We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Product switching hack/fee

Comments

-

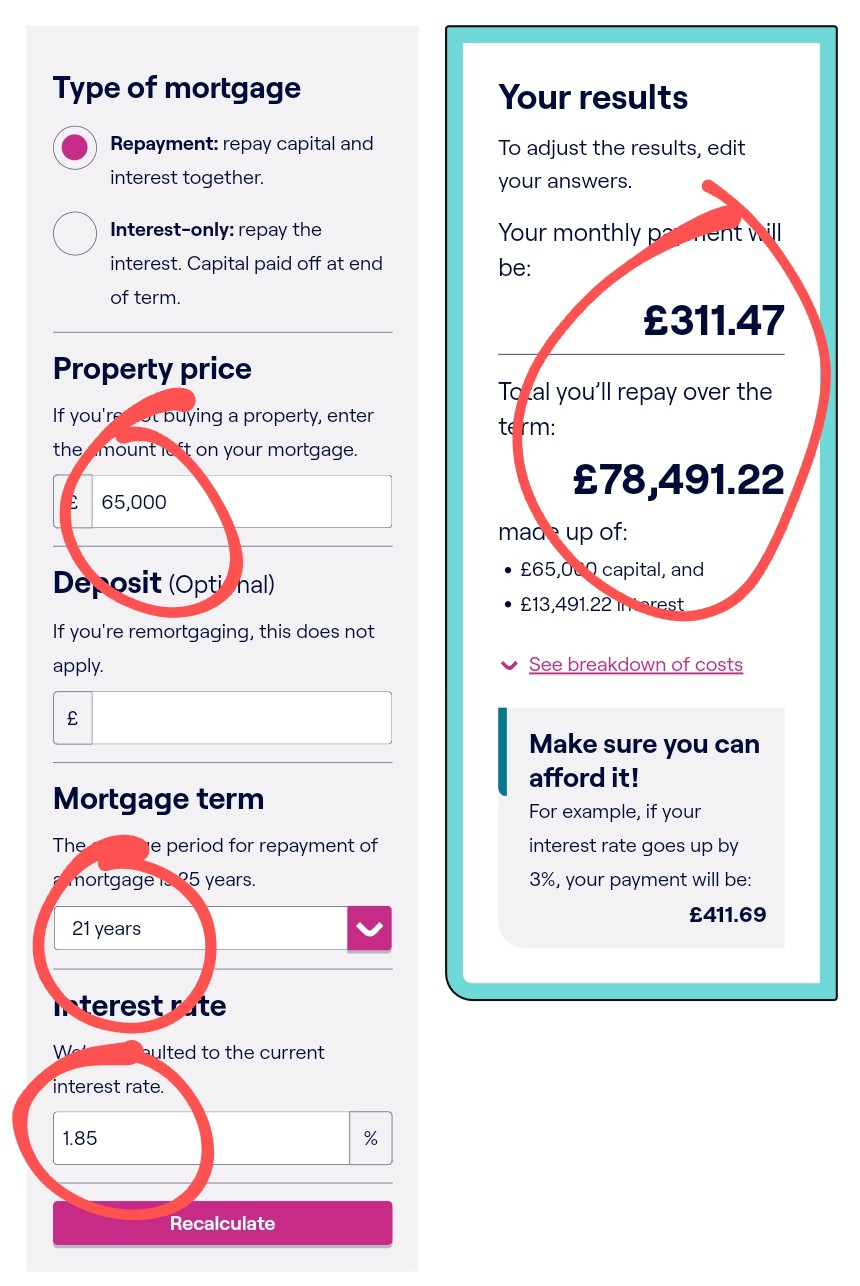

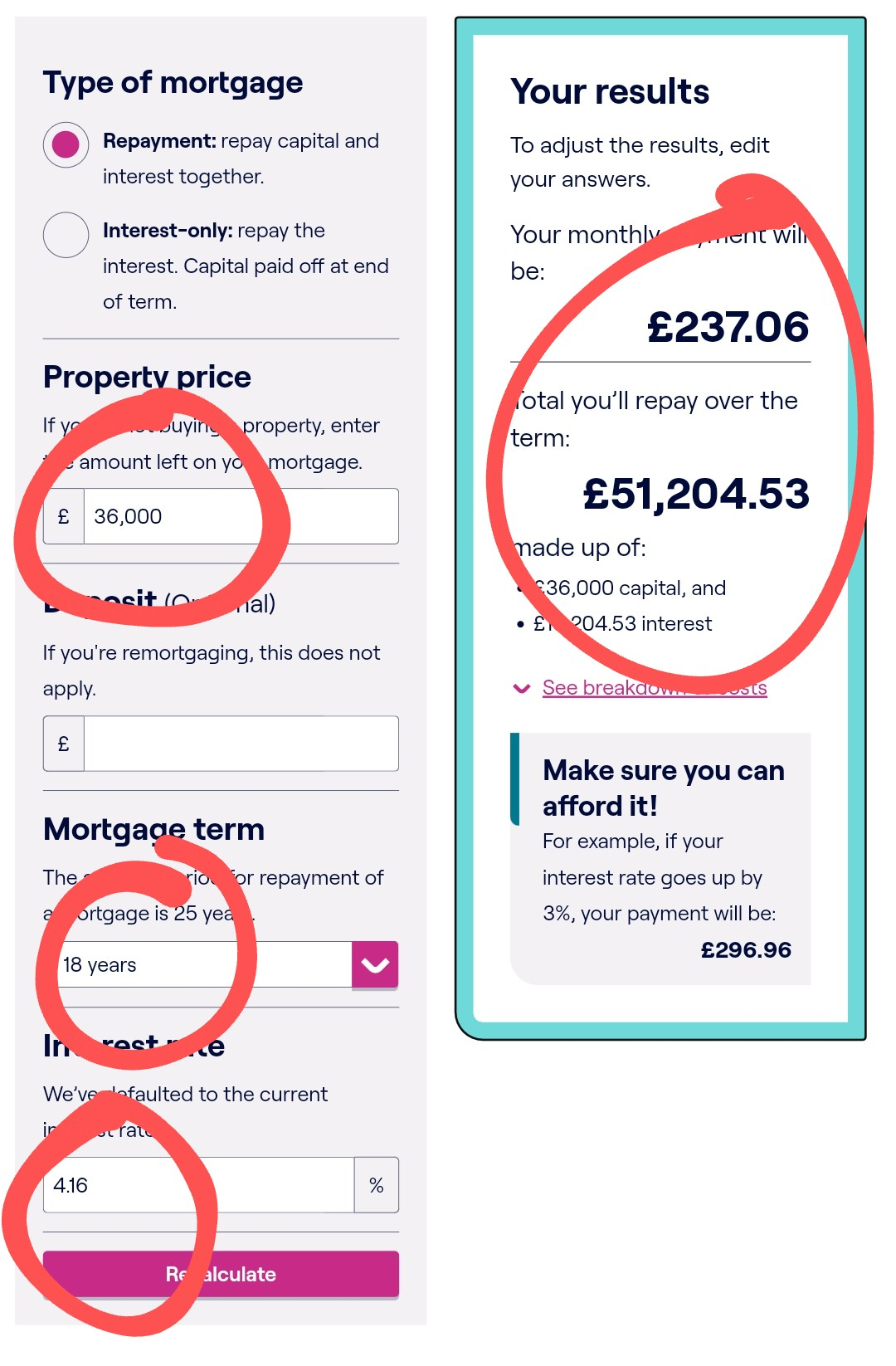

The maths still doesn’t math - how is your business overpayment being taken into account on the current mortgage - either lowering the monthly payment or shortening the term ?stud26 said:Initial term 21 years 1.85%. Now 18 years at 4.16%.

It's because the current payment was initially based on a £65,000 mortgage and the new payment would be calculated just on the remaining £36,000. Plug in the numbers yourself into a mortgage calculator and see.

Actually, I think there was an overpayment, but that doesn't affect this. I could still save by switching early.

But going back to my initial question, how much are exit fees?And only you know the exit fees based on the agreement you signed up to - no doubt if you have the lender/product code someone could tell you but much easier to look at your own account0 -

Here are the calculations:

When I took it the mortgage three years ago:

Now the mortgage is smaller and the new details would look like this:

Have I done something wrong in these calculations? Should the remortgage calculate based on the original amount, £65,000?Building my kids' savings from day one. Education and consistency are key to financial control.

Budgeting and using referral codes have been a game changer, I no longer pay for my dog's food.0 -

Will do, just wondering if there were general ball park figures like 1-2%, or a flat fee.user1977 said:

Go find your mortgage offer and read it to find out.stud26 said:

But going back to my initial question, how much are exit fees?Building my kids' savings from day one. Education and consistency are key to financial control.

Budgeting and using referral codes have been a game changer, I no longer pay for my dog's food.0 -

It looks like you are using 20 years as the period for both calculations, instead of taking the remaining balance and the remaining mortgage period which is probably 10 years at this point.

1 -

Thanks. My earlier screenshots show the terms I've used.MWT said:It looks like you are using 20 years as the period for both calculations, instead of taking the remaining balance and the remaining mortgage period which is probably 10 years at this point.Building my kids' savings from day one. Education and consistency are key to financial control.

Budgeting and using referral codes have been a game changer, I no longer pay for my dog's food.0 -

Yes, you are still comparing a £65k 21 year mortgage with a £36k 18 year mortgage when you can't still have 21 years to pay on the £65k mortgage. You can't even have 18 years left, more like 11.stud26 said:

Have I done something wrong in these calculations?

So do a calculation of £36k at 4.16 over the same number of years you have left on the current mortgage.

If you do that you will see your equivelent payment at 4.16% will be in the £340 per month range.3 -

It says it's due to finish May 2042. 17 years 7 months. Do you suspect something is wrong with this? Do I need to talk to the lender?400ixl said: You can't even have 18 years left, more like 11.Building my kids' savings from day one. Education and consistency are key to financial control.

Budgeting and using referral codes have been a game changer, I no longer pay for my dog's food.0 -

If you're paying 310 per month on a repayment mortgage (or even on an interest only) with no overpayments, there's no way that the mortgage would now be 29,000 less than three years ago2

-

None of your maths is adding up. How long was your original mortgage for?

£310 monthly on £65k is a 19 year 6 month mortgage at 1.18. If you still have 17 years 7 months left then you will not have £36k left to pay unless you were making massive over payments as you will have only paid 23 * £310 payments totalling £7,130 of which most would have been interest.

The simple fact is that if you keep the term the same, then 4.16% interest will always cost more than 1.18% for the same remaining balance you owe. The only way this changes for the same loan amount is that you pay it back over a longer period paying more overall.

2 -

£36k over 18 years at 1.18% is £185 per month and £39,976 total to repay

£36k over 18 years at 4.16% is £213 per month and £51,205 total to repay

Pure maths and you can't change it. Look at how much extra you pay back.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards