We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

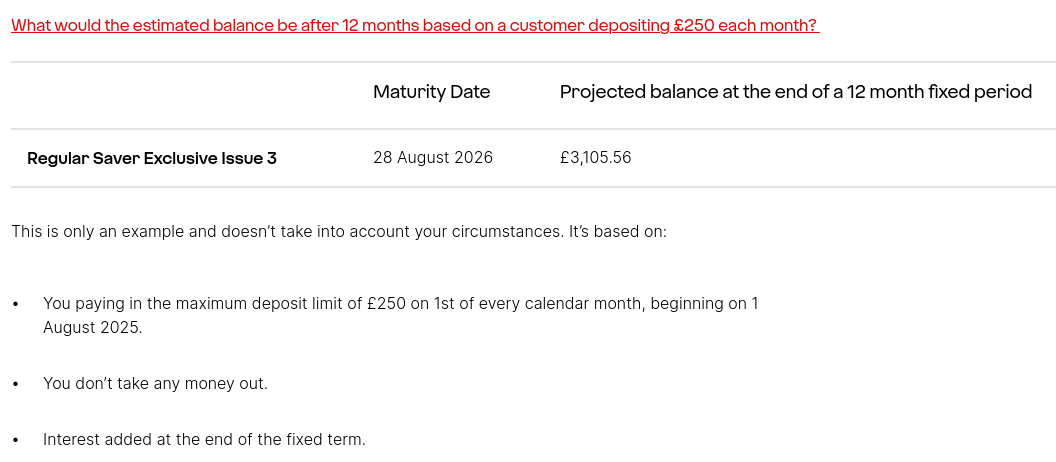

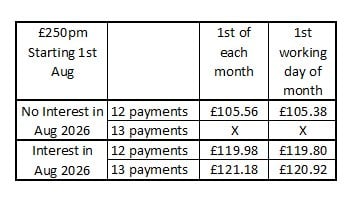

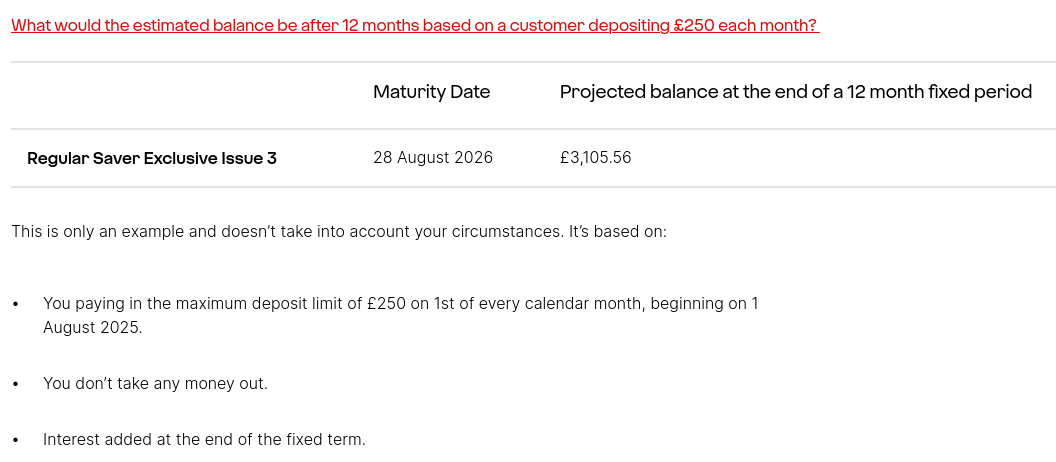

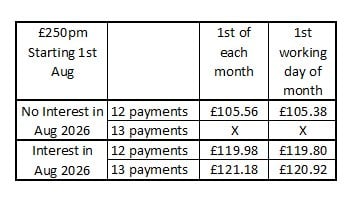

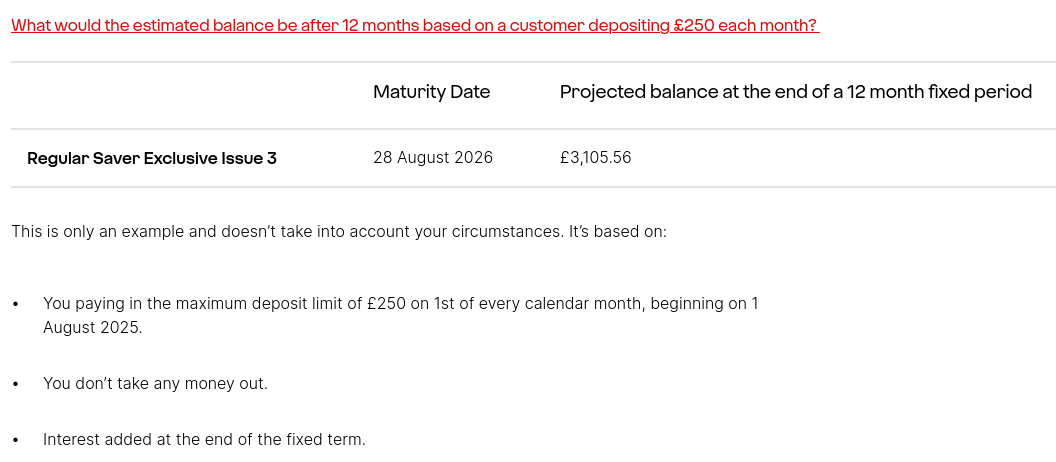

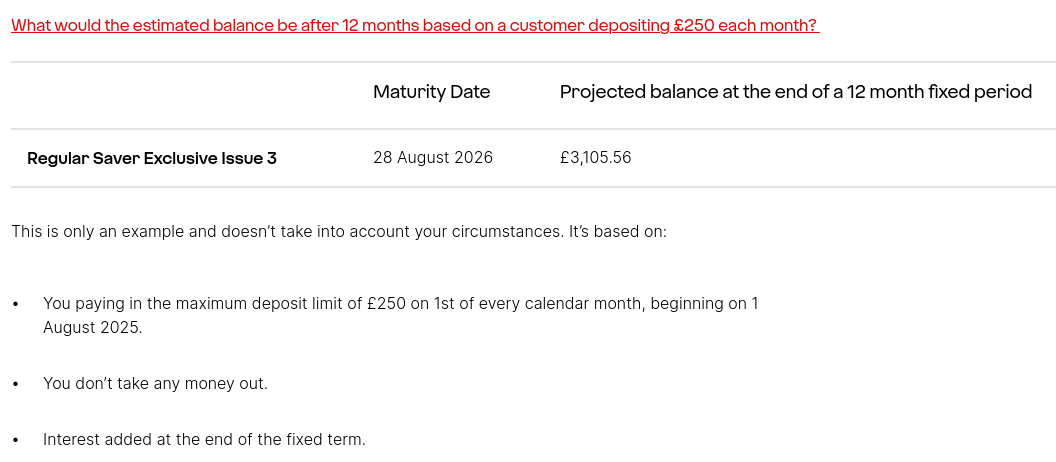

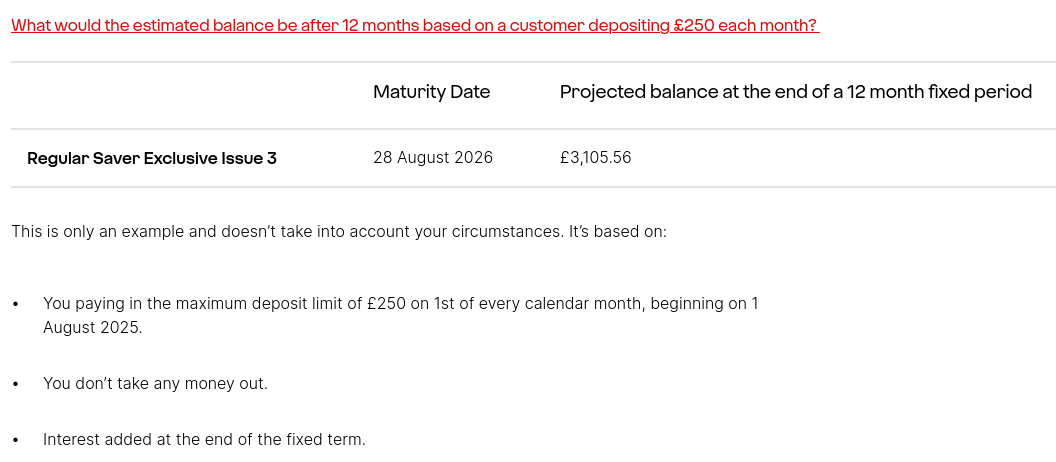

Your post got me wondering just how much this RS would actually pay at maturity. While playing with the spreadsheet I used for the Monmouthshire comparison and applying it to this VM RS, I realised that there seems to be just one specific set of factors that generate VM's estimate of £105.56 interest.masonic said:Anyone made sense of the following? If you open and fund on 1st August 2025 and pay in £250 on the 1st of every calendar month, then after 12 months (31st July 2025) you would have a balance of £3000, with no interest having been paid yet, or at maturity on 28th August you would have £3250+interest. Or is it actually a 12 month term?

Not only does the calculation have to start on the 1st of Aug with £250 and each following 1st of the month up to and including July 2026 (i.e. no 13th payment), as VM have stated, but also seems to only generate £105.56 if there is no interest for the whole of August 2026! Surely not?

I found this hard to believe and tried different scenarios, including calculating the total interest with the theoretical amount for £3000 for the 28 days in August 2026 added, also with a 13th payment and also altering the dates when the 1st of the month falls on a non-working day (apologies to Bridlington1 in advance )

)

Here are the results in short form ... to save boring the pants off those who expressed disinterest in my earlier tables ...

The lack of figures for No interest in August 2026 and 13 payments is simply that no one would pay in the 13th payment if it wasn't going to generate interest! In effect the figures would be identical to the row above in that case.

You can take your pick of which figure you think VM might pay out according to these specific cases!

I suggest you try a few "what if's" on a spreadsheet yourselves if you think I've screwed up the figures!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3 -

Matures tomorrowTheBanker said:Co-op Regular Saver

Thanks everyone. It's already matured this morning so I've withdrawn the balance (as I need it). Interestingly, the mobile app transaction listing has a line for credit interest, but the amount is blank. Interest has clearly been credited though as the balance has increased compared to yesterday. I am sure they will catch up at some point. I'll leave the Smart Saver open until the figure appears, as I need it for my tax return spreadsheet.

My Virgin RS hasn't matured yet.

I feel rich having both of these mature today... but the money is earmarked for spending next week, then the whole cycle can start again!0 -

35har1old said:

Matures tomorrowTheBanker said:Co-op Regular Saver

Thanks everyone. It's already matured this morning so I've withdrawn the balance (as I need it). Interestingly, the mobile app transaction listing has a line for credit interest, but the amount is blank. Interest has clearly been credited though as the balance has increased compared to yesterday. I am sure they will catch up at some point. I'll leave the Smart Saver open until the figure appears, as I need it for my tax return spreadsheet.

My Virgin RS hasn't matured yet.

I feel rich having both of these mature today... but the money is earmarked for spending next week, then the whole cycle can start again!They sent an email in mid-July stating: "we’re getting in touch because your Regular Saver Exclusive, earning 10.38% AER/10.00% Gross, matures on 31 July 2025. It will then become an Everyday Saver, earning 1.75% AER/1.74% Gross (variable), from 1 August 2025."0 -

No trouble here, just now 12.27am. Tap on sms option. Then tap on it again and it changes to the input box for me - if you get 2 codes, input the later of the 2... and then the 'M' pulses for a min..or 2.DealSeeker11 said:Is anyone having problems logging on via Monbs app? Mine is stuck on the following screen but it’s not given me the options:2-factor authentication

Please select an option below, to receive a six-digit verification code.

Android.0 -

Bobblehat said:

Your post got me wondering just how much this RS would actually pay at maturity. While playing with the spreadsheet I used for the Monmouthshire comparison and applying it to this VM RS, I realised that there seems to be just one specific set of factors that generate VM's estimate of £105.56 interest.masonic said:Anyone made sense of the following? If you open and fund on 1st August 2025 and pay in £250 on the 1st of every calendar month, then after 12 months (31st July 2025) you would have a balance of £3000, with no interest having been paid yet, or at maturity on 28th August you would have £3250+interest. Or is it actually a 12 month term?

Not only does the calculation have to start on the 1st of Aug with £250 and each following 1st of the month up to and including July 2026 (i.e. no 13th payment), as VM have stated, but also seems to only generate £105.56 if there is no interest for the whole of August 2026! Surely not?

I found this hard to believe and tried different scenarios, including calculating the total interest with the theoretical amount for £3000 for the 28 days in August 2026 added, also with a 13th payment and also altering the dates when the 1st of the month falls on a non-working day (apologies to Bridlington1 in advance )

)

Here are the results in short form ... to save boring the pants off those who expressed disinterest in my earlier tables ...

The lack of figures for No interest in August 2026 and 13 payments is simply that no one would pay in the 13th payment if it wasn't going to generate interest! In effect the figures would be identical to the row above in that case.

You can take your pick of which figure you think VM might pay out according to these specific cases!

I suggest you try a few "what if's" on a spreadsheet yourselves if you think I've screwed up the figures!

It does say "Projected balance at the end of a 12 month fixed period". Obviously whoever produced that document forgot to alter the template to cover the near 13 month term available to those quick off the mark. The actual account matures 28 August 2026, and interest will be paid for August 2026, but the standard template is for a 12 month term. I suspect making 12 payments on the 29th of each month would give the £105.38 interest, but I can't be bothered doing the calculations.Eco Miser

Saving money for well over half a century2 -

masonic said:Anyone made sense of the following? If you open and fund on 1st August 2025 and pay in £250 on the 1st of every calendar month, then after 12 months (31st July 2025) you would have a balance of £3000, with no interest having been paid yet, or at maturity on 28th August you would have £3250+interest. Or is it actually a 12 month term?

My reading of it is that they are posing the specific question:-

'What would the estimated balance be after 12 months based on a customer depositing £250 each month?'

and the answer to that specific question is a:'Projected balance at the end of a 12 month fixed period of £3105.56'

i.e. they are showing a projected balance purely on the basis of a 12 month term, not until a maturity date of 28.8.26

The additional information states 'Depending on when you open your account, the fixed term may be longer than 12-months.'

So, given that it's a calendar month account, with no stated maximum account balance, then a 13th payment should be allowed, and interest paid on full capital until the maturity date/end of the longer fixed term (they also state 'The interest rate is fixed from the day you open your account until the Maturity Date.), giving a higher projected balance than the one stipulated for 12 months only...?

My head's spinning, and it's 'the wee small hours', so I don't know if any of that actually makes sense?!

Then again, maybe I'm reading too much into it, and they've messed up the KPI?1 -

SJMALBA said:masonic said:Anyone made sense of the following? If you open and fund on 1st August 2025 and pay in £250 on the 1st of every calendar month, then after 12 months (31st July 2025) you would have a balance of £3000, with no interest having been paid yet, or at maturity on 28th August you would have £3250+interest. Or is it actually a 12 month term?

My reading of it is that they are posing the specific question:-

'What would the estimated balance be after 12 months based on a customer depositing £250 each month?'

and the answer to that specific question is a:'Projected balance at the end of a 12 month fixed period of £3105.56'?

It could only be £3105.56 if the account was closed after 12 months, as interest isn't credited until maturity.Why oh why didn't they use an opening date of 1st September (or 29th August) in the illustration. It seems they've over-complicated it for themselves.3 -

I don't think Virgin were anticipating MSE's regular saver pros to be scrutinising their calculationsSJMALBA said:masonic said:Anyone made sense of the following? If you open and fund on 1st August 2025 and pay in £250 on the 1st of every calendar month, then after 12 months (31st July 2025) you would have a balance of £3000, with no interest having been paid yet, or at maturity on 28th August you would have £3250+interest. Or is it actually a 12 month term?

My reading of it is that they are posing the specific question:-

'What would the estimated balance be after 12 months based on a customer depositing £250 each month?'

and the answer to that specific question is a:'Projected balance at the end of a 12 month fixed period of £3105.56'

i.e. they are showing a projected balance purely on the basis of a 12 month term, not until a maturity date of 28.8.26

The additional information states 'Depending on when you open your account, the fixed term may be longer than 12-months.'

So, given that it's a calendar month account, with no stated maximum account balance, then a 13th payment should be allowed, and interest paid on full capital until the maturity date/end of the longer fixed term (they also state 'The interest rate is fixed from the day you open your account until the Maturity Date.), giving a higher projected balance than the one stipulated for 12 months only...?

My head's spinning, and it's 'the wee small hours', so I don't know if any of that actually makes sense?!

Then again, maybe I'm reading too much into it, and they've messed up the KPI?

Can't remember which account it was, but there was one that offered a "projected balance" of over £10000 for a 12-month term despite a deposit limit of £250 a month. Something escaped the proof-reading process....1 -

Has anyone who have different profiles with virgin tried to open several Virgin RS Issue 3?

0 -

I had exactly the same. Tried all the combinations and finally got to the id screen. It wouldn't accept it. Gave upbrucefan_2 said:

The app froze on me completely yesterday evening. Uninstalled and then re-installed. On AndroidThePirates said:

Yep, same problem.DealSeeker11 said:Is anyone having problems logging on via Monbs app? Mine is stuck on the following screen but it’s not given me the options:2-factor authentication

Please select an option below, to receive a six-digit verification code.

Reinstall didn't help...

On opening the app was presented with the option of continuing as an 'Existing Customer' or 'New Customer'

As I had an account number and had seen the account in-app, 'Existing Customer' seemed the sensible route to take. Doing so brought up a screen with a further two options:

1. I have not registered for the app

2. I have registered for the app

Logic dictated that, having previously got as far as seeing my account (not registering my £5 deposit after several hours) that Option 2 was the path to go down ... at which point Monmouthshire decided it was appropriate on the next screen to tell me:

"We will now register your new phone or new number.

Please Select One of the following

1. I have a new phone

2. I am using a new number.

No, Monmouthshire, no - I don't have a new phone or new number. All I've done is re-install the app.

I don't think I'm missing something blindingly obvious here, but if so, apologies for casting criticism on the app flow, but I really don't see what I could be doing differently.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards