We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Growth of funds & fees: are fees taken in to account in graphs and data tables?

Scarum

Posts: 115 Forumite

I am currently invested in fund Janus Henderson Global (GB00B71DPP64) with a 0.85% fee. I have been looking to move to a lower cost tracker fund like Fidelity Index World P (GB00BJS8SJ34) with a 0.12% fee.

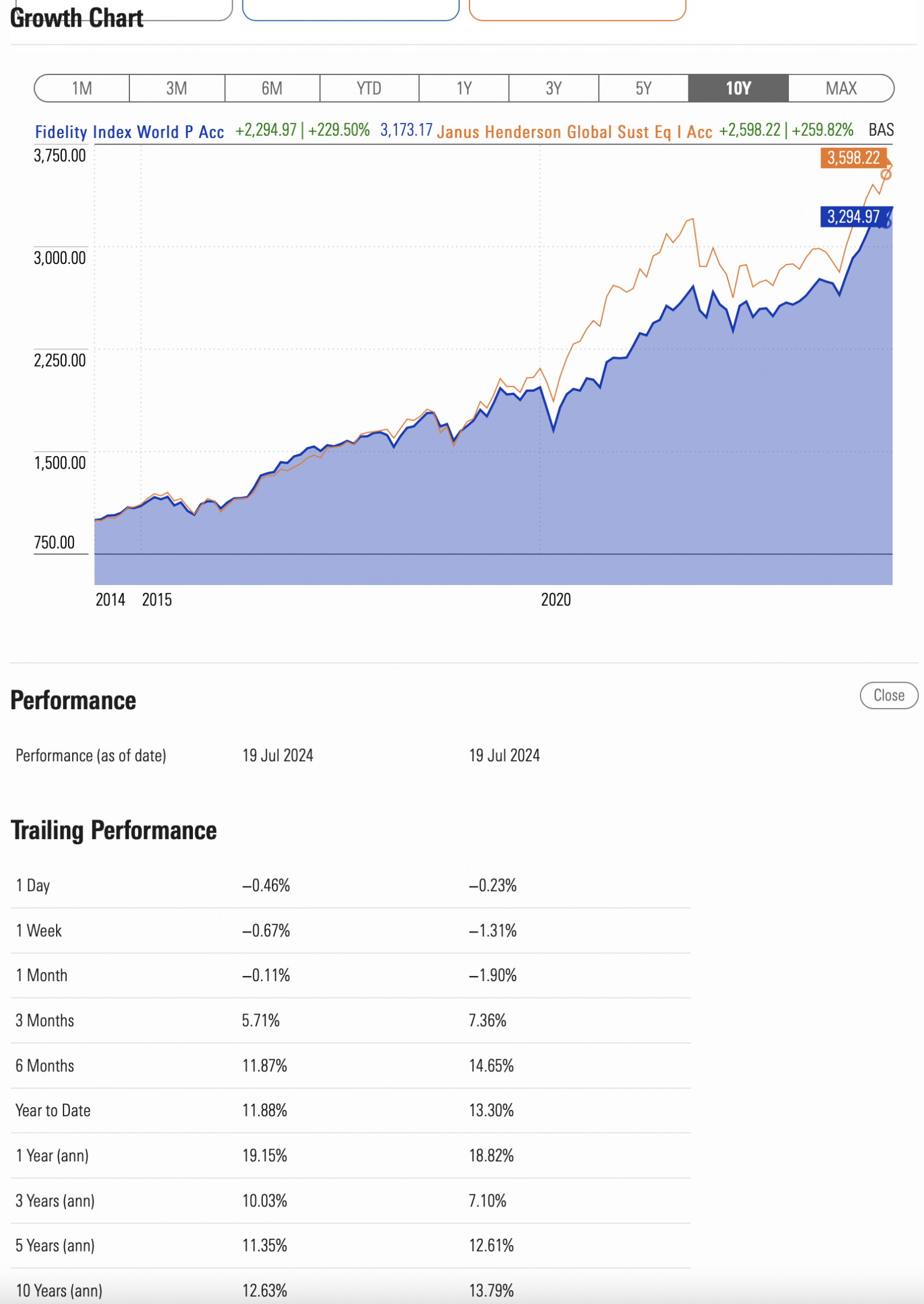

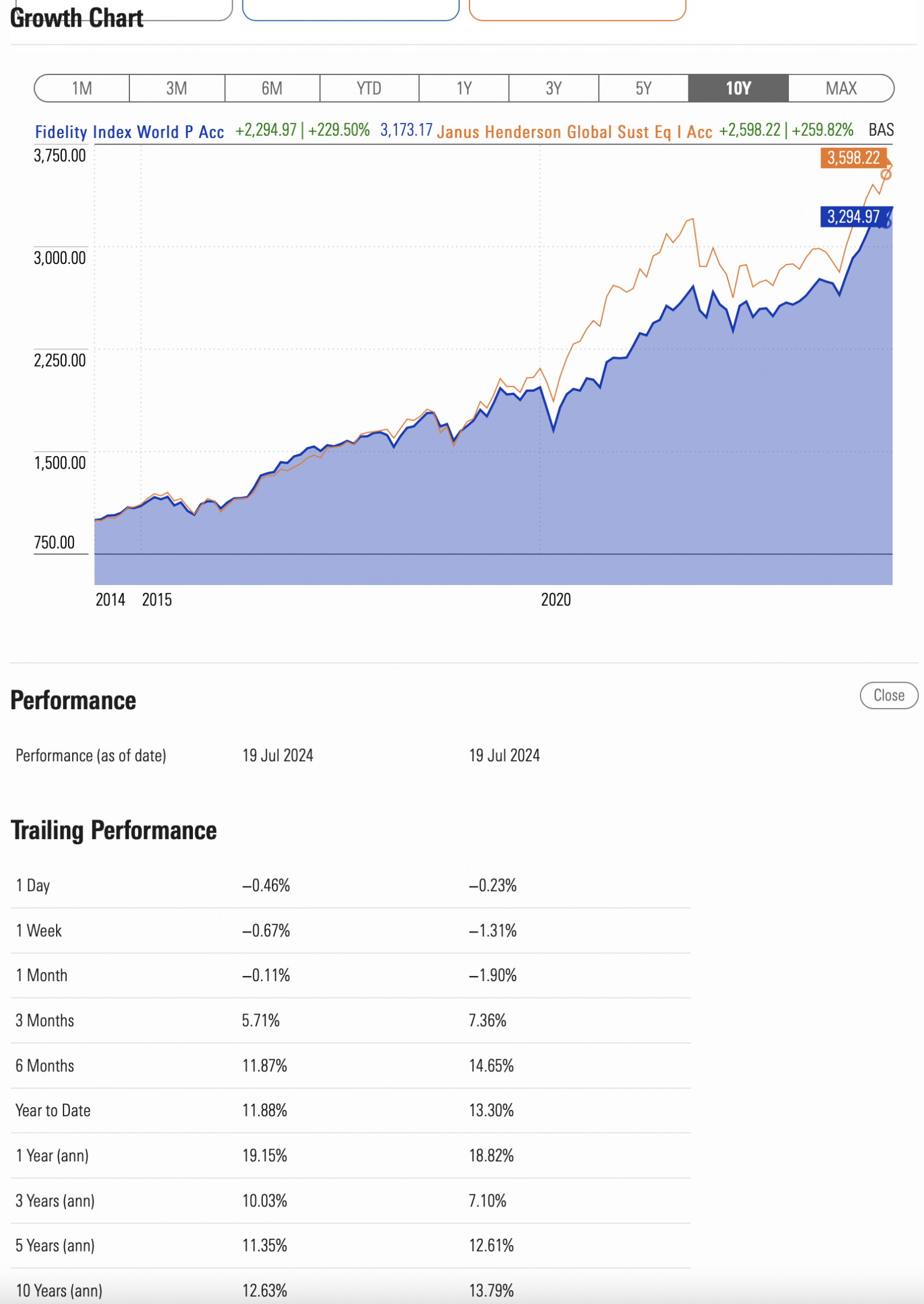

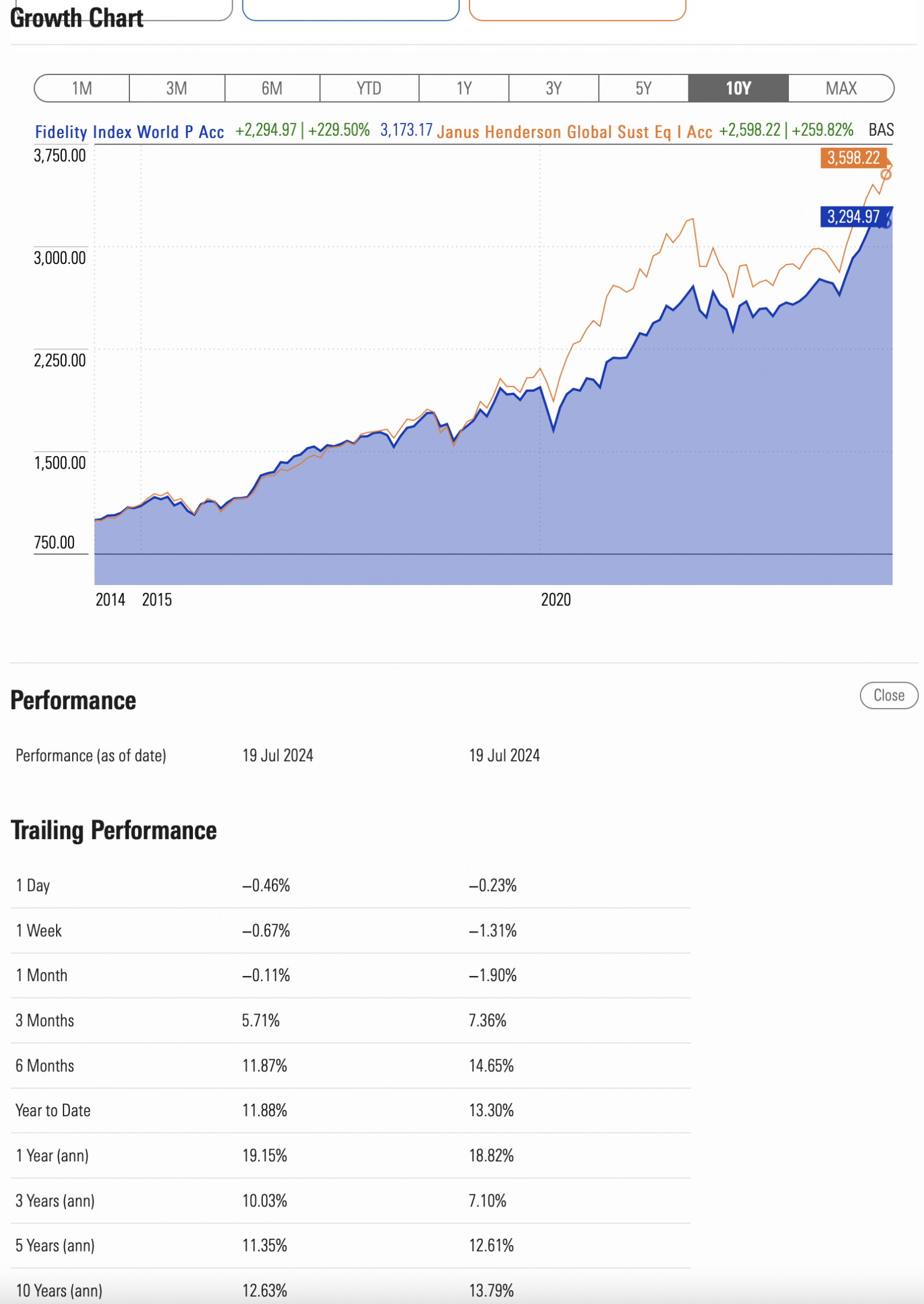

When I compare them in Morningstar I notice that over a long period the Janus Henderson data shows better performance; of course, there is no guarantee that this will continue. However, I wondered if the graph and data took in to account the fees because if they do, then staying with Janus Henderson, or going 50/50, might not be such a bad thing. I am looking at long-term investing of over 10 years.

Can anyone open my eyes whether the performance data is post fund fees?

0

Comments

-

All published performance data is after fund charges/fees but not your trading costs and platform costs which are outside the fund's control.Scarum said:I am currently invested in fund Janus Henderson Global (GB00B71DPP64) with a 0.85% fee. I have been looking to move to a lower cost tracker fund like Fidelity Index World P (GB00BJS8SJ34) with a 0.12% fee.When I compare them in Morningstar I notice that over a long period the Janus Henderson data shows better performance; of course, there is no guarantee that this will continue. However, I wondered if the graph and data took in to account the fees because if they do, then staying with Janus Henderson, or going 50/50, might not be such a bad thing. I am looking at long-term investing of over 10 years.Can anyone open my eyes whether the performance data is post fund fees?

However the funds are very diffent and cannot be easily compared. In particular the Janus Henderson fund is classed as "Sustainable" and has 37% assigned to tech companies. Fidelity world is 27% tech. Also the JH fund has a higher % of smaller companies. So you would expect the Janus Henderson Fund to be riskier with higher highs and lower lows than the Fidelity Index Fund.

These factors are likely to have a larger effect on year to year returns than a 0.7% difference in fees.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards