We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Moving from StepChange to a self managed DMP

debt_free_delilliah

Posts: 19 Forumite

I posted a couple of days ago about advice re a full and final settlement offer for my lowest creditor and received some advice to wait until a debt company offers a settlement figure. However, I've read some more and think a swapping to a self managed DMP might be the way forward.

I have been in a debt management plan with StepChange since August 2018. I originally had debts of circa £37k with seven different creditors. As at September 2024 my debts are down to circa £15.5k and just four creditors, as follows:

My mother died in February and a grant of probate completed in early July. I am due to receive around £35-40k after solicitors fees and other costs etc are paid. I'm not expecting to receive this money until early next year.

After reading on here extensively during the last couple of days I think now it is time that I should move to a self managed DMP and cancel my arrangement with StepChange. I believe I can just email to cancel my arrangement with StepChange.

I am going to send out CCA requests to my four creditors today. What do I do about paying my creditors from October onwards? StepChange has already deducted payment from me for September. Do I pay the same amount that I was paying StepChange? Do I pay nothing? Do I pay token amounts and build up a savings buffer during the next couple of months as I was for responses about the CCA requests? I currently have no savings.

I really want to take a proactive course of action so I can encourage full and final settlement offers to be made in the coming months. I have read on here that these can take time so by the time they start coming through I should hopefully have received my inheritance. Equally, I don't want to end up with any CCJ's just as the majority of these debts will fall off my credit file anyway in the next 6 months anyway.

Any advice will be gratefully appreciated. I really want to be debt free ASAP.

I have been in a debt management plan with StepChange since August 2018. I originally had debts of circa £37k with seven different creditors. As at September 2024 my debts are down to circa £15.5k and just four creditors, as follows:

- MBNA CC - £5578. Debt sold on to Intrum several years ago, managed by Moorcroft. Default date: March 2019.

- Nationwide CC - £3280. Debt still owned/managed by Nationwide. Default date: November 2020

- Santander loan - £5519. Debt owned by Santander but managed by Wescott. Default date: April 2019

- Santander CC - £1210. Debt owned by Santander but managed by Wescott. Default date: February 2019

My mother died in February and a grant of probate completed in early July. I am due to receive around £35-40k after solicitors fees and other costs etc are paid. I'm not expecting to receive this money until early next year.

After reading on here extensively during the last couple of days I think now it is time that I should move to a self managed DMP and cancel my arrangement with StepChange. I believe I can just email to cancel my arrangement with StepChange.

I am going to send out CCA requests to my four creditors today. What do I do about paying my creditors from October onwards? StepChange has already deducted payment from me for September. Do I pay the same amount that I was paying StepChange? Do I pay nothing? Do I pay token amounts and build up a savings buffer during the next couple of months as I was for responses about the CCA requests? I currently have no savings.

I really want to take a proactive course of action so I can encourage full and final settlement offers to be made in the coming months. I have read on here that these can take time so by the time they start coming through I should hopefully have received my inheritance. Equally, I don't want to end up with any CCJ's just as the majority of these debts will fall off my credit file anyway in the next 6 months anyway.

Any advice will be gratefully appreciated. I really want to be debt free ASAP.

0

Comments

-

You are sending CCA requests, accounts are automatically put on hold during this process, so payments should stop.

Wait and see who can or can`t comply, by then it will likely be past Christmas, so you can then settle or ignore dependant on response.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

When it comes to settling don't tell them about the inheritance, you want them to think that you have just about scraped the money together and will pay it to someone else if they don't accept your offer.0

-

Thank you both so much for the advice.

Yes, agreed. I wasn't going to tell them about the inheritance. I'd like to preserve as much of the inheritance as possible as pay down my outstanding mortgage balance. There is only 6 years and 4 months left on the mortgage term so hopefully it wont be many years until I am mortgage free as well.

I've written all my letters, now to try and obtain a postal order. I've never seen one in my life before let alone ask for one.1 -

Back again....

So after sending off the CCA requests I got a few letters from Moorcroft and Wescott to say my accounts were put in hold etc and they had informed the creditor etc.

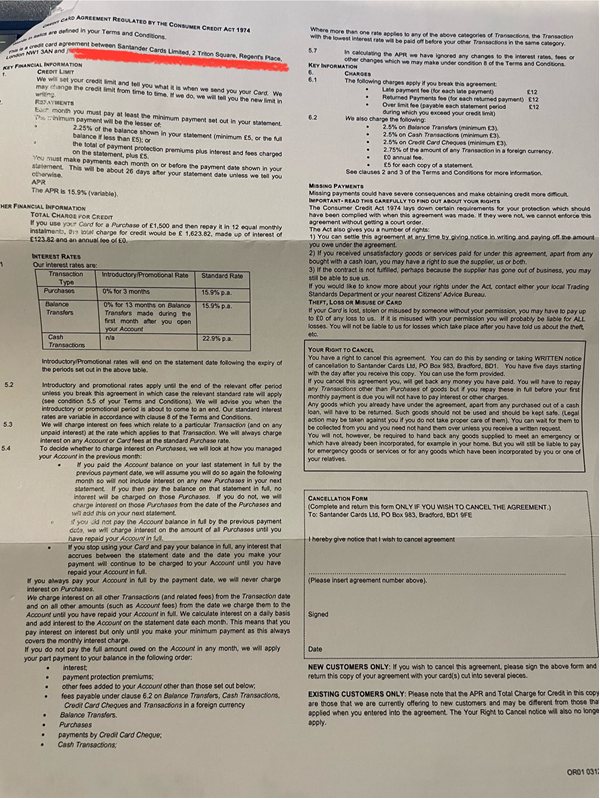

I've now received my first response from Santander in respect of the credit card I had with them but I have no idea whether what I have received is actually what I requested. Its a single sheet of paper which does have my name and address on but nothing else linking it to the credit card. How do I know whether they created the document last week? What do I do now?

0 -

This is what they have sent me.

0 -

A reconstituted copy is perfectly acceptable, if you want a definite answer, it has to be tested in court.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

-

If that is your name and address (at the time you took out the agreement) under the redaction, then it is likely to comply as a reconstruction.

I think your plan to take over managing these ahead of offering a settlement, is a good one.

I am not sure that Nationwide and Santander will be very generous but you should get somewhere with Intrum0 -

Thanks both for responding. I'll make contact with them to arrange a payment plan with the hope I can do full and finals at some point in the future.0

-

So after receiving a copy of my CCA from Santander for my credit card debt (balance circa £1,200) I have now set up a repayment plan with the aim of doing a full and final settlement ASAP.

I had sent another CCA request to Santander at the same time in respect of the loan I had with them (balance circa £5,500). I haven't received anything back in regards to that at all but today I received a letter for them, with less than 5 months before the default falls off my credit file, informing me that they sold the debt on to a third party company on 3 October which was about a month after I sent the CCA request. It doesn't state who this is, only that they'll write to me. At this stage, do I assume that they are unlikely to provide the CCA? Also, once I find out who the new creditor is, do I immediately send a CCA request to them? I don't want to get my hopes up but I am hoping for a positive outcome with this one, particularly as it accounts for around a third of my outstanding debt.

I haven't heard anything from Intrum which also accounts for around another third of my outstanding debt. Only 4 months until that default drops off my credit file.0 -

Hiya

I eventually found out that both of my debts with Santander (CC and loan) had been sold on to Cabot. Wescot have written to me today on Cabot's behalf about the loan debt and I am a bit perplexed by what they are saying. I think they are trying to say that my debt was an overdraft maybe? Any advice on how best to proceed? This is what the letter says:

"We refer to you recent request under sections 77-78 of the CCA 1974. These sections of the CCA do not apply to this account as it relates to a bank account therefore your request to supply a copy of the agreement in this instance is not relevant to S77-78.

This is because of the CC (Exempt Agreements) Order 1989, Article 3(1)(a).

It is set out that the CCA shall not apply to a running account credit agreement where the whole amount of the credit for a period is repayable in a single payment.

In your case, you have to make monthly payments for the whole of the charges incurred in the preceding period.

This is therefore not a CCA regulated agreement and no copy of the agreement will be supplied.

We are not aware of a dispute on the account or any other reason why you should not pay this balance and therefore you should contact us to arrange repayment. Please contact us by XXXX otherwise the account will return to standard collection activity and contact will restart".

This account relates to a loan. A default on the loan was registered in 25 March 2019 so its its about to drop off my credit file in 2 months also. I had a bank account with Santander which did have a overdraft on it but the overdraft was paid in full and the account closed in November 2019.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards