We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

I was wearing a green shirt when I did it and intend to again this Sunday.E_zroda said:

Principality RS rolloversmon3ysav3r said:

My online request for Principality RS 3 rollover to RS 4 was denied because I already have an RS 4, my previous attempt to rollover RS 2 to a RS 3 was also denied because I already had RS 3.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.

It is a Dark Art with many posts here dedicated to mastering it....20 -

Fair point. As I said I tweaked this from a different account so slapped the 1st on their just to illustrate how my excel calculations work. And I know I said I wouldn't tweak anymore but curiosity got the better of me so here's an updated table with the £42.83 interest figure.Bobblehat said:

Small tweak .... 1st Jan is a BH ... I used 2nd Jan as the start point (the rest of the dates as yours). I got £42.47 if closed on 2nd Sept and £42.79 if closed on 3rd Sept.Ch1ll1Phlakes said:

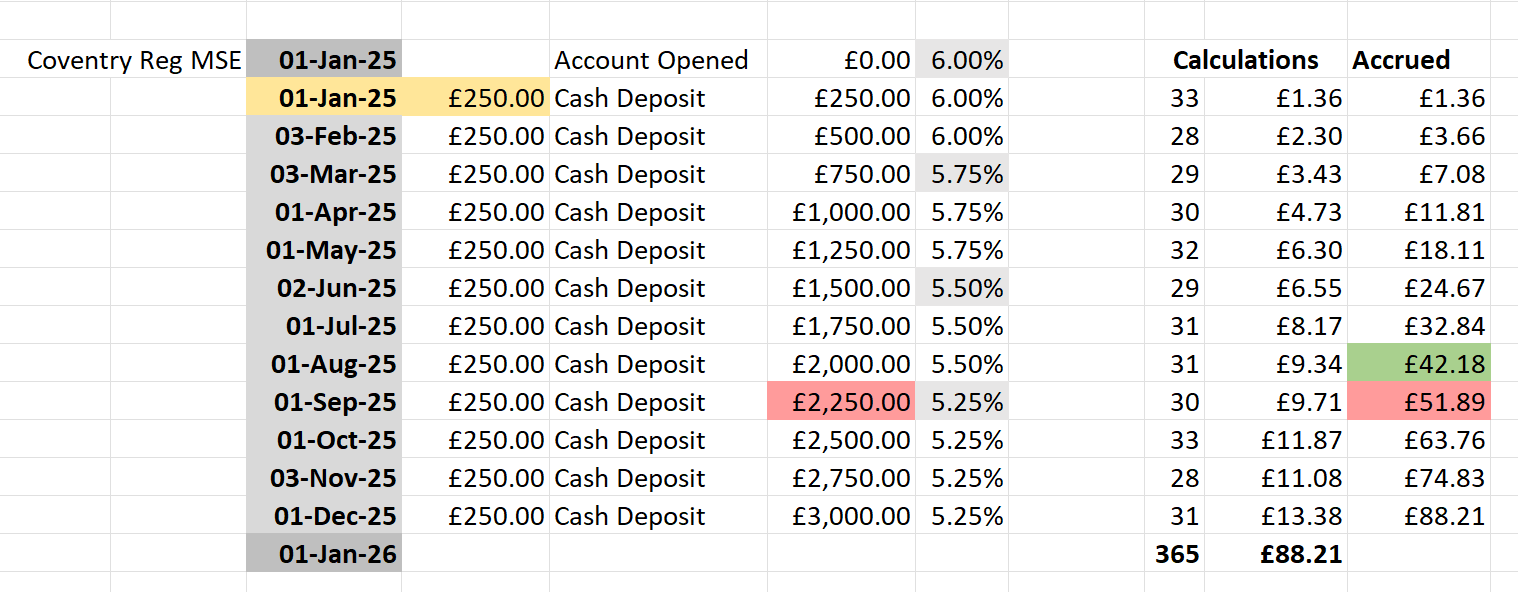

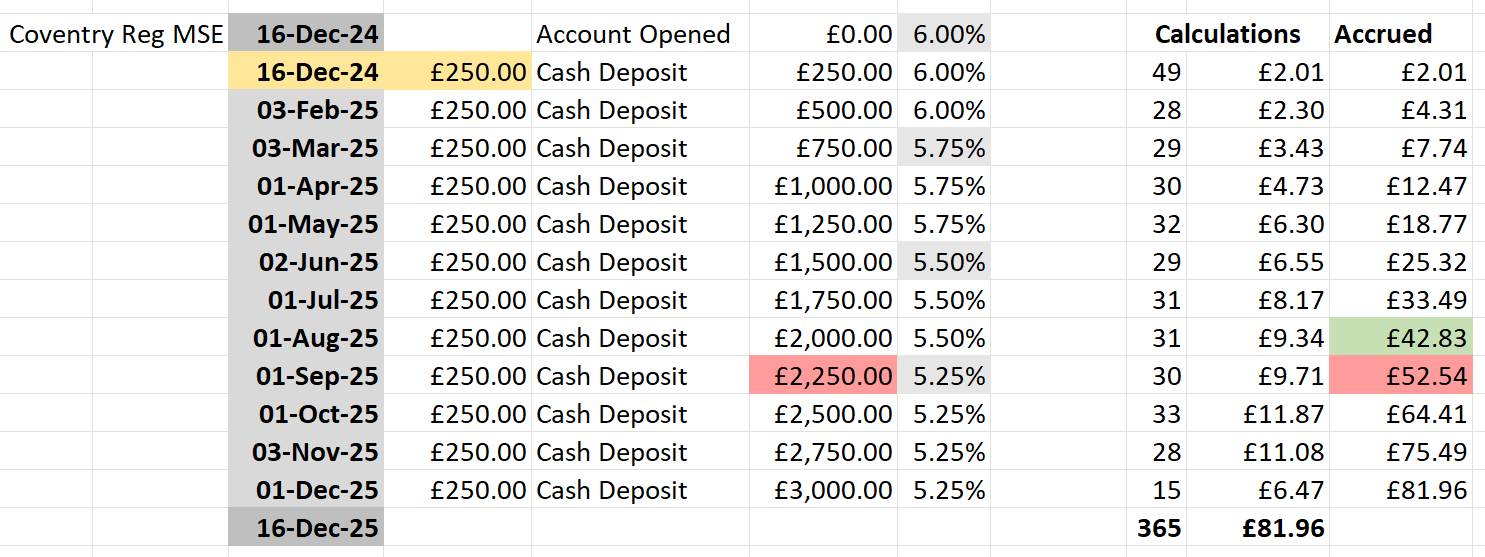

Using this and under the assumption the account was opened on the 1st January and paid into by standing order I have the following from my excelAidanmc said:

The Seasonal RS was originally 6%,Ch1ll1Phlakes said:

Without knowing the dates of your deposits it would be hard to confirm this is correct. A rough calculation using an interest rate of 5.25% (though I know it did start higher than this) provides the followings71hj said:

In online banking £2,292.83 is suggested closing balance ie £42.83 interest. Does this look like no penalty applied? I'm rubbish at those sort of sums!Aidanmc said:

I dont use the app at all.s71hj said:

Is there a way to close it in the app? I can't see an obvious button to press?Aidanmc said:

I kept the Seasonal saver for now.s71hj said:

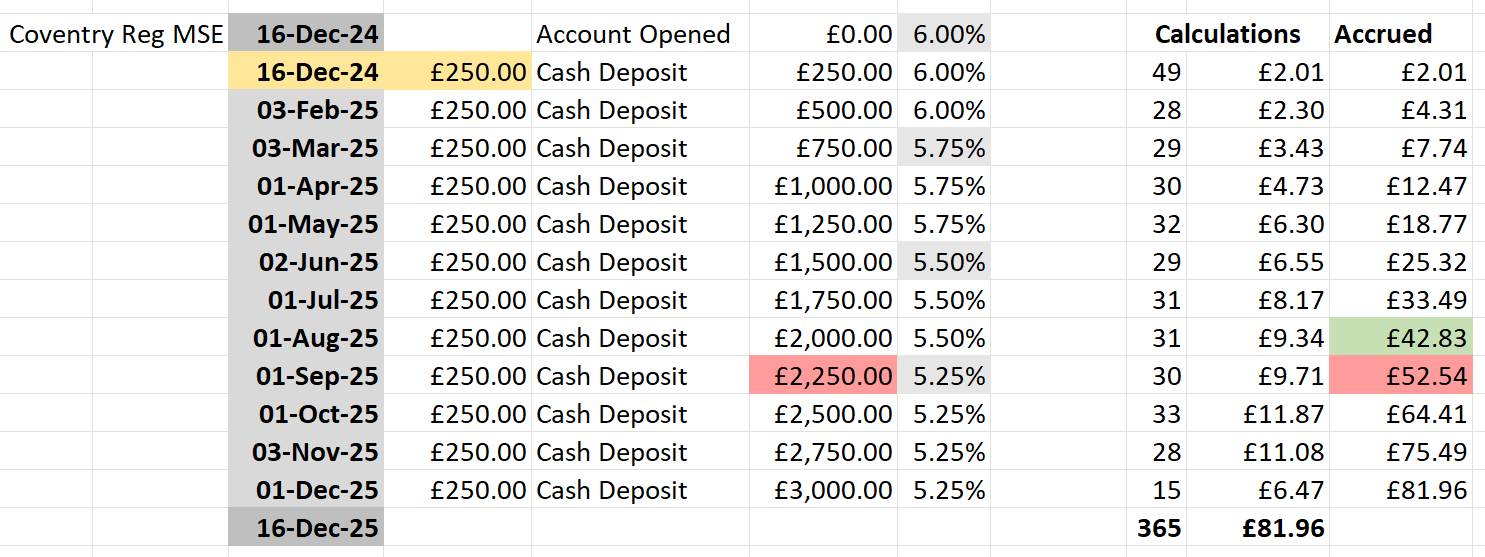

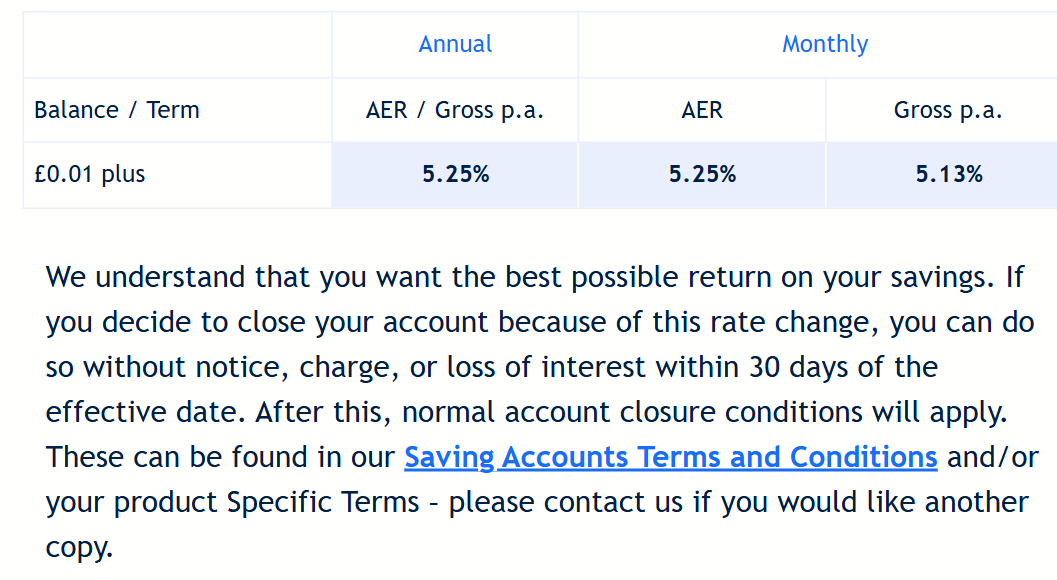

Is there a penalty for early closure of the Coventry Loyalty Seasonal saver?Aidanmc said:

You can close it penalty free until 2nd October.Kim_13 said:

They sent it on 18/8, but there has been confusion this time around due to the wording of that email suggesting it was 30 days from the effective date rather than the notification date.surreysaver said:

If I understand Coventry's T&Cs correctly, it is within a certain amount of time of receiving notification of the rate drop - not of the rate actually dropping.Speculator said:

There should be no penalty for closing due to the rate drop.roked said:I closed my Coventry seasonal RS today due to the rate dropping below my threshold and wanted to use the funds for other RS's anyway. Surprised to see that I seem to have only got a two-week penalty on interest instead of a full month. Not complaining

Can't remember when Coventry sent out its notifications, but I think it was quite a while agoCoventry haven’t responded to my secure message sent before they opened yesterday, if they don’t answer soon I guess I will close the Loyalty Saver myself and then raise a complaint if a penalty is applied.

I closed mine last week also without penalty.

But the same terms should apply as the rate was reduced also.

Penalty free until 2nd October

But you can close it in online banking

You haven't reached a full nine months of holding the account so expected interest is lower than £48.62 and higher than £38.84 (as you've had the account at least eight months) so yes from what I see that sounds about right for penalty free.

Note: I don't have this account so I don't know when the rate reductions were and please let me know if I've used incorrect figures.

A separate rough calculation with guessed rate reductions gives a range of around £41.50 to £51.25 so again seems fine.

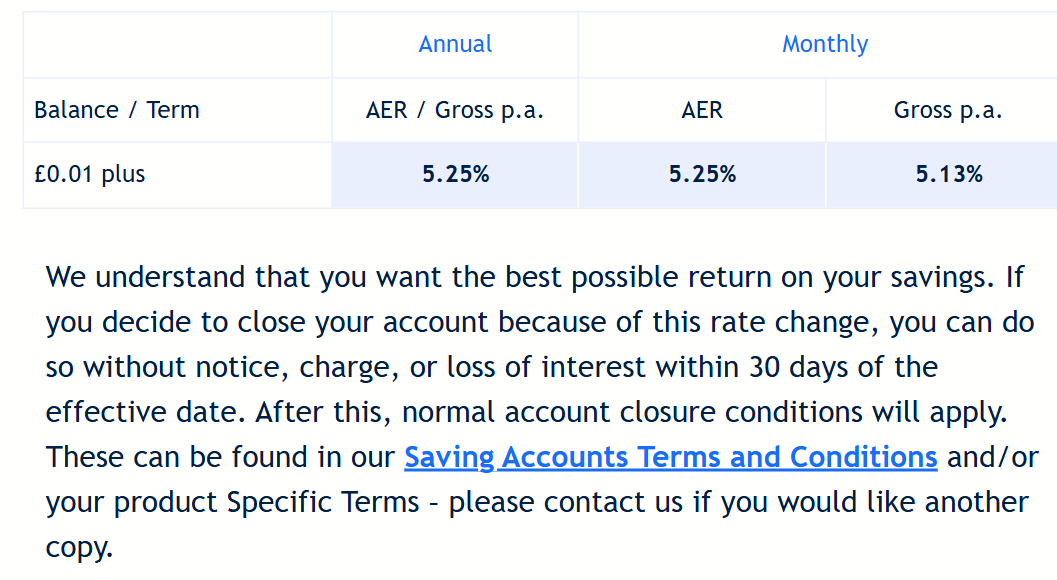

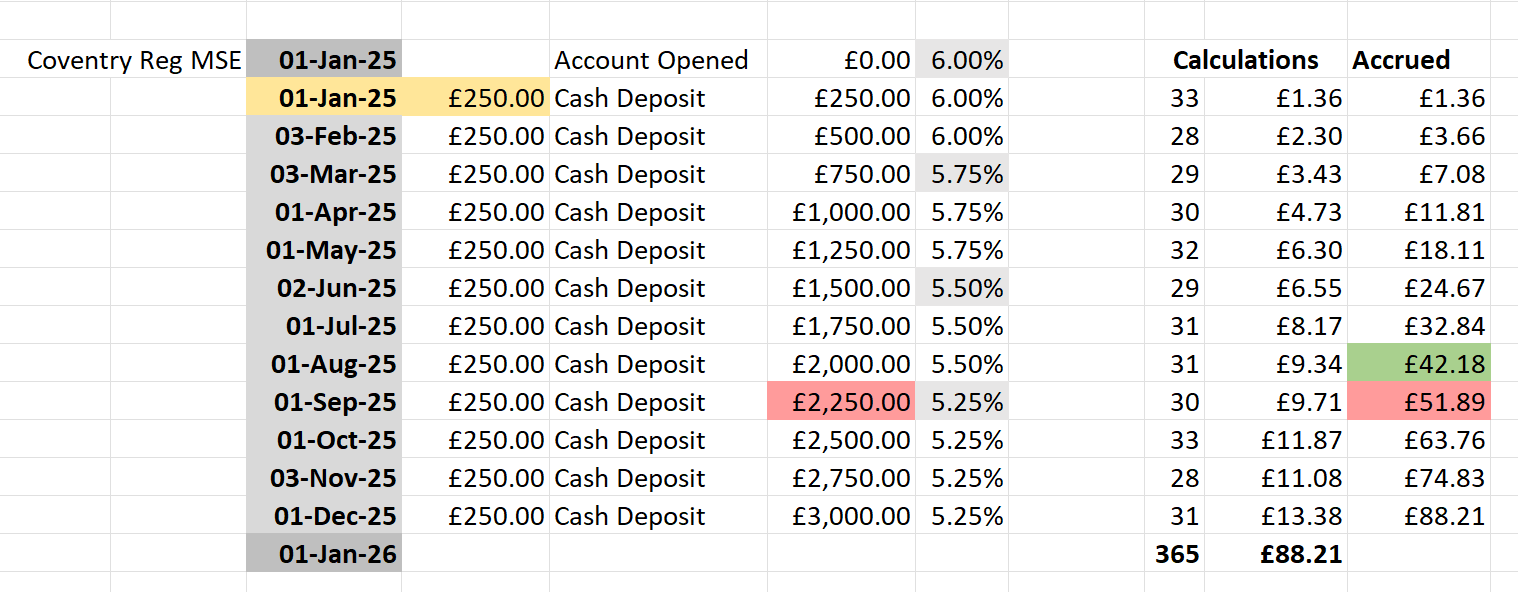

dropping to 5.75% on 3 March,

5.5% from 2 June

5.25% from 1 September

The green is giving the expected accrued interest on September 1st, a little tweaking (which I'm not going to do sorry as I don't have the account and don't know your start date) and I'd get the £42.83 you see on September 2nd. The value in pink/red is corresponding to if the £2250 was held until the end of September. These tables always nicely highlight the regular saver interest growth over time.

Note: Some dates aren't the 1st as this is due to me adapting this table from a different account but taking into account that standing orders usually won't be processed on weekends and go through on the next working day.

Still probably a little out though as closure value is from the 2nd but you get the idea. Also I know there's no payment for January but I've no idea when the deposits actually were so this is probably as good as I can get. PS I'll stop bothering people with these tables now 1

1 -

It is hugely appreciated that you do it.Ch1ll1Phlakes said:

Fair point. As I said I tweaked this from a different account so slapped the 1st on their just to illustrate how my excel calculations work. And I know I said I wouldn't tweak anymore but curiosity got the better of me so here's an updated table with the £42.83 interest figure.Bobblehat said:

Small tweak .... 1st Jan is a BH ... I used 2nd Jan as the start point (the rest of the dates as yours). I got £42.47 if closed on 2nd Sept and £42.79 if closed on 3rd Sept.Ch1ll1Phlakes said:

Using this and under the assumption the account was opened on the 1st January and paid into by standing order I have the following from my excelAidanmc said:

The Seasonal RS was originally 6%,Ch1ll1Phlakes said:

Without knowing the dates of your deposits it would be hard to confirm this is correct. A rough calculation using an interest rate of 5.25% (though I know it did start higher than this) provides the followings71hj said:

In online banking £2,292.83 is suggested closing balance ie £42.83 interest. Does this look like no penalty applied? I'm rubbish at those sort of sums!Aidanmc said:

I dont use the app at all.s71hj said:

Is there a way to close it in the app? I can't see an obvious button to press?Aidanmc said:

I kept the Seasonal saver for now.s71hj said:

Is there a penalty for early closure of the Coventry Loyalty Seasonal saver?Aidanmc said:

You can close it penalty free until 2nd October.Kim_13 said:

They sent it on 18/8, but there has been confusion this time around due to the wording of that email suggesting it was 30 days from the effective date rather than the notification date.surreysaver said:

If I understand Coventry's T&Cs correctly, it is within a certain amount of time of receiving notification of the rate drop - not of the rate actually dropping.Speculator said:

There should be no penalty for closing due to the rate drop.roked said:I closed my Coventry seasonal RS today due to the rate dropping below my threshold and wanted to use the funds for other RS's anyway. Surprised to see that I seem to have only got a two-week penalty on interest instead of a full month. Not complaining

Can't remember when Coventry sent out its notifications, but I think it was quite a while agoCoventry haven’t responded to my secure message sent before they opened yesterday, if they don’t answer soon I guess I will close the Loyalty Saver myself and then raise a complaint if a penalty is applied.

I closed mine last week also without penalty.

But the same terms should apply as the rate was reduced also.

Penalty free until 2nd October

But you can close it in online banking

You haven't reached a full nine months of holding the account so expected interest is lower than £48.62 and higher than £38.84 (as you've had the account at least eight months) so yes from what I see that sounds about right for penalty free.

Note: I don't have this account so I don't know when the rate reductions were and please let me know if I've used incorrect figures.

A separate rough calculation with guessed rate reductions gives a range of around £41.50 to £51.25 so again seems fine.

dropping to 5.75% on 3 March,

5.5% from 2 June

5.25% from 1 September

The green is giving the expected accrued interest on September 1st, a little tweaking (which I'm not going to do sorry as I don't have the account and don't know your start date) and I'd get the £42.83 you see on September 2nd. The value in pink/red is corresponding to if the £2250 was held until the end of September. These tables always nicely highlight the regular saver interest growth over time.

Note: Some dates aren't the 1st as this is due to me adapting this table from a different account but taking into account that standing orders usually won't be processed on weekends and go through on the next working day.

Still probably a little out though as closure value is from the 2nd but you get the idea. Also I know there's no payment for January but I've no idea when the deposits actually were so this is probably as good as I can get. PS I'll stop bothering people with these tables now 3

3 -

Market Harborough BS have launched a Limited Edition Regular Saver (04.11.2026) – Branch Exclusive at 6% Fixed, £300/mth max. Branch opening only but can be managed online.11

-

Can anyone tell me when the option for maturity comes up please? Mine (RS3) matures on 28/9 and nothing showing so far as to what options available.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.0 -

I believe it's 14 days ahead of renewalToastLady said:

Can anyone tell me when the option for maturity comes up please? Mine (RS3) matures on 28/9 and nothing showing so far as to what options available.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.2 -

What happens if it is denied? Do you get the chance to change your maturity instructions or you just get the whole amount transferred to your nominated account?mon3ysav3r said:

My online request for Principality RS 3 rollover to RS 4 was denied because I already have an RS 4, my previous attempt to rollover RS 2 to a RS 3 was also denied because I already had RS 3.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.0 -

They asked me what I wanted to do instead via a PM, I said transfer to another Easy Access account I hold with them, they didn't offer a default option as such.rallycurve said:

What happens if it is denied? Do you get the chance to change your maturity instructions or you just get the whole amount transferred to your nominated account?mon3ysav3r said:

My online request for Principality RS 3 rollover to RS 4 was denied because I already have an RS 4, my previous attempt to rollover RS 2 to a RS 3 was also denied because I already had RS 3.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.1 -

Bridlington1 said:Market Harborough BS have launched a Limited Edition Regular Saver (04.11.2026) – Branch Exclusive at 6% Fixed, £300/mth max. Branch opening only but can be managed online.

- Customers may only have a maximum of two Limited Edition Regular Saver accounts open at a time, either solely or jointly, with a combined maximum deposit of £300 per month not exceeding the maximum balance of £4,500.00

IIRC the previous max was £250 pm?1 -

It was, yes. It’ll be interesting to see whether £250 + £300 is accepted without issue, as previous accounts weren’t described as Limited Edition.soulsaver said:Bridlington1 said:Market Harborough BS have launched a Limited Edition Regular Saver (04.11.2026) – Branch Exclusive at 6% Fixed, £300/mth max. Branch opening only but can be managed online.- Customers may only have a maximum of two Limited Edition Regular Saver accounts open at a time, either solely or jointly, with a combined maximum deposit of £300 per month not exceeding the maximum balance of £4,500.00

IIRC the previous max was £250 pm?

Is it just me or do branch only accounts appear to be increasing, with actual branches going the other way 😕0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards