We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Contacting The Right Department By Phone

Comments

-

My records show I have 7 full years up to 5 April 1975 as well.

0 -

If the year is showing as "checking" it is HMRC you need to speak to, they are the collector of taxes and maintaining your NI record. That year does not exist, it is in limbo and the checker will not see it as fillable. You cannot fill it until the marker is removed. I am surprised the marker was not removed during the final checking process for your pension amount but likely it was caught in the crossover as you reached SPA shortly after.

1 -

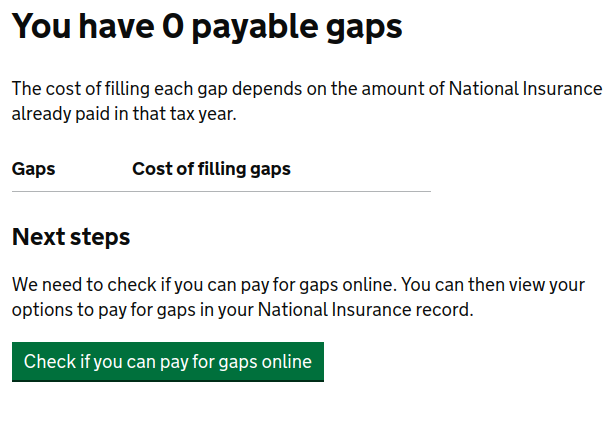

See what I'm seeing on the HMRC website;

0 -

Given that you are only a couple of pounds short of the maximum weekly new state pension, filling any years further back that 2016/17 isn't going to increase your state pension.shimeld said:

Further back there are a few gaps that I can't pay online because of the 6 year rule.jem16 said:

I assume you mean £875.76 every 4 weeks as it’s not paid monthly? If that’s the case you’re only £2.26pw short of maximum which probably isn’t worth paying voluntary NI unless it’s at Class 2.shimeld said:p00hsticks said:

?? If you are now 72, then presumably that gap is for the year before the one in which you reached state pension age, as you stop paying NI at that point. The most common reason for the 'looking into whether you need to pay' message we come across on these boards is when the person was self employed during the year in question and so could have made Class 2 payments.shimeld said:Online I can see a gap for one year in the last six, and it says they are looking into whether I need to pay gaps for that year. It's been like that for two years, and it never changes.I reached SPA in 2017. I am Male.I'm receiving £875.76 per month. Yes, I was working in during the tax year 2016/17. I started my current job in 2017 following a few years being self-employed.Is 2016/17 a full year or is it the one they’re checking?

It's that 2016/17 one that would potentially add the extra £2.26 a week to take you to the maximum, although as others have said it may not be worthwhile unless you can pay the lower class 2 rate.

And you first need to get HMRC to remove that 'checking' marker .....0 -

Well one good thing that has come from you posting this query is you are now £875.76/year better off than before you posted 😉shimeld said:Yes my pension is paid every 4weeks. 2016/17 is the one that they are checking.

But given the additional £2.26/week cannot be paid retrospectively, just from when you pay to add the post 2016 year, you need to consider if paying Class 3 NI would actually be worth it.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards