We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Income, Expenditure and Gifting from Excess Income

Comments

-

Your historic piece still counts after all it sets the trend so would be useful.

I am trying to use it not only to provide a history but also to forecast so I can see when I can gift, this should provide assurance that it is part of a long standing pattern.

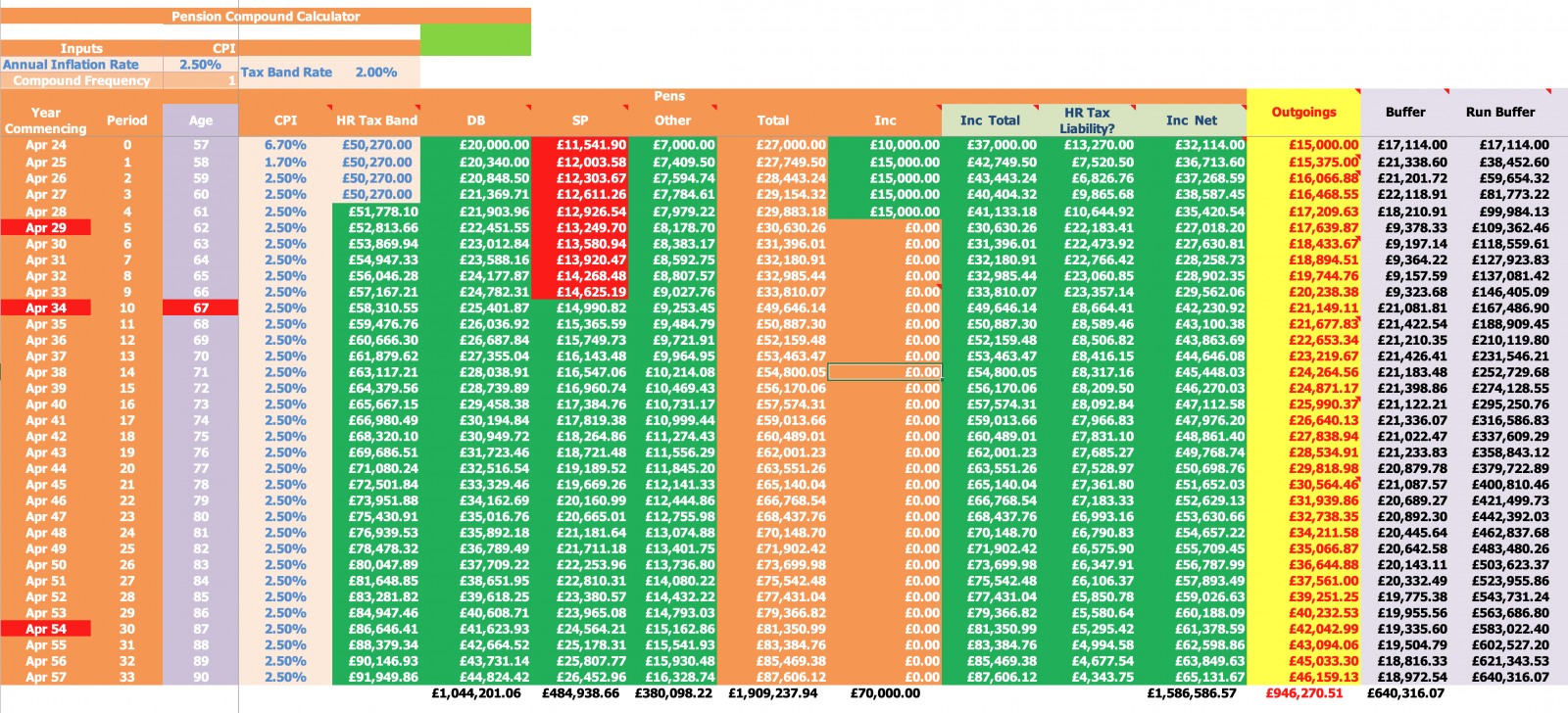

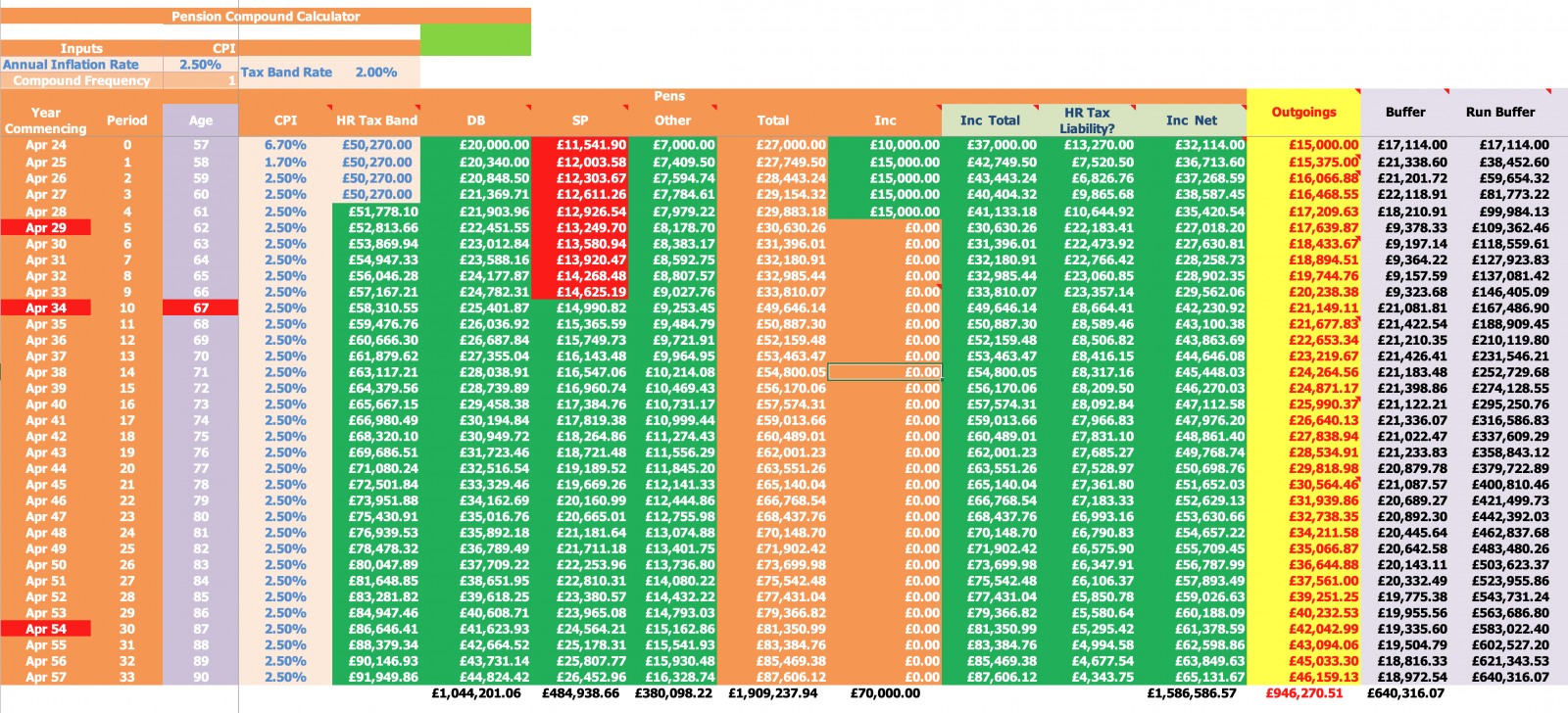

This is the income side, sorry it's a little small but if you zoom it should show ok..

Tracking of DB, SP when it kicks in, another pension and the Inc column to determine when I might wish to completely stop working, likely this will be replaced by some kind of drawdown.

HR tax liability, is actually headroom in green, or turns to red when I might be above £50270 to try and remain below the 40% threshold.

The HR Tax threshold fixed until Apr 2028 and then with a level of increase, always dreaming but it does drag behind CPI! On the flip side I have CPI+2% every other year on outgoings.

The buffer column is where the gift from income is justified, and the running buffer growth shows how quickly that capital might build and create a problem.

I have some hidden columns in there, currently empty, for a new motorbike or other large expenditure and some gifting to the kids so I can see where the option points might be.

or other large expenditure and some gifting to the kids so I can see where the option points might be.

Ultimately I do not want the running buffer to be growing and aiming to cap at for instance £50k-£100k will provide enough excess every year.

I have replaced the live data with generic figures to demonstrate. If there are any observations on how to improve they would be gratefully received.

2 -

BikingBud said:Your historic piece still counts after all it sets the trend so would be useful.

I am trying to use it not only to provide a history but also to forecast so I can see when I can gift, this should provide assurance that it is part of a long standing pattern.

This is the income side, sorry it's a little small but if you zoom it should show ok..

Tracking of DB, SP when it kicks in, another pension and the Inc column to determine when I might wish to completely stop working, likely this will be replaced by some kind of drawdown.

HR tax liability, is actually headroom in green, or turns to red when I might be above £50270 to try and remain below the 40% threshold.

The HR Tax threshold fixed until Apr 2028 and then with a level of increase, always dreaming but it does drag behind CPI! On the flip side I have CPI+2% every other year on outgoings.

The buffer column is where the gift from income is justified, and the running buffer growth shows how quickly that capital might build and create a problem.

I have some hidden columns in there, currently empty, for a new motorbike or other large expenditure and some gifting to the kids so I can see where the option points might be.

or other large expenditure and some gifting to the kids so I can see where the option points might be.

Ultimately I do not want the running buffer to be growing and aiming to cap at for instance £50k-£100k will provide enough excess every year.

I have replaced the live data with generic figures to demonstrate. If there are any observations on how to improve they would be gratefully received.

All I can say is Wow!

0 -

Are you sure? I think I read that if YOU gift and died within 7 years it would not be outside YOUR estate. It would not be part of the IHT free transfer to your wife as it has been gifted by you. So please checkSouthCoastBoy said:I an just starting gifting to my two children, 25k each at the moment. I have updated my records that sit alongside my will informing the executor of amount, date and who it was gifted to.

As I am leaving everything to my wife as long as one of us survives the next 7 years we will be OK for iht from this gift perspective0 -

Yes, I agree. Serious amounts of Gifts from Income must be well -planned before-hand. I think it would be very difficult for an executor to create a large claim unless the gifting had been fully documented at the time.poseidon1 said:

Excellent outcome.Linton said:

I successfully claimed >>£200K of gifts from income with over 500 relevent transactions. There was no professional involved in calculating the data and completing the form. HMRC accepted the numbers without argument, perhaps because they did not want to wade through dozens of pages of annotated bank statements and spreadsheet results.poseidon1 said:

Just a bit more background to my thoughts on this matter.poseidon1 said:

Anyone contemplating instigating a gifts out of income iht mitigation strategy should first take a look at form IHT 403 and the gifts out of income schedule at page 8. This gives an indication of the level of granular detail expected of executors to demonstrate ( to HMRCs satisfaction) that excess income was indeed available for each year of the purported gifts.EnglishMohican said:Thank you both - forgive me if I check my understanding of your answers by putting them in my own words and adding a bit from other sources.Firstly, I am not trying to be over-clever and find loopholes. I am trying to make it easy for my executors by sticking to the straight and narrow and not gifting anything over what they can genuinely show is excess income. Ideally to make sure the records are easily available to demonstrate that.Some things are clear, my pension is income, my food bill is expenditure. Both happen every month so they are simple.HMRC mention averaging over a number of years - which seems reasonable. One year of heavy expenditure does not mean that gifting has to stop providing that over a number of years, the total expenditure can be shown to be less than the total income. The good years can cover the bad one. I guess that a follow up is that the year after the bad one needs to look hopeful as a normal expenditure year, that would help a forward looking justification immensely.Where the extra money comes from (Cash ISA or Selling shares) is not important as long as that cash or those shares can reasonably be shown to be the result of the last "something" years of income.And if that heavy expenditure is not caused by something that I do in a pattern (two yearly, three yearly, whatever) it does not count in any case - as it is not normal.Not a mention of capital in that! Have I got it about right now?

It is recommended that if anyone is serious about the exemption being invoked by their executors on eventual death, they complete each year a detailed income and expenditure schedule for their executors' assistance.

It is apparent from the queries raised by OPs on this subject, that there is often a vague understanding of the distinction between capital and income in determining excess income on a year to year basis. In this regard, OPs are directed to HMRCs internal manuals, a link to part of the manual is shown below, and scrolling backwards and forwards from that page will give a more complete understanding of the hoops executors will need to jump through in successfully claiming the exemption.

https://www.gov.uk/hmrc-internal-manuals/inheritance-tax-manual/ihtm14250

OPs should be aware that although income in the IHT legislation is not specifically defined, it is to be determined by HMRC officers ' in accordance with normal accountancy rules'.

If you are not accountancy trained, you are already at a disadvantage here. As an example the 5% withdrawal facility from investment bonds is often characterised as income by insurance companies. It is not, its a return of your original capital. However, contrast this with pensioners taking regular UFPLSs from their SIPP. One might assume the element related to tax free cash should not be considered income, but apparently the entirety of the payment is income for the purposes of the exemption.

Also take a look at the annuities heading in the HMRC manual link above. In the case of purchased life annuities ( ie, purchased from your own capital rather than from accumulated pension funds), the return of capital element is not income for the purposes of the exemption.

What of ISA income which has not been distributed to the investor in the year, is that to be considered available income in subsequent years in ascertaining excess income? Well HMRC concede that although there are no hard and fast rules, in the absence of evidence to the contrary they rather arbitrarily state that in general, unspent income becomes capital after two years.

The above examples are indicative of the sort of things a trained tax accountant should know if advising a client, but would the ordinary lay person be cognizant of these nuances in attempting DIY planning of their own?

In summary, in drawing attention to the schedule to IHT403, and HMRC's extensive guidance manuals on the subject, OPs should acquaint themselves with the challenges their executors may face in proving the validity of gifts out of excess income claims, and provide them with coherent records to do so. This is especially the case where OPs may also wish to utilise any of the various other capital gifts exemptions in a particular year, such as PETs and the £3,000 gifts exemptions.

I have no experience of people attempting to secure this exemption on a DIY basis.

Prior to my retirement, my firm routinely reccomended the availability of this exemption to clients who typically had high 6 figure incomes pre and post retirement and on whose behalf we prepare and submit their tax returns. With that granular insight into their income and capital affairs and indepth knowledge of HMRC criteria for acceptance of the relief, we then devise the annual paper trail of necessary evidence for those clients inclined to utilise the exemption.

Typically those clients are minded to make 5 figure annual gifts out of income, in addition to substantial capital gifts ( requiring 7 year survival) so a coherent water tight paper trail is necessary to ensure their objectives are met.

To that end, we would eventually compile the submissions for the purposes of the IHT 403 declarations on behalf of the executors.

The point being made is in general, the exemption is neither well known or utilised by those in a position to benefit from it. The professional accountancy and legal firms who have the HNWI client base who can benefit, propose and implement the appropriate strategies and supporting evidence to ensure HMRC's ultimate acceptance on their behalf.

For those lower down the income/wealth scale now considering implementing the exemption on a DIY basis , spare a thought for your executors who will have no knowledge of HMRC's rules and criteria and may not be possessed of personal insight of your income/expenditure/capital to launch a convincing claim on your estate's behalf. You, therefore, during your lifetime are trying to replicate (as best you can) the kind of cohesive papertrail prepared on behalf of professionally advised persons.

Bear in mind the whole ethos and complexity of original inheritance tax/ death duty legislation (as well as case law pertaining thereto ) was built on the edifice of taxing a very small select group of the population, who typically would have accountants/lawyers assisting and navigating these matters on their behalf.

With the significant rise in house prices over the last 30/40 years , and the shrinking ( by default ) of the nil rate band ( unchanged for 14 years!) a broader mass affluent population has emerged who are not routinely professionally advised.

Other than the increase of the nil rate band from the original 1987 £71k level to £325k currently , the inherent complexity of the Inheritance tax system has not been adjusted for this changed demographic. So blithely assuming HMRC will take an understanding 'commonsense' stance when addressing this exemption claim from estates which are not professionally advised and where the deceased made little effort to provide the executors with acceptable evidence, I would suggest would be a mistake.

Perhaps anyone who has been the executor of an estate, claiming this exemption without the benefit of professional intervention could relate their experiences in this regard?

It was pretty straightforward with no need for smoke and mirrors or dubious categorisation since the deceased had a very large annuity way beyond his normal expenditure and lived well into his 90s. I was greatly helped by him having prepared a summary of income, expenditure and gifts at the end of each year..

However you support my point about the deceased having been proactive during his life time in preparing annual summaries in terms of income, expenditure and gifts to assist you with making the claim. Imagine what your task would have been like without his considerate efforts.

Whether professionally advised or not, a team approach necessary - the deceased by way of coherent and systematic record keeping and the executor ( or executor's assistant) with the ability and willingness to collate and present the necessary data in a manner acceptable to HMRC. I don't know about you, I don't know many people over 80 that could maintain the kind of annual records made available to you by the deceased.

You have to wonder, how many people posting on this thread could do what you and the deceased did in eventually securing the exemption for the the quantum of gifts in question.

I had PoA by the time the deceased was finding it difficult to maintain his own records and down-loaded his bank statements each month to MS Money. It was straightforward to generate most of the detailed reporting by categorising all expenditure and income within MS Money and directly transferring the data to a spreadsheet for final tweaking.0 -

Take this as a complement, the pre planning, execution ( by the deceased ) and your subsequent actions as holder of the deceased's POA are entirely comparable to a professional adviser acting in complete concert with an informed 'client'.Linton said:

Yes, I agree. Serious amounts of Gifts from Income must be well -planned before-hand. I think it would be very difficult for an executor to create a large claim unless the gifting had been fully documented at the time.poseidon1 said:

Excellent outcome.Linton said:

I successfully claimed >>£200K of gifts from income with over 500 relevent transactions. There was no professional involved in calculating the data and completing the form. HMRC accepted the numbers without argument, perhaps because they did not want to wade through dozens of pages of annotated bank statements and spreadsheet results.poseidon1 said:

Just a bit more background to my thoughts on this matter.poseidon1 said:

Anyone contemplating instigating a gifts out of income iht mitigation strategy should first take a look at form IHT 403 and the gifts out of income schedule at page 8. This gives an indication of the level of granular detail expected of executors to demonstrate ( to HMRCs satisfaction) that excess income was indeed available for each year of the purported gifts.EnglishMohican said:Thank you both - forgive me if I check my understanding of your answers by putting them in my own words and adding a bit from other sources.Firstly, I am not trying to be over-clever and find loopholes. I am trying to make it easy for my executors by sticking to the straight and narrow and not gifting anything over what they can genuinely show is excess income. Ideally to make sure the records are easily available to demonstrate that.Some things are clear, my pension is income, my food bill is expenditure. Both happen every month so they are simple.HMRC mention averaging over a number of years - which seems reasonable. One year of heavy expenditure does not mean that gifting has to stop providing that over a number of years, the total expenditure can be shown to be less than the total income. The good years can cover the bad one. I guess that a follow up is that the year after the bad one needs to look hopeful as a normal expenditure year, that would help a forward looking justification immensely.Where the extra money comes from (Cash ISA or Selling shares) is not important as long as that cash or those shares can reasonably be shown to be the result of the last "something" years of income.And if that heavy expenditure is not caused by something that I do in a pattern (two yearly, three yearly, whatever) it does not count in any case - as it is not normal.Not a mention of capital in that! Have I got it about right now?

It is recommended that if anyone is serious about the exemption being invoked by their executors on eventual death, they complete each year a detailed income and expenditure schedule for their executors' assistance.

It is apparent from the queries raised by OPs on this subject, that there is often a vague understanding of the distinction between capital and income in determining excess income on a year to year basis. In this regard, OPs are directed to HMRCs internal manuals, a link to part of the manual is shown below, and scrolling backwards and forwards from that page will give a more complete understanding of the hoops executors will need to jump through in successfully claiming the exemption.

https://www.gov.uk/hmrc-internal-manuals/inheritance-tax-manual/ihtm14250

OPs should be aware that although income in the IHT legislation is not specifically defined, it is to be determined by HMRC officers ' in accordance with normal accountancy rules'.

If you are not accountancy trained, you are already at a disadvantage here. As an example the 5% withdrawal facility from investment bonds is often characterised as income by insurance companies. It is not, its a return of your original capital. However, contrast this with pensioners taking regular UFPLSs from their SIPP. One might assume the element related to tax free cash should not be considered income, but apparently the entirety of the payment is income for the purposes of the exemption.

Also take a look at the annuities heading in the HMRC manual link above. In the case of purchased life annuities ( ie, purchased from your own capital rather than from accumulated pension funds), the return of capital element is not income for the purposes of the exemption.

What of ISA income which has not been distributed to the investor in the year, is that to be considered available income in subsequent years in ascertaining excess income? Well HMRC concede that although there are no hard and fast rules, in the absence of evidence to the contrary they rather arbitrarily state that in general, unspent income becomes capital after two years.

The above examples are indicative of the sort of things a trained tax accountant should know if advising a client, but would the ordinary lay person be cognizant of these nuances in attempting DIY planning of their own?

In summary, in drawing attention to the schedule to IHT403, and HMRC's extensive guidance manuals on the subject, OPs should acquaint themselves with the challenges their executors may face in proving the validity of gifts out of excess income claims, and provide them with coherent records to do so. This is especially the case where OPs may also wish to utilise any of the various other capital gifts exemptions in a particular year, such as PETs and the £3,000 gifts exemptions.

I have no experience of people attempting to secure this exemption on a DIY basis.

Prior to my retirement, my firm routinely reccomended the availability of this exemption to clients who typically had high 6 figure incomes pre and post retirement and on whose behalf we prepare and submit their tax returns. With that granular insight into their income and capital affairs and indepth knowledge of HMRC criteria for acceptance of the relief, we then devise the annual paper trail of necessary evidence for those clients inclined to utilise the exemption.

Typically those clients are minded to make 5 figure annual gifts out of income, in addition to substantial capital gifts ( requiring 7 year survival) so a coherent water tight paper trail is necessary to ensure their objectives are met.

To that end, we would eventually compile the submissions for the purposes of the IHT 403 declarations on behalf of the executors.

The point being made is in general, the exemption is neither well known or utilised by those in a position to benefit from it. The professional accountancy and legal firms who have the HNWI client base who can benefit, propose and implement the appropriate strategies and supporting evidence to ensure HMRC's ultimate acceptance on their behalf.

For those lower down the income/wealth scale now considering implementing the exemption on a DIY basis , spare a thought for your executors who will have no knowledge of HMRC's rules and criteria and may not be possessed of personal insight of your income/expenditure/capital to launch a convincing claim on your estate's behalf. You, therefore, during your lifetime are trying to replicate (as best you can) the kind of cohesive papertrail prepared on behalf of professionally advised persons.

Bear in mind the whole ethos and complexity of original inheritance tax/ death duty legislation (as well as case law pertaining thereto ) was built on the edifice of taxing a very small select group of the population, who typically would have accountants/lawyers assisting and navigating these matters on their behalf.

With the significant rise in house prices over the last 30/40 years , and the shrinking ( by default ) of the nil rate band ( unchanged for 14 years!) a broader mass affluent population has emerged who are not routinely professionally advised.

Other than the increase of the nil rate band from the original 1987 £71k level to £325k currently , the inherent complexity of the Inheritance tax system has not been adjusted for this changed demographic. So blithely assuming HMRC will take an understanding 'commonsense' stance when addressing this exemption claim from estates which are not professionally advised and where the deceased made little effort to provide the executors with acceptable evidence, I would suggest would be a mistake.

Perhaps anyone who has been the executor of an estate, claiming this exemption without the benefit of professional intervention could relate their experiences in this regard?

It was pretty straightforward with no need for smoke and mirrors or dubious categorisation since the deceased had a very large annuity way beyond his normal expenditure and lived well into his 90s. I was greatly helped by him having prepared a summary of income, expenditure and gifts at the end of each year..

However you support my point about the deceased having been proactive during his life time in preparing annual summaries in terms of income, expenditure and gifts to assist you with making the claim. Imagine what your task would have been like without his considerate efforts.

Whether professionally advised or not, a team approach necessary - the deceased by way of coherent and systematic record keeping and the executor ( or executor's assistant) with the ability and willingness to collate and present the necessary data in a manner acceptable to HMRC. I don't know about you, I don't know many people over 80 that could maintain the kind of annual records made available to you by the deceased.

You have to wonder, how many people posting on this thread could do what you and the deceased did in eventually securing the exemption for the the quantum of gifts in question.

I had PoA by the time the deceased was finding it difficult to maintain his own records and down-loaded his bank statements each month to MS Money. It was straightforward to generate most of the detailed reporting by categorising all expenditure and income within MS Money and directly transferring the data to a spreadsheet for final tweaking.

I have to maintain I don't believe average members of the general populace would be so organised and diligent in obtaining the outcome you and the deceased ultimately achieved, but your case is a shining example of what is possible on an unadvised basis assuming posession of the appropriate individual skillsets.2 -

I’m doing this very thing at the minute as a bit of an exercise to prepare to do it for future years for me and my wife. The income is easy but…It is a bit of a nightmare trying to fit spend into the categories on the IHT403 form. I find that the majority if not all of the expenditure appears on a joint credit card statement and a joint bank account so I’ve taken the approach that all the main bills from the bank account are split 50/50 unless it’s something I can specifically pin on one or the other of us and I just split the credit card statement between us. Assuming that’s OK the only issue I then have is what remains on the bank account when maybe smaller payments or cash withdrawals up to £200 are made and long ago forgotten what they were for??? Again I just totaled these up and split them - given I have to make an allowance to theroretically transfer some funds to my wife to cover her shortfall as her income is a lot less. When it comes to the form I include the credit card statement costs within the Household bills bit and on the entertainment , travel and holidays parts - I state it’s covered by the credit card statement costs in the Household Bills section.LHW99 said:I had a look at IHT403, as the 2027 rules are likely to require this (or similar) to be filled in.Horror! - the required categories are completely different to those I have been using for the past x years to classify / group expenditure.I shall try to re-classify expenditure from now, and in at least the last couple of financial years, and hope to last long enough that any executors will have the information they need at some (hopefully long) time in the future.

Does all that seem reasonable if you have managed to follow?

Thanks0 -

Now I've been looking at reorganising the spreadsheet, I have been putting the CC amounts under "other", as we don't pay routine food bills (or other household bills) by credit card, and if that blurs the line a little between entertainment, travel and true "other" I don't think that will be a big issue, as it's routinely a smallish amount in the overall scheme of things.

0 -

About 10 years ago I had the task of constructing a spreadsheet to show income and expenditure for the last 7 years of a friend’s husband. It involved trawling through bank statements, credit card bills and chequebook stubs. He liked using cash for day to day expenditure. It was time consuming however we were also able to show an increase in capital across the same timeline and a regular pattern of gifts so my allocation of payments to various headings I think didn’t matter as much.MIL a few years ago had her portfolio rejigged to produce income rather than growth. She runs two main bank accounts one which receives her pensions etc and one which receives her ISA income. The first shows a small surplus which initially was put into cash ISAs and now funds S&S ISA.

The second pays regular amounts to a number of beneficiaries.

4/5 years ago a number of PETs were made so hopefully a detailed breakdown of expenditure will not be needed as the estate is about 100k below the present IHT reliefs. She didn’t transfer more as the intention was to redirect the ISA income later to help with any care she might need.

I am hopeful that this approach will be enough as I know there is no chance of MIL producing a detailed expenditure analysis and any inheritance the grandchildren receive will be a bonus.0 -

This is true. We fell foul of this a few years back and it proved very costly....the youngest/fittest parent should make gift from their account...DT2001 said:

Are you sure? I think I read that if YOU gift and died within 7 years it would not be outside YOUR estate. It would not be part of the IHT free transfer to your wife as it has been gifted by you. So please checkSouthCoastBoy said:I an just starting gifting to my two children, 25k each at the moment. I have updated my records that sit alongside my will informing the executor of amount, date and who it was gifted to.

As I am leaving everything to my wife as long as one of us survives the next 7 years we will be OK for iht from this gift perspective

1 -

It may reduce the allowance I pass over to my wife, I.e. instead of 325k it would 275k, but my understanding is it would not go over any thresholds so no iht tax to pay. The online hmrc calculator appeared to confirm this, unless I have interpreted it incorrectly?DT2001 said:

Are you sure? I think I read that if YOU gift and died within 7 years it would not be outside YOUR estate. It would not be part of the IHT free transfer to your wife as it has been gifted by you. So please checkSouthCoastBoy said:I an just starting gifting to my two children, 25k each at the moment. I have updated my records that sit alongside my will informing the executor of amount, date and who it was gifted to.

As I am leaving everything to my wife as long as one of us survives the next 7 years we will be OK for iht from this gift perspectiveIt's just my opinion and not advice.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards