We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Paying Voluntary NI contributions.

Tax_Slave

Posts: 213 Forumite

My wife had gaps in her NI record and we have been paying these off.

Last year 2021/2022 it cost £800’ish and this year it was £824.20 for 2022/2023.

We made the payment 10 days ago and her NI record shows 2022/2023 now paid up/full years NI.

She now has 34 years of NI paid and I understand she is now 1 year short of the 35 years.

Looking at her pension forecast it shows she is £8.94 short or full amount pension of £221.20.

1) So the next payment for missing year will add £8.94

or

2) The pension forecast doesn’t include the latest payment we made 10 days ago.

Can the NI record update before the pension forecast does or are the computers linked and they both update at same time to show a NI payment for a gap year?

Thanks

Kevin

Last year 2021/2022 it cost £800’ish and this year it was £824.20 for 2022/2023.

We made the payment 10 days ago and her NI record shows 2022/2023 now paid up/full years NI.

She now has 34 years of NI paid and I understand she is now 1 year short of the 35 years.

Looking at her pension forecast it shows she is £8.94 short or full amount pension of £221.20.

1) So the next payment for missing year will add £8.94

or

2) The pension forecast doesn’t include the latest payment we made 10 days ago.

Can the NI record update before the pension forecast does or are the computers linked and they both update at same time to show a NI payment for a gap year?

Thanks

Kevin

0

Comments

-

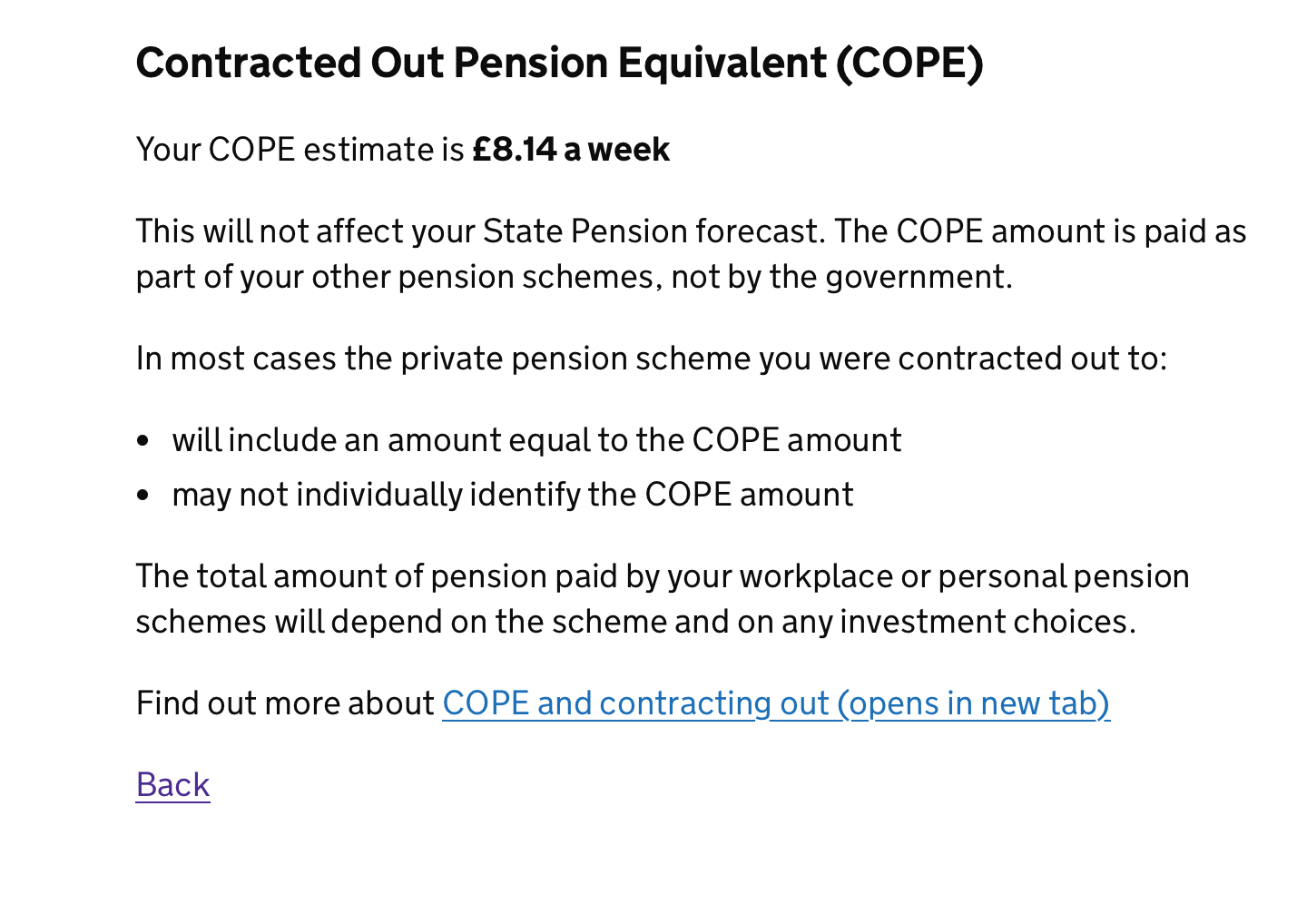

35 years is of no relevance to anyone with a pre 2016 NI history.How many tears does the forecast state she needs to reach the full amount ? The forecast always shows that - what did it show previously ? The pension forecast should update at the same time as the NI record updates.Was she in a contracted out pension scheme ? - more than likely. Her forecast will state that she was contacted out with a click link to a COPE amount. If contracted out for more than a very short period she will need more than 35 years.1

-

Why does she think she needs 35 years?Tax_Slave said:My wife had gaps in her NI record and we have been paying these off.

Last year 2021/2022 it cost £800’ish and this year it was £824.20 for 2022/2023.

We made the payment 10 days ago and her NI record shows 2022/2023 now paid up/full years NI.

She now has 34 years of NI paid and I understand she is now 1 year short of the 35 years.

Looking at her pension forecast it shows she is £8.94 short or full amount pension of £221.20.

1) So the next payment for missing year will add £8.94

or

2) The pension forecast doesn’t include the latest payment we made 10 days ago.

Can the NI record update before the pension forecast does or are the computers linked and they both update at same time to show a NI payment for a gap year?

Thanks

KevinGoogling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1 -

You are starting off with a total misunderstanding of how the new State Pension works.Tax_Slave said:My wife had gaps in her NI record and we have been paying these off.

Last year 2021/2022 it cost £800’ish and this year it was £824.20 for 2022/2023.

We made the payment 10 days ago and her NI record shows 2022/2023 now paid up/full years NI.

She now has 34 years of NI paid and I understand she is now 1 year short of the 35 years.

Looking at her pension forecast it shows she is £8.94 short or full amount pension of £221.20.

1) So the next payment for missing year will add £8.94

or

2) The pension forecast doesn’t include the latest payment we made 10 days ago.

Can the NI record update before the pension forecast does or are the computers linked and they both update at same time to show a NI payment for a gap year?

Thanks

Kevin

Only those starting to build up an NI record from April 2016 need 35 years.

She will have her own bespoke number.1 -

How would she find out her bespoke number?Dazed_and_C0nfused said:

You are starting off with a total misunderstanding of how the new State Pension works.Tax_Slave said:My wife had gaps in her NI record and we have been paying these off.

Last year 2021/2022 it cost £800’ish and this year it was £824.20 for 2022/2023.

We made the payment 10 days ago and her NI record shows 2022/2023 now paid up/full years NI.

She now has 34 years of NI paid and I understand she is now 1 year short of the 35 years.

Looking at her pension forecast it shows she is £8.94 short or full amount pension of £221.20.

1) So the next payment for missing year will add £8.94

or

2) The pension forecast doesn’t include the latest payment we made 10 days ago.

Can the NI record update before the pension forecast does or are the computers linked and they both update at same time to show a NI payment for a gap year?

Thanks

Kevin

Only those starting to build up an NI record from April 2016 need 35 years.

She will have her own bespoke number.

Looking further at the pension forecast it says ‘2 missing years for a full pension’.

So I presume it’s 2 years if the 2022/2023 payment we made 10 days ago is not included or 1 year short after it’s included or it is included already (10 days after payment) and we have 2 years to pay.

0 -

Sorry I missed your first reply.molerat said:35 years is of no relevance to anyone with a pre 2016 NI history.How many tears does the forecast state she needs to reach the full amount ? The forecast always shows that - what did it show previously ? The pension forecast should update at the same time as the NI record updates.Was she in a contracted out pension scheme ? - more than likely. Her forecast will state that she was contacted out with a click link to a COPE amount. If contracted out for more than a very short period she will need more than 35 years.

Forecast says 2 years short, so she will need to make another 2 years payments then aka 37 years NI contributions.

She was contracted out, yes.

Makes sense now - thanks for reply.

0 -

It is quite unlikely that a very recent payment is showing on her account already.

0 -

Assuming the very recent payment isn't yet factored in then that will take her to £218.58/week.Tax_Slave said:

How would she find out her bespoke number?Dazed_and_C0nfused said:

You are starting off with a total misunderstanding of how the new State Pension works.Tax_Slave said:My wife had gaps in her NI record and we have been paying these off.

Last year 2021/2022 it cost £800’ish and this year it was £824.20 for 2022/2023.

We made the payment 10 days ago and her NI record shows 2022/2023 now paid up/full years NI.

She now has 34 years of NI paid and I understand she is now 1 year short of the 35 years.

Looking at her pension forecast it shows she is £8.94 short or full amount pension of £221.20.

1) So the next payment for missing year will add £8.94

or

2) The pension forecast doesn’t include the latest payment we made 10 days ago.

Can the NI record update before the pension forecast does or are the computers linked and they both update at same time to show a NI payment for a gap year?

Thanks

Kevin

Only those starting to build up an NI record from April 2016 need 35 years.

She will have her own bespoke number.

Looking further at the pension forecast it says ‘2 missing years for a full pension’.

So I presume it’s 2 years if the 2022/2023 payment we made 10 days ago is not included or 1 year short after it’s included or it is included already (10 days after payment) and we have 2 years to pay.

And one further year will add the final £2.62/week (it's capped at that, she doesn't get the full £6.32/week increase like she does with the first year).1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards