We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Yes, you can open another one once the existing one has maturedt1redmonkey said:Hey all - haven't read this thread yet since created, not had time over Xmas so apologies if this has already been discussed.

For those of us who've had the West Brom 6% RS mature this month, can we open another one or are we not allowed to? @t1redmonkey If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

@t1redmonkey If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

I think ForumUser7's memory is pretty spot-on .... I also "renewed" my Skipton Member RS (Iss 3) as a gamble on 31/05/2024, thus moving the maturity date on from the original RS's earlier date.simonsmithsays said:

Am I missing something here?mattojgb said:

Went ahead with this. Closed existing Member Regular Saver (balance transferred to existing Skipton account), opened another Member Regular Saver and funded it (transfer from existing Skipton account) all on the app in less than 5 minutes.mattojgb said:

Re Skipton - I was wondering about refreshing/renewing this too. Mine matures 14th Jan. Seems possible that they may launch a new version around 11 Jan with a lower interest rate.ForumUser7 said:

Re Skipton, anyone think it is worth refreshing at this point please? Mine matures in April or something, and while the funds would be going below 7%, I could secure the rate for another year? ThanksBridlington1 said:

It's worth noting that Skipton have a habit of launching a loyalty regular saver and stating that the eligibility cut off date is the day before it was launched so I would try to get a foot in the door ASAP with Skipton if you haven't already done so.

Possibly a slight gamble in that the account may have still been available post maturity of existing account. But decided now was probably the best time to do it given that I can add funds today and tomorrow.

My Skipton 7% Members RS has a May maturity

I'm wondering if I did something similar last year!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum2 -

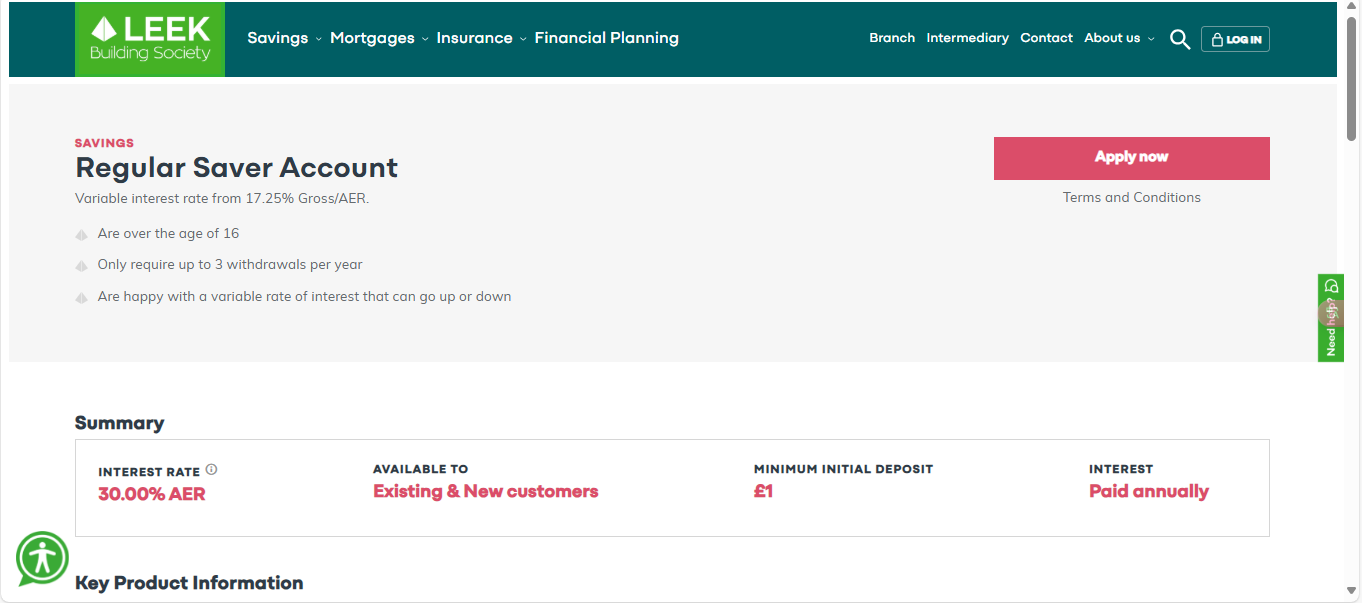

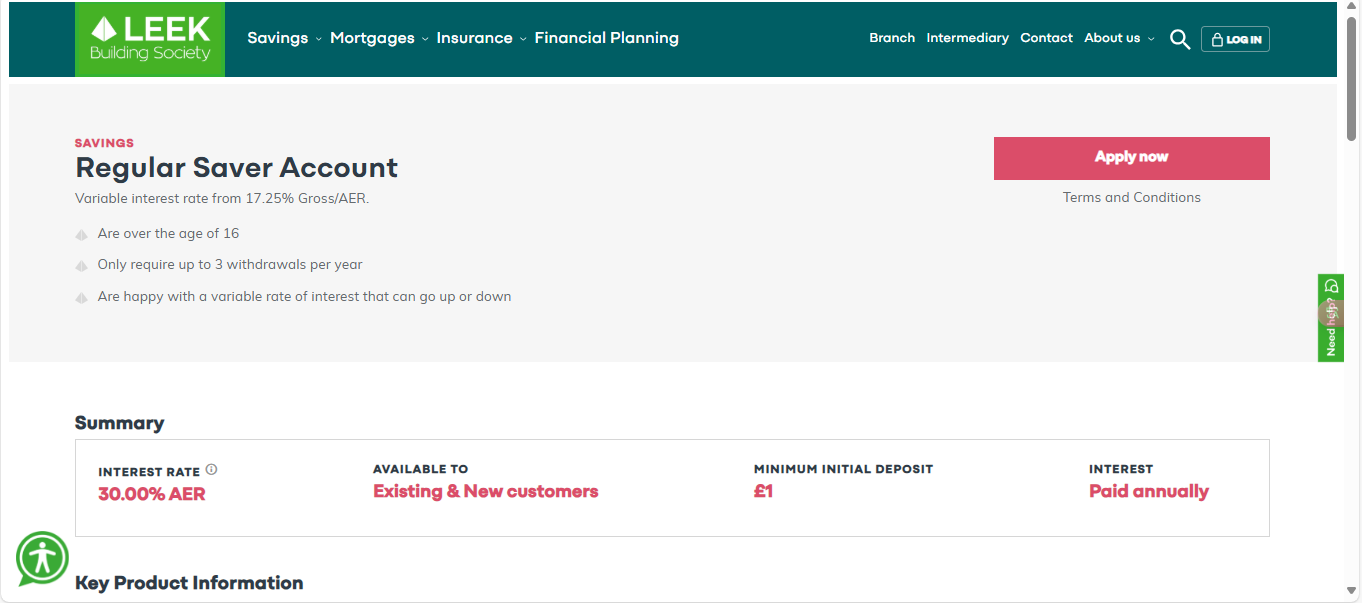

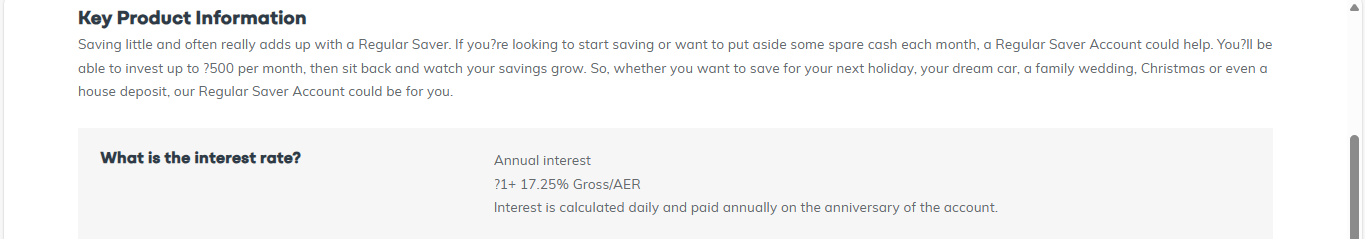

It seems the new year has made Leek BS's technical systems become rather generous, it says their regular saver has risen from 5% to 30% or 17.25% depending on where you look:

12

12 -

Bobblehat said:

I think ForumUser7's memory is pretty spot-on .... I also "renewed" my Skipton Member RS (Iss 3) as a gamble on 31/05/2024, thus moving the maturity date on from the original RS's earlier date.simonsmithsays said:

Am I missing something here?mattojgb said:

Went ahead with this. Closed existing Member Regular Saver (balance transferred to existing Skipton account), opened another Member Regular Saver and funded it (transfer from existing Skipton account) all on the app in less than 5 minutes.mattojgb said:

Re Skipton - I was wondering about refreshing/renewing this too. Mine matures 14th Jan. Seems possible that they may launch a new version around 11 Jan with a lower interest rate.ForumUser7 said:

Re Skipton, anyone think it is worth refreshing at this point please? Mine matures in April or something, and while the funds would be going below 7%, I could secure the rate for another year? ThanksBridlington1 said:

It's worth noting that Skipton have a habit of launching a loyalty regular saver and stating that the eligibility cut off date is the day before it was launched so I would try to get a foot in the door ASAP with Skipton if you haven't already done so.

Possibly a slight gamble in that the account may have still been available post maturity of existing account. But decided now was probably the best time to do it given that I can add funds today and tomorrow.

My Skipton 7% Members RS has a May maturity

I'm wondering if I did something similar last year!

Thanks you twoExactly right - having checked my spreadsheetI had the 7.5% RS opened on the 1/6/23 and then must have closed it to open the 7% on the 31/5/24

Thanks again2 -

Cambridge is £100 minimum in an easy access & 1 year to be eligible for reward regular @ 5%, minimum of 3 years to be eligible for Extra Reward Regular Saver @ 6%.WillPS said:

Saffron BS cut off for their member's month saver has been 1st June the previous year.s71hj said:

Good to know. Do any of these have a tendency towards specifying a particular cut off date to your knowledge? I can sense a new trenche of preparatory fieldwork beginning for the next years RS opening!!Bridlington1 said:WillPS said:

Skipton is presently 11th Jan too, so perhaps worth getting a foot in the door there too.Bridlington1 said:One observation of note is that Coventry BS have often set 1st January as the cut off date for eligibility for their loyalty regular savers.

With barely 25 hours to go till the New Year now may be a good time to open an easy access account with Coventry and stick £1 in it for ``loyalty purposes" if you haven't already done so.Additionally the following building societies to my knowledge have restricted some regular savers to those who have been members for however long and/or have restricted accounts to existing members only unless you live in certain parts of the country:

Bath BSCambridge BSCoventry BSDarlington BSESBSLeek BSMansfield BSMarket Harborough BSMonmouthshire BSNationwideNewbury BSNewcastle BSPenrith BSProgressive BSSaffron BSScottish BSSkiptonSuffolk BSVernon BSWest Brom BSYBS

Mansfield BS is 1 year's continuous membership. Same for YBS.

Cambridge is 2/3 year's continuous memership (and their only open-to-all accounts have minimum deposits in the hundreds).

Monmouthshire BS last cut off was the day before their last Exclusive account was launched, previously all existing members were eligible.

West Brom don't stipulate a duration, so you can apply straight away. Same for Nationwide.

Vernon BS presently don't allow even existing members to access their regular saver unless you live in the right area.

I'm playing a long game with them, been with them just over a year.

But as people have already said get in with as many as possible with the minimum possible then forget for a year or whatever then you more likely to be eligible for decent accounts1 -

Yes you can but what a palaver, fill in online form, send photo of new signature and wait up to 5 working days for it to open. But I will say, C.S staff are very helpful and pleasant to deal with.t1redmonkey said:Hey all - haven't read this thread yet since created, not had time over Xmas so apologies if this has already been discussed.

For those of us who've had the West Brom 6% RS mature this month, can we open another one or are we not allowed to?I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.1 -

I'm not, was £100 minimum for me🙄😏🥹Bridlington1 said:

Whist this probably won't apply to most of the people who are reading this, if you are under 21 you can open their First Account with £1, when you turn 21 it converts into a maturity account, also with a £1 minimum balance.WillPS said:

Cambridge is 2/3 year's continuous memership (and their only open-to-all accounts have minimum deposits in the hundreds).s71hj said:

Good to know. Do any of these have a tendency towards specifying a particular cut off date to your knowledge? I can sense a new trenche of preparatory fieldwork beginning for the next years RS opening!!Bridlington1 said:WillPS said:

Skipton is presently 11th Jan too, so perhaps worth getting a foot in the door there too.Bridlington1 said:One observation of note is that Coventry BS have often set 1st January as the cut off date for eligibility for their loyalty regular savers.

With barely 25 hours to go till the New Year now may be a good time to open an easy access account with Coventry and stick £1 in it for ``loyalty purposes" if you haven't already done so.Additionally the following building societies to my knowledge have restricted some regular savers to those who have been members for however long and/or have restricted accounts to existing members only unless you live in certain parts of the country:

Bath BSCambridge BSCoventry BSDarlington BSESBSLeek BSMansfield BSMarket Harborough BSMonmouthshire BSNationwideNewbury BSNewcastle BSPenrith BSProgressive BSSaffron BSScottish BSSkiptonSuffolk BSVernon BSWest Brom BSYBS

I was able to get a foot in Cambridge BS's door that way not so long back.0 -

I think it's been fixed - showing 5% at my endBridlington1 said:It seems the new year has made Leek BS's technical systems become rather generous, it says their regular saver has risen from 5% to 30% or 17.25% depending on where you look:

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

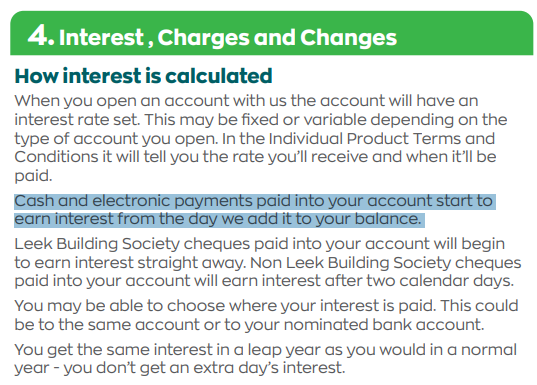

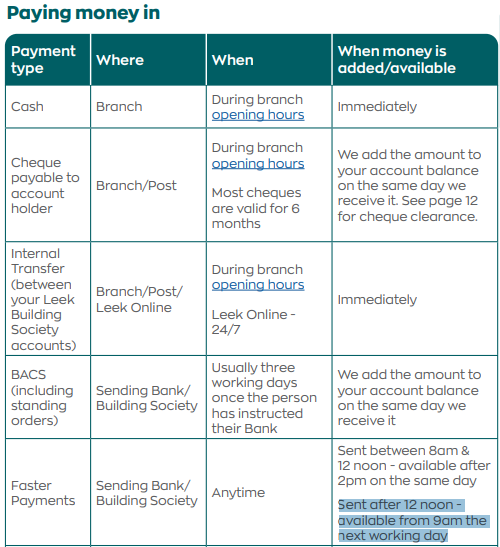

Regarding Leek BS all the time I've been eligible for their regular saver the rate has always been slightly below the minimum for me to warrant funding it so I've only ever made 2 faster payments into Leek BS, both on working days so I was going solely off the Ts&Cs for that listing on the first page of this thread.LZC said:

Thank you.Bridlington1 said:

Following on from the above the listings on the first page of this thread have now been updated to state how payments received into each account on non-working days are treated as promised.Bridlington1 said:

Thanks for reminding me.PowerSavingMode said:At the risk of showing just how thrilling I'm expecting my New Year's Day to be, is it pointless sending faster payments over to any regular saver on New Year's Day?

The answer to your question depends on the bank/building society in question, some treat payments received on non-working days as having been received the next working day for interest purposes, others do not.

I shall go through the first post of the thread and add a remark to each listing to state how payments received into each account on non-working days are treated.

I'm at work tomorrow so this shall probably be finalised at some point late tomorrow evening (30/12/24) so you should know by New Year's Eve whether you should fund each account listed on the first page on New Year's Day or not.FWIW I believe Leek may be same day if before noon.The first in September fell on a Sunday and my statement shows it as the 1st.According to Ts&Cs cash and electronic payments paid into your account earn interest from the day we add it to your balance.When it is added to your balance is less clear but “faster payments sent between 8am and 12noon are available from 2pm the same day” and presumably it must have been added to your balance in order to be available.

https://www.leekbs.co.uk/content/images/page/files/General%20Savings%20Terms%20and%20Conditions.pdf

Similarly for West Brom my September payment was shown as received 1st September. All I can find for West Brom is that interest is calculated daily.

My reading was that the Ts&Cs state:

I've got a regular saver with them sat with £1 so I shall send £1 across to it tomorrow morning as a test.1 -

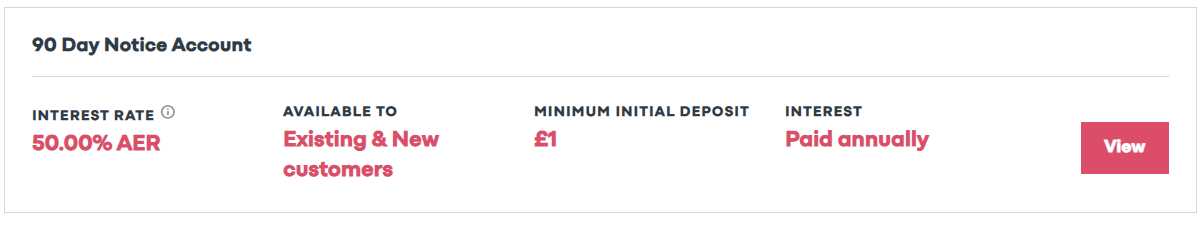

Still shows as 30% for me, their website is also showing a 90 day notice account paying 50% among other accounts:ForumUser7 said:

I think it's been fixed - showing 5% at my endBridlington1 said:It seems the new year has made Leek BS's technical systems become rather generous, it says their regular saver has risen from 5% to 30% or 17.25% depending on where you look:

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards