We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

HMRC Response

RandomUser923759

Posts: 133 Forumite

in Cutting tax

Hey All,

Getting a bit desperate and in need of some advice. Really not sure if this is the best place on the board.

I received a 5K tax bill (which I've disputed)

HMRC kept adding late fees and interest etc - so in order to halt this I thought it best to pay the bill and continue the dispute and hopefully then get it refunded.

I wrote the requested letter and provided all the backing documents of the case, I sent it in April and it was logged on HMRC by mid May.

I was told the initial timeframe for a response was by Mid July - I sat back and waited - even thought I already thought this was a very long time.

July came around and since then every time I contact HMRC they tell me to wait another month.

This happened until mid-Sept where they now say - you'll get a call within 3-5 days, this has cycled 3-4 times now too with no call.

Getting a bit desperate and in need of some advice. Really not sure if this is the best place on the board.

I received a 5K tax bill (which I've disputed)

HMRC kept adding late fees and interest etc - so in order to halt this I thought it best to pay the bill and continue the dispute and hopefully then get it refunded.

I wrote the requested letter and provided all the backing documents of the case, I sent it in April and it was logged on HMRC by mid May.

I was told the initial timeframe for a response was by Mid July - I sat back and waited - even thought I already thought this was a very long time.

July came around and since then every time I contact HMRC they tell me to wait another month.

This happened until mid-Sept where they now say - you'll get a call within 3-5 days, this has cycled 3-4 times now too with no call.

0

Comments

-

I thought it best to pay the bill and continue the dispute and hopefully then get it refunded.

A wise decision......

https://www.thetimes.co.uk/money-mentor/article/hmrc-contact-tax-phone-number-delays-help/4. It may be cheaper to pay the charge, and dispute it with HMRC later

Many of HMRC’s systems are automated. This matters because if you are disputing a charge or a fine, then interest will continue to accrue while the issue is investigated. If your problem takes a year to resolve, you could rack up a great deal of interest.

I hate having to advise this, but if you can afford it, paying the money might make sense, on the understanding that you will be making a complaint and seeking a full refund.

See also

https://www.litrg.org.uk/tax-guides/tax-basics/enquiries-penalties-appeals-complaints-and-debt/how-do-i-complain-hmrc#:~:text=If you do not hear,a claim for compensation later.

0 -

See also

https://forums.moneysavingexpert.com/discussion/comment/80348883/#Comment_80348883

Hope is not dead...... 0

0 -

I received a 5K tax bill (which I've disputed)

HMRC kept adding late fees and interest etc - so in order to halt this I thought it best to pay the bill and continue the dispute and hopefully then get it refunded.That indicates it could be Self Assessment related.

Are you able to expand on the reason for the "bill"?

Was it from a Self Assessment return?

Was it an assessment issued by HMRC?

Was it even for income tax?0 -

It stems from self assessment.0

-

How does it stem from SA though? The tax payable is fairly clear and standard from a SATR so there should not generally be anything to dispute unless it was submitted late, paid late, or HMRC disagreed with costs you have used as part of your self assessment.RandomUser923759 said:It stems from self assessment.0 -

Maybe the OP has not submitted a required return.MattMattMattUK said:

How does it stem from SA though? The tax payable is fairly clear and standard from a SATR so there should not generally be anything to dispute unless it was submitted late, paid late, or HMRC disagreed with costs you have used as part of your self assessment.RandomUser923759 said:It stems from self assessment.0 -

I have submitted a return - and I disagree with the amount payable. My concern is more that I have been waiting so long for a response.

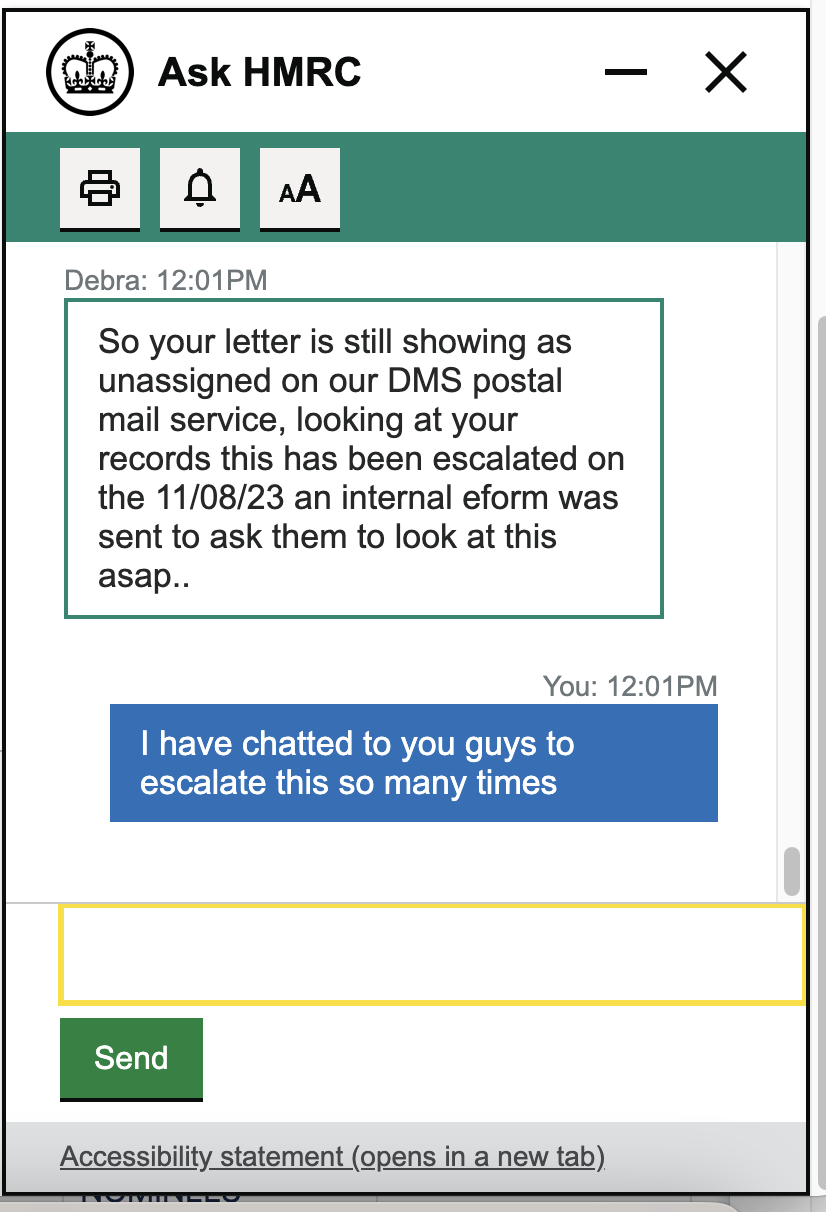

This is from HMRC webchat today:

0 -

Unless you are prepared to explain the full situation no one on here can help.

The starting point would be that it is called Self Assessment for a reason so are you certain you completed the return correctly?

But if you did then you need to explain in a lot more detail exactly what the issue is.

Wew you being investigated? Was it first year your ANI went above £100k (a common scenario where a large underpayment occurs)?1 -

I understand your response, but really I am looking at how to navigate getting a response to my letter. I do not need help with the content.

I don't know how to get HMRC to answer.0 -

How you get HMRC to answer might well depend on the root of the issue. If you filled in your SA wrong then that is different to them disallowing certain costs, if you just disagree with tax policy and think you should pay less but to not have a reason based in legislation and/or case law then they will likely ignore you.RandomUser923759 said:I understand your response, but really I am looking at how to navigate getting a response to my letter. I do not need help with the content.

I don't know how to get HMRC to answer.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards