We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

It will have to be done in several goes if this is allowed, leaving a minimum of £1 - the withdrawal screen says the full balance is more than the maximum for a single transaction. Mine matures on Saturday so potentially a Tuesday payment otherwise (if a similar process timeline to Mon BS for example).Bridlington1 said:For those of you with a Furness BS Christmas Regular Saver due to mature on Friday 10/1/25.

In my experience of withdrawals from Furness BS by faster payment funds are debited from the account the day the request is made but arrive the next working day, thus if the account is due to mature on Friday and you choose to have the account closed upon maturity I would suspect the funds would be debited from your account on Friday but not arrive in your nominated account till Monday, not earning interest in that time, which is noteworthy given the final balance could be potentially over £6k .

One option worth considering could be to empty the account today (can be done in online banking) in order to reduce the amount of time you've got a large sum ``in transit" earning no interest.1 -

Maximum is £5k, I've just made 2 withdrawals (one for £5k, one for £999) and it's gone through.PloughmansLunch said:

It will have to be done in several goes if this is allowed, leaving a minimum of £1 - the withdrawal screen says the full balance is more than the maximum for a single transaction. Mine matures on Saturday so potentially a Tuesday payment otherwise.Bridlington1 said:For those of you with a Furness BS Christmas Regular Saver due to mature on Friday 10/1/25.

In my experience of withdrawals from Furness BS by faster payment funds are debited from the account the day the request is made but arrive the next working day, thus if the account is due to mature on Friday and you choose to have the account closed upon maturity I would suspect the funds would be debited from your account on Friday but not arrive in your nominated account till Monday, not earning interest in that time, which is noteworthy given the final balance could be potentially over £6k .

One option worth considering could be to empty the account today (can be done in online banking) in order to reduce the amount of time you've got a large sum ``in transit" earning no interest.4 -

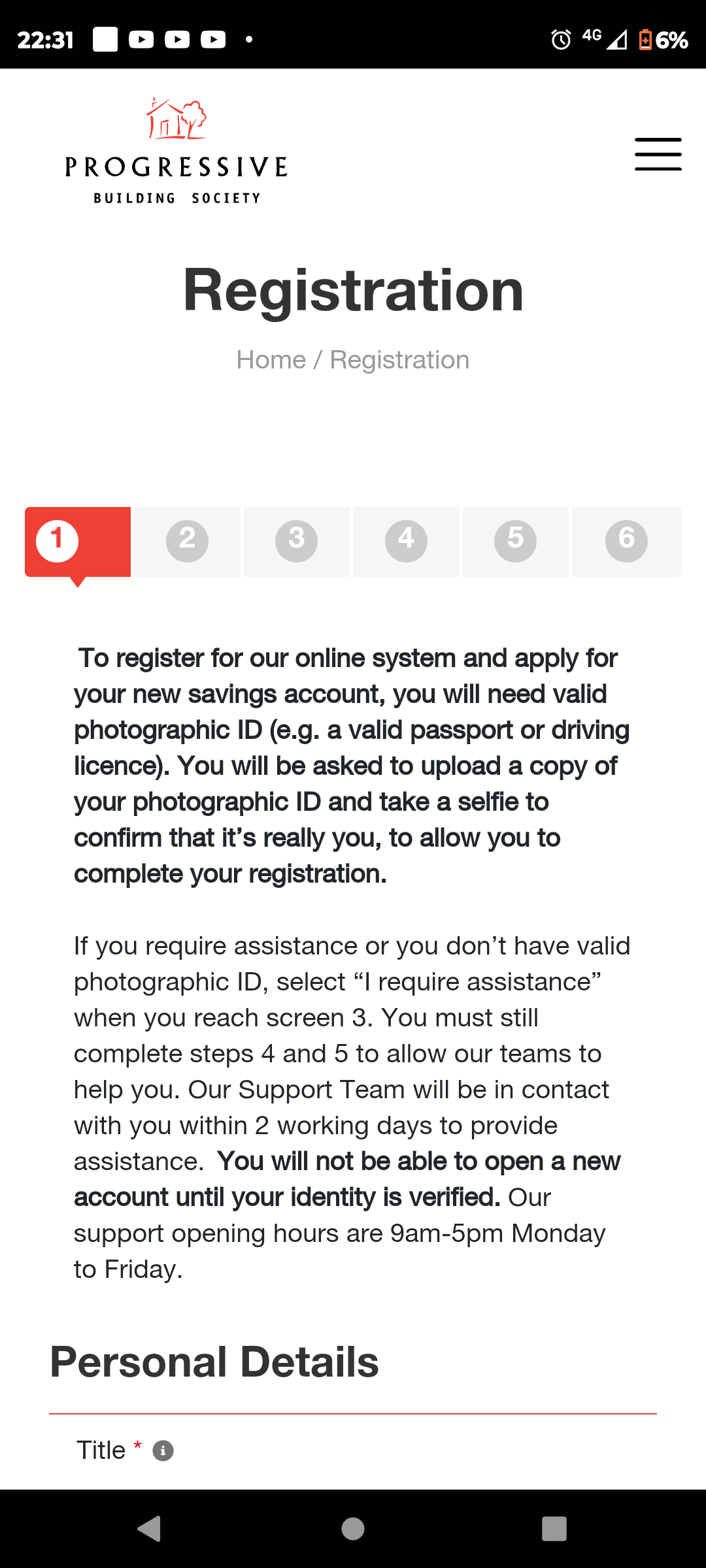

I don't remember. Perhaps it's changed since July. I certainly didn't choose a, "I require assistance" option.nottsphil said:

Did they show this page before you applied?wmb194 said:

Progressive BSnottsphil said:

Are you suggesting that new customers might be able to open this new issue without photo ID? (My only photo ID is a bus pass, which I would not be willing to post to them). Why do they insist on this anyway? It's not as if mainlanders are going to travel to Northern Ireland and turn up at a branch in person! What alternatives would the Progressive accept?OneUser1 said:Progressive Building Society have made their on-line Regular Saver Issue 3 (still Issue 2 on page 1 of this thread) paying 6%.

Progressive are based in Northern Ireland but the account is open to everyone over 18 in the UK with photo ID (although the staff are friendly on the phone and previously - Issue 1 - could accommodate those without photo ID.)

When I opened my account in July 2024 I didn't have to supply any ID, it was opened with electronic checks.

Looking at its website this still appears to be the case, "We undertake a search with a Credit Reference Agency or Data Reference Agency. They supply us with information, including from the Electoral Register, for the purpose of verifying your identity. ... If we’re unable to verify your identity from the information provided you will be required to produce two items of documentation as proof of your identification."

https://theprogressive.com/support-information/savings-support/savings-faqs 0

0 -

Thinking about opening the 6 Month Fixed Term Woodland Saver with Gatehouse Bank. I want to save £10k, approximately 60% of what I have right now. Do you guys think this is a safe bank? I had never heard of them before this week.

0 -

Gatehouse

Perfectly safe. Sharia conpliant bank.

I have been using them for years and currently have a five figure sum in their coffers at 5% epr1 -

anonymous12124 said:Thinking about opening the 6 Month Fixed Term Woodland Saver with Gatehouse Bank. I want to save £10k, approximately 60% of what I have right now. Do you guys think this is a safe bank? I had never heard of them before this week.They are very good, I have a large sum saved with them on a 5 year fixed rate savings bond, had a regular saver and still have an easy access account.The fixed rate pays interest away every year and so far both payments were on time.So very happy with them.Been with them from 01/09/2022.0

-

Yes, it is safe. Your money is protected up to £85,000 by FSCS.anonymous12124 said:Thinking about opening the 6 Month Fixed Term Woodland Saver with Gatehouse Bank. I want to save £10k, approximately 60% of what I have right now. Do you guys think this is a safe bank? I had never heard of them before this week.0 -

I have regularly used Gatehouse Bank for various accounts and recently opened the 6 month fixed term account with no problems. I also have their 5 year fixed rate ISA opened at 4.6% and their easy access account. Would recommend. Remember they are a bank that operates under Shariah principles so it is expected profit rather than interest but there has never been any issues about paying the profit figure, to my knowledgeanonymous12124 said:Thinking about opening the 6 Month Fixed Term Woodland Saver with Gatehouse Bank. I want to save £10k, approximately 60% of what I have right now. Do you guys think this is a safe bank? I had never heard of them before this week.0 -

Is this a regular saver? 🤔anonymous12124 said:Thinking about opening the 6 Month Fixed Term Woodland Saver with Gatehouse Bank. I want to save £10k, approximately 60% of what I have right now. Do you guys think this is a safe bank? I had never heard of them before this week.0 -

My maturity experience with Furness was far from smooth. I had requested that the matured funds be transferred to my nominated account. The instruction was sent in the post (since they sent me a form via eMail) and subsequently also via the App (which was never mentioned in the maturity eMail). Both were sent way before the deadline, but both were ignored and the regular saver matured into an EA saving account, which I then had to close and wait until the following day to get the funds. Effectively I had to wait two days longer than if they'd carried out my original instruction.Bridlington1 said:For those of you with a Furness BS Christmas Regular Saver due to mature on Friday 10/1/25.

In my experience of withdrawals from Furness BS by faster payment funds are debited from the account the day the request is made but arrive the next working day, thus if the account is due to mature on Friday and you choose to have the account closed upon maturity I would suspect the funds would be debited from your account on Friday but not arrive in your nominated account till Monday, not earning interest in that time, which is noteworthy given the final balance could be potentially over £6k .

One option worth considering could be to empty the account today (can be done in online banking) in order to reduce the amount of time you've got a large sum ``in transit" earning no interest.

1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards