We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Like already mentioned, it does depend on when you opened the account and when the deposits are made. If it helps as a guide, my interest was £46.02 and I opened it on December 18th (with the first deposit) and deposited the full amount on the 1st of every month (except this month of course). I used a spreadsheet to calculate all the daily interest, with the rate drops and thats how I knew it was out by two weeks.s71hj said:

Brill thanks. Is that from a tool you have created or some off the shelf one? Looks really useful for this game! Thank you for sharing.Ch1ll1Phlakes said:

Without knowing the dates of your deposits it would be hard to confirm this is correct. A rough calculation using an interest rate of 5.25% (though I know it did start higher than this) provides the followings71hj said:

In online banking £2,292.83 is suggested closing balance ie £42.83 interest. Does this look like no penalty applied? I'm rubbish at those sort of sums!Aidanmc said:

I dont use the app at all.s71hj said:

Is there a way to close it in the app? I can't see an obvious button to press?Aidanmc said:

I kept the Seasonal saver for now.s71hj said:

Is there a penalty for early closure of the Coventry Loyalty Seasonal saver?Aidanmc said:

You can close it penalty free until 2nd October.Kim_13 said:

They sent it on 18/8, but there has been confusion this time around due to the wording of that email suggesting it was 30 days from the effective date rather than the notification date.surreysaver said:

If I understand Coventry's T&Cs correctly, it is within a certain amount of time of receiving notification of the rate drop - not of the rate actually dropping.Speculator said:

There should be no penalty for closing due to the rate drop.roked said:I closed my Coventry seasonal RS today due to the rate dropping below my threshold and wanted to use the funds for other RS's anyway. Surprised to see that I seem to have only got a two-week penalty on interest instead of a full month. Not complaining

Can't remember when Coventry sent out its notifications, but I think it was quite a while agoCoventry haven’t responded to my secure message sent before they opened yesterday, if they don’t answer soon I guess I will close the Loyalty Saver myself and then raise a complaint if a penalty is applied.

I closed mine last week also without penalty.

But the same terms should apply as the rate was reduced also.

Penalty free until 2nd October

But you can close it in online banking

You haven't reached a full nine months of holding the account so expected interest is lower than £48.62 and higher than £38.84 (as you've had the account at least eight months) so yes from what I see that sounds about right for penalty free.

Note: I don't have this account so I don't know when the rate reductions were and please let me know if I've used incorrect figures.

A separate rough calculation with guessed rate reductions gives a range of around £41.50 to £51.25 so again seems fine.0 -

I usually do these calculations in excel so I can enter specific dates on deposits for the most accurate prediction of interest. For rough calculations like the one above I use theCalculatorSite linked heres71hj said:

Brill thanks. Is that from a tool you have created or some off the shelf one? Looks really useful for this game! Thank you for sharing.Ch1ll1Phlakes said:

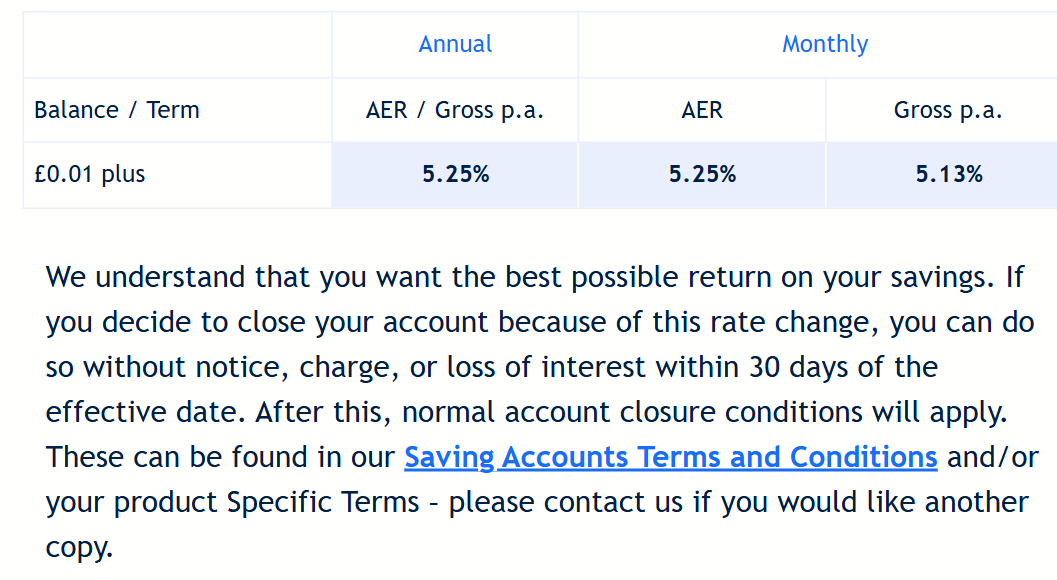

Without knowing the dates of your deposits it would be hard to confirm this is correct. A rough calculation using an interest rate of 5.25% (though I know it did start higher than this) provides the followings71hj said:

In online banking £2,292.83 is suggested closing balance ie £42.83 interest. Does this look like no penalty applied? I'm rubbish at those sort of sums!Aidanmc said:

I dont use the app at all.s71hj said:

Is there a way to close it in the app? I can't see an obvious button to press?Aidanmc said:

I kept the Seasonal saver for now.s71hj said:

Is there a penalty for early closure of the Coventry Loyalty Seasonal saver?Aidanmc said:

You can close it penalty free until 2nd October.Kim_13 said:

They sent it on 18/8, but there has been confusion this time around due to the wording of that email suggesting it was 30 days from the effective date rather than the notification date.surreysaver said:

If I understand Coventry's T&Cs correctly, it is within a certain amount of time of receiving notification of the rate drop - not of the rate actually dropping.Speculator said:

There should be no penalty for closing due to the rate drop.roked said:I closed my Coventry seasonal RS today due to the rate dropping below my threshold and wanted to use the funds for other RS's anyway. Surprised to see that I seem to have only got a two-week penalty on interest instead of a full month. Not complaining

Can't remember when Coventry sent out its notifications, but I think it was quite a while agoCoventry haven’t responded to my secure message sent before they opened yesterday, if they don’t answer soon I guess I will close the Loyalty Saver myself and then raise a complaint if a penalty is applied.

I closed mine last week also without penalty.

But the same terms should apply as the rate was reduced also.

Penalty free until 2nd October

But you can close it in online banking

You haven't reached a full nine months of holding the account so expected interest is lower than £48.62 and higher than £38.84 (as you've had the account at least eight months) so yes from what I see that sounds about right for penalty free.

Note: I don't have this account so I don't know when the rate reductions were and please let me know if I've used incorrect figures.

A separate rough calculation with guessed rate reductions gives a range of around £41.50 to £51.25 so again seems fine.

Compound Interest Calculator - Daily, Monthly, Yearly Compounding

3 -

Born2Save_3 said:Of the new accounts available only the Loyalty Mortgage Saver (2) is appealing at 4.8%. Does anyone know if the Coventry are sticklers over actually having a mortgage or is entering genuine details of a mortgage necessary ?

If Coventry's records don't show you have a mortgage, they won't let you open an account.0 -

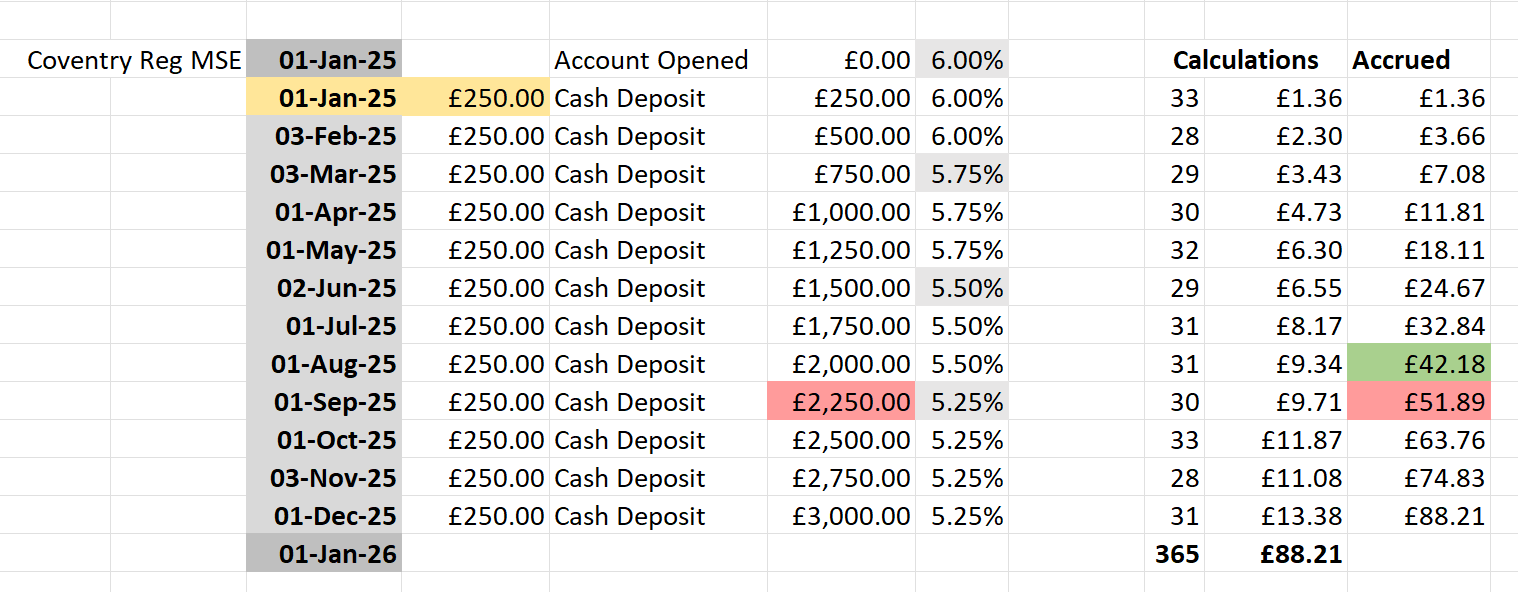

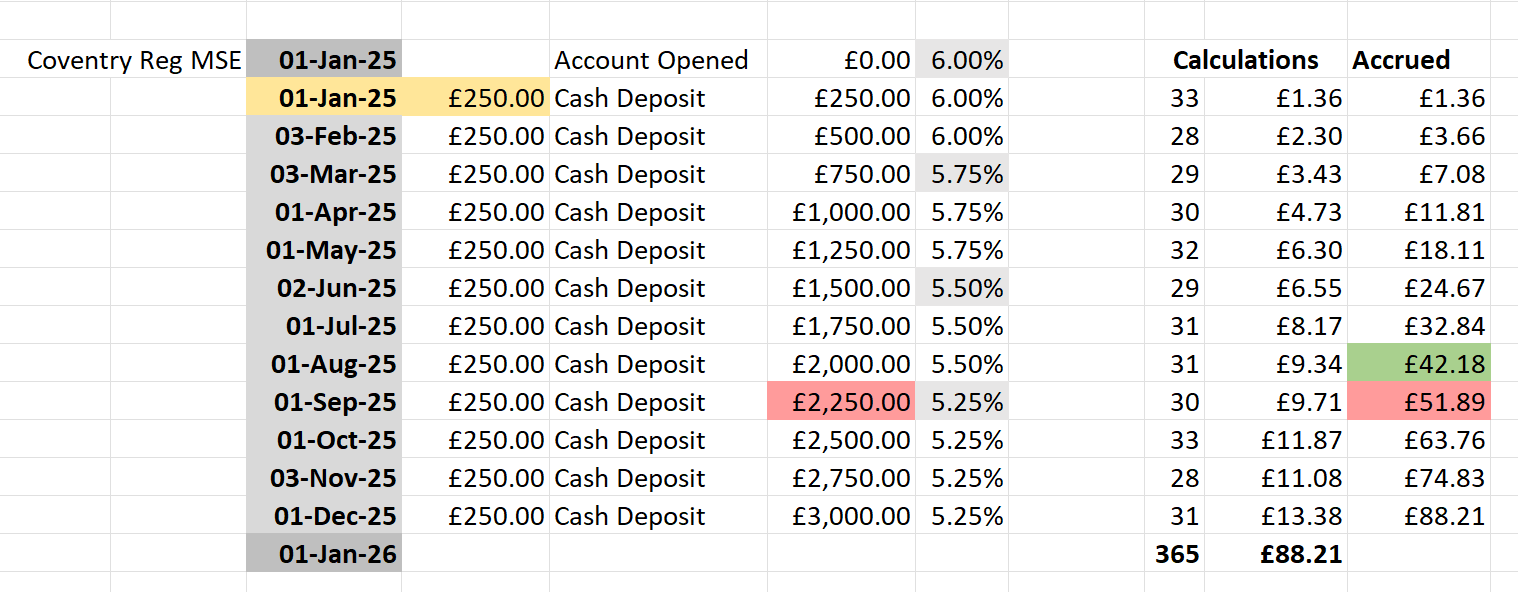

Using this and under the assumption the account was opened on the 1st January and paid into by standing order I have the following from my excelAidanmc said:

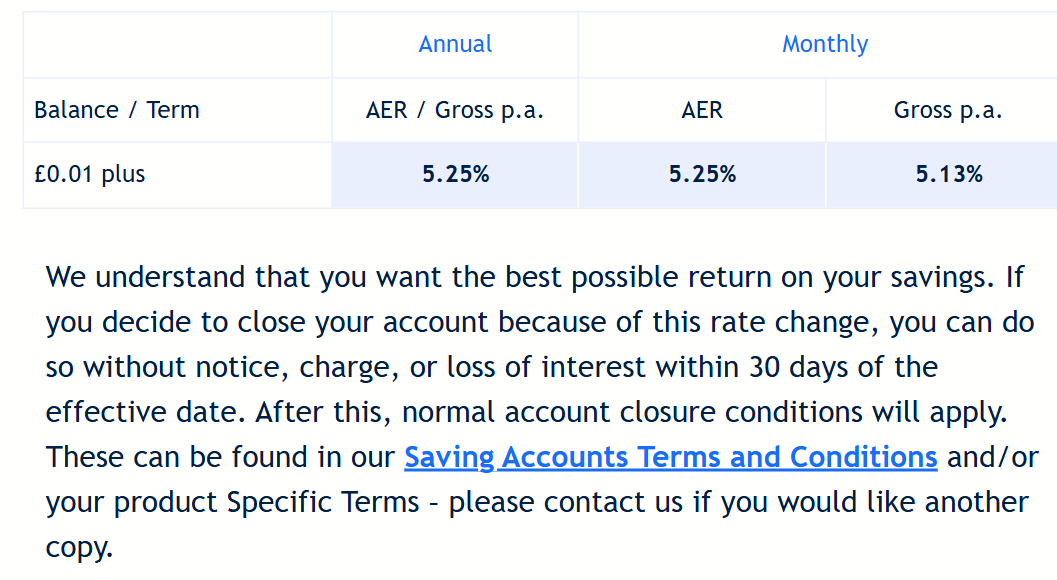

The Seasonal RS was originally 6%,Ch1ll1Phlakes said:

Without knowing the dates of your deposits it would be hard to confirm this is correct. A rough calculation using an interest rate of 5.25% (though I know it did start higher than this) provides the followings71hj said:

In online banking £2,292.83 is suggested closing balance ie £42.83 interest. Does this look like no penalty applied? I'm rubbish at those sort of sums!Aidanmc said:

I dont use the app at all.s71hj said:

Is there a way to close it in the app? I can't see an obvious button to press?Aidanmc said:

I kept the Seasonal saver for now.s71hj said:

Is there a penalty for early closure of the Coventry Loyalty Seasonal saver?Aidanmc said:

You can close it penalty free until 2nd October.Kim_13 said:

They sent it on 18/8, but there has been confusion this time around due to the wording of that email suggesting it was 30 days from the effective date rather than the notification date.surreysaver said:

If I understand Coventry's T&Cs correctly, it is within a certain amount of time of receiving notification of the rate drop - not of the rate actually dropping.Speculator said:

There should be no penalty for closing due to the rate drop.roked said:I closed my Coventry seasonal RS today due to the rate dropping below my threshold and wanted to use the funds for other RS's anyway. Surprised to see that I seem to have only got a two-week penalty on interest instead of a full month. Not complaining

Can't remember when Coventry sent out its notifications, but I think it was quite a while agoCoventry haven’t responded to my secure message sent before they opened yesterday, if they don’t answer soon I guess I will close the Loyalty Saver myself and then raise a complaint if a penalty is applied.

I closed mine last week also without penalty.

But the same terms should apply as the rate was reduced also.

Penalty free until 2nd October

But you can close it in online banking

You haven't reached a full nine months of holding the account so expected interest is lower than £48.62 and higher than £38.84 (as you've had the account at least eight months) so yes from what I see that sounds about right for penalty free.

Note: I don't have this account so I don't know when the rate reductions were and please let me know if I've used incorrect figures.

A separate rough calculation with guessed rate reductions gives a range of around £41.50 to £51.25 so again seems fine.

dropping to 5.75% on 3 March,

5.5% from 2 June

5.25% from 1 September

The green is giving the expected accrued interest on September 1st, a little tweaking (which I'm not going to do sorry as I don't have the account and don't know your start date) and I'd get the £42.83 you see on September 2nd. The value in pink/red is corresponding to if the £2250 was held until the end of September. These tables always nicely highlight the regular saver interest growth over time.

Note: Some dates aren't the 1st as this is due to me adapting this table from a different account but taking into account that standing orders usually won't be processed on weekends and go through on the next working day.2 -

7

-

You might not be asked for change of password if using other authenticators but they do require a little more imputmasonic said:

This was a discussion about being prompted to change your password when logging in.35har1old said:

Any authenticator works but Salesforce is already open when you open the phone and it only requires a swipe to proceedmasonic said:

They are using Salesforce to power the online banking site. It is probably just that the password change is poorly enforced. You may get nagged again during your next login session.Slinky said:Well that's odd. Having abandoned the login attempt without changing the password, when I went back to try and login again, the account page was already open without me changing the password. Feels a tad dodgy.0 -

I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.2

-

Small tweak .... 1st Jan is a BH ... I used 2nd Jan as the start point (the rest of the dates as yours). I got £42.47 if closed on 2nd Sept and £42.79 if closed on 3rd Sept.Ch1ll1Phlakes said:

Using this and under the assumption the account was opened on the 1st January and paid into by standing order I have the following from my excelAidanmc said:

The Seasonal RS was originally 6%,Ch1ll1Phlakes said:

Without knowing the dates of your deposits it would be hard to confirm this is correct. A rough calculation using an interest rate of 5.25% (though I know it did start higher than this) provides the followings71hj said:

In online banking £2,292.83 is suggested closing balance ie £42.83 interest. Does this look like no penalty applied? I'm rubbish at those sort of sums!Aidanmc said:

I dont use the app at all.s71hj said:

Is there a way to close it in the app? I can't see an obvious button to press?Aidanmc said:

I kept the Seasonal saver for now.s71hj said:

Is there a penalty for early closure of the Coventry Loyalty Seasonal saver?Aidanmc said:

You can close it penalty free until 2nd October.Kim_13 said:

They sent it on 18/8, but there has been confusion this time around due to the wording of that email suggesting it was 30 days from the effective date rather than the notification date.surreysaver said:

If I understand Coventry's T&Cs correctly, it is within a certain amount of time of receiving notification of the rate drop - not of the rate actually dropping.Speculator said:

There should be no penalty for closing due to the rate drop.roked said:I closed my Coventry seasonal RS today due to the rate dropping below my threshold and wanted to use the funds for other RS's anyway. Surprised to see that I seem to have only got a two-week penalty on interest instead of a full month. Not complaining

Can't remember when Coventry sent out its notifications, but I think it was quite a while agoCoventry haven’t responded to my secure message sent before they opened yesterday, if they don’t answer soon I guess I will close the Loyalty Saver myself and then raise a complaint if a penalty is applied.

I closed mine last week also without penalty.

But the same terms should apply as the rate was reduced also.

Penalty free until 2nd October

But you can close it in online banking

You haven't reached a full nine months of holding the account so expected interest is lower than £48.62 and higher than £38.84 (as you've had the account at least eight months) so yes from what I see that sounds about right for penalty free.

Note: I don't have this account so I don't know when the rate reductions were and please let me know if I've used incorrect figures.

A separate rough calculation with guessed rate reductions gives a range of around £41.50 to £51.25 so again seems fine.

dropping to 5.75% on 3 March,

5.5% from 2 June

5.25% from 1 September

The green is giving the expected accrued interest on September 1st, a little tweaking (which I'm not going to do sorry as I don't have the account and don't know your start date) and I'd get the £42.83 you see on September 2nd. The value in pink/red is corresponding to if the £2250 was held until the end of September. These tables always nicely highlight the regular saver interest growth over time.

Note: Some dates aren't the 1st as this is due to me adapting this table from a different account but taking into account that standing orders usually won't be processed on weekends and go through on the next working day.Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

My online request for Principality RS 3 rollover to RS 4 was denied because I already have an RS 4, my previous attempt to rollover RS 2 to a RS 3 was also denied because I already had RS 3.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.1 -

Principality RS rolloversmon3ysav3r said:

My online request for Principality RS 3 rollover to RS 4 was denied because I already have an RS 4, my previous attempt to rollover RS 2 to a RS 3 was also denied because I already had RS 3.s71hj said:I've had a letter confirming my Principality RS 3 rollover to RS 4 even though I already have an RS 4. I did my request online on Sunday. Will do my wife's this coming Sunday in the hope that may be the reason it worked although I have to say my suspicion is more it's random chance.

It is a Dark Art with many posts here dedicated to mastering it....8

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards