We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

NatWest annual over payment allowance

ElwoodBlues

Posts: 387 Forumite

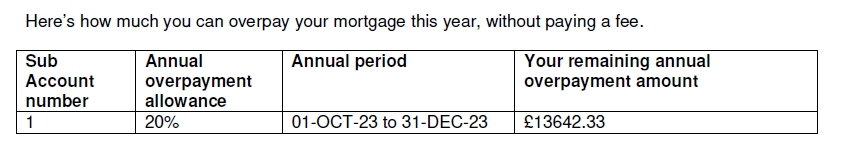

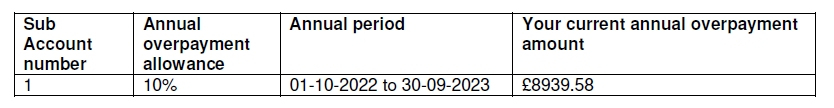

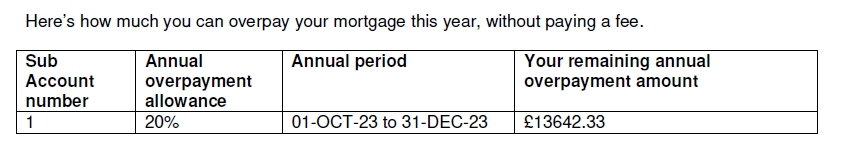

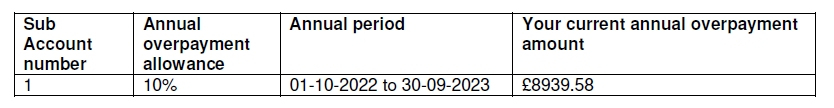

For the last few years, NatWest have been sending me an overpayment allowance statement, and the annual period has been from 1st Oct to 30th Sept the following year. Just noticed that this year's is only for 3 months - 1st Oct to 31st Dec 2023. My current fix ends on 31st December, so I guess that's probably why.

I've signed up for another fixed rate term to follow on. But what happens to the overpayment allowance? Do they recalculate it based on the loan balance at 1st Jan 2024, and then the annual period runs for 12 months from then (i.e. calendar year), or does the current overpayment allowance stand, until 30th Sept 2024?

It's a minor thing, but I'm running the numbers to decide on a 2yr vs 5yr fixed term, and overpayment allowance is a factor for me.

I've signed up for another fixed rate term to follow on. But what happens to the overpayment allowance? Do they recalculate it based on the loan balance at 1st Jan 2024, and then the annual period runs for 12 months from then (i.e. calendar year), or does the current overpayment allowance stand, until 30th Sept 2024?

It's a minor thing, but I'm running the numbers to decide on a 2yr vs 5yr fixed term, and overpayment allowance is a factor for me.

0

Comments

-

You can overpay a maximum of 20% of your outstanding mortgage balance in each 12 month period – commencing on completion of your mortgage and continuing from each anniversary of that date until the end date of the rate – without incurring an early repayment charge.

If your mortgage is made up of more than one part you can overpay up to a maximum of 20% of the outstanding balance of each part.

I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards