We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Pension dropping suddenly

Comments

-

Probably just forgot to mention their IFA.german_keeper said:

I can't see any mention of an IFA. OP quotes "we decided" I take that to be her and husband. You do seem to have a very unhealthy obsession, maybe you should try and get out more.Ibrahim5 said:Your IFA may have just glanced at the investments and then taken his fee for looking at them.-1 -

Those Imaginary Financial Advisers get everywhere.... 🙄Ibrahim5 said:

Probably just forgot to mention their IFA.german_keeper said:

I can't see any mention of an IFA. OP quotes "we decided" I take that to be her and husband. You do seem to have a very unhealthy obsession, maybe you should try and get out more.Ibrahim5 said:Your IFA may have just glanced at the investments and then taken his fee for looking at them.18 -

As said this is just ho-hum noise in the market, prices bounce around a bit all the time with periodic large falls and an upward trend overall.

Depending on what the plan is for this pension in terms of annuity or drawdown when he retires is something you need to consider.

If you are going to buy an annuity then it makes sense to lower the risk profile of the investments as the purchase date approaches. Lifestyle funds typically start to gradually do this from about 10 years out.

If drawdown will be the approach used in retirement then at age 48 he has potentially 40 to 50 years of investment returns ahead of him and a 2% fall in a week in 2024 won't even register on any graph he might look at, even a 20% fall will be a miniscule bump in the line.

These reassurances might help or they might not but either way I would suggest that he considers his attitude to the risk he is facing and whether he is invested too aggressively for his own good. The biggest danger to his wealth is seeing a much larger fall, panicking and selling at a low price thus creating a real loss in value rather than the entirely hypothetical one shown on his phone or tablet screen.2 -

My pension lost £25k last week. No presents for the kids this year!5

-

As above it's not a drop of any significance at all. But panic selling when something is low and buying high is the worst possible thing to do.happymum37 said:He's panicking and saying he should change investments. I have said he needs to stay putRemember the saying: if it looks too good to be true it almost certainly is.3 -

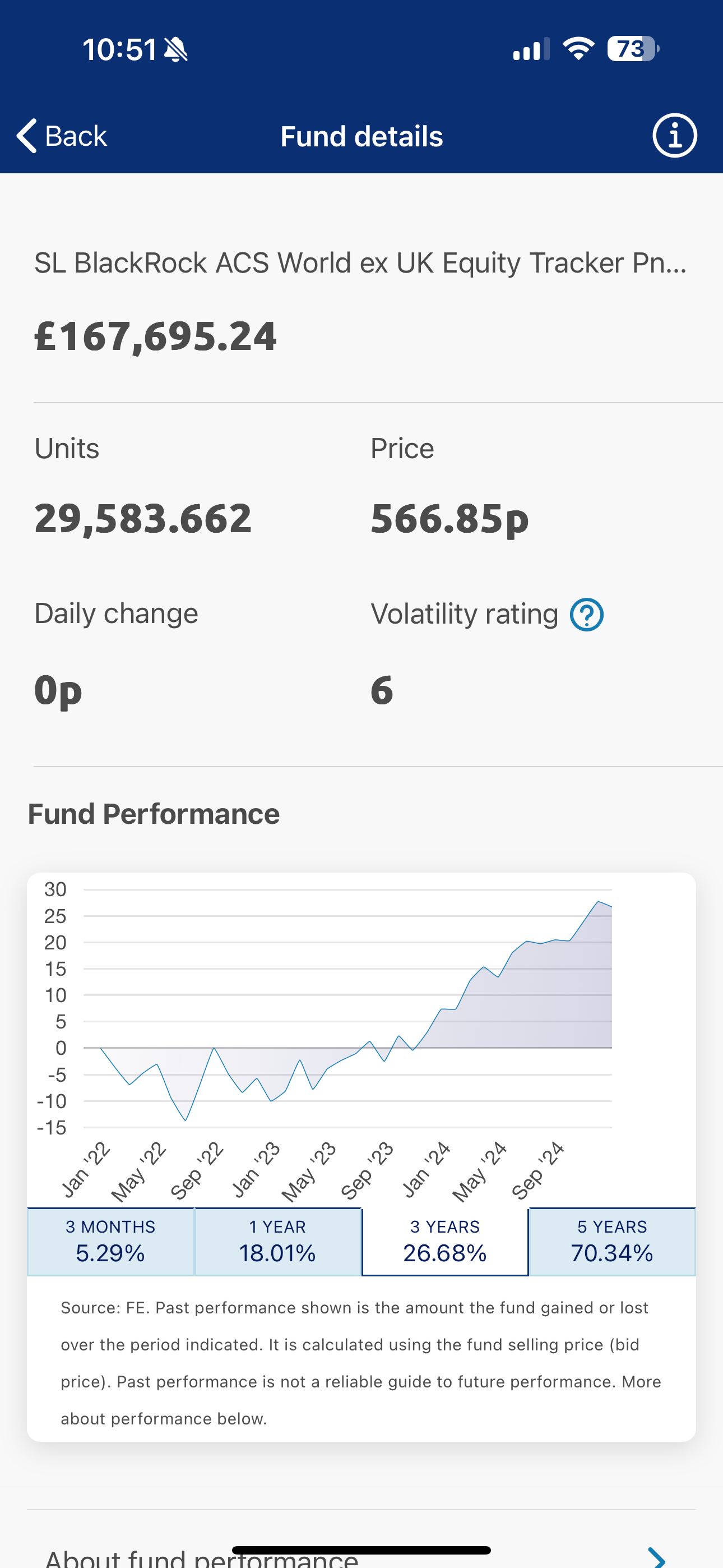

This fund about 40% of my pension investment and is one of my best performing funds. It has lost a few £k in the past week and you can see it has been a rollercoaster over the last 3 years but 70% growth in 5 years and almost 20% in the last 12 months is not to be sniffed at. (I probably should have picked a UK one and you could have seen the heart stopping bounce when Liz Truss was prime minister)

Also, the units I bought in the summer of 2022 have grown particularly well, a big benefit of buying monthly in small increments, as you do with pensions.

As others have said, if you can't live with the ride then it might be worth finding safer investments but the best thing to do is check a couple of times a year and make only changes based on what you think will happen in the long term.

0 -

Defining safer is the challenge though. Shifting equity allocation to bonds just changes the nature of the risk. The key is balancing them. And the major criterion here should be time to retirement. Attitude and capacity for risk come in to it too, they they should be constrained by the former.Moonwolf said:

As others have said, if you can't live with the ride then it might be worth finding safer investments but the best thing to do is check a couple of times a year and make only changes based on what you think will happen in the long term.

I think the lifestyle funds might be the right choice here.

Making changes on what you think will happen isn't a good approach either. It relies on you being right. I just assume the whole thing is a random biased walk.

"Real knowledge is to know the extent of one's ignorance" - Confucius2 -

I'm about to retire and will have good enough cover in DB pension, and expect to get 20-30 years from DC before spending it all, so have generally stayed mostly in equities.kinger101 said:

Defining safer is the challenge though. Shifting equity allocation to bonds just changes the nature of the risk. The key is balancing them. And the major criterion here should be time to retirement. Attitude and capacity for risk come in to it too, they they should be constrained by the former.Moonwolf said:

As others have said, if you can't live with the ride then it might be worth finding safer investments but the best thing to do is check a couple of times a year and make only changes based on what you think will happen in the long term.

I think the lifestyle funds might be the right choice here.

Making changes on what you think will happen isn't a good approach either. It relies on you being right. I just assume the whole thing is a random biased walk.

However, I have recently switched some into less volatile funds because I expect more volatility in the years until I reach state pension and all my DBs mature than I am comfortable with. Not a detailed prediction but a broad one taking into account my specific situation.3 -

Hardly tanked. This is little more than a small fluctuation and quite normal.happymum37 said:Hubby panicking. His pension with aviva has tanked since early Dec. It had 124k in it and dropped to 122k in a week.

Not a problem and where I would have been at his age.happymum37 said:He has 5 investments all equal 20% and all high risk funds.

happymum37 said:

That is hardly likely if he was invested.He's almost 48 and we decided to do this as his pension wasn't growing at all.

Does he know what he is invested in? Unless you understand that you cannot even begin to consider whether you should move.happymum37 said:He's panicking and saying he should change investments.

Deep breath time Helen. Don't panic, take stock and so some reading. The drop in his pot is nothing.happymum37 said:Please help. Utter novice here4 -

I am in a similar position, I've been building an investment pot for a decade, soon to start drawing. Historically a flexible withdrawal rate of between 3-6% should preserve my wealth until state pension is available. 12 years before SPA I will have DC pot, after SPA I care less about running the investment pot down.Moonwolf said:I'm about to retire and will have good enough cover in DB pension, and expect to get 20-30 years from DC before spending it all, so have generally stayed mostly in equities.

However, I have recently switched some into less volatile funds because I expect more volatility in the years until I reach state pension and all my DBs mature than I am comfortable with. Not a detailed prediction but a broad one taking into account my specific situation.

My ISA and unsheltered pot needs to cover the gaps before taking pensions, I anticipate some large expenditures in that time so I have moved capital into cash, fixed interest with known redemptions and amounts.

Selling some investments and keeping as cash. fixed rate deposits, gilts and corporate bonds is about fixing/managing my expenses from equities/cash/bonds etc..1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards