We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The future of pensions - thoughts!

Comments

-

Given that every Government in history has tried to reduce benefit 'fraud' and curtail those 'scrounging' and failed miserably. Although I suppose they've managed to contribute to deaths and misery of thousands of legitimate claimants so I suppose that's a sucessful cleansing of the undesirables. Ironically many of these efforts cost far more than the actual level of fraud and any percieved savings achieved.What magical solutions do you and other posters propose?The UK does have a problem which is largely related to NHS underfunding, Social and Childcare as well as attitudes toward those without a full capacity for work often now related to Age.Far more producitve to have a thread on the future of workplace pensions and auto-enrolment. Is CDC the panacea many seem to think, will AE contributions ever actually be increased, what about jingoistic reporting of UK investments by pension schemes etc.0

-

I don’t know if we move in different circles but even people I know who I would consider well off don’t have two foreign holidays a year. I don’t think you’re painting a realistic picture.dunstonh said:What if people can’t afford 10% to 15% deducted from their wages, how would that be managed?They would need to go back to living within their means.

Lower income people in particular would find that a serious struggle.

Cue Panorama filming people saying they are really hard up and unable to afford to pay into a pension whilst sitting in their lounge with a 65-inch ultra HD TV, every subscription under the sun and a bookcase with 200 PlayStation games at £50 a go. Whilst going on two overseas holidays a year, eating takeaways and texting on the last top of the range phone....

Priorities have changed spending habits.0 bonus saver

35 NS&I

248 credit union

0 Computer

Credit card 2250

Overdraft 492 -

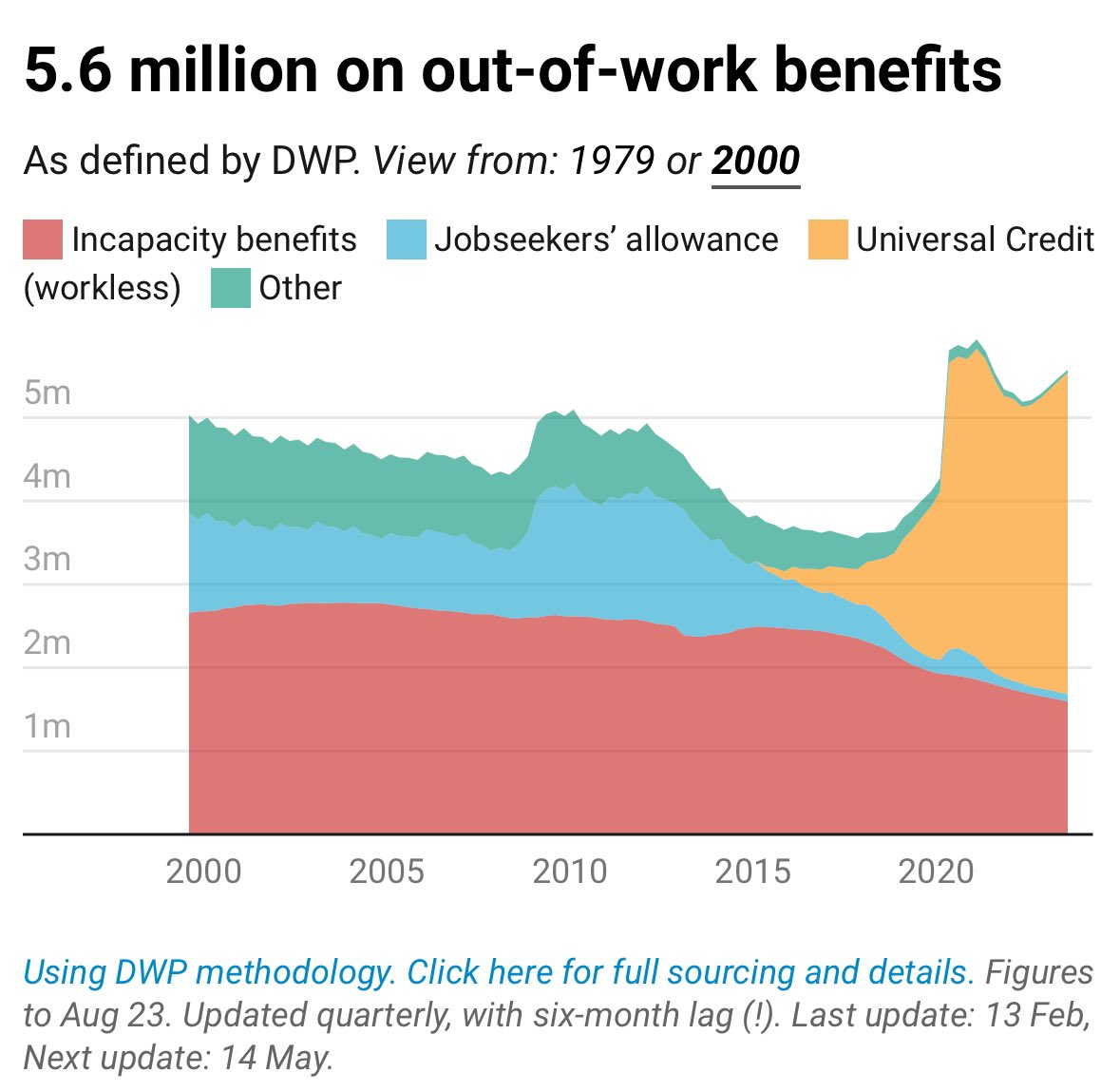

5m? Is that a guess or a real figure?BlackKnightMonty said:

Very admirable.ukpoker said:According to most financial analysts the country can't afford to keep paying out an ever increasing amount of pensions to people that are living longer and require more money every year just to keep up with the basics.

Its therefore an idea for the government to grasp the nettle and start to come up with ideas on how to solve this issue.

My thoughts are as follows :

- Tell the public that as from 2065 no new pensioners will be created. In other words anyone becoming of retirement age (currently 67) will no longer get a STATE pension.

- Enforce a strict contribution scheme whereby people of a certain age will be deducted a percentage of their salary in order to fund their retirement.

Aged - 18 thru 25 -> 3% of earnings

25 thru 30 -> 5% of earnings

30 thru 35 -> 8% of earnings

35 thru 40 -> 10% of earnings

40 thru 50 -> 12.5% of earnings

50+ -> 15% of earnings

All contributions will be government MATCHED!

By 2100 all monies usually being paid out on state pension will be none existent and can then be used to fund the ever going saga of the NHS...but that's another story

How would that work for the 5m unemployed who sit on benefits throughout their working life and then pick up a free state pension?1 -

I don't think the comments about Panorama necessarily painted a realistic or common picture.itsthelittlethings said:

I don’t know if we move in different circles but even people I know who I would consider well off don’t have two foreign holidays a year. I don’t think you’re painting a realistic picture.dunstonh said:What if people can’t afford 10% to 15% deducted from their wages, how would that be managed?They would need to go back to living within their means.

Lower income people in particular would find that a serious struggle.

Cue Panorama filming people saying they are really hard up and unable to afford to pay into a pension whilst sitting in their lounge with a 65-inch ultra HD TV, every subscription under the sun and a bookcase with 200 PlayStation games at £50 a go. Whilst going on two overseas holidays a year, eating takeaways and texting on the last top of the range phone....

Priorities have changed spending habits.

It is, though, the type of situation that TV (or other tabloid press) would find and report as it sells. Individuals tend not to like to be told by Government how to use their money - even if that compulsion is for pensions and securing their own future well-being.

I can't find it now as it has gone / edited but, in the morning of the budget this week, BBC News website had a click-bait article about a couple both earning £50k - £60k (each, not total) and how hard up they were really struggling because of HICBIC. While HICBIC needs to be resolved (and appears may be), highlighting a couple with a joint income in excess of £100k as struggling is rather disingenuous but it does sell / create views.

There seems to be no acceptance of a difference between "want" and "need" and no acceptance that anyone should go without anything that their neighbours have...1 -

I mean, at the end of the day this is what taxes are for.0 bonus saver

35 NS&I

248 credit union

0 Computer

Credit card 2250

Overdraft 490 -

westv said:

5m? Is that a guess or a real figure?BlackKnightMonty said:

Very admirable.ukpoker said:According to most financial analysts the country can't afford to keep paying out an ever increasing amount of pensions to people that are living longer and require more money every year just to keep up with the basics.

Its therefore an idea for the government to grasp the nettle and start to come up with ideas on how to solve this issue.

My thoughts are as follows :

- Tell the public that as from 2065 no new pensioners will be created. In other words anyone becoming of retirement age (currently 67) will no longer get a STATE pension.

- Enforce a strict contribution scheme whereby people of a certain age will be deducted a percentage of their salary in order to fund their retirement.

Aged - 18 thru 25 -> 3% of earnings

25 thru 30 -> 5% of earnings

30 thru 35 -> 8% of earnings

35 thru 40 -> 10% of earnings

40 thru 50 -> 12.5% of earnings

50+ -> 15% of earnings

All contributions will be government MATCHED!

By 2100 all monies usually being paid out on state pension will be none existent and can then be used to fund the ever going saga of the NHS...but that's another story

How would that work for the 5m unemployed who sit on benefits throughout their working life and then pick up a free state pension? Real figures I’m afraid.4

Real figures I’m afraid.4 -

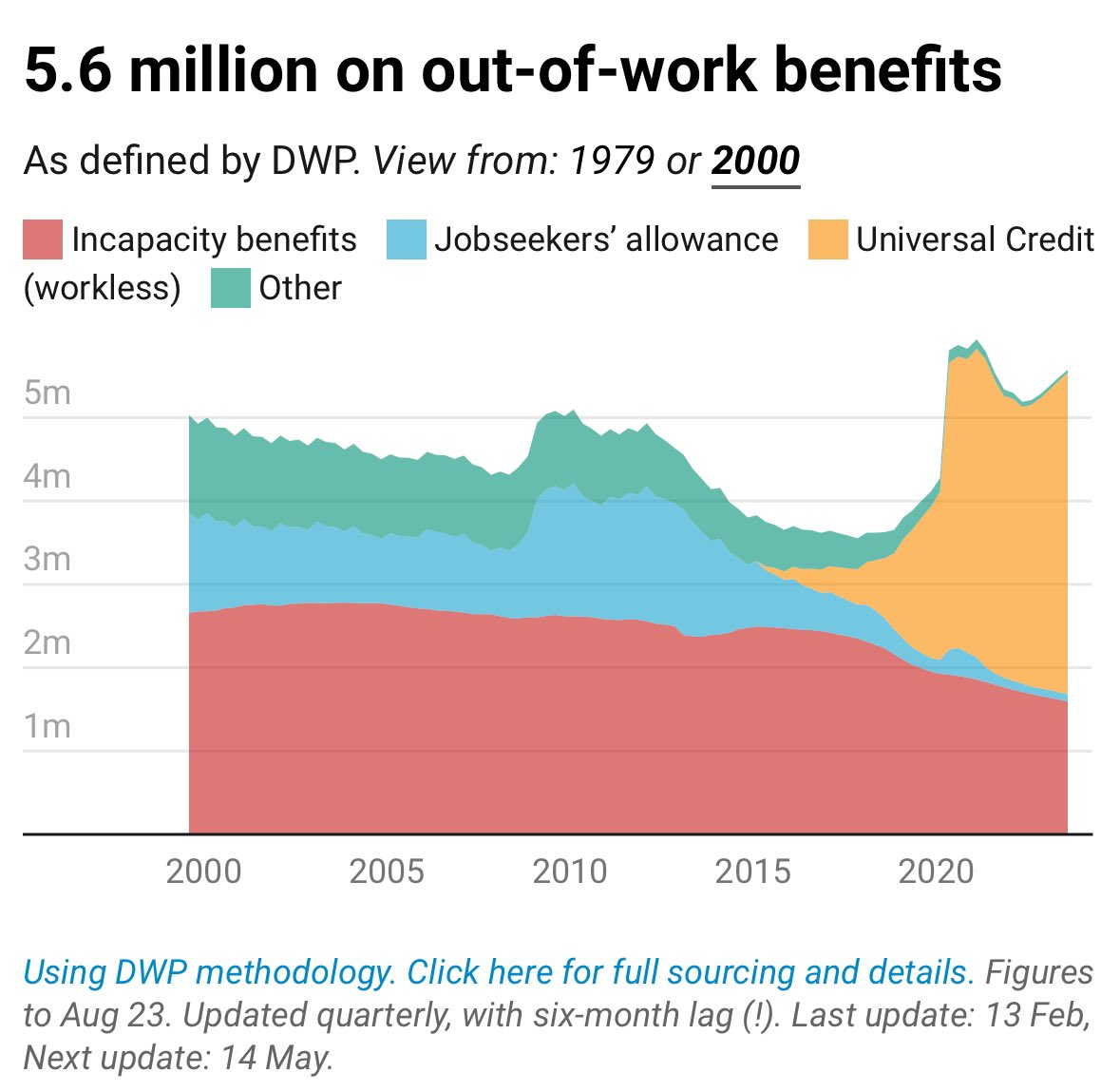

Labour have already confirmed that if/when they form the next Government they will go all out to get youngsters, in particular, into meaningful employment because 'relying on benefits is bad for them and the Country'.BlackKnightMonty said:westv said:

5m? Is that a guess or a real figure?BlackKnightMonty said:

Very admirable.ukpoker said:According to most financial analysts the country can't afford to keep paying out an ever increasing amount of pensions to people that are living longer and require more money every year just to keep up with the basics.

Its therefore an idea for the government to grasp the nettle and start to come up with ideas on how to solve this issue.

My thoughts are as follows :

- Tell the public that as from 2065 no new pensioners will be created. In other words anyone becoming of retirement age (currently 67) will no longer get a STATE pension.

- Enforce a strict contribution scheme whereby people of a certain age will be deducted a percentage of their salary in order to fund their retirement.

Aged - 18 thru 25 -> 3% of earnings

25 thru 30 -> 5% of earnings

30 thru 35 -> 8% of earnings

35 thru 40 -> 10% of earnings

40 thru 50 -> 12.5% of earnings

50+ -> 15% of earnings

All contributions will be government MATCHED!

By 2100 all monies usually being paid out on state pension will be none existent and can then be used to fund the ever going saga of the NHS...but that's another story

How would that work for the 5m unemployed who sit on benefits throughout their working life and then pick up a free state pension? Real figures I’m afraid.

Real figures I’m afraid.

Reminded me of a news clip during the pre 1997 election campaign... a Labour hopeful was out knocking on doors, one of which was opened by a young scruff in a Bruce Willis vest. The Labour candidate asked him what he did for work, and the lad replied that he was one of Mrs Thatcher's (unemployed) army, even though she had been out of office for some years.

The candidate then said that if he voted for him, and if he was elected to be his MP, then he would PERSONALLY ensure that laddie would get a job. Cue look of sheer and absolute panic on the part of the lad, followed by the door being slammed in the candidates face - who then mugged to the camera and said 'well, I suppose you can't please all of the people all of the time'.

Pure comedy.2 -

The education system needs to start teaching people how to budget properly again and differentiate between NEED and WANT, also to stop thinking they are entitled to have A B C regardless of their income, and expecting Government to cover any shortfall.Given all the other things the education system is currently being expected to do, it might be helpful if a few more parents could consider taking some steps towards doing that.I do feel there is an issue whereby obtaining certain benefits (eg Universal credit, pension credit) then entitles you to access to a lot of other benefits on top, which those earning just above the claiming limits cannot get. That could be a case for a Universal basic income, set at a level around NMW. However that would result in the same problem that those who received it on top of a large additional earned / private pension income were castigated because "its not fair that they get this Government payment when they've already got so much income of their own"1

-

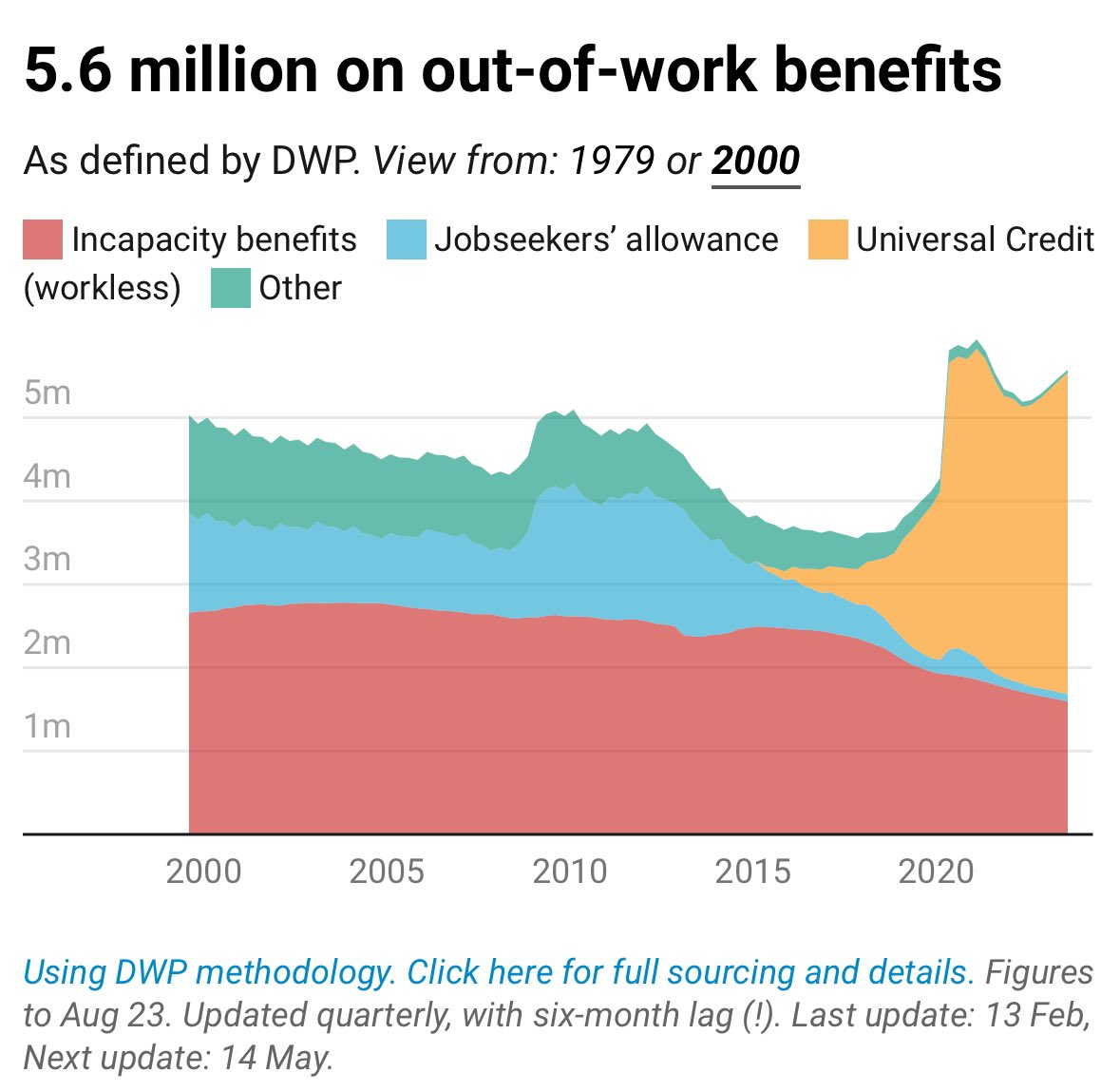

I mean, you’re always going to have some people who can’t work due to disability and illness the way the working market is set up. Full employment would be a disaster for employers because they would have to start offering better pay and conditions so this is an artificially created set of circumstances in a way. Demonising people on benefits is pointless and neither here nor there.BlackKnightMonty said:westv said:

5m? Is that a guess or a real figure?BlackKnightMonty said:

Very admirable.ukpoker said:According to most financial analysts the country can't afford to keep paying out an ever increasing amount of pensions to people that are living longer and require more money every year just to keep up with the basics.

Its therefore an idea for the government to grasp the nettle and start to come up with ideas on how to solve this issue.

My thoughts are as follows :

- Tell the public that as from 2065 no new pensioners will be created. In other words anyone becoming of retirement age (currently 67) will no longer get a STATE pension.

- Enforce a strict contribution scheme whereby people of a certain age will be deducted a percentage of their salary in order to fund their retirement.

Aged - 18 thru 25 -> 3% of earnings

25 thru 30 -> 5% of earnings

30 thru 35 -> 8% of earnings

35 thru 40 -> 10% of earnings

40 thru 50 -> 12.5% of earnings

50+ -> 15% of earnings

All contributions will be government MATCHED!

By 2100 all monies usually being paid out on state pension will be none existent and can then be used to fund the ever going saga of the NHS...but that's another story

How would that work for the 5m unemployed who sit on benefits throughout their working life and then pick up a free state pension? Real figures I’m afraid.0 bonus saver

Real figures I’m afraid.0 bonus saver

35 NS&I

248 credit union

0 Computer

Credit card 2250

Overdraft 490 -

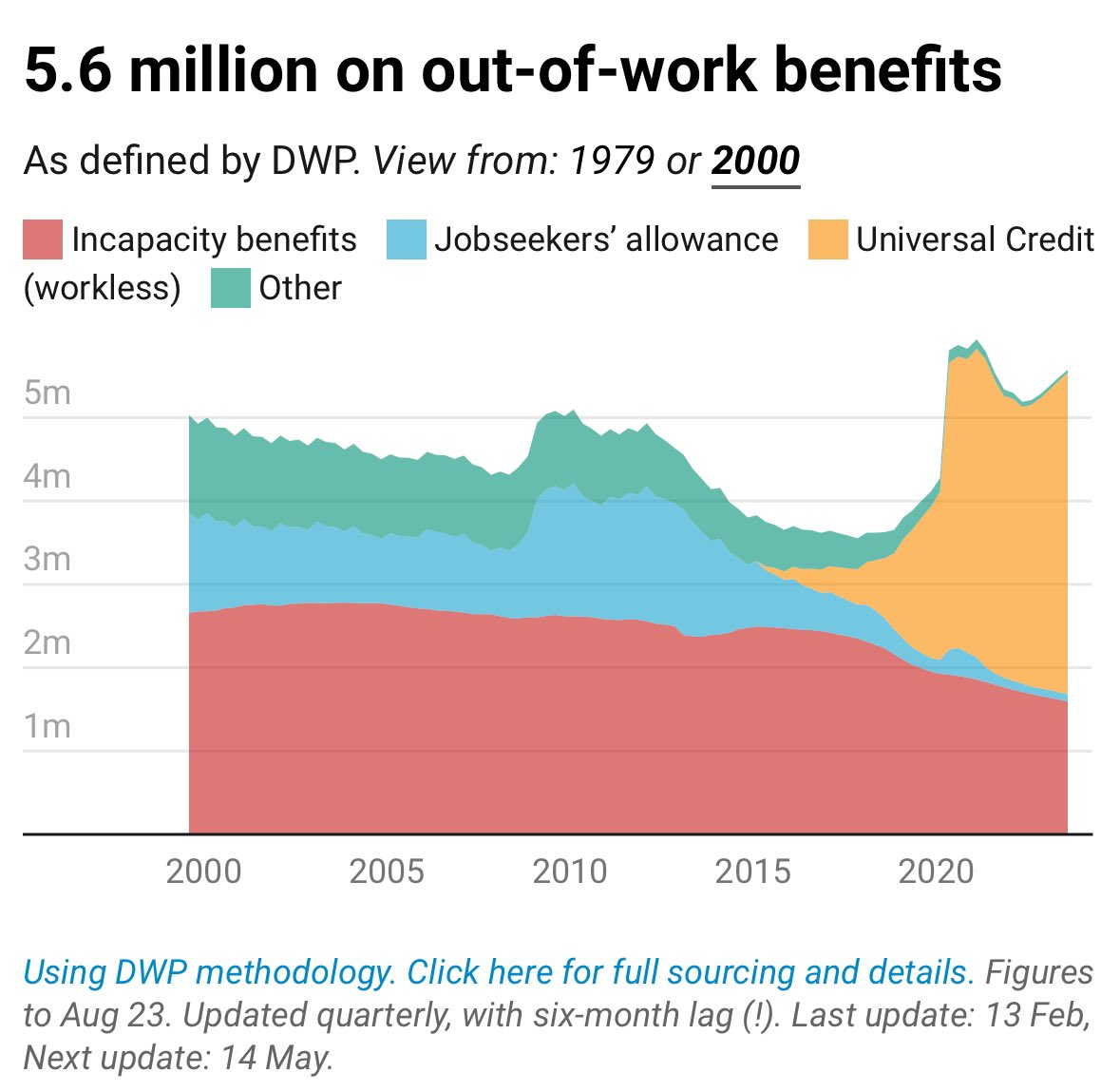

It’s intergenerational. All town centres have these people. It’s such a waste of a life. Better we pull them out of these situations and give them a sense of self worth and purpose. I’m not advocating a bunch of brown shirts here. More something like a compulsory Duke of Edinburgh scheme for all teenagers.Silvertabby said:

Labour have already confirmed that if/when they form the next Government they will go all out to get youngsters, in particular, into meaningful employment because 'relying on benefits is bad for them and the Country'.BlackKnightMonty said:westv said:

5m? Is that a guess or a real figure?BlackKnightMonty said:

Very admirable.ukpoker said:According to most financial analysts the country can't afford to keep paying out an ever increasing amount of pensions to people that are living longer and require more money every year just to keep up with the basics.

Its therefore an idea for the government to grasp the nettle and start to come up with ideas on how to solve this issue.

My thoughts are as follows :

- Tell the public that as from 2065 no new pensioners will be created. In other words anyone becoming of retirement age (currently 67) will no longer get a STATE pension.

- Enforce a strict contribution scheme whereby people of a certain age will be deducted a percentage of their salary in order to fund their retirement.

Aged - 18 thru 25 -> 3% of earnings

25 thru 30 -> 5% of earnings

30 thru 35 -> 8% of earnings

35 thru 40 -> 10% of earnings

40 thru 50 -> 12.5% of earnings

50+ -> 15% of earnings

All contributions will be government MATCHED!

By 2100 all monies usually being paid out on state pension will be none existent and can then be used to fund the ever going saga of the NHS...but that's another story

How would that work for the 5m unemployed who sit on benefits throughout their working life and then pick up a free state pension? Real figures I’m afraid.

Real figures I’m afraid.

Reminded me of a news clip during the pre 1997 election campaign... a Labour hopeful was out knocking on doors, one of which was opened by a young scruff in a Bruce Willis vest. The Labour candidate asked him what he did for work, and the lad replied that he was one of Mrs Thatcher's (unemployed) army, even though she had been out of office for some years.

The candidate then said that if he voted for him, and if he was elected to be his MP, then he would PERSONALLY ensure that laddie would get a job. Cue look of sheer and absolute panic on the part of the lad, followed by the door being slammed in the candidates face - who then mugged to the camera and said 'well, I suppose you can't please all of the people all of the time'.

Pure comedy.

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.6K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.9K Spending & Discounts

- 244.6K Work, Benefits & Business

- 599.9K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards