We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Leeds BS Interest Rate Reductions 17/9/25:

Home Deposit Saver (all issues) ~~~ NO CHANGE to headline rate on balances of under £30k so remains at 4.8%. Rate for balances above £30k to reduce from 1.85% to 1.7%

REGULAR SAVER (ISSUE 45, 46, 47, 48, 49, 50, 51, 52, 53, 54, 56, 57, 59, 60, 61, 62, 63, 64, 65 & 66) ~~~ NO CHANGE to headline rate on balances of under £6k so remains at 4.7%. Rate for balances above £30k to reduce from 1.85% to 1.7%

REGULAR SAVER (ISSUE 55 & 58) ~~~ NO CHANGE to headline rate on balances of under £6k so remains at 4.85%. Rate for balances above £30k to reduce from 1.85% to 1.7%11 -

Darlington Building Society Regular Monthly Saver and Green Monthly Saver

Hello,

Did anyone receive any correspondence regarding the conversion of these accounts to easy access savings accounts please?

If you did, can you please advise if you held more than £100 in either of the accounts?

If you did not, can you also advise if you held more than £100 in either of the accounts please?

Darlington Building Society have advised communications around the product change were only sent to members with more than £100 in one of the affected accounts, and they say this is in line with their ts and cs. However I think communications should have been sent to all members (or at least put in branch/online) and that not doing so was not in line with the terms, as there is no stated required minimum balance for notifying of changes to 'specific terms' (while there is relating to interest rates).

I looked through this thread, and it seems weird that no one posted about the changes before they occurred, which is why I am asking the question as it will help confirm if:- Communications were actually sent out to anyone (on balance of probabilities, someone on here probably had more than £100 in either account)

- If communications were actually limited to those with more than £100 balances

Thank you0 -

Welcome to the forum.

My accounts were converted and I was not notified either, but I did hold less than £100. They probably are supposed to notify us.

I don't think anyone did post before the changes occurred, but I posted (as did @BestSeagull ) when we became aware, albeit after the changes had taken place. I am unsure what their balance was. I don't believe anyone else posted about the same issue, so perhaps it is just us three affected.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

I had a Darlington RS with over £100 that matured recently and I asked them why I did not receive notification that this was going to occur.Saver684926 said:Darlington Building Society Regular Monthly Saver and Green Monthly Saver

Did anyone receive any correspondence regarding the conversion of these accounts to easy access savings accounts please?

If you did, can you please advise if you held more than £100 in either of the accounts?

They claimed that the maturity notifications had been sent by email and may have ended up in my Spam folder.

Don't really buy that but not really worth the effort to pursue1 -

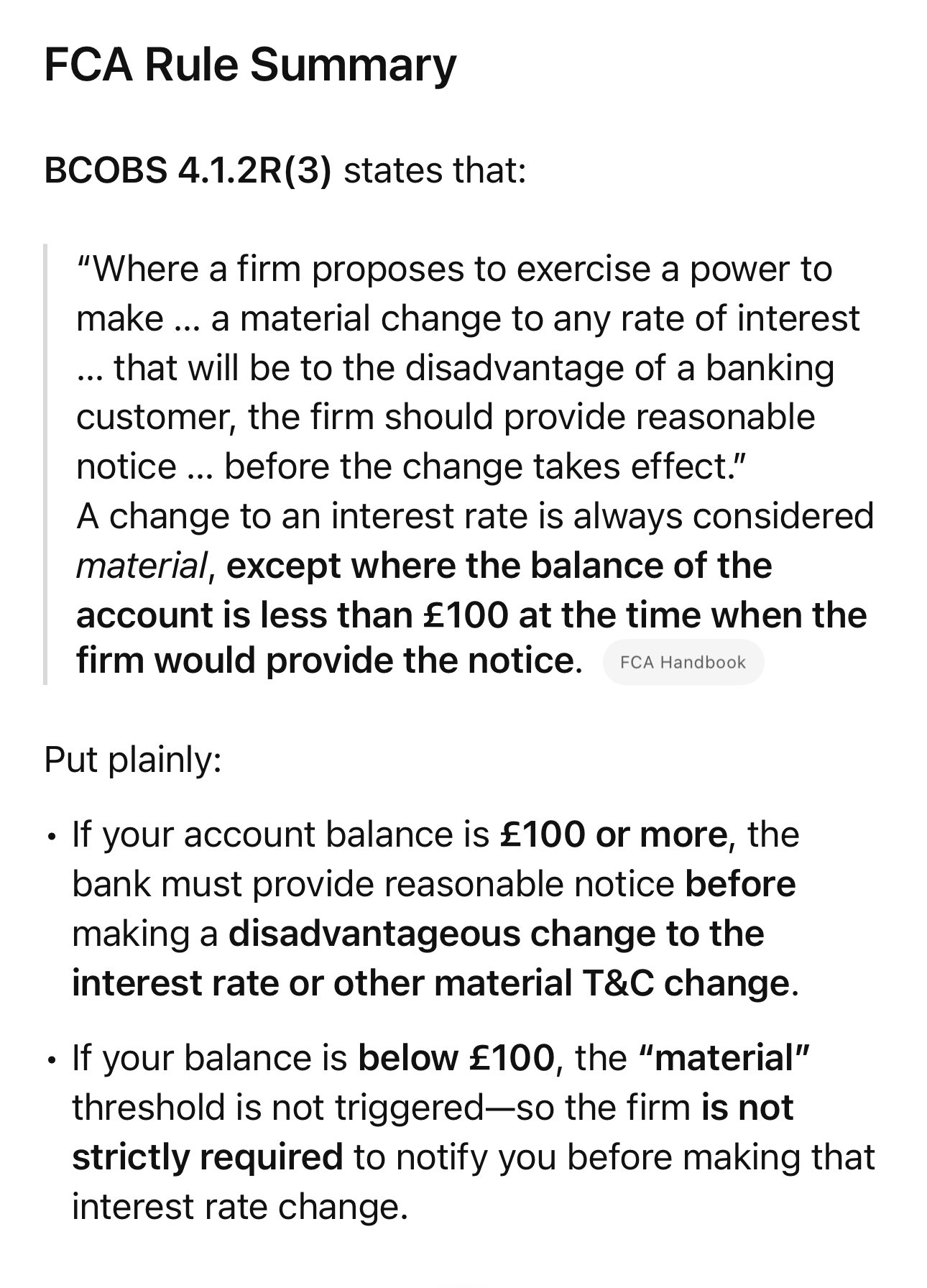

AFAIK, the obligation to notify applies, by FCA rules, only to accounts with balances >£100. But check for yourself.

2

2 -

I had the same occur too. They confirmed no notice had been sent for conversion due to balance, but claimed to have sent out notice for the maturity. They did not send me anything for the maturing account and could not prove that they had when I asked for this.gt94sss2 said:

I had a Darlington RS with over £100 that matured recently and I asked them why I did not receive notification that this was going to occur.Saver684926 said:Darlington Building Society Regular Monthly Saver and Green Monthly Saver

Did anyone receive any correspondence regarding the conversion of these accounts to easy access savings accounts please?

If you did, can you please advise if you held more than £100 in either of the accounts?

They claimed that the maturity notifications had been sent by email and may have ended up in my Spam folder.

Don't really buy that but not really worth the effort to pursue1 -

Seems my £250 is showing up in my Darlington Regular today ☺️0

-

No communications received by either of us and both of us less than £100Saver684926 said:Darlington Building Society Regular Monthly Saver and Green Monthly Saver

Hello,

Did anyone receive any correspondence regarding the conversion of these accounts to easy access savings accounts please?

If you did, can you please advise if you held more than £100 in either of the accounts?

If you did not, can you also advise if you held more than £100 in either of the accounts please?

Darlington Building Society have advised communications around the product change were only sent to members with more than £100 in one of the affected accounts, and they say this is in line with their ts and cs. However I think communications should have been sent to all members (or at least put in branch/online) and that not doing so was not in line with the terms, as there is no stated required minimum balance for notifying of changes to 'specific terms' (while there is relating to interest rates).

I looked through this thread, and it seems weird that no one posted about the changes before they occurred, which is why I am asking the question as it will help confirm if:- Communications were actually sent out to anyone (on balance of probabilities, someone on here probably had more than £100 in either account)

- If communications were actually limited to those with more than £100 balances

Thank youIf you want to be rich, never, ever have kids 1

1 -

@gt94sss2 - Was that a Regular Monthly Saver or Green Regular Saver, or was it a 12 Month Regular Saver or something please?

@friolento I've found BCOBS 4.1.2(3) in the handbook, and it sides with them re the rate (I agree with them on that too), but it doesn't stipulate a minimum threshold for a terms change notification etc.

@10_66 - Was that a 12 month regular saver maturity please?0 -

It was a 12 Month Regular SaverSaver684926 said:@gt94sss2 - Was that a Regular Monthly Saver or Green Regular Saver, or was it a 12 Month Regular Saver or something please?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards