We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

"Surplus"AVC

Comments

-

I think I would open a pension with someone modern with good customer service like H&L or AJBell. You’ll need to put £100 in. Then when they say where do you want excess AVC sent you will have somewhere for it to go.1

-

Thanks 😊 we have been looking at AJ Bell, don't want to lose a lot of money in fee's going forward.

0 -

Hi,

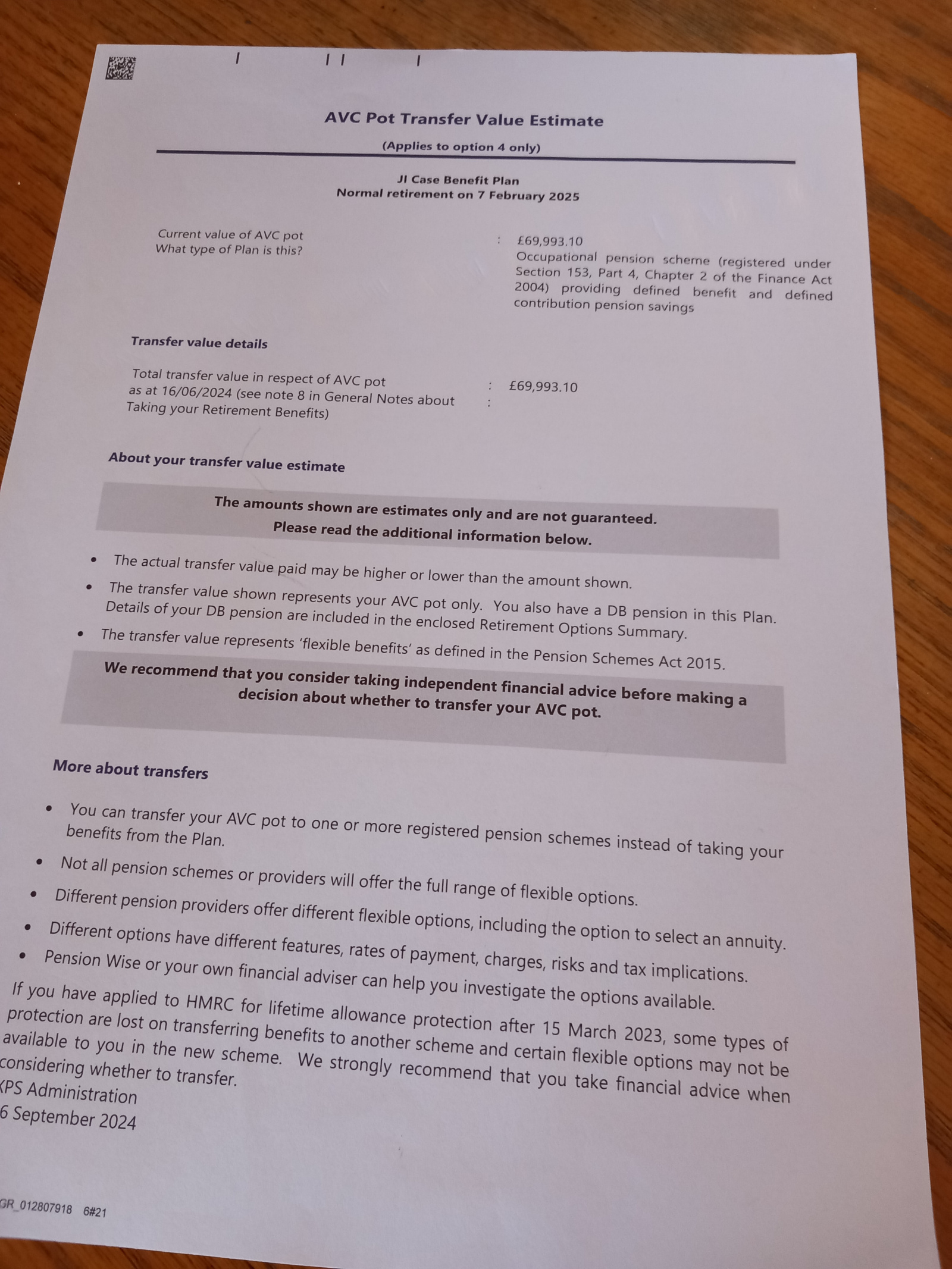

I suspect the issue here is that the scheme will have been set up so that the AVC provides some or all of a lump sum from the DB scheme. The main DB pension will have provided a pension and maybe a lump sum which might be commutatable to pension.

What will have happened is that the main DB has been adjusted (if it provided a lump sum in the first place) to be all pension (3622.51).

The maximum tax free lump sum is 25% of the total (inland revenue) value of the pension (25% of 20x the pension plus the lump sum) so the maximum tax free lump sum they can give you is 3622.51 x 20 (to give 75% of the IR value) / 3 to give 25% of the total IR value which is 24150.07.

You have more AVC than 24150.07 so the rest is surplus.

It is unclear to me whether the transfer of the surplus would be of a crystallised pot (I.e. it is all subject to income tax) or is a partial transfer of the AVC before crystallisation (in which case you could still get 25% of the surplus tax free after it has been transferred elsewhere). You need to check the basis of the transfer.

It would be well worth checking the rules of the DB scheme - some DB scheme rules envisage this possibility and require / permit the scheme to use the surplus to create more DB pension at the scheme commutation rate which might be very advantageous.

1 -

Thought I had put paperwork on obviously not!

He is taking option 1

[Image removed by Forum Team]

0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards