We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Voluntary backdated NI payment class 2 disallowed prior to 11/04/2015 - why?

donglefan

Posts: 410 Forumite

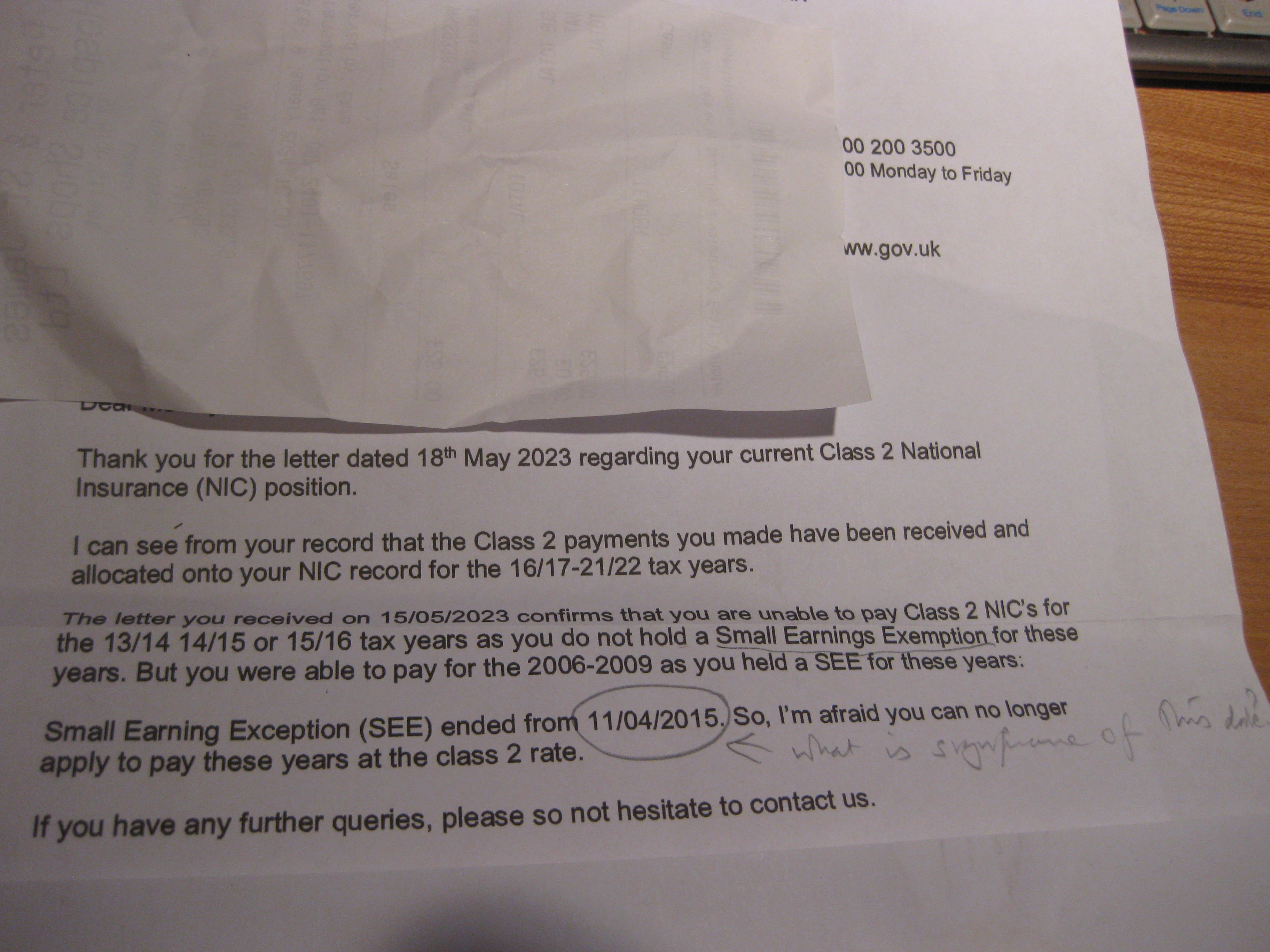

I asked the Revenue if I could pay back to 2013 at class 2 because I had self employment and low income back to 2013, but they have only permitted me to pay class 2 back to 11/04/2015.

I phoned to ask what happened on that date, as nothing changed on my side. I didn't understand the reply - something about the way they collected something changed on that date, and that because I did not have a 'small earnings exemption' in place for those years, I could not now pay for them at class 2, only at class 3. I said that in fact I had small earnings for the relevant years and this was not disputed, the problem was that I did not have the 'exemption' in place at the time.

May I check with the seasoned experts on MSE that this advice from HMRC accords with the law about being able to backdate Class 2 payments to 2006? Is there any form of appeal it would be worth making in order to be able to pay class 2's for these years now?

I phoned to ask what happened on that date, as nothing changed on my side. I didn't understand the reply - something about the way they collected something changed on that date, and that because I did not have a 'small earnings exemption' in place for those years, I could not now pay for them at class 2, only at class 3. I said that in fact I had small earnings for the relevant years and this was not disputed, the problem was that I did not have the 'exemption' in place at the time.

May I check with the seasoned experts on MSE that this advice from HMRC accords with the law about being able to backdate Class 2 payments to 2006? Is there any form of appeal it would be worth making in order to be able to pay class 2's for these years now?

0

Comments

-

It seems what they are saying is that from 2015-16 class 2 became part of SA and the requirement to pay was worked out from that submission. Prior to that you had to apply for a small earnings exception, nothing was due but you had to have a certificate confirming that - a bit like paying your £0 car tax each year, you still have to apply. As you did not do that you are effectively late in paying (£0) - because you failed to apply to not pay it - so can no longer pay as it is outside the time frame for late payment so the only option is class 3.

1 -

Thank you molerat.

I will attach the letter from HMRC below. I think I should be able to pay the 15/16 year at class 2 in this case?

0 -

You [presumably] don't have a small earning exception for the first few days of 2015-2016 and I expect HMRC are relying on that.

1 -

Thank you. Is that relevant if I did not earn on those particular days?squirrelpie said:You [presumably] don't have a small earning exception for the first few days of 2015-2016 and I expect HMRC are relying on that.0 -

The letter you have copied states that you don't have SEE for tax year 15/16. If that's the case I assume your earnings in the period from 6/4/15 to 11/4/15 are irrelevant.donglefan said:

Thank you. Is that relevant if I did not earn on those particular days?squirrelpie said:You [presumably] don't have a small earning exception for the first few days of 2015-2016 and I expect HMRC are relying on that.1 -

as i understand it (which is isn't fully), after the change in the rules, it wasn't necessary to have this 'exception' arrangement.german_keeper said:

The letter you have copied states that you don't have SEE for tax year 15/16. If that's the case I assume your earnings in the period from 6/4/15 to 11/4/15 are irrelevant.donglefan said:

Thank you. Is that relevant if I did not earn on those particular days?squirrelpie said:You [presumably] don't have a small earning exception for the first few days of 2015-2016 and I expect HMRC are relying on that.0 -

I think I agree now. So if the rules changed on 11/4/15, 2014/2015 should be the last tax year affected by the SEE rules. If so the reference to 2015/2016 in the letter you received is incorrect.donglefan said:

as i understand it (which is isn't fully), after the change in the rules, it wasn't necessary to have this 'exception' arrangement.german_keeper said:

The letter you have copied states that you don't have SEE for tax year 15/16. If that's the case I assume your earnings in the period from 6/4/15 to 11/4/15 are irrelevant.donglefan said:

Thank you. Is that relevant if I did not earn on those particular days?squirrelpie said:You [presumably] don't have a small earning exception for the first few days of 2015-2016 and I expect HMRC are relying on that.1 -

I've received a letter from HMRC about this, but it doesn't answer my letter. For one thing it thanks me for my letter of 12/04/24, but my letter was dated January 24. Then it completely ignores the rule change and simply states "As previously advised class 2 contributions are subject to strict time limits and can only go back 6 years."

I know that is wrong because I paid some back to 2006 at class 2 in 2023.

Where do I go from here? Try phoning again? How can I raise a complaint and is there time to do that?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards