We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FIRE Girls Pension Diary - Aim High & Dream Big

Comments

-

I think definitely not having all your investment eggs in one basket e.g house or pension is a good thing - and having some ISAs too helps. I totally relate to seeing people die before they get to draw their pension - but it would be worse to get to pension age and not have enough £ to see you through. It is a balancing act between current and future self and making a life and memories along the way..Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £171.3K Equity 36.55%

2) £2.6K Net savings after CCs 10/10/25

3) Mortgage neutral by 06/30 (AVC £30.9K + Lump Sums DB £4.6K + (25% of SIPP 1.25K) = 35.5/£127.5K target 27.8% 14/11/25

(If took bigger lump sum = 62K or 48.6%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.1K updated 14/11/253 -

So true @savingholmes. It’s a balancing act and I think as I get older I get more content with where we are. Not striving for anything in particular at the moment!So it’s time to update my figures!!! I’ll come back and do that on Monday

. I think this year the markets are in my favour

. I think this year the markets are in my favour  Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5003 -

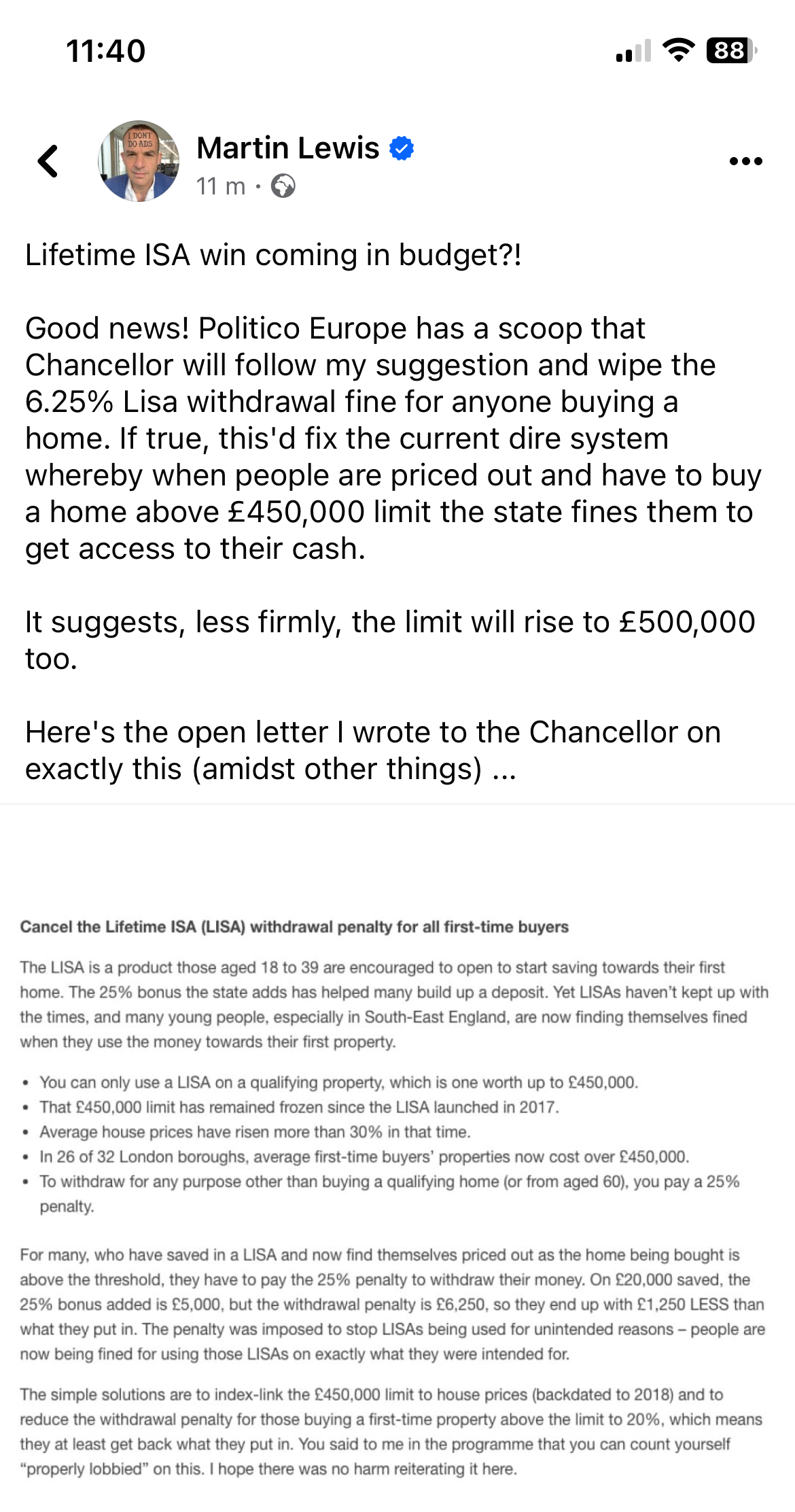

Just spotted this thread and link…..sadly there were no changes as Martin Lewis had hoped 😏Firegirl said:

Plan for tomorrow, enjoy today!4 -

What an interesting thread! We are the same age but I am way behind you on my number. I was very late on the investing game, had very little knowledge of pensions and I am now starting to wake up. I will be following your journey, good luck on reaching your target.Original mortgage 2016 -£310,500 Current balance Dec 25 -£171,180

Total OP so far £6479.15/18,275.80

Total OP 2025 £10,902.38

"Do the best you can until you know better. Then when you know better, do better"-Maya Angelou2 -

I have just played with USS Benefits calculation tool. I don't know if I understand it right, but it seems when people take early retirement, the Defined Benefit really gets a hit.I can see that if I retire at 65 the DB is a bit less than 25K annual pension, which is about right when I take 1/75 of annual salary times the number of years left till 65 plus the current DB/year.But if I put 57 as the age to take benefits then it comes right down to less than 13K, which is SO MUCH less than 1/75 annual salary times the number of years left till 57 plus the current DB/year, which should be a bit less than 18K/year.I like the idea of retiring early but it looks like early retirement charge is really really high.3

-

Indeed. My response to this is to increase my savings into the Investment Builder with a view to transferring a good chunk out to use as a bridging fund.LL_USS said:I have just played with USS Benefits calculation tool. I don't know if I understand it right, but it seems when people take early retirement, the Defined Benefit really gets a hit.I can see that if I retire at 65 the DB is a bit less than 25K annual pension, which is about right when I take 1/75 of annual salary times the number of years left till 65 plus the current DB/year.But if I put 57 as the age to take benefits then it comes right down to less than 13K, which is SO MUCH less than 1/75 annual salary times the number of years left till 57 plus the current DB/year, which should be a bit less than 18K/year.I like the idea of retiring early but it looks like early retirement charge is really really high.

edit: Didn't realise that this was posted in the wrong thread, sorry.4 -

Thanks for popping by @Sensiblesaver.

It’s never too late to start putting money away when you can and taking advantage of compound interest. All the kids are into it now too as it’s all over my son’s TikTok account! Best of luck on your journey!

I landed an amazingly well paid job a few years ago but it’s contract work so very unstable. It’s unreal really, still can’t believe it and always waiting for the bubble to bust at contract renewal time. My big plan could completely go to pot. Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5004 -

I’m taking today 20/04 as the day to update my first comments on this thread. This year the markets are in my favour! I’ve rounded the figures. £18k above target!!!! I’m super excited at a great start….although fully aware it’s sort of like a false start really

Let’s see what the next few years bring!

Let’s see what the next few years bring! Pension 1 - £173,500

Pension 2 - £55,000

Pension 3 - £10,500

ISA - £90,500

Total = £329,500

Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5005 -

Good to appreciate where you are - while being mindful of the risks.Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £171.3K Equity 36.55%

2) £2.6K Net savings after CCs 10/10/25

3) Mortgage neutral by 06/30 (AVC £30.9K + Lump Sums DB £4.6K + (25% of SIPP 1.25K) = 35.5/£127.5K target 27.8% 14/11/25

(If took bigger lump sum = 62K or 48.6%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.1K updated 14/11/252 -

Thank you. Like you I also increased my income drastically (double from 2 years ago) and at least now I have a lot of spare cash to play catch up. My son is 15 and also knows about investments, he has a S&S ISA and I talk to him a lot so he won't fall behind like meFiregirl said:Thanks for popping by @Sensiblesaver.

It’s never too late to start putting money away when you can and taking advantage of compound interest. All the kids are into it now too as it’s all over my son’s TikTok account! Best of luck on your journey!

I landed an amazingly well paid job a few years ago but it’s contract work so very unstable. It’s unreal really, still can’t believe it and always waiting for the bubble to bust at contract renewal time. My big plan could completely go to pot.

Congratulations on your £329k. I read somewhere that 300k is halfway to 1 million, so you will get there pretty quickly Original mortgage 2016 -£310,500 Current balance Dec 25 -£171,180

Original mortgage 2016 -£310,500 Current balance Dec 25 -£171,180

Total OP so far £6479.15/18,275.80

Total OP 2025 £10,902.38

"Do the best you can until you know better. Then when you know better, do better"-Maya Angelou2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards