We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Buying GILTS and holding to maturity in an ISA with Interactive Investor

JamTomorrow

Posts: 169 Forumite

I haven't held GILTS directly previously and have invested in Bond funds.

Now looking for some short-term certainty on return on some of my holdings in an ISA with II and want to check my thinking is correct.

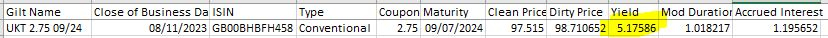

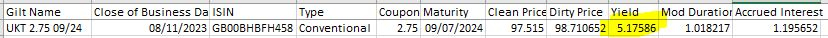

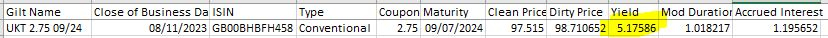

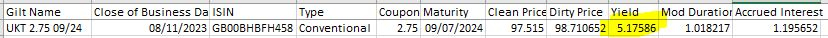

From reviewing data at Tradeweb it looks like the GILT below has a ~5.2% yield if I hold to maturity on 7th September 2024.

Is it just as simple as I purchase that ISIN code (GB00BHBFH458) on II and hold to maturity and in just under 13 months time I would have secured a return of ~5.2% (unless Govt goes broke)?

Thanks.

Now looking for some short-term certainty on return on some of my holdings in an ISA with II and want to check my thinking is correct.

From reviewing data at Tradeweb it looks like the GILT below has a ~5.2% yield if I hold to maturity on 7th September 2024.

Is it just as simple as I purchase that ISIN code (GB00BHBFH458) on II and hold to maturity and in just under 13 months time I would have secured a return of ~5.2% (unless Govt goes broke)?

Thanks.

0

Comments

-

Yes. And since I cannot post a three character answer here is a nice link for current bonds and yields https://www.dividenddata.co.uk/uk-gilts-prices-yields.py.PS Your wording "a return of ~5.2%" might suggest a composite return rather than annual yield. Annual yield will be ~5.2% but composite return in a year and a few weeks will be just over 5.5%.

1 -

Yes

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0 -

I was recently accepted onto the approved list of direct purchasers of Gilts. They sent me the list of Ts and Cs. There's a 0.7% commission for buy and sell, minimum £12.50.JamTomorrow said:I haven't held GILTS directly previously and have invested in Bond funds.

Now looking for some short-term certainty on return on some of my holdings in an ISA with II and want to check my thinking is correct.

From reviewing data at Tradeweb it looks like the GILT below has a ~5.2% yield if I hold to maturity on 7th September 2024.

Is it just as simple as I purchase that ISIN code (GB00BHBFH458) on II and hold to maturity and in just under 13 months time I would have secured a return of ~5.2% (unless Govt goes broke)?

Thanks.

I'm unclear now why I'd bother. I can buy and sell for £5 on iWeb, and then don't have the faf of looking after the certificate, or posting stuff to sell.

Am I missing something? Will iWeb have a large bid/offer spread that somehow makes them more expensive? On the couple of trades I have done with iWeb the differential between the price I got and the quoted mid-market one in the FT was minimal.0 -

Yeah, in a GIA and not an ISA that's, what I have been doing on II too. TN25 and T26a in my case.

Approved purchaser? That sounds a, bit naff if you need to pay so much for each trade and a % commission? Why would anyone want to do that if £5 or something is the alternative?

Iweb wise, I think you need to phone to buy gilts no?

0 -

Buying gilts is akin to locking in a fixed rate for the period in question although unlike the case of doing this via a fixed rate deposit, here you get early access (via liquidation) which can come either with a profit or loss on your invested capital.0

-

Quick Q: If you buy an individual IL gilt on ii, for example, is there a an ii sell fee at maturity? Thanks.

0 -

-

Not exactly. In my limited experience, you go to place the order online as you would with a popular equity, it then pops up a message saying that no online quotes are available but if you care to click "Continue" their dealers will execute the order at best. In each case for me, within 20 minutes or so that order has been completed and the Gilt ready to view in the portal. No phone call required.ChilliBob said:Yeah, in a GIA and not an ISA that's, what I have been doing on II too. TN25 and T26a in my case.

Approved purchaser? That sounds a, bit naff if you need to pay so much for each trade and a % commission? Why would anyone want to do that if £5 or something is the alternative?

Iweb wise, I think you need to phone to buy gilts no?2 -

Yes but keep in mind the capital gain is free whilst the coupon may attract tax.JamTomorrow said:I haven't held GILTS directly previously and have invested in Bond funds.

Now looking for some short-term certainty on return on some of my holdings in an ISA with II and want to check my thinking is correct.

From reviewing data at Tradeweb it looks like the GILT below has a ~5.2% yield if I hold to maturity on 7th September 2024.

Is it just as simple as I purchase that ISIN code (GB00BHBFH458) on II and hold to maturity and in just under 13 months time I would have secured a return of ~5.2% (unless Govt goes broke)?

Thanks.

It's why low coupon gilts are popular right now.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards