We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Me too. When I opened the second one I split the deposit into £10 and £240. I kept this schedule for several months until it was reported on here that £250x2 works fine. I have deposited £250x2 since… It will be interesting to see which account will be getting a hair cut and whether the action will be consistent or random.ForumUser7 said:Market Harborough BS

If anyone contacts them, I would be interested to know what they say they will be returning please.

Thanks3 -

Co-op.Marcoos said:

Couple of days. Existing customer applied via the app on a Wednesday, account appeared on the Fridaypedrodelgado said:

How long is it taking to open one of these? Applied via on line while logged in and still waiting to hear back. How hard can it be , it's just a reg saver.Bridlington1 said:Co-operative Bank Interest Rate Reductions 22/10/25:

Co-operative Bank Regular Saver ~~~ NO CHANGE ~~~ Remains at 7%It can take longer if weekend is involved.0 -

In this case opening it now and funding it (asap) versus gambling it still being available to open and fund (asap) on 1st Sept for ~£0.08p gain!s71hj said:

Same here. I know some people have a different approach though.allegro120 said:

I tend to fund the accounts offering competitive rates straight away because I have no idea what the rates are going to be in 12 months time.s71hj said:

Once opened I believe I read you have 28 days to fund so if so inclined could fund 1st Sept and get interest for all of Sept 2026. I know some like this approach though must say I tend to just get the money in earning the money ASAP.Kim_13 said:

As it matures on 31/8/26 regardless of when in August it is opened, I did a £1.01 NatWest DC payment. I figure it’s unlikely to still be around on September 1 so I don’t lose anything by opening it with the minimum today.clairec666 said:

My crystal ball foresees the topic of discussion on this thread on 31/8/2026... rather similar to the last few days, but substitute "Darlington" for "Virgin"Hattie627 said:Darlington BS 12 month Regular Saver Issue 2

A wee quirk to note is that the account doesn't mature on the anniversary date but on the last day of the month during which the anniversary date falls. So all accounts opened in August 2025 will mature on 31 August 2026. So it's one of those mass maturity dates which sometimes give rise to issues at maturity. Don't know if the same applies to Issue 1 as I don't have that one.

Looks like a good account to have, given that it was released after the base rate cut so (fingers crossed) should stay at 6% for a while. What are people's experiences with Darlington? Do they offer good member/loyalty accounts? I don't really have the funds for another regular saver this month, but am tempted to shuffle some money around to open this one.Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

You can open it now and not fund until 1st Sept so no gamble..... But £0.08 gain!!!!Bobblehat said:

In this case opening it now and funding it (asap) versus gambling it still being available to open and fund (asap) on 1st Sept for ~£0.08p gain!s71hj said:

Same here. I know some people have a different approach though.allegro120 said:

I tend to fund the accounts offering competitive rates straight away because I have no idea what the rates are going to be in 12 months time.s71hj said:

Once opened I believe I read you have 28 days to fund so if so inclined could fund 1st Sept and get interest for all of Sept 2026. I know some like this approach though must say I tend to just get the money in earning the money ASAP.Kim_13 said:

As it matures on 31/8/26 regardless of when in August it is opened, I did a £1.01 NatWest DC payment. I figure it’s unlikely to still be around on September 1 so I don’t lose anything by opening it with the minimum today.clairec666 said:

My crystal ball foresees the topic of discussion on this thread on 31/8/2026... rather similar to the last few days, but substitute "Darlington" for "Virgin"Hattie627 said:Darlington BS 12 month Regular Saver Issue 2

A wee quirk to note is that the account doesn't mature on the anniversary date but on the last day of the month during which the anniversary date falls. So all accounts opened in August 2025 will mature on 31 August 2026. So it's one of those mass maturity dates which sometimes give rise to issues at maturity. Don't know if the same applies to Issue 1 as I don't have that one.

Looks like a good account to have, given that it was released after the base rate cut so (fingers crossed) should stay at 6% for a while. What are people's experiences with Darlington? Do they offer good member/loyalty accounts? I don't really have the funds for another regular saver this month, but am tempted to shuffle some money around to open this one.0 -

clivep said:VirginRequested our closures by the form on 2nd August. No acknowledgement. No closure. No interest. Secure messages sent this morning.Security key ordered for my account by secure message and acknowledgement received that it's on it's way (not received yet but they've got 12 months!).The one ordered for my wife has not received a reply.VirginYou couldn't make it up!...Replies to my wife's messages received yesterday:"The security token would need to be ordered by our online banking team. They can be reached on 0800 121 7365, available from 7am-9pm Mon-Sat, 10am-5pm Sun". Yet mine is on it's way?"The Everyday Saver account cannot be closed by online form....". Yet today the a/c has been closed with interest paid.My a/c has also been closed with interest paid. Message from them says "There is no online form for closing the Everyday Saver. The only online form available for closures is for the M range Current Accounts and linked M range Saver, that doesn't apply to the Everyday Saver".

2 -

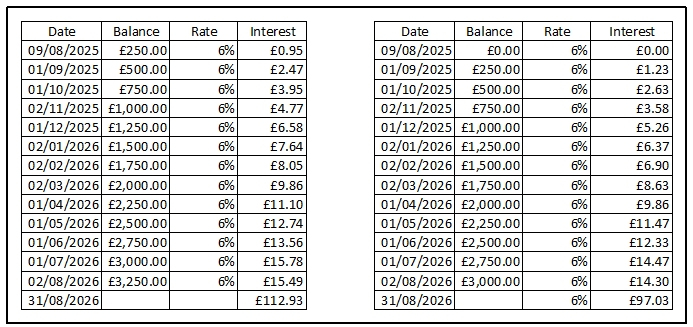

If you opened it now and made your 1st deposit on 1st Sept, you would lose nearly £16 compared to funding it fully just after opening it now. You'd only lose ~£15 instead, if you didn't fund the 13th payment (left-hand table).s71hj said:

You can open it now and not fund until 1st Sept so no gamble..... But £0.08 gain!!!!Bobblehat said:

In this case opening it now and funding it (asap) versus gambling it still being available to open and fund (asap) on 1st Sept for ~£0.08p gain!s71hj said:

Same here. I know some people have a different approach though.allegro120 said:

I tend to fund the accounts offering competitive rates straight away because I have no idea what the rates are going to be in 12 months time.s71hj said:

Once opened I believe I read you have 28 days to fund so if so inclined could fund 1st Sept and get interest for all of Sept 2026. I know some like this approach though must say I tend to just get the money in earning the money ASAP.Kim_13 said:

As it matures on 31/8/26 regardless of when in August it is opened, I did a £1.01 NatWest DC payment. I figure it’s unlikely to still be around on September 1 so I don’t lose anything by opening it with the minimum today.clairec666 said:

My crystal ball foresees the topic of discussion on this thread on 31/8/2026... rather similar to the last few days, but substitute "Darlington" for "Virgin"Hattie627 said:Darlington BS 12 month Regular Saver Issue 2

A wee quirk to note is that the account doesn't mature on the anniversary date but on the last day of the month during which the anniversary date falls. So all accounts opened in August 2025 will mature on 31 August 2026. So it's one of those mass maturity dates which sometimes give rise to issues at maturity. Don't know if the same applies to Issue 1 as I don't have that one.

Looks like a good account to have, given that it was released after the base rate cut so (fingers crossed) should stay at 6% for a while. What are people's experiences with Darlington? Do they offer good member/loyalty accounts? I don't really have the funds for another regular saver this month, but am tempted to shuffle some money around to open this one.

I don't think this is one of those RS's that only start when you make your 1st deposit ... unless you know otherwise? Please let me know if it is and I'll correct the above!

Edit: reworded what you would lose if you didn't make the 13th payment shown in the left-hand tableCompiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

Darlington BS RS

The term starts from the date of opening, so you are losing out on 6% interest (less whatever you are earning on the money you would otherwise have paid in) by not funding immediately0 -

That's what I thought! I think the comparison I posted was fairly accurate.Hattie627 said:Darlington BS RS

The term starts from the date of opening, so you are losing out on 6% interest (less whatever you are earning on the money you would otherwise have paid in) by not funding immediatelyCompiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

I, too, only got a referral number but no account details. Will need to wait for some human intervention, I presume.PloughmansLunch said:I must have been unlucky as I didn’t get any details after completing the process - it’s normally only YBS that flag up any (every) savings account application 1

1 -

Darlington BS are on the ball, i sent a payment about 10am to my RS from Halifax by FP this morning (saturday) and it showed as credited within the hour !!1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards