We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Credit card debt has spiralled

Comments

-

01.12.2020 - CC £16,839 / Loan £18,820 / EF £0

03.07.2023 - CC (0%) £9,859 / Loan £0 / Savings £10,1100 -

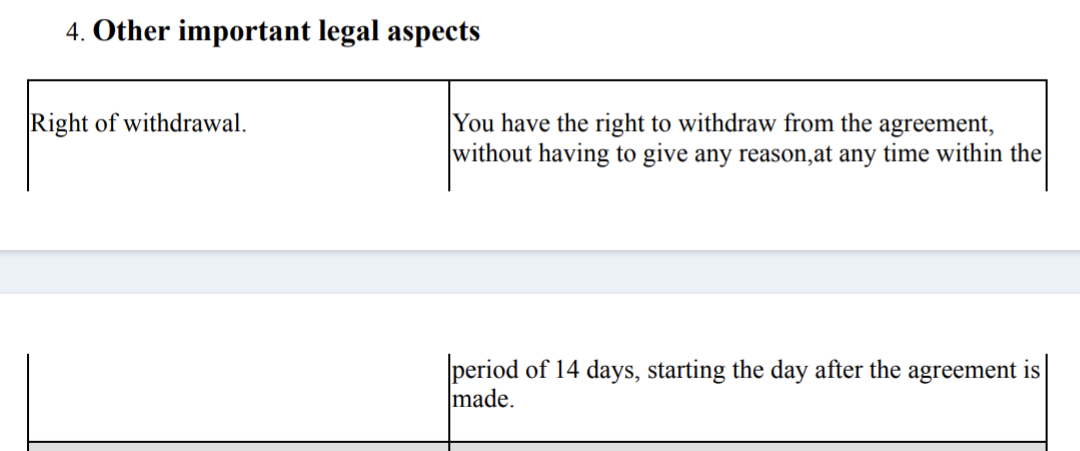

That's all it says.0 -

Oh and this.0 -

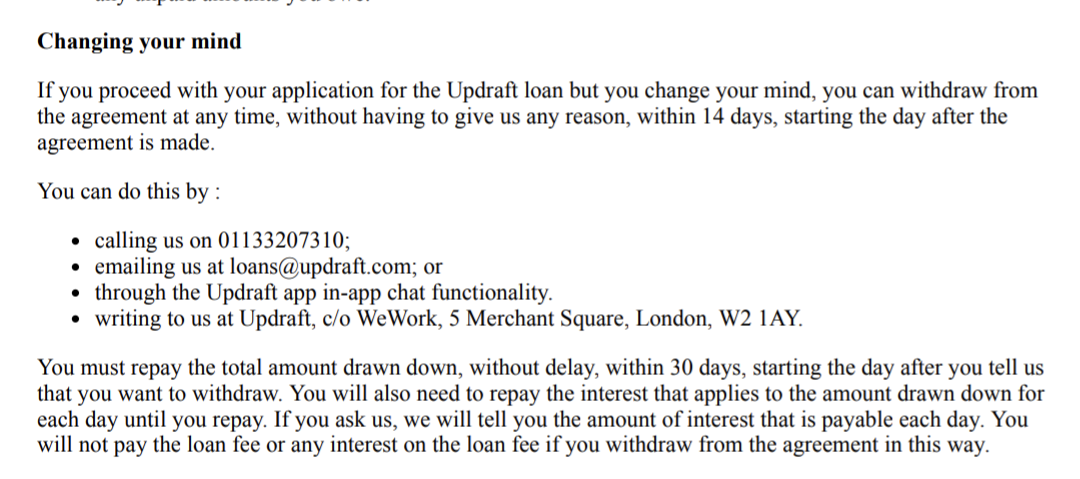

I'm not a legal expert, but I would let them know in writing (their t and C's say what they consider to be in writing) that you are withdrawing and pay the money back. You might need to pay a day of interest (how do you actually pay it back? If by transfer then check how much you can transfer out of your bank account each day), so after the transfer, call and ask them to calculate that if it is due. Tell them to show you where it says that you have to pay £240 if they say it again - sometimes it's just the customer service rep not knowing the products well enough.Statement of Affairs (SOA) link: https://www.lemonfool.co.uk/financecalculators/soa.phpFor free, non-judgemental debt advice, try: Stepchange or National Debtline. Beware fee charging companies with similar names.0

-

Thanks. I have already paid it back the second it was received. It was in my bank for less than 3 mins. Surely that can't warrant any punishmentkimwp said:I'm not a legal expert, but I would let them know in writing (their t and C's say what they consider to be in writing) that you are withdrawing and pay the money back. You might need to pay a day of interest (how do you actually pay it back? If by transfer then check how much you can transfer out of your bank account each day), so after the transfer, call and ask them to calculate that if it is due. Tell them to show you where it says that you have to pay £240 if they say it again - sometimes it's just the customer service rep not knowing the products well enough.0 -

I believe the only thing they can charge for is a daily interest rate (which they normally have to state) which is only applicable for up to 30 consecutive days once the ‘right of withdrawal’ has been exercised, not sure it would amount to £240 so I would certainly dispute that, however, what you don’t want to do is get yourself in a situation whereby the £240 turns in to a ‘non-payment’ / ‘missed payment’ and becomes reflected on your Credit Report.

If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing0 -

I know. I will pay if it gets to that. Or I'll just tell them to send me the money back and take the loan route after all. Pretty poor form from a company who advertise themselves on getting people out of debt and helping to consolidate to then unfairly heap more debt onto someone.MrFrugalFever said:I believe the only thing they can charge for is a daily interest rate (which they normally have to state) which is only applicable for up to 30 consecutive days once the ‘right of withdrawal’ has been exercised, not sure it would amount to £240 so I would certainly dispute that, however, what you don’t want to do is get yourself in a situation whereby the £240 turns in to a ‘non-payment’ / ‘missed payment’ and becomes reflected on your Credit Report.

0 -

Unfortunately these ‘specialist’ lenders are akin to loan sharks and thrive off of people seeking to find a way out of financial mess. Just take a look at what happened to the PayDay Loan sector!

Keep everything in writing with them in case you need to escalate to the FOS.

Your light at the end of the tunnel is going to be correct usage of 0% CC offers and very disciplined money management.If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing0 -

It would seem to make sense if I am reading your thread right to pay off the very card and as much as possible of the virgin money.

While it is great you have a few at zero percent and a few more cards on the way it is a worry that even with about 9k on interest free you have not been making much if any headroom. Be aware that the deals might dry up soon once the credit card companies sense your weakness and you will quickly spiral out of control. I don't mean that as a dig.

Is there anyway to reduce your child care costs and leave with family or a friend as that is a big burden.1 -

Child care unfortunately is not something we can change but as I mentioned in an earlier post, I feel if I can make a dent in the number over the next 12/18 months on the 0% cards by properly budgeting and cutting costs as much as possible. Then when the oldest child is in school in 2 years and by then I'd hope myself and my partner will be earning more money, then what's left should be quite straightforward to clear in comparison, as you say my childcare is a huge chunk but once this is freed up I can really attack the remainder.th081 said:It would seem to make sense if I am reading your thread right to pay off the very card and as much as possible of the virgin money.

While it is great you have a few at zero percent and a few more cards on the way it is a worry that even with about 9k on interest free you have not been making much if any headroom. Be aware that the deals might dry up soon once the credit card companies sense your weakness and you will quickly spiral out of control. I don't mean that as a dig.

Is there anyway to reduce your child care costs and leave with family or a friend as that is a big burden.

I get your point about not making dents in the debt or making much headroom but the last three years my other half has been on maternity for a large chunk and we moved house, renovated, and on top of that childcare and I just wasn't budgeting. I was putting things on cards thinking what I was paying was more than I was spending when in fact it was the other way around. My plan is to have no cards to physically spend on and to budget properly meaning I will be making inroads.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards