We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What to expect from an IFA?

GenX0212

Posts: 239 Forumite

* Re-posted here as mistakenly posted in the wrong forum earlier *

So, me and my wife are thinking of retiring fairly soon and I have spent quite some time building a detailed model/plan to see what's possible.

As a quick summary:

So, me and my wife are thinking of retiring fairly soon and I have spent quite some time building a detailed model/plan to see what's possible.

As a quick summary:

Me:

- Age 55

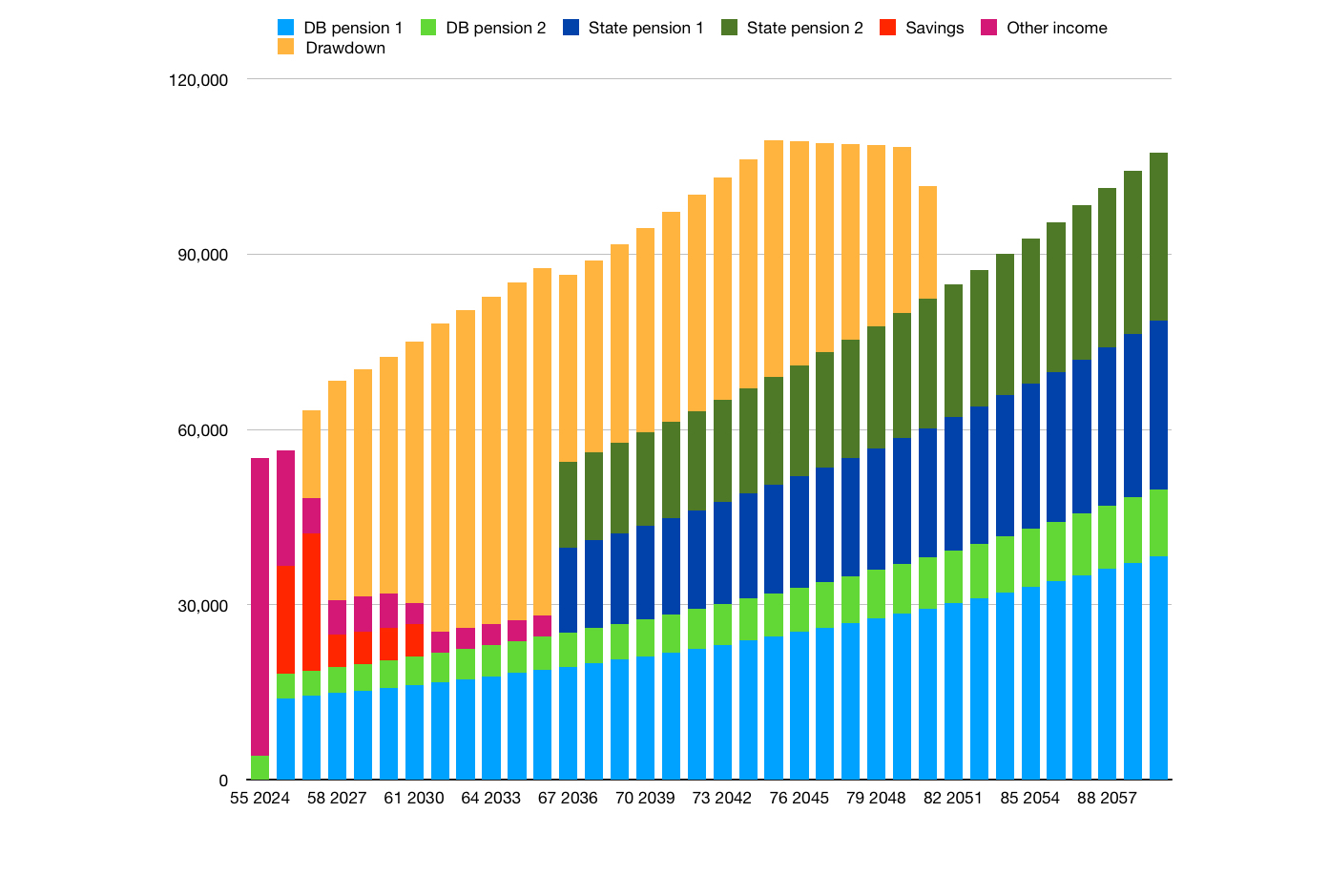

- A deferred DB pension available from age 55 approx £14k a year

- A current workplace DC pension current value > £400k, low costs ~0.25%, flexible options, no drawdown fees, performing well.

- A couple of other private pensions, total about £100k. Mid costs ~0.6 to 0.8 %

- A Full State Pension expected. 38 full years so far.

Her:

- Age 55

- A deferred DB pension available from age 55 approx £4K a year

- A small robopension pot of about £18k. 0.8% costs

- A Full State Pension expected. 37 full years so far.

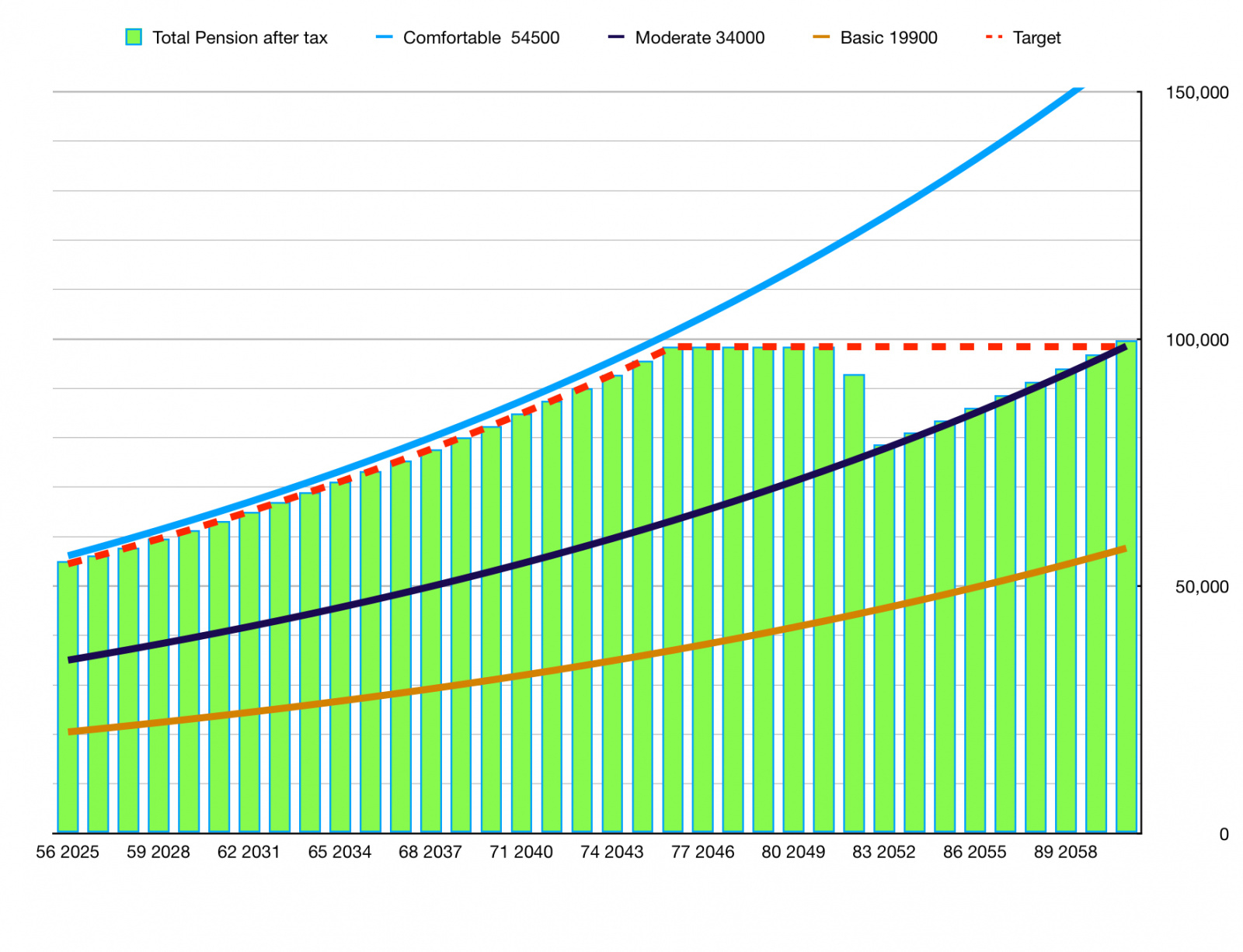

The aim is to retire from 55/56 with a Comfortable living standard (based on last months PLSA numbers) until at least age 75 and Moderate (or better) thereafter. We expect to need less as we become older.

I have modelled 3% inflation and 2% growth and the pot doesn't run out until after 80.

With 3% inflation and 0% growth then the pot would run out around 72 but we will still have a guaranteed minimum of a Moderate living standard at all times.

I have modelled 3% inflation and 2% growth and the pot doesn't run out until after 80.

With 3% inflation and 0% growth then the pot would run out around 72 but we will still have a guaranteed minimum of a Moderate living standard at all times.

If I die before 67 then my wife would have a £12k pension (hers plus widows) plus the pots; £22k after 67 plus the pots.

If there is a market crash before we are 67 then we have a combined guaranteed pension of £18k plus whatever is left from the pots.

With our DB pensions and State Pensions we would have a guaranteed Moderate living standard when we reach 67 regardless of what's left in the pot.

If there is a market crash before we are 67 then we have a combined guaranteed pension of £18k plus whatever is left from the pots.

With our DB pensions and State Pensions we would have a guaranteed Moderate living standard when we reach 67 regardless of what's left in the pot.

The plan draws the money down in a tax efficient way, me staying below the 40% tax bracket and my wife only paying a small amount of tax when she starts drawing her State pension.

I'm aware of the option for me to transfer £2.8k to her each year before 67 in order for her to get £3.6k. I'm also aware of the Married persons tax allowance to gain a few hundred pound more each year.

Clearly we aren't going to attempt to transfer the DB pensions and unless something changes drastically then I see no reason to move away from my current DC scheme although I would likely reduce the investment risk profile. I would be happy with the return of 2% growth and have no interest in investing in any high risk strategies.

If an IFA is charging 1-2% of my pot for advice (£5k - £10k) am I likely to get a real return on the money or am I likely to get a 'yeah all looks ok' response for the money? I have no objection whatsoever to paying the £10k if I am likely to get some value out of it.

Would love to hear others experience of using an IFA and the value they got from doing so, equally from anyone who didn't then do you have any regrets?

I'm aware of the option for me to transfer £2.8k to her each year before 67 in order for her to get £3.6k. I'm also aware of the Married persons tax allowance to gain a few hundred pound more each year.

Clearly we aren't going to attempt to transfer the DB pensions and unless something changes drastically then I see no reason to move away from my current DC scheme although I would likely reduce the investment risk profile. I would be happy with the return of 2% growth and have no interest in investing in any high risk strategies.

If an IFA is charging 1-2% of my pot for advice (£5k - £10k) am I likely to get a real return on the money or am I likely to get a 'yeah all looks ok' response for the money? I have no objection whatsoever to paying the £10k if I am likely to get some value out of it.

Would love to hear others experience of using an IFA and the value they got from doing so, equally from anyone who didn't then do you have any regrets?

0

Comments

-

I'm sure you will get some comments on what IFAs do (and don't do).

In the meantime, just to be clear, when you say you modelled 3% inflation and 2% growth, do you mean 2% growth in excess of inflation, or do you mean you have modelled that growth is 1% less than inflation?

If it's the latter, that's pretty pessimistic if your funds are "performing welll".0 -

3% inflation, 5% overall growth.Pat38493 said:I'm sure you will get some comments on what IFAs do (and don't do).

In the meantime, just to be clear, when you say you modelled 3% inflation and 2% growth, do you mean 2% growth in excess of inflation, or do you mean you have modelled that growth is 1% less than inflation?

If it's the latter, that's pretty pessimistic if your funds are "performing welll".0 -

GenX0212 said:The aim is to retire from 55/56 with a Comfortable living standard (based on last months PLSA numbers) until at least age 75 and Moderate (or better) thereafter.So £59k pa until 75 then £43k pa? The PLSA numbers are post-tax, so (allowing for two personal allowances, and assuming neither of you have to pay HR tax) that's closer to £68k and £48k?Or did you mean last year's PLSA numbers, which were somewhat lower?

Between you, you've got £18k pa of DB pension (how does this revalue, RPI or CPI? Any cap?) from 55, and £500k, plus two SPs (say £21k pa) from age 67.GenX0212 said:As a quick summary:

From 55 to 67 you'll have £18k of DB. You'll need an extra £50k pa from your £500k pot. £50k pa for 12 years is £600k, and even with 2% pa growth it'll run out before you get to 67.Have I misunderstood?N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.0 -

With regard to your comment on your other thread about having 38 and 37 years of contributions and consequently have full SP locked in, unfortunately you are under transitional rules so it doesn't just depend on the number of years contributed. Some people have reported a full pension after 29 years whilst others are into 40+ years before they have a full pension. The only way to be sure is to get an official pension forecast and check it carefully to see what you have got.

0 -

DB pensions are CPI.Between you, you've got £18k pa of DB pension (how does this revalue, RPI or CPI? Any cap?) from 55, and £500k, plus two SPs (say £21k pa) from age 67.

From 55 to 67 you'll have £18k of DB. You'll need an extra £50k pa from your £500k pot. £50k pa for 12 years is £600k, and even with 2% pa growth it'll run out before you get to 67.Have I misunderstood?

State Pension will go up with inflation

The residual pot is growing at an estimated 2% each year so that's + £10k in year one

We have some savings and lump sums to play in as well, I hadn't included them in the original post as was just trying to summarise. I will post the full figures/forecast shortly.0 -

Here it is:Notepad_Phil said:With regard to your comment on your other thread about having 38 and 37 years of contributions and consequently have full SP locked in, unfortunately you are under transitional rules so it doesn't just depend on the number of years contributed. Some people have reported a full pension after 29 years whilst others are into 40+ years before they have a full pension. The only way to be sure is to get an official pension forecast and check it carefully to see what you have got.You can get your State Pension on xxxxxxxx. 2036

Your forecast is £203.85 a week, £886.38 a month, £10,636.60 a year

Your forecast

- is not a guarantee and is based on the current law

- is based on your National Insurance record up to 5 April 2023

- does not include any increase due to inflation

£203.85 is the most you can get

You cannot improve your forecast any more.

Your National Insurance recordYou have:

- 38 years of full contributions

- 12 years to contribute before 5 April 2035

- 1 year when you did not contribute enough

I have put a note on the other thread that I will post further answers here to avoid repetition. My mistake originally.0 -

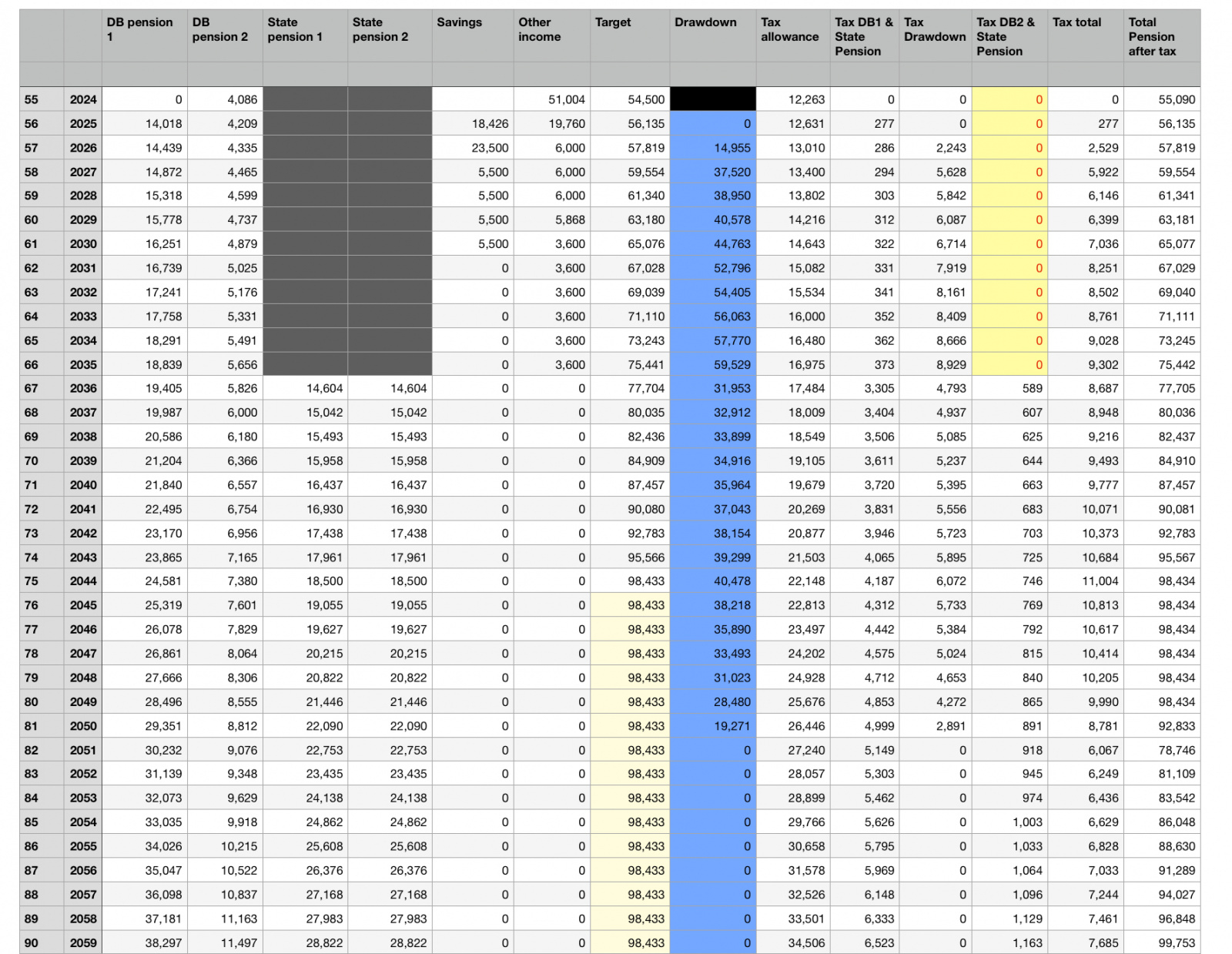

Here are my figures:

1 -

Yes, it's the "is the most you can get" which shows you've the full amount locked in, so if that's shows for your wife as well then you're both ok. I thought that I should comment as many people have thought that they only need 35 years of contributions, but that is only for new people who have started paying NI since 2016.GenX0212 said:

Here it is:Notepad_Phil said:With regard to your comment on your other thread about having 38 and 37 years of contributions and consequently have full SP locked in, unfortunately you are under transitional rules so it doesn't just depend on the number of years contributed. Some people have reported a full pension after 29 years whilst others are into 40+ years before they have a full pension. The only way to be sure is to get an official pension forecast and check it carefully to see what you have got.You can get your State Pension on xxxxxxxx. 2036

Your forecast is £203.85 a week, £886.38 a month, £10,636.60 a year

Your forecast

- is not a guarantee and is based on the current law

- is based on your National Insurance record up to 5 April 2023

- does not include any increase due to inflation

£203.85 is the most you can get

...

1 -

sorry that should have said:

DB pensions are CPI.Have I misunderstood?

State Pension will go up with inflation

The residual pot is growing at an estimated 2% each year so that's + £10k in year one

We have some savings and lump sums to play in as well, I hadn't included them in the original post as was just trying to summarise. I will post the full figures/forecast shortly.

The residual pot is growing at an estimated 3%inflation+2% each year so that's + £25k in year one

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards