We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Choosing a Money Market fund

Comments

-

How do I actually interpret the information then. The TN25 bond is available on Interactive INvestor with a closing price last week of 0.9231, maturity date of 31/01/2025 and rate 0.25.NedS said:The only thing I'll add (for any newbies) is as a UK investor to ensure you are buying a Sterling money market fund, not any other currency, otherwise you are buying the currency movements which may be far greater than any underlying interest rate, and your very low risk MMF is now effectively at a far higher risk level.In the OP's situation, they may also like to consider gilts - TN25, for example, matures 31/01/2025 and currently yields around 5.2% if held to maturity. Obviously that's more than the current SONIA rate, and reflects the markets expectations that interest rates will rise further. Whether locking in a guaranteed rate of 5.2 % now for the next 18 months will out-perform a SONIA tracker over the next 18 months, who knows? You could hedge your bets buying TN25 now with any available (large) cash amounts, and then drip feed future monthly contributions into the MMF hoping for future rate rises.

What does the 0.25 mean? Is this a monthly interest rate or what?

So does this mean that if I buy this and hold it until 31/01/2025, I will receive a payment equivalent to the guaranteed interest amount into my cash fund, and the bond is automatically sold at that point? I am not sure how it works in practice when buying this?

If I buy the bond now do I get the entire interest from the date the bond was first issued at the maturity date, or only the interest pro rated to when I bought it?

Also is the original price of this bond 1, so the bond currently costs a bit less than the original Treasury value?

Is there a calculator or something that allows me to work out what I will actually get if buying the fund at today’s price?0 -

You pay £92.31 for the bond. If you keep it until 31/1/25 they (the government) will give you £100 for it. So your gain comes from the difference between the buying and redemption price. I believe the interest is paid twice yearly, but it's 1/4% - that's 25p so not a big factor. You only get the interest payments from the time after you buy it. Sometimes the purchase price is adjusted because you might be about to receive an interest payment. If somebody held it for 5+ months, then you held it for a week and got the whole interest payment, that's unfair, so they charge you the upcoming payment on top of the quoted price. If the price you see is the price you pay, that's called a clean price. If you have to pay back some interest it's called a dirty price. So, normally, you need to check that. In this case, the interest is negligible, so it matters little.

The price will likely go up as maturity approaches (gradually approaching £100), so you could potentially sell at a fair price in the future if you wanted your money+gains back.4 -

There is a very useful thread on the savings and investment board regarding gilts:Pat38493 said:

How do I actually interpret the information then. The TN25 bond is available on Interactive INvestor with a closing price last week of 0.9231, maturity date of 31/01/2025 and rate 0.25.NedS said:The only thing I'll add (for any newbies) is as a UK investor to ensure you are buying a Sterling money market fund, not any other currency, otherwise you are buying the currency movements which may be far greater than any underlying interest rate, and your very low risk MMF is now effectively at a far higher risk level.In the OP's situation, they may also like to consider gilts - TN25, for example, matures 31/01/2025 and currently yields around 5.2% if held to maturity. Obviously that's more than the current SONIA rate, and reflects the markets expectations that interest rates will rise further. Whether locking in a guaranteed rate of 5.2 % now for the next 18 months will out-perform a SONIA tracker over the next 18 months, who knows? You could hedge your bets buying TN25 now with any available (large) cash amounts, and then drip feed future monthly contributions into the MMF hoping for future rate rises.

What does the 0.25 mean? Is this a monthly interest rate or what?

So does this mean that if I buy this and hold it until 31/01/2025, I will receive a payment equivalent to the guaranteed interest amount into my cash fund, and the bond is automatically sold at that point? I am not sure how it works in practice when buying this?

If I buy the bond now do I get the entire interest from the date the bond was first issued at the maturity date, or only the interest pro rated to when I bought it?

Also is the original price of this bond 1, so the bond currently costs a bit less than the original Treasury value?

Is there a calculator or something that allows me to work out what I will actually get if buying the fund at today’s price?

https://forums.moneysavingexpert.com/discussion/6309692/gilts-understanding/p1

This thread might also help:

https://forums.moneysavingexpert.com/discussion/6456439/a-couple-of-simple-gilt-questions-i-think/p1

'Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it' - Albert Einstein.1 -

A bit of drift, but I'm a bit confused, any pointers or information most welcome on my not understandings.

I have a Vanguard and Aviva ISAs and normally just leave the pot in their pretty standard worldwide index tracker units and like most else fairly flatish the last 12/18 months and decided to swop some units in to their money market sterling for a change(bar of soap I know)

The Aviva units increase daily Tuesday to Friday and I notice on a Monday it jumps up 3 fold approximately.

Reference the Aviva, I'm surprised how different the increase is daily, I thought it would be pretty steady and it's certainly way below say 5% Sonia rate?

The Vanguard money market cash is completely different to understand, it just puts cash in to the ISA once a month and again it is way short of Sonia 5% range?

I've looked on their sites and cannot find a simple page information showing exactly how much these money market funds get daily?

One reason I've plonked in to money markets is I'm guessing IMHO markets are still pretty high currently and I expect we will see some fairly reasonable falls over the next 3 to 18 months and plan to buy back normal units whilst in the dip, I'm aware trying to time the markets normally ends up with milk on the floor, but I just fancy taking a punt.

Apart from money markets sterling units, is their any units available on them providers that may behave somewhat like Sonia, IMHO I'm guessing USA and 🇬🇧 bank rates will peak about Xmas(+/-) this year and a slow slow ramp down to the average longterm rates in the early 2025, my cunning plan is to lock in to interest rates this Xmas time if you see what I mean.

Any pointers must welcome.

Cheers Roger.0 -

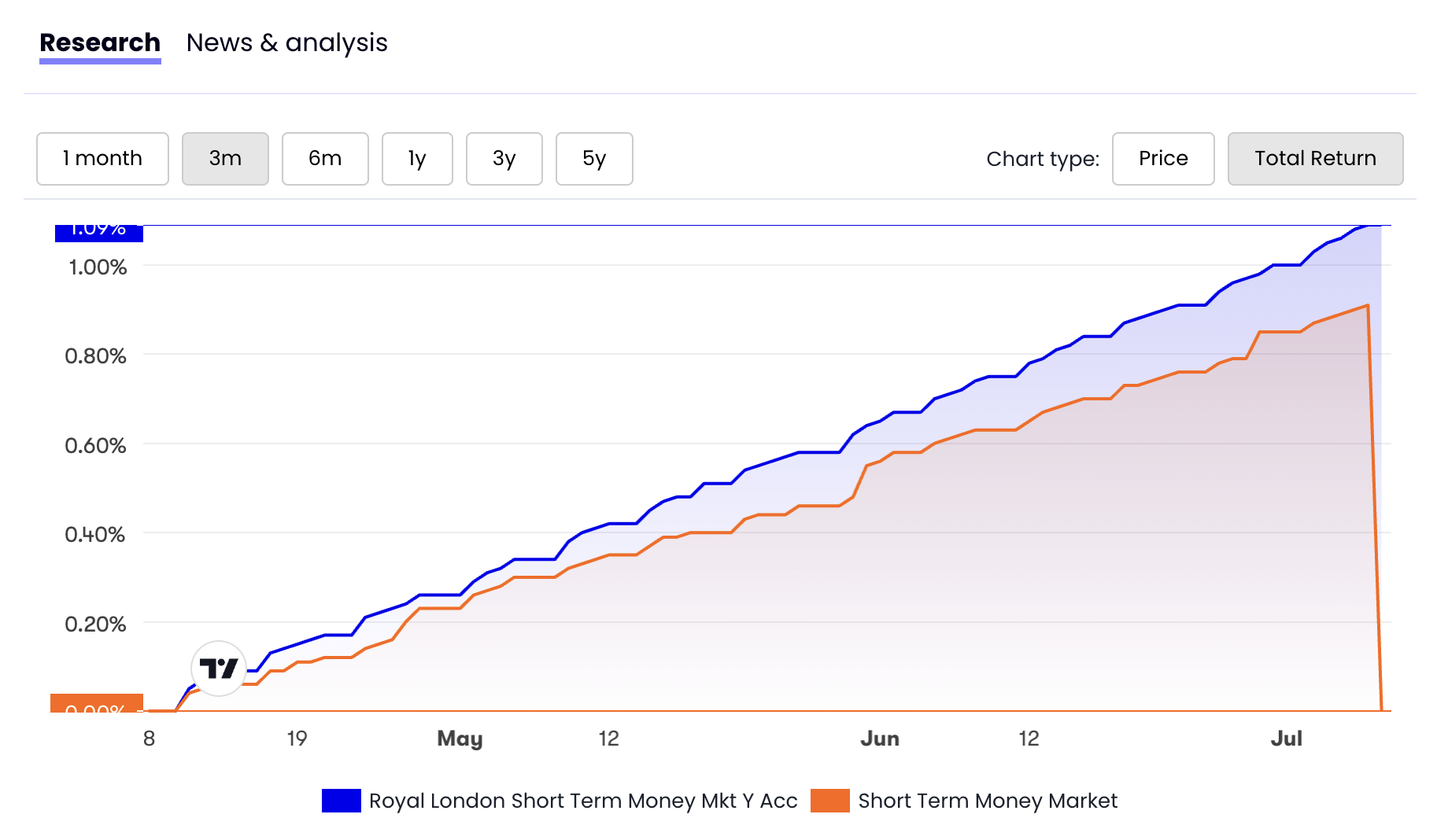

Do you know if the MMFs are income or accumulation units, they behave differently. I have the Royal London STMMF acc fund, and this has a steady rise week to week. You say 'certainly way below say 5% Sonia rate', you are aware this is the approximate annual increase in the fund? Looking at the past 6 months, the RL STMMF has returned ~2% (so ~4% annualised), I expect this to increase going forward. The day to day change would be very small.RogerPensionGuy said:A bit of drift, but I'm a bit confused, any pointers or information most welcome on my not understandings.

I have a Vanguard and Aviva ISAs and normally just leave the pot in their pretty standard worldwide index tracker units and like most else fairly flatish the last 12/18 months and decided to swop some units in to their money market sterling for a change(bar of soap I know)

The Aviva units increase daily Tuesday to Friday and I notice on a Monday it jumps up 3 fold approximately.

Reference the Aviva, I'm surprised how different the increase is daily, I thought it would be pretty steady and it's certainly way below say 5% Sonia rate?

The Vanguard money market cash is completely different to understand, it just puts cash in to the ISA once a month and again it is way short of Sonia 5% range?

I've looked on their sites and cannot find a simple page information showing exactly how much these money market funds get daily?

One reason I've plonked in to money markets is I'm guessing IMHO markets are still pretty high currently and I expect we will see some fairly reasonable falls over the next 3 to 18 months and plan to buy back normal units whilst in the dip, I'm aware trying to time the markets normally ends up with milk on the floor, but I just fancy taking a punt.

Apart from money markets sterling units, is their any units available on them providers that may behave somewhat like Sonia, IMHO I'm guessing USA and 🇬🇧 bank rates will peak about Xmas(+/-) this year and a slow slow ramp down to the average longterm rates in the early 2025, my cunning plan is to lock in to interest rates this Xmas time if you see what I mean.

Any pointers must welcome.

Cheers Roger.'Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it' - Albert Einstein.1 -

The Vanguard fund is based on SONIA, but don't forget that about 98% of the bonds in there have a spread of maturity times made of up to 1 month, up to 3 months and some up to 6 months lifetime. So there is always a lag compared to the current SONIA rate until those "short term" bonds mature.Check the Distribution by credit maturity (% of fund) here:

If you want to be rich, live like you're poor; if you want to be poor, live like you're rich.1 -

I think the Aviva is accumulation and Vanguard income.Doctor_Who said:

Do you know if the MMFs are income or accumulation units, they behave differently. I have the Royal London STMMF acc fund, and this has a steady rise week to week. You say 'certainly way below say 5% Sonia rate', you are aware this is the approximate annual increase in the fund? Looking at the past 6 months, the RL STMMF has returned ~2% (so ~4% annualised), I expect this to increase going forward. The day to day change would be very small.RogerPensionGuy said:A bit of drift, but I'm a bit confused, any pointers or information most welcome on my not understandings.

I have a Vanguard and Aviva ISAs and normally just leave the pot in their pretty standard worldwide index tracker units and like most else fairly flatish the last 12/18 months and decided to swop some units in to their money market sterling for a change(bar of soap I know)

The Aviva units increase daily Tuesday to Friday and I notice on a Monday it jumps up 3 fold approximately.

Reference the Aviva, I'm surprised how different the increase is daily, I thought it would be pretty steady and it's certainly way below say 5% Sonia rate?

The Vanguard money market cash is completely different to understand, it just puts cash in to the ISA once a month and again it is way short of Sonia 5% range?

I've looked on their sites and cannot find a simple page information showing exactly how much these money market funds get daily?

One reason I've plonked in to money markets is I'm guessing IMHO markets are still pretty high currently and I expect we will see some fairly reasonable falls over the next 3 to 18 months and plan to buy back normal units whilst in the dip, I'm aware trying to time the markets normally ends up with milk on the floor, but I just fancy taking a punt.

Apart from money markets sterling units, is their any units available on them providers that may behave somewhat like Sonia, IMHO I'm guessing USA and 🇬🇧 bank rates will peak about Xmas(+/-) this year and a slow slow ramp down to the average longterm rates in the early 2025, my cunning plan is to lock in to interest rates this Xmas time if you see what I mean.

Any pointers must welcome.

Cheers Roger.

I get the data I can see per day and multiple it by 365 daze and divide them by each other and get the % uplift.

0 -

Noted thanks, I did call up Vanguard and a chap tried explaining it to me, it just confused me(don't take much)Bravepants said:The Vanguard fund is based on SONIA, but don't forget that about 98% of the bonds in there have a spread of maturity times made of up to 1 month, up to 3 months and some up to 6 months lifetime. So there is always a lag compared to the current SONIA rate until those "short term" bonds mature.Check the Distribution by credit maturity (% of fund) here:

He explains about the 28th day of every month and you must of held the unit or units for a certain time, it's certainly not as simple as my post office savings account blue book I used to have in the 70s.1 -

Yes, but unlike cash earning interest (e.g. Chip) the return in a MMF is not a straight line......compared to equities it's straight, compared to cash it's not! Here is the RL acc fund over the past 3 months. For some short periods it's flat, if you calculated the gain on those days it would be zero! My suggestion: don't keep looking at it every day/week/month!RogerPensionGuy said:

I think the Aviva is accumulation and Vanguard income.Doctor_Who said:

Do you know if the MMFs are income or accumulation units, they behave differently. I have the Royal London STMMF acc fund, and this has a steady rise week to week. You say 'certainly way below say 5% Sonia rate', you are aware this is the approximate annual increase in the fund? Looking at the past 6 months, the RL STMMF has returned ~2% (so ~4% annualised), I expect this to increase going forward. The day to day change would be very small.RogerPensionGuy said:A bit of drift, but I'm a bit confused, any pointers or information most welcome on my not understandings.

I have a Vanguard and Aviva ISAs and normally just leave the pot in their pretty standard worldwide index tracker units and like most else fairly flatish the last 12/18 months and decided to swop some units in to their money market sterling for a change(bar of soap I know)

The Aviva units increase daily Tuesday to Friday and I notice on a Monday it jumps up 3 fold approximately.

Reference the Aviva, I'm surprised how different the increase is daily, I thought it would be pretty steady and it's certainly way below say 5% Sonia rate?

The Vanguard money market cash is completely different to understand, it just puts cash in to the ISA once a month and again it is way short of Sonia 5% range?

I've looked on their sites and cannot find a simple page information showing exactly how much these money market funds get daily?

One reason I've plonked in to money markets is I'm guessing IMHO markets are still pretty high currently and I expect we will see some fairly reasonable falls over the next 3 to 18 months and plan to buy back normal units whilst in the dip, I'm aware trying to time the markets normally ends up with milk on the floor, but I just fancy taking a punt.

Apart from money markets sterling units, is their any units available on them providers that may behave somewhat like Sonia, IMHO I'm guessing USA and 🇬🇧 bank rates will peak about Xmas(+/-) this year and a slow slow ramp down to the average longterm rates in the early 2025, my cunning plan is to lock in to interest rates this Xmas time if you see what I mean.

Any pointers must welcome.

Cheers Roger.

I get the data I can see per day and multiple it by 365 daze and divide them by each other and get the % uplift.

'Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it' - Albert Einstein.2 -

RogerPensionGuy said:A bit of drift, but I'm a bit confused, any pointers or information most welcome on my not understandings.

I have a Vanguard and Aviva ISAs and normally just leave the pot in their pretty standard worldwide index tracker units and like most else fairly flatish the last 12/18 months and decided to swop some units in to their money market sterling for a change(bar of soap I know)

The Aviva units increase daily Tuesday to Friday and I notice on a Monday it jumps up 3 fold approximately.

Reference the Aviva, I'm surprised how different the increase is daily, I thought it would be pretty steady and it's certainly way below say 5% Sonia rateThat's because the price on a Monday has to reflect the interest (or return) from Sat, Sun and Monday hence a gain approximately 3 fold the 'daily rate' to account for the weekend when markets are closed and the fund cannot be priced. You still earn interest 7 days per week, not just five Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter0

Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards