We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FIREDreamer’s Retirement Journey

FIREDreamer

Posts: 1,116 Forumite

I handed in my notice at the start of the year and will retirecat 60 at the end of June 2024. My thread won’t be as interesting as @Sea_Shell ‘s journey but putting my placeholder here which I intend to update on 1 July 2024 and every six months thereafter to see how my journey pans out.

This is for a family as my wife doesn’t work and the £2,880 contribution is made to her SIPP which I am ignoring here.

01/01/2024

Crystallised Drawdown SIPP £300,000

Uncrystallised SIPP £39,000 (increases by £3,000 per month until I retire in June)

DB 1 in Payment £8,500 pa (Capped RPI increases in July)

DB 2 in Payment £4,300 pa (Capped CPI increases in July)

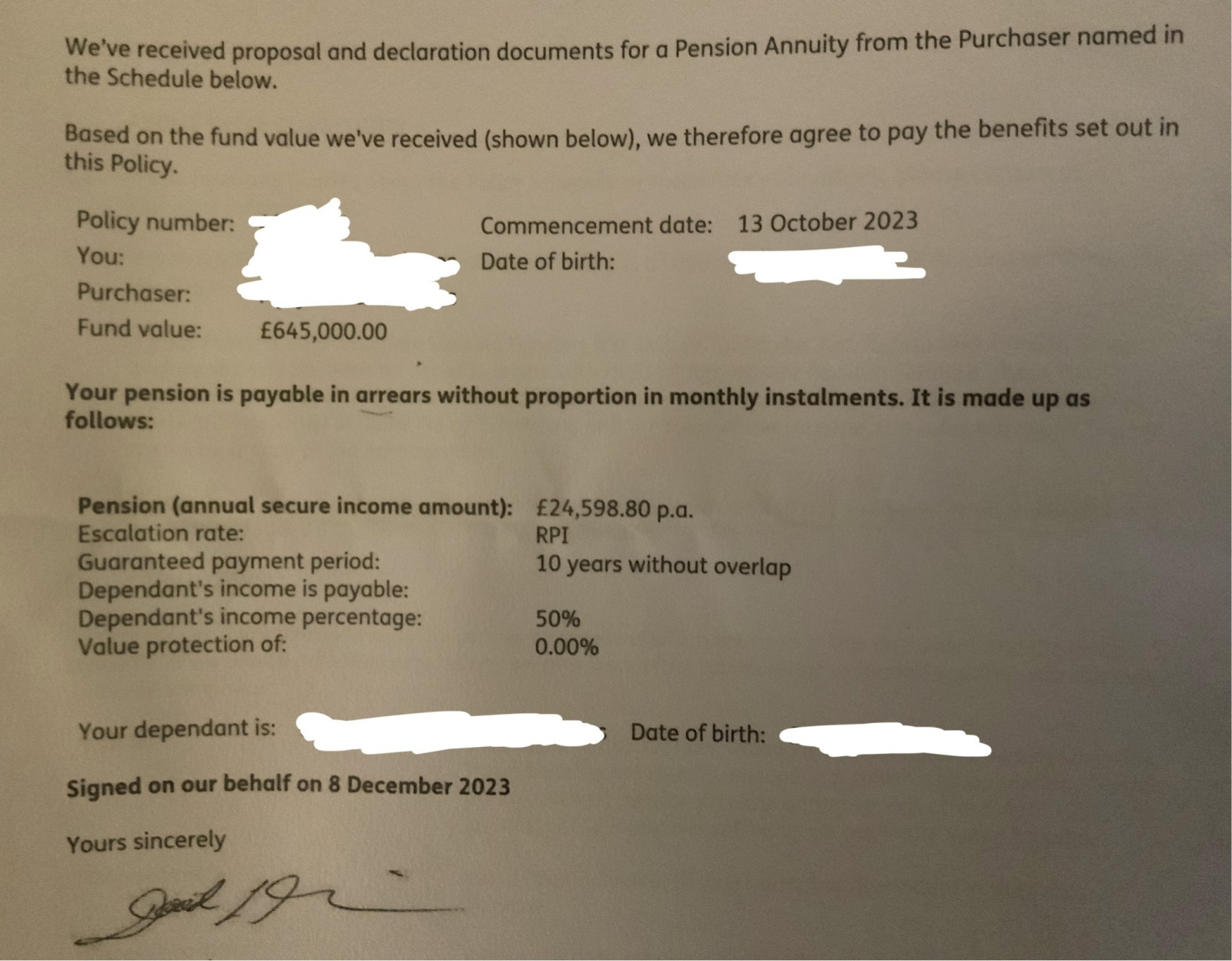

Annuity in Payment £24,600 pa. (Uncapped RPI increases in November)

Cash Pot £170,000

Shares ISA £605,000

Unless higher rate band increases, my state pension will take me into higher rate when I reach SPA in 2031 so will stop any drawdown then if I don’t need it. We both have the full state pension already - fully checked, e.g. mine …

This is for a family as my wife doesn’t work and the £2,880 contribution is made to her SIPP which I am ignoring here.

01/01/2024

Crystallised Drawdown SIPP £300,000

Uncrystallised SIPP £39,000 (increases by £3,000 per month until I retire in June)

DB 1 in Payment £8,500 pa (Capped RPI increases in July)

DB 2 in Payment £4,300 pa (Capped CPI increases in July)

Annuity in Payment £24,600 pa. (Uncapped RPI increases in November)

Cash Pot £170,000

Shares ISA £605,000

Unless higher rate band increases, my state pension will take me into higher rate when I reach SPA in 2031 so will stop any drawdown then if I don’t need it. We both have the full state pension already - fully checked, e.g. mine …

3

Comments

-

That's an impressive pension income, think I still have a little way to go to match that. Back to the grindstone.It's just my opinion and not advice.1

-

Salary sacrifice down to minimum wage for 13 years helped! Then a big boost to annuity rates when I did not have any bond investments to take a similar hit - so I took advantage of the annuity rates thanks to the ongoing aftermath of Liz Truss!SouthCoastBoy said:That's an impressive pension income, think I still have a little way to go to match that. Back to the grindstone.2 -

So £37k in income (with RPI) until SPA then another £21k or so. £350k in a SIPP and a further £770k in savings. Only seven years to SPA.You don’t actually say what your Number is (which BTW is the most useful thread on here) - how much you’re going to spend or how much you need so these figures need some context, but with £37k for seven years and then £58k after that forever (index linked) and £1.1 million as a backup in savings, it sounds like you’ll be ok!0

-

The discipline has paid off. Congrats.FIREDreamer said:

Salary sacrifice down to minimum wage for 13 years helped! Then a big boost to annuity rates when I did not have any bond investments to take a similar hit - so I took advantage of the annuity rates thanks to the ongoing aftermath of Liz Truss!SouthCoastBoy said:That's an impressive pension income, think I still have a little way to go to match that. Back to the grindstone.It's just my opinion and not advice.1 -

Suggestion you draw down from your sipp up to the basic rate tax threshold until SPA stashing any spare cash into your isa to minimise any higher rate tax payable on drawdown post state pension receipt (unless the sipp is entirely an inheritance tax vehicle)I think....1

-

That is my thinking too. Maybe cash ISA now as have enough equities now. Or perhaps bonds in my shares ISA?michaels said:Suggestion you draw down from your sipp up to the basic rate tax threshold until SPA stashing any spare cash into your isa to minimise any higher rate tax payable on drawdown post state pension receipt (unless the sipp is entirely an inheritance tax vehicle)1 -

Strangely enough, without the annuity guaranteed income, I probably would have “one more yeared” again.jimi_man said:So £37k in income (with RPI) until SPA then another £21k or so. £350k in a SIPP and a further £770k in savings. Only seven years to SPA.You don’t actually say what your Number is (which BTW is the most useful thread on here) - how much you’re going to spend or how much you need so these figures need some context, but with £37k for seven years and then £58k after that forever (index linked) and £1.1 million as a backup in savings, it sounds like you’ll be ok!1 -

So what is your Number? How much do you think you’ll need?FIREDreamer said:

Strangely enough, without the annuity guaranteed income, I probably would have “one more yeared” again.jimi_man said:So £37k in income (with RPI) until SPA then another £21k or so. £350k in a SIPP and a further £770k in savings. Only seven years to SPA.You don’t actually say what your Number is (which BTW is the most useful thread on here) - how much you’re going to spend or how much you need so these figures need some context, but with £37k for seven years and then £58k after that forever (index linked) and £1.1 million as a backup in savings, it sounds like you’ll be ok!1 -

That 24k RPI annuity must have cost a pretty penny, even with today's payout rates.And so we beat on, boats against the current, borne back ceaselessly into the past.1

-

Bostonerimus1 said:That 24k RPI annuity must have cost a pretty penny, even with today's payout rates.

Approx £650k but worth it for peace of mind.

EDIT: and less investment management for my wife should I go first.

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards