We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Do Raisin Bank understand the difference between AER and Gross interest rate?

dalts99

Posts: 2 Newbie

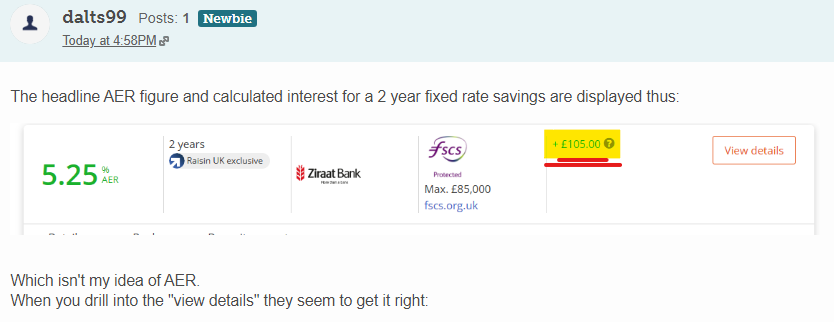

The headline AER figure and calculated interest for a 2 year fixed rate savings are displayed thus:

Which isn't my idea of AER.

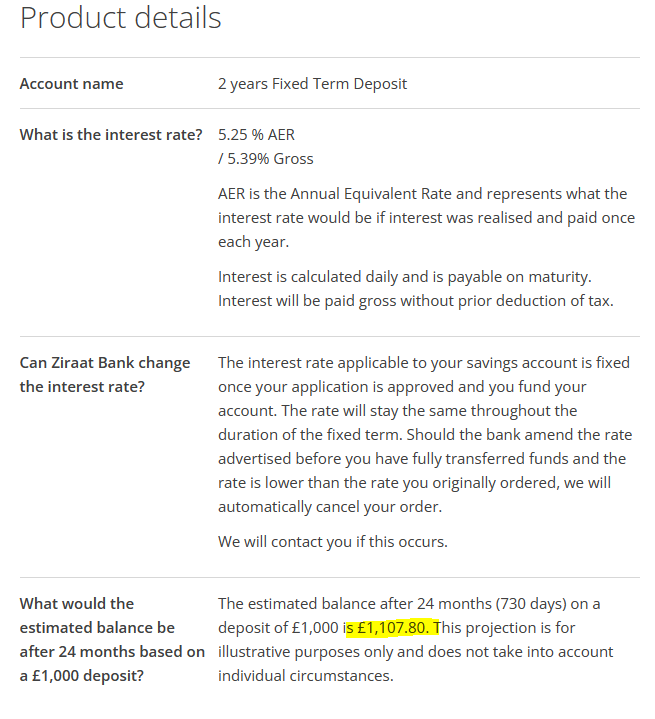

When you drill into the "view details" they seem to get it right:

A little worrying that they can't get this right?

Which isn't my idea of AER.

When you drill into the "view details" they seem to get it right:

A little worrying that they can't get this right?

0

Comments

-

Hopeless..... they should stick to currant accounts

6

6 -

It appears Raisin's approximations use the AER figure, even for accounts paying simple interest.0

-

1.0525 compounded for two years = £107.8 of interest. (actually £107.75)

1.0539 plain interest not compounded in second year = £53.9 of interest per year = £107.8

I'm not sure i see the problem? as both methods give the same interest payable.

BTW i think Raisin is Sharia banking?

Their website say they cant offer interest rates... specifically saying they don't offer AER's just expected profits - but then they go on to list a bunch of AER's against their sharia savings accounts.

e.g. see here:

https://www.raisin.co.uk/banking/al-rayan-faq/

I guess that's because they have to offer equivalent AER by UK rules?

But are they somehow doing it a little different?

1 -

On-the-coast said:

1.0525 compounded for two years = £107.8 of interest. (actually £107.75)

1.0539 plain interest not compounded in second year = £53.9 of interest per year = £107.8

I'm not sure i see the problem? as both methods give the same interest payable.The green "+ £105.00" approximation calculated on Raisin's web interface. Raisin uses the AER instead of gross, even for accounts paying simple interest.

On-the-coast said:BTW i think Raisin is Sharia banking?

Raisin is not a bank and doesn't offer any savings products directly. They're a 'savings marketplace' allowing customers to apply for and manage savings accounts from their 35+ partner banks via one single login.

0 -

I don't understand. If 'simple interest' means that they pay 2*5.39%=10.78% at the end of 2 years, this is exactly £107.80. And, recalculated to AER, this becomes 5.25%.AmityNeon said:On-the-coast said:1.0525 compounded for two years = £107.8 of interest. (actually £107.75)

1.0539 plain interest not compounded in second year = £53.9 of interest per year = £107.8

I'm not sure i see the problem? as both methods give the same interest payable.The green "+ £105.00" approximation calculated on Raisin's web interface. Raisin uses the AER instead of gross, even for accounts paying simple interest.

0 -

grumbler said:AmityNeon said:On-the-coast said:

1.0525 compounded for two years = £107.8 of interest. (actually £107.75)

1.0539 plain interest not compounded in second year = £53.9 of interest per year = £107.8

I'm not sure i see the problem? as both methods give the same interest payable.The green "+ £105.00" approximation calculated on Raisin's web interface. Raisin uses the AER instead of gross, even for accounts paying simple interest.

I don't understand. If 'simple interest' means that they pay 2*5.39%=10.78% at the end of 2 years, this is exactly £107.80. And, recalculated to AER, this becomes 5.25%.

Indeed, the account pays simple interest at 5.39% gross, so how do you think Raisin is calculating +£105.00? It's not just this account either; Raisin appears to always calculate their interest approximations using the AER, but the AER is not a figure that should be used in calculating gross interest.

0 -

Where do you see £105? I see £1,107.80, i.e. £107.80 interest, that corresponds to 5.39% gross and means 5.25% AER.

0 -

It's easy to miss - in the first picture, below "The headline AER figure and calculated interest for a 2 year fixed rate savings are displayed thus:", and between the FSCS and "view details" cells.grumbler said:Where do you see £105? I see £1,107.80, i.e. £107.80 interest, that corresponds to 5.39% gross and means 5.25% AER.1 -

grumbler said:

Where do you see £105? I see £1,107.80, i.e. £107.80 interest, that corresponds to 5.39% gross and means 5.25% AER.

The whole point of this thread was to contrast Raisin's (dynamic) calculative error compared to the correct (static) information revealed when "View details" is clicked. £105.00 isn't @dalts99's idea of 5.25% AER, but £107.80 is.

2

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards