We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Just to clarify, it's the reference that's causing the problem, not the account holder name. Santander offers a "continue anyway" button, but then blocks the payment anyway. Nationwide doesn't even offer a way to bypass the check.happybagger said:With PBS you won't get a CoP match until the following day. Try it tomorrow,

So is the Reference number now part of the CoP check, with no option to bypass the check and make the payment anyway?0 -

If it's Vernon building society, you are talking about I applied for the RS today at 2pm it let me apply so far but stopped the application because I'm not local.happybagger said:It's also quite possible the Online RS is being pulled soon - If you go to "Apply" you get the "Not currently available" message.

Which l knew but you never know? 0

0 -

I'm thinking if I open an Easy Access account jointly with my wife for £100 I get us both membership for future offers and only have to invest £100 at an inferior interest rateOneUser1 said:This WON’T get you into a Vernon Building Society 6.5% Regular Saver at the moment but might be useful information for those who take a long view.

The Vernon usually only let locals (25 miles of Stockport) open accounts although they’ve offered to anyone a rubbish bond for a while with a high minimum balance and low interest rate. However they occasionally relax things and I note currently you can open a range of accounts including a £100 minimum balance Easy Access account. But not the Regular Saver.Like I said they change the requirements from time to time so MAYBE they will offer some future Regular Saver to locals and existing members. Or, of course, they might offer a new Regular Saver open to anyone. Or not. But they do change and change back so this could be a good time to get in if that’s your thing.0 -

Fingerbobs said:

So is the Reference number now part of the CoP check, with no option to bypass the check and make the payment anyway?

The Reference number has been part of the CoP check for some time. Though not all the companies requiring a Reference are necessarily participating in CoP yet. Principality however, definitely is, and I have made CoP-matched and unmatched payments from Santander to Principality in the very recent past. I am using the Santander app - it might work differently in Santander online.

1 -

There appears to be a way of holding onto membership with £1 if you don't mind sacrificing some of your ISA allowance.OneUser1 said:This WON’T get you into a Vernon Building Society 6.5% Regular Saver at the moment but might be useful information for those who take a long view.

The Vernon usually only let locals (25 miles of Stockport) open accounts although they’ve offered to anyone a rubbish bond for a while with a high minimum balance and low interest rate. However they occasionally relax things and I note currently you can open a range of accounts including a £100 minimum balance Easy Access account. But not the Regular Saver.Like I said they change the requirements from time to time so MAYBE they will offer some future Regular Saver to locals and existing members. Or, of course, they might offer a new Regular Saver open to anyone. Or not. But they do change and change back so this could be a good time to get in if that’s your thing.

Their Regular Saver ISA is currently open to all, this requires £25 to open the account. Once open there is no minimum withdrawal amount but you must keep £1 in the account to keep it open.

The terms do reference a £25 minimum monthly deposit although it also says if you miss at least 1 monthly payment you'll lose the bonus rate of interest so one interpretation of this term could be that you can miss payments but the penalty for doing so is the loss of the bonus rate of interest (in other words you shall earn 3.15% instead of 3.8%)4 -

My mistake. It took me literally years to get in at The Vernon always blocked by the "25 miles of Stockport" restriction so it’s now permanently embedded into my consciousness.IanManc said:

Vernon BS haven't used the "25 miles from Stockport" criterion for quite a while.OneUser1 said:This WON’T get you into a Vernon Building Society 6.5% Regular Saver at the moment but might be useful information for those who take a long view.

The Vernon usually only let locals (25 miles of Stockport) open accounts although they’ve offered to anyone a rubbish bond for a while with a high minimum balance and low interest rate. However they occasionally relax things and I note currently you can open a range of accounts including a £100 minimum balance Easy Access account. But not the Regular Saver.Like I said they change the requirements from time to time so MAYBE they will offer some future Regular Saver to locals and existing members. Or, of course, they might offer a new Regular Saver open to anyone. Or not. But they do change and change back so this could be a good time to get in if that’s your thing.

The current restriction is that you must live in postcodes BL, CH, CW, M, OL, SK, WA or WN, which is a lot wider. For example, most of Flintshire in north Wales has CH postcodes, but is a lot further than 25 miles from Stockport. It's lot easier to identify qualifying applicants though. With the old 25 mile restriction I've seen staff in a branch have to get a map out.0 -

Presumably this only sacrifices £1 of your isa allowance, as you can now replenish withdrawn funds back to an ISA In a tax year?Bridlington1 said:

There appears to be a way of holding onto membership with £1 if you don't mind sacrificing some of your ISA allowance.OneUser1 said:This WON’T get you into a Vernon Building Society 6.5% Regular Saver at the moment but might be useful information for those who take a long view.

The Vernon usually only let locals (25 miles of Stockport) open accounts although they’ve offered to anyone a rubbish bond for a while with a high minimum balance and low interest rate. However they occasionally relax things and I note currently you can open a range of accounts including a £100 minimum balance Easy Access account. But not the Regular Saver.Like I said they change the requirements from time to time so MAYBE they will offer some future Regular Saver to locals and existing members. Or, of course, they might offer a new Regular Saver open to anyone. Or not. But they do change and change back so this could be a good time to get in if that’s your thing.

Their Regular Saver ISA is currently open to all, this requires £25 to open the account. Once open there is no minimum withdrawal amount but you must keep £1 in the account to keep it open.

The terms do reference a £25 minimum monthly deposit although it also says if you miss at least 1 monthly payment you'll lose the bonus rate of interest so one interpretation of this term could be that you can miss payments but the penalty for doing so is the loss of the bonus rate of interest (in other words you shall earn 3.15% instead of 3.8%)0 -

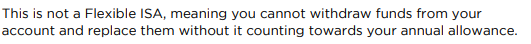

My understanding is that it will sacrifice £25 of your ISA allowance, unless the account is flexible, in which case the £24 can be returned to the Vernon account in the same tax year.s71hj said:

Presumably this only sacrifices £1 of your isa allowance, as you can now replenish withdrawn funds back to an ISA In a tax year?Bridlington1 said:

There appears to be a way of holding onto membership with £1 if you don't mind sacrificing some of your ISA allowance.OneUser1 said:This WON’T get you into a Vernon Building Society 6.5% Regular Saver at the moment but might be useful information for those who take a long view.

The Vernon usually only let locals (25 miles of Stockport) open accounts although they’ve offered to anyone a rubbish bond for a while with a high minimum balance and low interest rate. However they occasionally relax things and I note currently you can open a range of accounts including a £100 minimum balance Easy Access account. But not the Regular Saver.Like I said they change the requirements from time to time so MAYBE they will offer some future Regular Saver to locals and existing members. Or, of course, they might offer a new Regular Saver open to anyone. Or not. But they do change and change back so this could be a good time to get in if that’s your thing.

Their Regular Saver ISA is currently open to all, this requires £25 to open the account. Once open there is no minimum withdrawal amount but you must keep £1 in the account to keep it open.

The terms do reference a £25 minimum monthly deposit although it also says if you miss at least 1 monthly payment you'll lose the bonus rate of interest so one interpretation of this term could be that you can miss payments but the penalty for doing so is the loss of the bonus rate of interest (in other words you shall earn 3.15% instead of 3.8%)1 -

I'm afraid the terms are very explicit on that point:s71hj said:

Presumably this only sacrifices £1 of your isa allowance, as you can now replenish withdrawn funds back to an ISA In a tax year?Bridlington1 said:

There appears to be a way of holding onto membership with £1 if you don't mind sacrificing some of your ISA allowance.OneUser1 said:This WON’T get you into a Vernon Building Society 6.5% Regular Saver at the moment but might be useful information for those who take a long view.

The Vernon usually only let locals (25 miles of Stockport) open accounts although they’ve offered to anyone a rubbish bond for a while with a high minimum balance and low interest rate. However they occasionally relax things and I note currently you can open a range of accounts including a £100 minimum balance Easy Access account. But not the Regular Saver.Like I said they change the requirements from time to time so MAYBE they will offer some future Regular Saver to locals and existing members. Or, of course, they might offer a new Regular Saver open to anyone. Or not. But they do change and change back so this could be a good time to get in if that’s your thing.

Their Regular Saver ISA is currently open to all, this requires £25 to open the account. Once open there is no minimum withdrawal amount but you must keep £1 in the account to keep it open.

The terms do reference a £25 minimum monthly deposit although it also says if you miss at least 1 monthly payment you'll lose the bonus rate of interest so one interpretation of this term could be that you can miss payments but the penalty for doing so is the loss of the bonus rate of interest (in other words you shall earn 3.15% instead of 3.8%)

1 -

Re: Vernon

The Easy Access account doesn't seem to have a minimum operating balance, just a minimum opening balance.

The terms of the ORS a/c state they will open an EA a/c when you open the ORS, so they transfer the balance over each 12 months. So the EA account is opened with a zero balance at that time.

Personally, if I wasn't already in here, I'd just open the EA with £100 anyway, then the ORS, then when the ORS matures into the EA withdraw down at that point. The op cost is around £2 with an op gain of around £353

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards