularly of a particularly strong maturity offer; at best they're in line with rates openly available.

That being said pretty much all our money is sat in either our LISAs or regular savers; I appreciate once you have a little more than we do to play with you'll have filled up all the 5+% reg savers, filled up your ISA allowance(s) then maybe the fixed term maturity options are more interesting - perhaps I'm just not remembering the options that wouldn't work for us presently.

No great love lost for MHBS here, leaving £1 with them just in case but they've been a bit of a pain to deal with and they are behind the keenest in the market with their newer options.

I recall holders of Cambridge's Extra Reward Regular Saver being offered another even when it wasn't accepting new applications, but they are the only cases I can think of.

0 -

7.36% is the gross, the AER is the 7.5%. You would use the gross, but I think you just mixed up the termsCh1ll1Phlakes said:

Can add one other thing? Interest calculations for the 6 Month Regular should use the AER not the Gross interest rate, i.e 7.36% not 7.5%. My calculations of previous versions of the 6 Month Regular Saver using the AER give interest correct to the exact amount paid into the account. I know it won't make much difference but it will narrow the gap between the two types of account. Great table non the less, as with all prediction tables assumptions have to be made as the exact details of the account and deposits are only known after the account is completed.clairec666 said:

A clever spreadsheet, you say...chris_the_bee said:

Principality BSallegro120 said:

I've picked 6 months this time. Can't remember what tipped the scale, but it wasn't a simple decision to make. Last year I picked Christmas.rallycurve said:Principality BS

Regarding the renewal of a matured RS, would it be better to renew to an additional 6 month regular saver at 7.50% (£200 pm) or go with an additional Christmas regular saver at 6.50% (£150pm) but lasting for a full year?

I am assuming it'll be possible to have multiple Christmas RS too via maturity instructions

If in 6 months time the 6 Months RS will be still available at the same rate and the maturity scheme is still going, then 6M was the right decision to make. Otherwise, Christmas looks more attractive because of its length.

Interest on 2 X 6MRS (if still available in 6 months time) would be approx £54, whereas interest from a Christmas RS would be £63.37. However, if the proceeds of the fist 6MRS, £1,027 [(6*200)-200 for reinvest in 2nd 6MRS] were invested at say 4.5%, this would result in an extra £23.10 making the 2 X 6MRS more attractive. Perhaps someone with a clever spreadsheet could confirm or otherwise.

https://docs.google.com/spreadsheets/d/1n50F6t5Jsb3kpjSVxP7HwvaoLDi0a0-IjllulAmxrGE/edit?usp=sharing

I rustled this up a while ago in response to a previous debate. I've set all deposits to £150 in order to make a direct comparison between the 6 month and Christmas accounts.

I'm making the assumption that a) the interest rate for the 6 month account hasn't dropped by the time you renew, and b) you can get yourself an extra one on maturity (i.e. if there's a new issue)

Assuming also that you don't have an initial lump sum deposit, and the £150 comes from income each month.

After 6 months the "excess" is put into an easy-access account for drip-feeding. I've set this bar quite low at 3.5% for this particular example. (Currently my drip-feeding accounts are all 5.5% regular savers which I can't fully fund, so my figures work out even better!)

Anyway, the conclusion is that 6 month RS + dripfeeding wins, in this scenario anyway.

I tried a similar table using the £150pm and £200pm values and the accounts are surprising similar. My assumptions were all months of equal length, the 6 month interest rate does not drop (as above), and I ignored the extra account at maturity. I conversely assume there was an initial deposit of £2000 (to cover both regular savers to the max) which was held in an EA as it was drip feed into the regular savers.

With EA @ 3.5% the Christmas Regular wins by £1.78 but with EA @ 4.5% the 6 Month Regular Saver wins £1.10.

0 -

Yeah, good point, I'll update the spreadsheet.Ch1ll1Phlakes said:

Can add one other thing? Interest calculations for the 6 Month Regular should use the AER not the Gross interest rate, i.e 7.36% not 7.5%. My calculations of previous versions of the 6 Month Regular Saver using the AER give interest correct to the exact amount paid into the account. I know it won't make much difference but it will narrow the gap between the two types of account. Great table non the less, as with all prediction tables assumptions have to be made as the exact details of the account and deposits are only known after the account is completed.clairec666 said:

A clever spreadsheet, you say...chris_the_bee said:

Principality BSallegro120 said:

I've picked 6 months this time. Can't remember what tipped the scale, but it wasn't a simple decision to make. Last year I picked Christmas.rallycurve said:Principality BS

Regarding the renewal of a matured RS, would it be better to renew to an additional 6 month regular saver at 7.50% (£200 pm) or go with an additional Christmas regular saver at 6.50% (£150pm) but lasting for a full year?

I am assuming it'll be possible to have multiple Christmas RS too via maturity instructions

If in 6 months time the 6 Months RS will be still available at the same rate and the maturity scheme is still going, then 6M was the right decision to make. Otherwise, Christmas looks more attractive because of its length.

Interest on 2 X 6MRS (if still available in 6 months time) would be approx £54, whereas interest from a Christmas RS would be £63.37. However, if the proceeds of the fist 6MRS, £1,027 [(6*200)-200 for reinvest in 2nd 6MRS] were invested at say 4.5%, this would result in an extra £23.10 making the 2 X 6MRS more attractive. Perhaps someone with a clever spreadsheet could confirm or otherwise.

https://docs.google.com/spreadsheets/d/1n50F6t5Jsb3kpjSVxP7HwvaoLDi0a0-IjllulAmxrGE/edit?usp=sharing

I rustled this up a while ago in response to a previous debate. I've set all deposits to £150 in order to make a direct comparison between the 6 month and Christmas accounts.

I'm making the assumption that a) the interest rate for the 6 month account hasn't dropped by the time you renew, and b) you can get yourself an extra one on maturity (i.e. if there's a new issue)

Assuming also that you don't have an initial lump sum deposit, and the £150 comes from income each month.

After 6 months the "excess" is put into an easy-access account for drip-feeding. I've set this bar quite low at 3.5% for this particular example. (Currently my drip-feeding accounts are all 5.5% regular savers which I can't fully fund, so my figures work out even better!)

Anyway, the conclusion is that 6 month RS + dripfeeding wins, in this scenario anyway.

I tried a similar table using the £150pm and £200pm values and the accounts are surprising similar. My assumptions were all months of equal length, the 6 month interest rate does not drop (as above), and I ignored the extra account at maturity. I conversely assume there was an initial deposit of £2000 (to cover both regular savers to the max) which was held in an EA as it was drip feed into the regular savers.

With EA @ 3.5% the Christmas Regular wins by £1.78 but with EA @ 4.5% the 6 Month Regular Saver wins £1.10.1 -

Principality 6 Month v ChristmasCh1ll1Phlakes said:

Can add one other thing? Interest calculations for the 6 Month Regular should use the AER not the Gross interest rate, i.e 7.36% not 7.5%. My calculations of previous versions of the 6 Month Regular Saver using the AER give interest correct to the exact amount paid into the account. I know it won't make much difference but it will narrow the gap between the two types of account. Great table non the less, as with all prediction tables assumptions have to be made as the exact details of the account and deposits are only known after the account is completed.clairec666 said:

A clever spreadsheet, you say...chris_the_bee said:

Principality BSallegro120 said:

I've picked 6 months this time. Can't remember what tipped the scale, but it wasn't a simple decision to make. Last year I picked Christmas.rallycurve said:Principality BS

Regarding the renewal of a matured RS, would it be better to renew to an additional 6 month regular saver at 7.50% (£200 pm) or go with an additional Christmas regular saver at 6.50% (£150pm) but lasting for a full year?

I am assuming it'll be possible to have multiple Christmas RS too via maturity instructions

If in 6 months time the 6 Months RS will be still available at the same rate and the maturity scheme is still going, then 6M was the right decision to make. Otherwise, Christmas looks more attractive because of its length.

Interest on 2 X 6MRS (if still available in 6 months time) would be approx £54, whereas interest from a Christmas RS would be £63.37. However, if the proceeds of the fist 6MRS, £1,027 [(6*200)-200 for reinvest in 2nd 6MRS] were invested at say 4.5%, this would result in an extra £23.10 making the 2 X 6MRS more attractive. Perhaps someone with a clever spreadsheet could confirm or otherwise.

https://docs.google.com/spreadsheets/d/1n50F6t5Jsb3kpjSVxP7HwvaoLDi0a0-IjllulAmxrGE/edit?usp=sharing

I rustled this up a while ago in response to a previous debate. I've set all deposits to £150 in order to make a direct comparison between the 6 month and Christmas accounts.

I'm making the assumption that a) the interest rate for the 6 month account hasn't dropped by the time you renew, and b) you can get yourself an extra one on maturity (i.e. if there's a new issue)

Assuming also that you don't have an initial lump sum deposit, and the £150 comes from income each month.

After 6 months the "excess" is put into an easy-access account for drip-feeding. I've set this bar quite low at 3.5% for this particular example. (Currently my drip-feeding accounts are all 5.5% regular savers which I can't fully fund, so my figures work out even better!)

Anyway, the conclusion is that 6 month RS + dripfeeding wins, in this scenario anyway.

I tried a similar table using the £150pm and £200pm values and the accounts are surprising similar. My assumptions were all months of equal length, the 6 month interest rate does not drop (as above), and I ignored the extra account at maturity. I conversely assume there was an initial deposit of £2000 (to cover both regular savers to the max) which was held in an EA as it was drip feed into the regular savers.

With EA @ 3.5% the Christmas Regular wins by £1.78 but with EA @ 4.5% the 6 Month Regular Saver wins £1.10.

I did some calcs assuming a £1,800+ initial lump sum (i.e. not funding through income). If you assume the 6 Month RS is available at the current rate as a maturity option in 6 months time then it basically boils down to the easy access rate you can achieve. I found the cross-over to be at 4.35%, above that the 6 Month RS wins, below that the Christmas wins.

This assumes the easy access rate remains the same for the next 12 months where as in reality I think we're looking at a decreasing rate starting next month with the BoE MPC meeting. Given this and the possibility that Principality may stop these renewals then I'm likely to opt for the Christmas RS.

fwiw the function fv() can be used to cross-check regular saver interest.5 -

Stafford can be £75K by FPsurreysaver said:

I've still to pop up to Stafford to take money out of my Regular Saver there. I'll see if I can pop into Manchester on my way back (although the T&Cs aren't clear if we can take money out online after maturity)...Born2Save_3 said:Chaykin said:Newcastle BS / Manchester BS Festive RSs:Who knows - maybe they will put up QR codes in branches? Yes please, if anyone comes across a QR code, please take a photo or use a scanning app to convert to a URL. This would be very helpful to many people here.After all it is unfair to local people who work night shift all of the time, or people who are immuno compromised and are clinically extremely vulnerable to airborne viruses; and there's many more valid cases why visiting a local branch may not be practical or even life threatening.1

Yes please, if anyone comes across a QR code, please take a photo or use a scanning app to convert to a URL. This would be very helpful to many people here.After all it is unfair to local people who work night shift all of the time, or people who are immuno compromised and are clinically extremely vulnerable to airborne viruses; and there's many more valid cases why visiting a local branch may not be practical or even life threatening.1 -

surreysaver said:

I've still to pop up to Stafford to take money out of my Regular Saver there. I'll see if I can pop into Manchester on my way back (although the T&Cs aren't clear if we can take money out online after maturity)...Born2Save_3 said:Chaykin said:Newcastle BS / Manchester BS Festive RSs:Who knows - maybe they will put up QR codes in branches? Yes please, if anyone comes across a QR code, please take a photo or use a scanning app to convert to a URL. This would be very helpful to many people here.After all it is unfair to local people who work night shift all of the time, or people who are immuno compromised and are clinically extremely vulnerable to airborne viruses; and there's many more valid cases why visiting a local branch may not be practical or even life threatening.Thanks, that would be very helpful, plus anything further you can find out.I've withdrawn money from Stafford BS previously by post with a passbook and their withdrawal form and it all went well. I have a Pullman account with them to keep membership longer term and I have a feeling that it might be possible to make withdrawals from this account without posting a passbook to them.

Yes please, if anyone comes across a QR code, please take a photo or use a scanning app to convert to a URL. This would be very helpful to many people here.After all it is unfair to local people who work night shift all of the time, or people who are immuno compromised and are clinically extremely vulnerable to airborne viruses; and there's many more valid cases why visiting a local branch may not be practical or even life threatening.Thanks, that would be very helpful, plus anything further you can find out.I've withdrawn money from Stafford BS previously by post with a passbook and their withdrawal form and it all went well. I have a Pullman account with them to keep membership longer term and I have a feeling that it might be possible to make withdrawals from this account without posting a passbook to them.

1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards