We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Annuity rates on the up, is now a time to buy one?

Comments

-

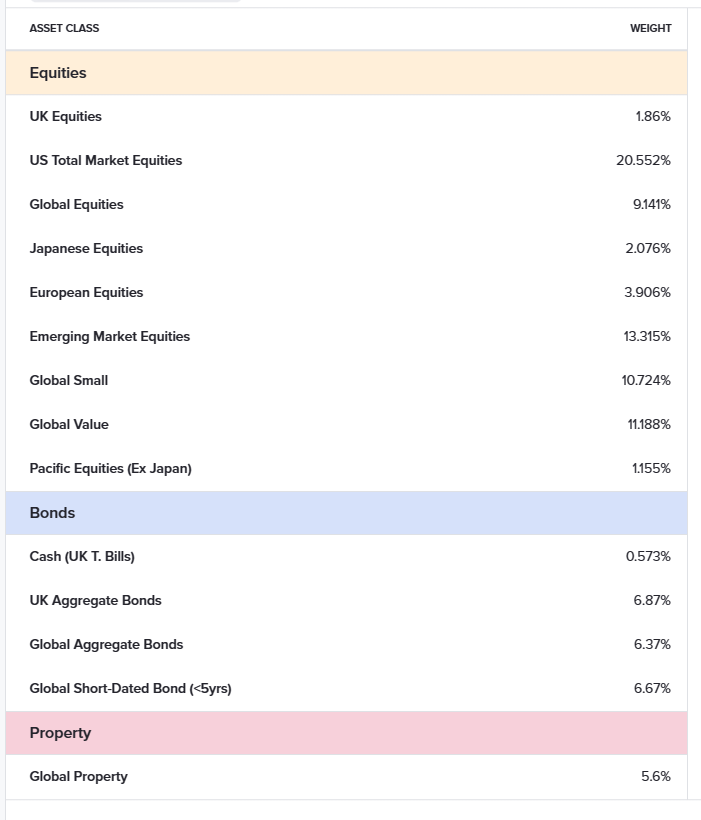

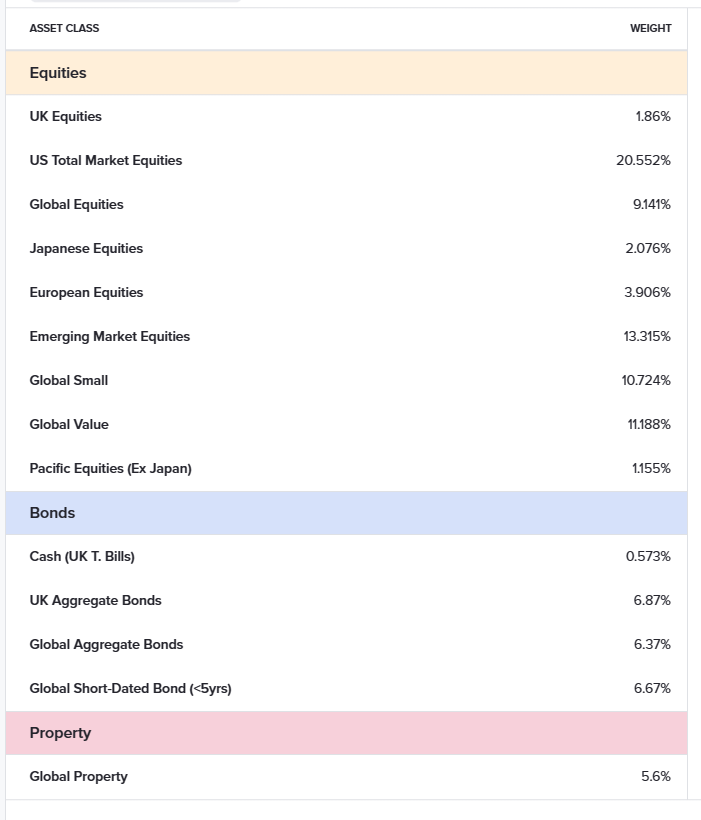

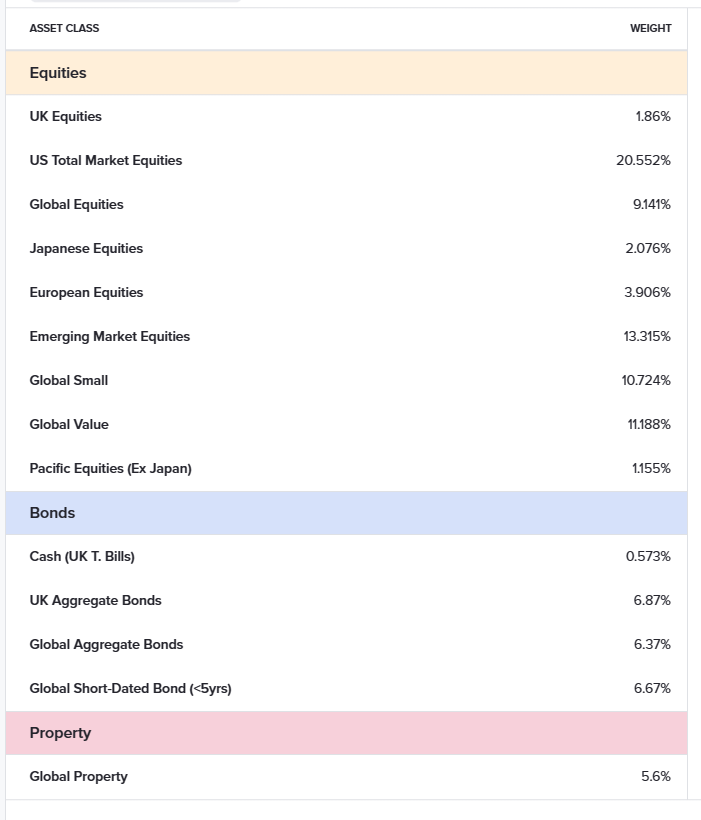

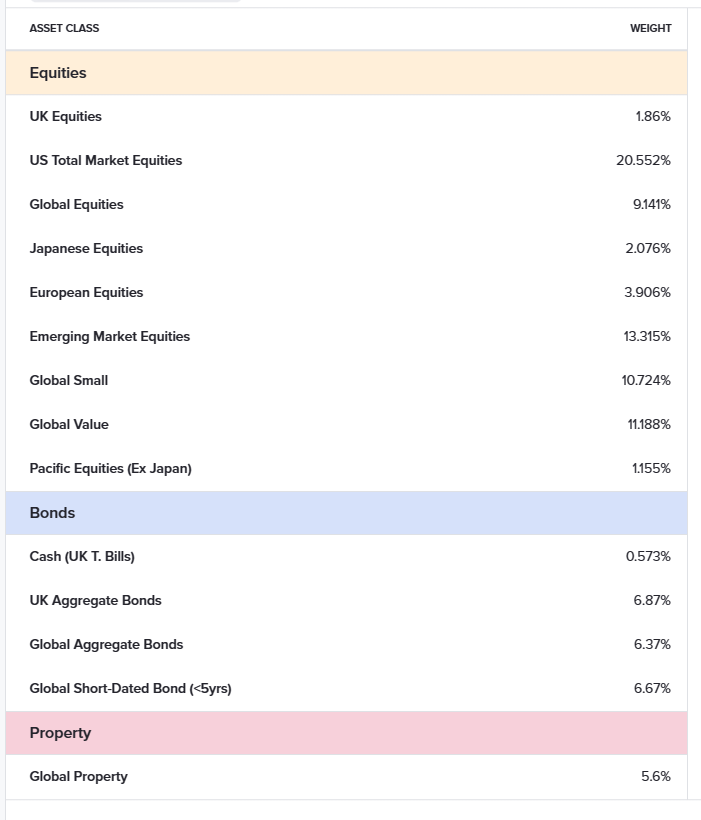

That's an interesting set of investments - I would guess that is the reason for the very different results, since even using a portfolio with 60% US stocks, 20% UK stocks, 10% UK bonds, and 10% UK cash, the SWR only reaches 3.4% (compared to 2.6% for UK only).Pat38493 said:This is the asset mix used for the 80/20 - there is possibly some min/maxing of stats based on past history that will obviously not give the same results going forward?

1 -

Yes. I guess the interesting question is whether this portfolio is actually a good mix to have going forward if you are trying to start a 44 year retirement plan, or if actually they have found a kind of "path" through the past history which for whatever reason is almost impossible that it will happen in the future.OldScientist said:

That's an interesting set of investments - I would guess that is the reason for the very different results, since even using a portfolio with 60% US stocks, 20% UK stocks, 10% UK bonds, and 10% UK cash, the SWR only reaches 3.4% (compared to 2.6% for UK only).Pat38493 said:This is the asset mix used for the 80/20 - there is possibly some min/maxing of stats based on past history that will obviously not give the same results going forward?

However - if I change the portfolio to HSBC global fund (100% global equities) I can still get 100% success on a 3.6% WR and 3% failure rate on 4% (according to Timeline).0 -

Today the US FED rates were above the latest inflation rate shown in first chart. This has been a target over the decades with rates acting as a buffer against inflation.

F01yo-DWYAU4auL (850×595) (twimg.com)

FYDN7BzVUAAsgbc (1200×503) (twimg.com)

A similar situation in the UK although today well down 9% inflation v 5% base ? Government hoping for 5% inflation and base rate similar.

inflation-interest-rates-1945-2011.png (944×650) (economicshelp.org)

So it's not unreasonable to expect a base or savings rate matching inflation ? I've looked again at the H/L list of annuity rates.

Annuity Rates: View Best Annuity Rates from the UK Market (hl.co.uk)

Using a savings calculator I've loaded a few examples for annuities. Maybe there's already a setting for this out there but I don't know of any ? All I'm trying to do is see how long your own pot would last in a SIPP or ISA etc. You could leave your money in a money market fund MMF currently paying around 5%. I'll be unkind to savings and use 3% as an annual interest rate. This has been one of the lowest rates in a century until recent years. Inflation increase I've used 5% again which is above BOE target of 2%. Set the calculator with £100000 and an interest rate of 3% annually over 25 year period. From the H/L list the Single Life £6000 yearly withdrawal would last 24 years. A £7000 withdrawal around 19 years . Using £3500 annual withdrawal and add 5% inflation this would last 23 years. If you were to close that interest and inflation gap better results judging by the history of rates and inflation. Higher inflation well that's another story. Just guesswork at the end of the day ?

Savings Calculator With Regular Deposits/Withdrawals (thecalculatorsite.com)

1 -

With 50% UK and 50% US stocks (which is, obviously, not the same as a properly global portfolio) I get about 3.3% for 44 years with ~8% failure for WR=4% (with no fees), so within the level of uncertainty. Not sure I'd be willing to go with 100% stocks though!Pat38493 said:

Yes. I guess the interesting question is whether this portfolio is actually a good mix to have going forward if you are trying to start a 44 year retirement plan, or if actually they have found a kind of "path" through the past history which for whatever reason is almost impossible that it will happen in the future.OldScientist said:

That's an interesting set of investments - I would guess that is the reason for the very different results, since even using a portfolio with 60% US stocks, 20% UK stocks, 10% UK bonds, and 10% UK cash, the SWR only reaches 3.4% (compared to 2.6% for UK only).Pat38493 said:This is the asset mix used for the 80/20 - there is possibly some min/maxing of stats based on past history that will obviously not give the same results going forward?

However - if I change the portfolio to HSBC global fund (100% global equities) I can still get 100% success on a 3.6% WR and 3% failure rate on 4% (according to Timeline).

0 -

The problem with such calculations (useful as they are) is that they ignore sequence of inflation (which is analogous to sequence of returns for portfolio withdrawals). In other words, it isn't just the annualised level of inflation, it is the sequence in which it occurs with higher inflation soon after annuity purchase being much more important than high inflation occurring later on.coastline said:Today the US FED rates were above the latest inflation rate shown in first chart. This has been a target over the decades with rates acting as a buffer against inflation.

F01yo-DWYAU4auL (850×595) (twimg.com)

FYDN7BzVUAAsgbc (1200×503) (twimg.com)

A similar situation in the UK although today well down 9% inflation v 5% base ? Government hoping for 5% inflation and base rate similar.

inflation-interest-rates-1945-2011.png (944×650) (economicshelp.org)

So it's not unreasonable to expect a base or savings rate matching inflation ? I've looked again at the H/L list of annuity rates.

Annuity Rates: View Best Annuity Rates from the UK Market (hl.co.uk)

Using a savings calculator I've loaded a few examples for annuities. Maybe there's already a setting for this out there but I don't know of any ? All I'm trying to do is see how long your own pot would last in a SIPP or ISA etc. You could leave your money in a money market fund MMF currently paying around 5%. I'll be unkind to savings and use 3% as an annual interest rate. This has been one of the lowest rates in a century until recent years. Inflation increase I've used 5% again which is above BOE target of 2%. Set the calculator with £100000 and an interest rate of 3% annually over 25 year period. From the H/L list the Single Life £6000 yearly withdrawal would last 24 years. A £7000 withdrawal around 19 years . Using £3500 annual withdrawal and add 5% inflation this would last 23 years. If you were to close that interest and inflation gap better results judging by the history of rates and inflation. Higher inflation well that's another story. Just guesswork at the end of the day ?

Savings Calculator With Regular Deposits/Withdrawals (thecalculatorsite.com)

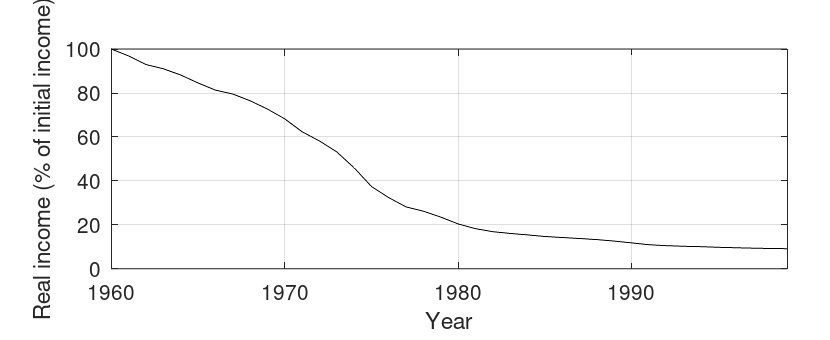

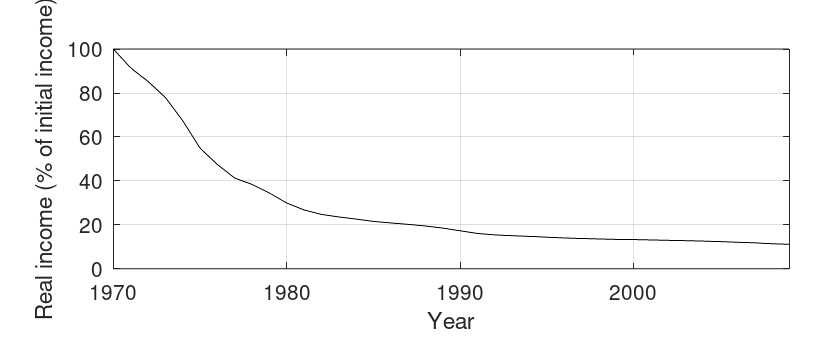

For example, here is a plot of the real value of constant nominal income as a function of time starting in 1960 (UK cpi from macrohistory.net)

and then in 1970

While the real income after 20 years is similar, the first 10 years is a nightmare for the 1970 case with it falling by a horrible 70% by the end of the 1970s.

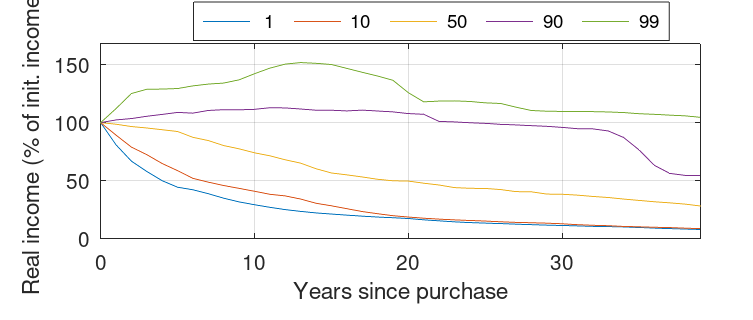

And the percentiles from history (i.e. the 1st percentile is the worst 1% of cases, the 50% percentile is the median etc.)

You'll note that the income goes up in about 10% of cases, that is due to deflation in the years prior to the 1930s. However, even in the median case, income in real terms is about 25% of the initial income after 40 years.

Of course, while history tells us what has happened (and may suggest the magnitude of inflation risk a level annuity is exposed to), it doesn't tell us what will happen.

1 -

Well as I mentioned above, there was an outlier scenario where the fund lost 50% of its value in about 2.5 years, but, it then succeeded. ERN research seemed to conclude that you need to be at least 80% in equities if you have a long 40 years or more horizon, especially if you are FIRE and looking at 50 or 60 years (although also concluded that going to 60/40 at retirement and then ramping up from there in the first 10 years helped a bit as well, but didn't make a huge difference).OldScientist said:

With 50% UK and 50% US stocks (which is, obviously, not the same as a properly global portfolio) I get about 3.3% for 44 years with ~8% failure for WR=4% (with no fees), so within the level of uncertainty. Not sure I'd be willing to go with 100% stocks though!Pat38493 said:

Yes. I guess the interesting question is whether this portfolio is actually a good mix to have going forward if you are trying to start a 44 year retirement plan, or if actually they have found a kind of "path" through the past history which for whatever reason is almost impossible that it will happen in the future.OldScientist said:

That's an interesting set of investments - I would guess that is the reason for the very different results, since even using a portfolio with 60% US stocks, 20% UK stocks, 10% UK bonds, and 10% UK cash, the SWR only reaches 3.4% (compared to 2.6% for UK only).Pat38493 said:This is the asset mix used for the 80/20 - there is possibly some min/maxing of stats based on past history that will obviously not give the same results going forward?

However - if I change the portfolio to HSBC global fund (100% global equities) I can still get 100% success on a 3.6% WR and 3% failure rate on 4% (according to Timeline).

As discussed on another recent thread, it's debatable whether anybody would dare to keep their withdrawal plan constant if they saw a 50% reduction in the first 5% of their time period, even if they knew that this had worked out ok in the past.1 -

More views and an old poster appears.

Is anyone up for an annuity? - Retirement - Forums - Citywire Funds Insider Forum

1 -

Reference getting an Annuity deferred, ie, buy it now and a start date in the future?OldScientist said:

There is some information on deferred annuities at https://www.onlinemoneyadvisor.co.uk/pensions/pension-annuities/deferred-annuity/RogerPensionGuy said:

Is it possible to sign up for an annuity rate a person likes today and it only starts paying out at a point in the future.peterg1965 said:

It's a good point. However, i am quite a high earner, already have a DB pension in payment and am over the threshold of the additional rate (45% Income tax) so taking another source of income form an annuity whilst still working would see 45% of it disappear in tax straight away. I cant stomach that!RogerPensionGuy said:

You say three years away.peterg1965 said:Its unfortunate timing for me, as I am 3 years away form being in a position to stop work and start taking the DC element of my pension income. With a likely £500,000 sum available (in 3 years when i will be 61), a fixed rate annuity with 50% spousal income and a 10 year guarantee is coming in at about £32,000, this would be compelling.

The alternative, which has been my intent all along, was to do a staged drawdown at £36k for 2 years, reducing to £30k for 3 years, then £24k for the following 14 years (until 80) then £10k a year from then on. Staging as SP starts (myself and wife) and mortgage paid off.

The prospect of a zero risk £32000/year annuity would trump that drawdown plan in my eyes.

Lets see what the annuity landscape in like at the end of 2026!

If you really liked annuity rates at anytime like now, could you not buy an annuity at that point in time?

I'm always amazed when stopping paid employment and activation of pension vehicles appears to be hard linked in a spot time, I've never considered this the case, I am and was always happy to overlap them or a gap in between these matter.

I'm imagine if and when annuity rates jump up another 1% or 2% maybe lots of people will buy annuities before they thought they would.

Example, sign up now and the monthly income just parks itself up inside the plan if you see what I mean, then somehow them 3 years of shelved payments then allow a sensible withdrawal method in a tax efficient way, ie, could annuity flow be plonked in a SIPP?

Or is it possible that a person can lock in to a an annuity today that only starts paying out at a point in the future, like when paid employment stops if you see what I mean.

Or guess if annuity rates went so attractive this Xmas time, just buy one and absorb paying higher or highest rate Income tax for jisr a few years as in the long-term it generated a better net return for a person.

Whilst posting here, to anyone, is it possible a person can buy lock in an annuity now that only starts paying out in a year or two as this is probably something that would suit me, any information much appreciated?

I've yet to find any information online on the rates available though... perhaps one of our resident IFAs could shed some light.

Aviva say they don't do such a vehicle, their direct Annuity rate is not the best/highest by a long chalk anyways as if taking it now(ie, say 10 weeks from accepting the deal/rate) they are happy if I chunk out a % of my low cost SIPP to another provider and take the 25% as it leaves them to Annuity provider or the full % goes to Annuity provider and I can keep open my old company agreed low cost SIPP as per normal with Aviva. This Aviva pot will probably be kept as a slow feeding flexi-drawdown.

***************

The moneyhelper site/link below is great for doing Deferred Annuity Quotes, after getting a dated quote I just went back to draw date page and changed date, I used Sep23, Jul24 and May25 and then expand the quote page getting all the different companies.

Next step for me would be try the various companies in the quotes direct and see what numbers pop up.

.

https://comparison.moneyhelper.org.uk/en/guaranteed-income-for-life/quotes1 -

I'm not sure that the moneyhelper is giving quotes for a deferred annuity, rather than ones that you would get if you were the age that you have deferred to. For example,RogerPensionGuy said:

Reference getting an Annuity deferred, ie, buy it now and a start date in the future?OldScientist said:

There is some information on deferred annuities at https://www.onlinemoneyadvisor.co.uk/pensions/pension-annuities/deferred-annuity/RogerPensionGuy said:

Is it possible to sign up for an annuity rate a person likes today and it only starts paying out at a point in the future.peterg1965 said:

It's a good point. However, i am quite a high earner, already have a DB pension in payment and am over the threshold of the additional rate (45% Income tax) so taking another source of income form an annuity whilst still working would see 45% of it disappear in tax straight away. I cant stomach that!RogerPensionGuy said:

You say three years away.peterg1965 said:Its unfortunate timing for me, as I am 3 years away form being in a position to stop work and start taking the DC element of my pension income. With a likely £500,000 sum available (in 3 years when i will be 61), a fixed rate annuity with 50% spousal income and a 10 year guarantee is coming in at about £32,000, this would be compelling.

The alternative, which has been my intent all along, was to do a staged drawdown at £36k for 2 years, reducing to £30k for 3 years, then £24k for the following 14 years (until 80) then £10k a year from then on. Staging as SP starts (myself and wife) and mortgage paid off.

The prospect of a zero risk £32000/year annuity would trump that drawdown plan in my eyes.

Lets see what the annuity landscape in like at the end of 2026!

If you really liked annuity rates at anytime like now, could you not buy an annuity at that point in time?

I'm always amazed when stopping paid employment and activation of pension vehicles appears to be hard linked in a spot time, I've never considered this the case, I am and was always happy to overlap them or a gap in between these matter.

I'm imagine if and when annuity rates jump up another 1% or 2% maybe lots of people will buy annuities before they thought they would.

Example, sign up now and the monthly income just parks itself up inside the plan if you see what I mean, then somehow them 3 years of shelved payments then allow a sensible withdrawal method in a tax efficient way, ie, could annuity flow be plonked in a SIPP?

Or is it possible that a person can lock in to a an annuity today that only starts paying out at a point in the future, like when paid employment stops if you see what I mean.

Or guess if annuity rates went so attractive this Xmas time, just buy one and absorb paying higher or highest rate Income tax for jisr a few years as in the long-term it generated a better net return for a person.

Whilst posting here, to anyone, is it possible a person can buy lock in an annuity now that only starts paying out in a year or two as this is probably something that would suit me, any information much appreciated?

I've yet to find any information online on the rates available though... perhaps one of our resident IFAs could shed some light.

Aviva say they don't do such a vehicle, their direct Annuity rate is not the best/highest by a long chalk anyways as if taking it now(ie, say 10 weeks from accepting the deal/rate) they are happy if I chunk out a % of my low cost SIPP to another provider and take the 25% as it leaves them to Annuity provider or the full % goes to Annuity provider and I can keep open my old company agreed low cost SIPP as per normal with Aviva. This Aviva pot will probably be kept as a slow feeding flexi-drawdown.

***************

The moneyhelper site/link below is great for doing Deferred Annuity Quotes, after getting a dated quote I just went back to draw date page and changed date, I used Sep23, Jul24 and May25 and then expand the quote page getting all the different companies.

Next step for me would be try the various companies in the quotes direct and see what numbers pop up.

.

https://comparison.moneyhelper.org.uk/en/guaranteed-income-for-life/quotes

1) If you are 65, then get a quote for a deferred annuity that starts when you are 85 (i.e. 20 years hence).

2) Now get a quote for an 85 year old - I've found it is the same as in step 1.

My understanding (based on US practices, where deferred annuities are available) is that a deferred annuity (where you hand over a single premium now for say, 20 years time), gives the insurance company 20 years to grow your premium before paying out (and for the sum to gain mortality benefits as well since, in the UK, about 40% of 65 year olds die before getting to 85). In other words, the effective payout rate in 20 years time should be greater than it is now and you lock in current bond yields.

Of course, you could self-defer by placing the premium in inflation linked gilts with a 20 year maturity and buy an annuity with the proceeds, but there would be interest rate risk and no mortality credits, so, under those circumstances, you would be better off buying an inflation linked annuity with a long guarantee period right away.

1 -

My view was probably short term, example a person likes the current annuity rate an outfit will give if you plonk them money today.OldScientist said:

I'm not sure that the moneyhelper is giving quotes for a deferred annuity, rather than ones that you would get if you were the age that you have deferred to. For example,RogerPensionGuy said:

Reference getting an Annuity deferred, ie, buy it now and a start date in the future?OldScientist said:

There is some information on deferred annuities at https://www.onlinemoneyadvisor.co.uk/pensions/pension-annuities/deferred-annuity/RogerPensionGuy said:

Is it possible to sign up for an annuity rate a person likes today and it only starts paying out at a point in the future.peterg1965 said:

It's a good point. However, i am quite a high earner, already have a DB pension in payment and am over the threshold of the additional rate (45% Income tax) so taking another source of income form an annuity whilst still working would see 45% of it disappear in tax straight away. I cant stomach that!RogerPensionGuy said:

You say three years away.peterg1965 said:Its unfortunate timing for me, as I am 3 years away form being in a position to stop work and start taking the DC element of my pension income. With a likely £500,000 sum available (in 3 years when i will be 61), a fixed rate annuity with 50% spousal income and a 10 year guarantee is coming in at about £32,000, this would be compelling.

The alternative, which has been my intent all along, was to do a staged drawdown at £36k for 2 years, reducing to £30k for 3 years, then £24k for the following 14 years (until 80) then £10k a year from then on. Staging as SP starts (myself and wife) and mortgage paid off.

The prospect of a zero risk £32000/year annuity would trump that drawdown plan in my eyes.

Lets see what the annuity landscape in like at the end of 2026!

If you really liked annuity rates at anytime like now, could you not buy an annuity at that point in time?

I'm always amazed when stopping paid employment and activation of pension vehicles appears to be hard linked in a spot time, I've never considered this the case, I am and was always happy to overlap them or a gap in between these matter.

I'm imagine if and when annuity rates jump up another 1% or 2% maybe lots of people will buy annuities before they thought they would.

Example, sign up now and the monthly income just parks itself up inside the plan if you see what I mean, then somehow them 3 years of shelved payments then allow a sensible withdrawal method in a tax efficient way, ie, could annuity flow be plonked in a SIPP?

Or is it possible that a person can lock in to a an annuity today that only starts paying out at a point in the future, like when paid employment stops if you see what I mean.

Or guess if annuity rates went so attractive this Xmas time, just buy one and absorb paying higher or highest rate Income tax for jisr a few years as in the long-term it generated a better net return for a person.

Whilst posting here, to anyone, is it possible a person can buy lock in an annuity now that only starts paying out in a year or two as this is probably something that would suit me, any information much appreciated?

I've yet to find any information online on the rates available though... perhaps one of our resident IFAs could shed some light.

Aviva say they don't do such a vehicle, their direct Annuity rate is not the best/highest by a long chalk anyways as if taking it now(ie, say 10 weeks from accepting the deal/rate) they are happy if I chunk out a % of my low cost SIPP to another provider and take the 25% as it leaves them to Annuity provider or the full % goes to Annuity provider and I can keep open my old company agreed low cost SIPP as per normal with Aviva. This Aviva pot will probably be kept as a slow feeding flexi-drawdown.

***************

The moneyhelper site/link below is great for doing Deferred Annuity Quotes, after getting a dated quote I just went back to draw date page and changed date, I used Sep23, Jul24 and May25 and then expand the quote page getting all the different companies.

Next step for me would be try the various companies in the quotes direct and see what numbers pop up.

.

https://comparison.moneyhelper.org.uk/en/guaranteed-income-for-life/quotes

1) If you are 65, then get a quote for a deferred annuity that starts when you are 85 (i.e. 20 years hence).

2) Now get a quote for an 85 year old - I've found it is the same as in step 1.

My understanding (based on US practices, where deferred annuities are available) is that a deferred annuity (where you hand over a single premium now for say, 20 years time), gives the insurance company 20 years to grow your premium before paying out (and for the sum to gain mortality benefits as well since, in the UK, about 40% of 65 year olds die before getting to 85). In other words, the effective payout rate in 20 years time should be greater than it is now and you lock in current bond yields.

Of course, you could self-defer by placing the premium in inflation linked gilts with a 20 year maturity and buy an annuity with the proceeds, but there would be interest rate risk and no mortality credits, so, under those circumstances, you would be better off buying an inflation linked annuity with a long guarantee period right away.

I only used my age of 60 and to start drawing next month, next year and the year after and the starting figure just ramps up the longer away it starts.

IIRC it was sorta showing for a 61 year old with 100K and no medical or guarantee or spouse etc etc, 6.8Kish till death.

I'm aware inflation is hard to predict, even the experts at the Bank of England cannot do it well, unless the government and Bank change their comments and actions, they will ensure we endure a longish spell of nasty medicine and will be slow stopping treatment until they are 99.99% sure inflation has been reduced and stable.

I'm aware about sequencing of inflation especially in the early years of buying an annuity and tricky to get it right, I do think about how people that took out annuities 2 or 3 years ago are feeling now.

I guess there's always a number and if I see that number I would buy one today.

My possible delaying of payments was just a bit of tax housekeeping.

Cheers.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards