We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Hmmm.... I said the same thing at the end of July, and somehow have ended up with a Darlington, two Monmouthshires, and very soon a new Principalityjameseonline said:Think I'm done opening new accounts for now, apart from the new Principality 6 Month Issue 4 😆

5 -

It is a game & 1 I'm never 100% on but I hope I'm doing the right kind of movesHattie627 said:

Good philosophy when playing the regular saver game. You win some, you lose some. The secret is to keep playing the gamejameseonline said:

Just aim to get 1 by applying asap, anything more (via maturity) is a bonusschiff said:I suppose it's the utmost cheek opening the Issue 4 by application now, and then expecting it to be one of the choices when I get word about my existing 6 month account's maturity in two weeks time. Or ensuring it anyway by opening it today and seeing what happens. You never know with Principality.

Not showing on the home page yet though.0 -

Ha Ha . I guess you are not the only one.clairec666 said:

Hmmm.... I said the same thing at the end of July, and somehow have ended up with a Darlington, two Monmouthshires, and very soon a new Principalityjameseonline said:Think I'm done opening new accounts for now, apart from the new Principality 6 Month Issue 4 😆

0

0 -

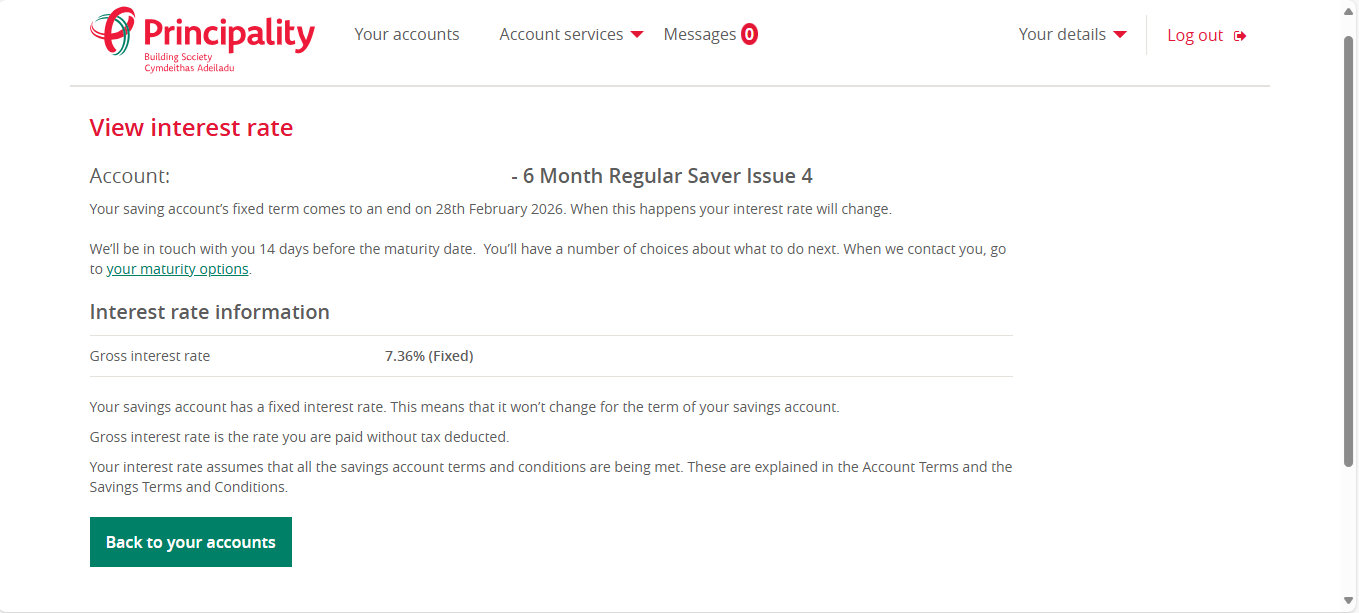

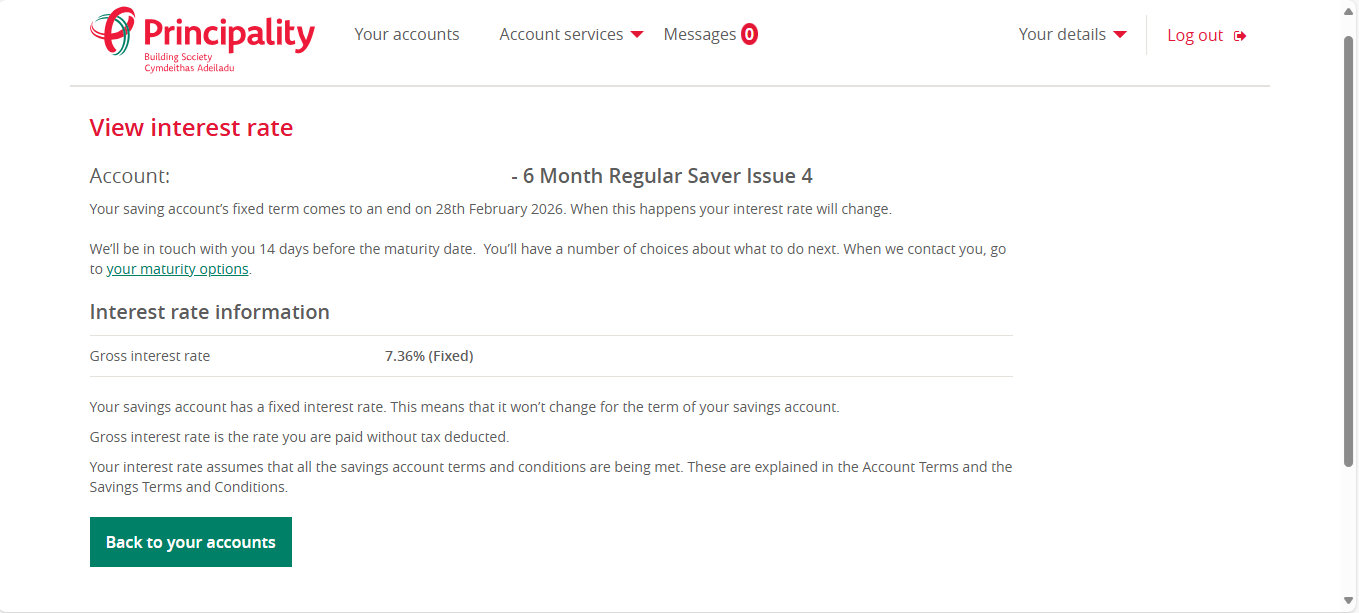

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

1 -

HiBridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

Do you have a direct link please? I'm still getting issue 3 showing when I try to apply and an application is refused

Thanks0 -

So I have 2 of the issue 3(!). Am I also allowed to open an issue 4 then?Bridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate. 1

1 -

Bridlington is very good at this black art, I think we need to chill a little. I'm sure the account will show very soon on the website and we can all open it in an orderly manner.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.4 -

Yes you can.s71hj said:

So I have 2 of the issue 3(!). Am I also allowed to open an issue 4 then?Bridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate. 0

0 -

When the website will likely crash!trickydicky14 said:Bridlington is very good at this black art, I think we need to chill a little. I'm sure the account will show very soon on the website and we can all open it in an orderly manner.I consider myself to be a male feminist. Is that allowed?0 -

Bilmey! Just when I think it's gone quiet! I wonder if the more cautious environment re interest rate cuts has led to a change of approach. All this before savings week too!GetRichOrDieSaving said:

Yes you can.s71hj said:

So I have 2 of the issue 3(!). Am I also allowed to open an issue 4 then?Bridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards