We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

What would you do in this situation?

Comments

-

I was in a similar situation in 2016 when I was 46 and my DB pension also started offering a DC part to the pension, making it a hybrid scheme. To entice us to start saving extra my employer offered to match the 1st 1% into this DC scheme so I started off just matching the 1%. It dawned on me over time how much tax and NI I could save if I upped my contributions. I gradually upped it over the years, and am now salary sacrificing 23% into this DC part of my pension. I have kept a spreadsheet of all my extra contributions and what it has actually cost me in reduced take-home pay.

It has cost me just over £51k in reduced pay, but thanks to Income tax and NI savings and decent growth over the years, my pot is worth just over £120k.

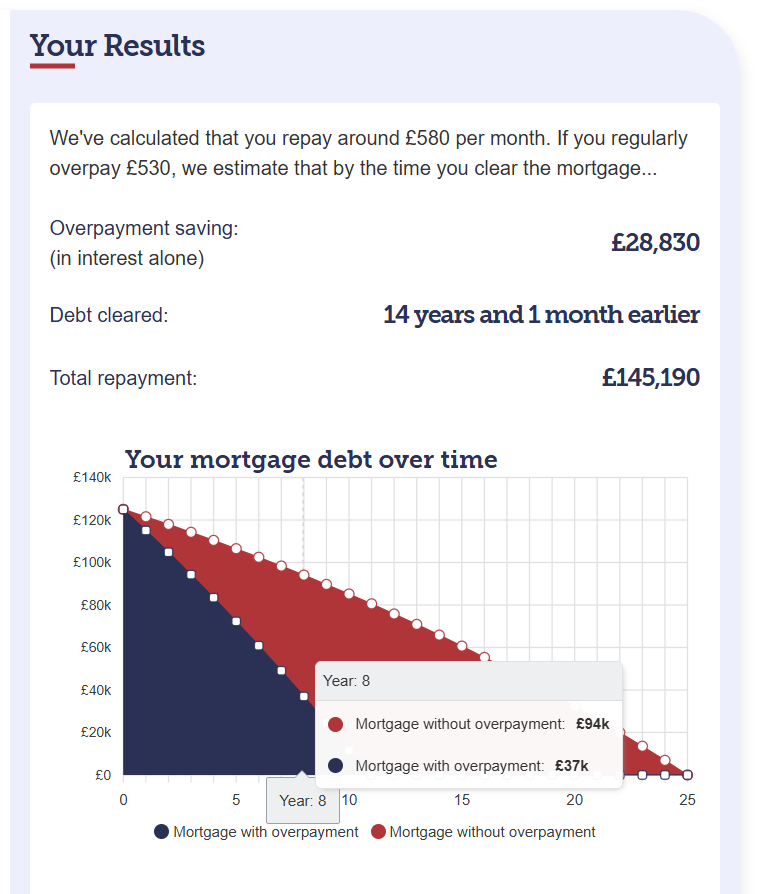

My mortgage in 2016 was £125k, it is now £94k. To simplify things, if I assume all my pension overpayments were equal over the 8 years, that is around £530/month that I could have overpaid my mortgage. That would mean at this point in time I would still have £37k left on my mortgage.

So my mortgage would be £57k less, but I would not have a pot of £120k in my pension. By prioritising my pension over my mortgage I am £63k better off.

3 -

Also worth noting that the AVC linked to the LGPS can be taken 100% tax free when taken at the same time as the DB pension (up to the limit of approx 25%, of 20x the annual pension amout plus the AVC amount ). In a lot of cases it can be made by salary sacrifice adding an extra boost.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards