We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Co-operative

Have received an email to say my application for a current account has been successful..

How long does it take them to send account details, so i can open their RS? Is it via email or post?0 -

West Brom RS 7 maturity details received today. No decent replacement RS, just a RS account at 2.35%. Disappointing.2

-

Should receive account details on the same day and can immediately apply for a regular saver, forgot if it was online or in the app though. Regular saver acct ready to be funded in two days.topyam said:Co-operative

Have received an email to say my application for a current account has been successful..

How long does it take them to send account details, so i can open their RS? Is it via email or post?0 -

Manchester Regular Saver (Issue 1)

Has anyone had any issues opening this, please?I successfully (or so I thought) opened this in the wee hours of the 23rd Sep, and despite having an email saying something about needing further ID (but not saying what and how) "We advised you of this at the end of the application and will send you an email shortly which will remind you of what we need," — there was NO mention of said advice at the end of my application! — I have not heard a thing back from them. I have sent emails, and just get auto-response "we will get back to you..."0 -

Loughborough

The 5 Year Retirement Monthly Saver was supposed to pay interest 12 month s after opening. However, due to a glitch in the system (their words, not mine) they paid interest on 31st March 2025 as well. The fault has been rectified for the future.

Just a note in case it affects peoples 2024-25 tax/return and/or 2025-26 tax projection. Still, benefit by nearly £4 as interest has been paid on the March 31st interest. There is no online access, so one needs to phone for a balance.1 -

Club Lloyds Regular

I just opened a new account today and deposited the £400.

However I’ve just noticed that the summary box says:

“You can save £25 to £400 every month by 1 standing order or a bank transfer. This needs to reach your account before the 25th of the month“

I have two questions:

if the £400 hit my account today (26th) does this matter as the T&Cs say 25th

is it based on calendar month, ie make a further deposit on the 1st?0 -

As long as your funds are showing as being deposited this month (ie, doesn't matter if on 26th), you can add to it on the 1st October.7sefton said:Club Lloyds Regular

I just opened a new account today and deposited the £400.

However I’ve just noticed that the summary box says:

“You can save £25 to £400 every month by 1 standing order or a bank transfer. This needs to reach your account before the 25th of the month“

I have two questions:

if the £400 hit my account today (26th) does this matter as the T&Cs say 25th

is it based on calendar month, ie make a further deposit on the 1st?1 -

1. No, the 25th is really just to do with timing for SOs. 2. Yes, you can make another deposit on the 1st.7sefton said:Club Lloyds Regular

I just opened a new account today and deposited the £400.

However I’ve just noticed that the summary box says:

“You can save £25 to £400 every month by 1 standing order or a bank transfer. This needs to reach your account before the 25th of the month“

I have two questions:

if the £400 hit my account today (26th) does this matter as the T&Cs say 25th

is it based on calendar month, ie make a further deposit on the 1st?

1 -

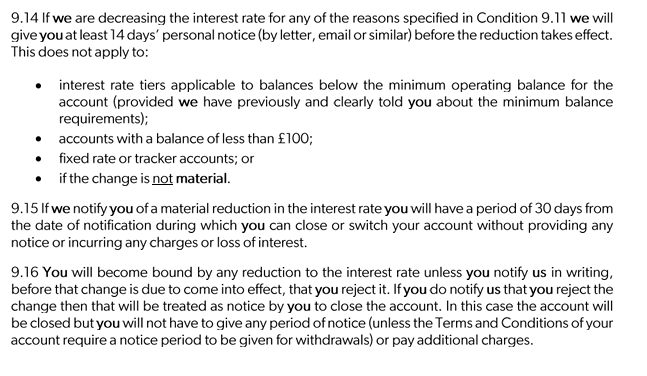

It is in the terms. The Ts&Cs state:s71hj said:

I hope that's in writing somewhere buried in the literature!Bridlington1 said:Just spoken to Beverley BS, the branch manager has confirmed that if they announce a cut to the interest rate of the Online RS and you decided to close the account early as a result you would still earn the bonus rate of interest provided you've paid in £10-£150 up to the day of closure.

General Ts&Cs state:

Thus my interpretation of the terms would be that losing the bonus would be a loss of interest, thus if they announce a cut to the interest rate of the account you could close the account and still get the bonus rate of interest under 9.15 of the general Ts&Cs.

The manager of their only branch has corroborated this interpretation.5 -

Received no account details yet and applied and got approved yestdiomedeidae said:

Should receive account details on the same day and can immediately apply for a regular saver, forgot if it was online or in the app though. Regular saver acct ready to be funded in two days.topyam said:Co-operative

Have received an email to say my application for a current account has been successful..

How long does it take them to send account details, so i can open their RS? Is it via email or post? 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards