We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

USS pension scheme - what is the underlying fund they invest in?

dllive

Posts: 1,342 Forumite

Hi

I have my SIPP which is all in the Vanguard Lifestyle100 fund. I also have my company pension which is the USS scheme. I have the "Do It For Me" option as my investment choice in normal contributions and AVCs.

What is the underlying fund that USS uses? Is it a Blackrock fund or similar?

What Id like to do is compare the USS fund with the Vanguard Lifestyle100 fund to help me decide which I should focus putting new money into. I dont pay management fees for the USS, so thats a little bonus. But if the Lifestyle100 fund has performed better then Ill choose that option.

What Id like to do is compare the USS fund with the Vanguard Lifestyle100 fund to help me decide which I should focus putting new money into. I dont pay management fees for the USS, so thats a little bonus. But if the Lifestyle100 fund has performed better then Ill choose that option.

Thanks

0

Comments

-

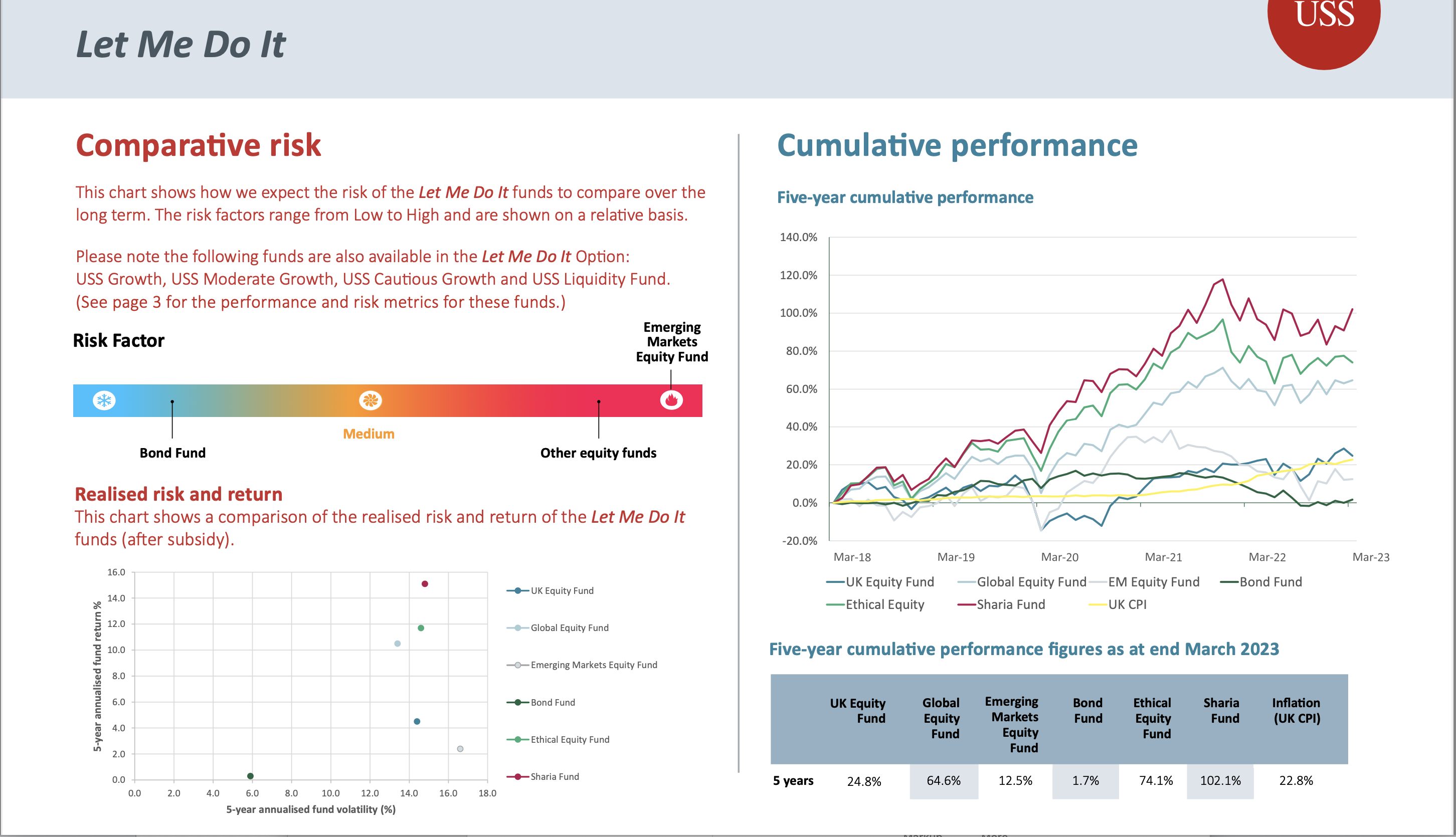

I'm a deferred USS member. I used the 'Let Me Do It' option for my Investment Builder and that gives a range of funds to choose from (see the pdf in the link below). I think the funds are proprietary USS funds and not the like of Vanguard or Blackrock. They give you an idea of the equity/bond split and risk level, but not much else. I couldn't easily find anything else regarding their underlying investments. You could ask USS, but whether they would tell you is another matter!

https://www.uss.co.uk/-/media/project/ussmainsite/files/for-members/guides/a-guide-to-investing-in-the-investment-builder.pdf?rev=f7efc219d7da4d47bd30486ce1956510&hash=FFADF8DA0EBC2B1F99F8355718DA999B

'Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it' - Albert Einstein.3 -

Try https://www.uss.co.uk/how-we-invest/our-investment-performance and scroll down to the link to the latest quarterly investment report towards the bottom of that page.dllive said:HiI have my SIPP which is all in the Vanguard Lifestyle100 fund. I also have my company pension which is the USS scheme. I have the "Do It For Me" option as my investment choice in normal contributions and AVCs.What is the underlying fund that USS uses? Is it a Blackrock fund or similar?

What Id like to do is compare the USS fund with the Vanguard Lifestyle100 fund to help me decide which I should focus putting new money into. I dont pay management fees for the USS, so thats a little bonus. But if the Lifestyle100 fund has performed better then Ill choose that option.ThanksGoogling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!2 -

Thanks guys. I must be misremembering. I thought I read somewhere that - under the bonnet - they were using a Blackrock fund or similar.

Ill take a look at their Quarterly Investment Report later.

Cheers

0 -

Information about the Investment Builder (DC component) can be found at https://www.uss.co.uk/my-uss/investment-builder/fund-information (page 19 of the quarterly report mentioned by others lists the funds used). If you want a 100% allocation to stocks (as in your SIPP) then you will need to move to the 'Let me do it' option and choose the global equity fund (or ethical equivalent) and, if you want a home bias as per Lifestyle 100, the UK equity fund too.dllive said:HiI have my SIPP which is all in the Vanguard Lifestyle100 fund. I also have my company pension which is the USS scheme. I have the "Do It For Me" option as my investment choice in normal contributions and AVCs.What is the underlying fund that USS uses? Is it a Blackrock fund or similar?

What Id like to do is compare the USS fund with the Vanguard Lifestyle100 fund to help me decide which I should focus putting new money into. I dont pay management fees for the USS, so thats a little bonus. But if the Lifestyle100 fund has performed better then Ill choose that option.Thanks

Information about the underlying fund for the DB component (which is actively managed and bespoke including about 25% private equity such as Thames Water!) can be found at under the 'how we invest' tab.

2 -

Ive just been reading the Quarterly Investment Report. IM going to show my ignroance here Im afraid: On the USS Growth Fund (for example), just under the Fund Performance chart, it reads "Risk Measures: Five-year annualised fund volatility: 10.1%". What does this mean?It seems all the performance charts are cumulative. I was hoping to see it broken down by year like Hargreaves and Vanguard do(?)0

-

Each individual year performance tells you very little. Better to look at 5 year annualised performance( just divide cumulative performance over 5 years by 5 ) or better still 10 year if it is available.dllive said:Ive just been reading the Quarterly Investment Report. IM going to show my ignroance here Im afraid: On the USS Growth Fund (for example), just under the Fund Performance chart, it reads "Risk Measures: Five-year annualised fund volatility: 10.1%". What does this mean?It seems all the performance charts are cumulative. I was hoping to see it broken down by year like Hargreaves and Vanguard do(?)

Even then 'past performance is no guide to the future'1 -

The volatility figure is a measure of risk, the higher the number the more you can expect the fund to vary by from month to month. You would also expect a higher return for accepting higher volatility. Below is taken from the USS report:dllive said:Ive just been reading the Quarterly Investment Report. IM going to show my ignroance here Im afraid: On the USS Growth Fund (for example), just under the Fund Performance chart, it reads "Risk Measures: Five-year annualised fund volatility: 10.1%". What does this mean?It seems all the performance charts are cumulative. I was hoping to see it broken down by year like Hargreaves and Vanguard do(?) It seems all the performance charts are cumulative. I was hoping to see it broken down by year like Hargreaves and Vanguard do(?)The bar chart below shows performance figures for 3 years per annum, 5 years per annum and since launch per annum. As Albermarle says, these are better to use for comparisons.

It seems all the performance charts are cumulative. I was hoping to see it broken down by year like Hargreaves and Vanguard do(?)The bar chart below shows performance figures for 3 years per annum, 5 years per annum and since launch per annum. As Albermarle says, these are better to use for comparisons.

'Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it' - Albert Einstein.1 -

Great, thanks.

So, taking into account inflation, the performance is very underwhelming compared to LifeStrategy100! https://www.vanguardinvestor.co.uk/investments/vanguard-lifestrategy-100-equity-fund-accumulation-shares/price-performance

0 -

LS100 is ~8.6% per annum over the past 5 years, compared to 5.8% pa for the USS growth fund. The USS ethical growth fund is ~9.2% pa. There seem to be better (and worse) options in the 'Let Me Do It' range, e.g. the Sharia fund (~20% pa), Ethical equity fund (~15% pa) and the Global equity fund (~12% pa). With the usual caveat that past performance is not an indicator of future performance!dllive said:Great, thanks.

So, taking into account inflation, the performance is very underwhelming compared to LifeStrategy100! https://www.vanguardinvestor.co.uk/investments/vanguard-lifestrategy-100-equity-fund-accumulation-shares/price-performance

'Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it' - Albert Einstein.1 -

Thanks - thats good to know. I think Ill contribute more into my SIPP (LifeStrategy100). I will be paying Vanguard management fees, but this will be offset by LifeStrategy's (hopefully!) enhanced performance.

Im going to see what the performance of other pension providers are and see how they compare. 5.8%pa doesnt sound like much when inflation is factored in. Especially this year!

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards