We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Skipton to offer 100% mortgages

Comments

-

I'm in two minds about them.mi-key said:

Hopefully we will never see those again !Aberdeenangarse said:I wonder how long before someone starts flogging 125% Mortgages, like Northern Rock did just before the GFC? I seem to remember that didn’t end well!

Had it not been for the Northern Rock Together mortgage where we borrowed 105% of the property value then we would never have gotten onto the housing ladder.

Yes house prices dropped and we ended up stuck in that house for a lot longer than expected, but it kept a roof over our head and eventually has allowed us to move onto the home that we love now.

Had over 100% mortgages not existed we would most likely still be stuck paying high rents. As it stands we will be mortgage free in the next 10 years.

But there were a lot of people who were left not in a position to pay their mortgages and for them the situation was a lot different. There are still thousands now stuck on legacy Northern Rock mortgages. Its a double edged sword.0 -

I do. I like to sleep st night, I turn business away that does not sit right with me. Thats not to say I am right, but I need to feel comfortable on the cases I place.lojo1000 said:

Do you consider the financial risk it puts families in? If the unexpected happens and you need to sell, it does matter if you borrowed 100% of the purchase price.ACG said:Negative equity only becomes an issue if you are trying to sell. People do not usually plan to buy and then sell within 5 years, at which point I would assume any house price drops would have probably recovered/mostly recovered.

I do not care if my house is worth £1 or £1 million. It is all relative and I have no intentions of moving.

If someone has no deposit and is paying £1,000 a month in rent but can get a 100% mortgage paying £800 a month, is that not doing the person a favour?

As a broker, I am not sure where I stand on it. I think it is a good idea, but in a world where people like to complain and everything is someone elses fault I would be reluctant.

I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.4 -

It wouldnt though.lojo1000 said:I don't think the government should allow anything over 50% debt/equity when buying a house.

Prices would fall to a new equilibrium and from there the financial risk would be lower on both the buyer and the lenders.

It would reduce house prices, but then you have more people who can afford them.

Then you have more people who are unhappy about the amount of deposit needed.

You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.2 -

"It would reduce house prices, but then you have more people who can afford them." - that's the objective, more people can afford them without getting into excess debt.ACG said:

It wouldnt though.lojo1000 said:I don't think the government should allow anything over 50% debt/equity when buying a house.

Prices would fall to a new equilibrium and from there the financial risk would be lower on both the buyer and the lenders.

It would reduce house prices, but then you have more people who can afford them.

Then you have more people who are unhappy about the amount of deposit needed.

You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up.

"Then you have more people who are unhappy about the amount of deposit needed. " - I can live with some unhappy people who want to borrow more since prices will be lower, the interest paid will be less and financial risk to the buyer, bank and taxpayer will be less.

"You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up. " - if rents go up whilst house prices are coming down then the yield is increasing significantly creating an incentive to add supply to the rented sector.

Allowing 100% mortgages is reflective of the issue that house prices are too high relative to incomes. There is not enough income to generate the wealth needed to buy a house without borrowing from the future.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

Yet every month tens of thousands of people manage to obtain a mortgage. Which seems to suggest that people can afford it.lojo1000 said:

"It would reduce house prices, but then you have more people who can afford them." - that's the objective, more people can afford them without getting into excess debt.ACG said:

It wouldnt though.lojo1000 said:I don't think the government should allow anything over 50% debt/equity when buying a house.

Prices would fall to a new equilibrium and from there the financial risk would be lower on both the buyer and the lenders.

It would reduce house prices, but then you have more people who can afford them.

Then you have more people who are unhappy about the amount of deposit needed.

You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up.

"Then you have more people who are unhappy about the amount of deposit needed. " - I can live with some unhappy people who want to borrow more since prices will be lower, the interest paid will be less and financial risk to the buyer, bank and taxpayer will be less.

"You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up. " - if rents go up whilst house prices are coming down then the yield is increasing significantly creating an incentive to add supply to the rented sector.

Allowing 100% mortgages is reflective of the issue that house prices are too high relative to incomes. There is not enough income to generate the wealth needed to buy a house without borrowing from the future.

Every generation has claimed that housing is unaffordable, yet people have still gotten on with life, bought their homes and carried on.2 -

Would you rather have a higher LTV or lower purchase price to achieve the objective of buying a house?RelievedSheff said:

I'm in two minds about them.mi-key said:

Hopefully we will never see those again !Aberdeenangarse said:I wonder how long before someone starts flogging 125% Mortgages, like Northern Rock did just before the GFC? I seem to remember that didn’t end well!

Had it not been for the Northern Rock Together mortgage where we borrowed 105% of the property value then we would never have gotten onto the housing ladder.

Yes house prices dropped and we ended up stuck in that house for a lot longer than expected, but it kept a roof over our head and eventually has allowed us to move onto the home that we love now.

Had over 100% mortgages not existed we would most likely still be stuck paying high rents. As it stands we will be mortgage free in the next 10 years.

But there were a lot of people who were left not in a position to pay their mortgages and for them the situation was a lot different. There are still thousands now stuck on legacy Northern Rock mortgages. Its a double edged sword.

Most would say the latter. So why don't people think that it is good govt policy to limit the max LTV given taxpayer money is at risk when banks get bailed?To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

Last time I checked (maybe its changed) there was limits on LTV - 95% perhaps? And that was only to be a certain percentage of a banks mortgage book (ie. to allow it in limitation).lWould you rather have a higher LTV or lower purchase price to achieve the objective of buying a house?

Most would say the latter. So why don't people think that it is good govt policy to limit the max LTV given taxpayer money is at risk when banks get bailed?

Regulatory compliance then enforces the rest, with far more stringent capital requirements over 75% LTV (I'm out of touch recently, but it was 35% versus 75% or 100% for the subsequent risk weighting capital charge iirc, based on the LTV split of the mortgage amount).Peter

Debt free - finally finished paying off £20k + Interest.1 -

They cannot afford it if they are borrowing to finance the purchase. That is the point.RelievedSheff said:

Yet every month tens of thousands of people manage to obtain a mortgage. Which seems to suggest that people can afford it.lojo1000 said:

"It would reduce house prices, but then you have more people who can afford them." - that's the objective, more people can afford them without getting into excess debt.ACG said:

It wouldnt though.lojo1000 said:I don't think the government should allow anything over 50% debt/equity when buying a house.

Prices would fall to a new equilibrium and from there the financial risk would be lower on both the buyer and the lenders.

It would reduce house prices, but then you have more people who can afford them.

Then you have more people who are unhappy about the amount of deposit needed.

You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up.

"Then you have more people who are unhappy about the amount of deposit needed. " - I can live with some unhappy people who want to borrow more since prices will be lower, the interest paid will be less and financial risk to the buyer, bank and taxpayer will be less.

"You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up. " - if rents go up whilst house prices are coming down then the yield is increasing significantly creating an incentive to add supply to the rented sector.

Allowing 100% mortgages is reflective of the issue that house prices are too high relative to incomes. There is not enough income to generate the wealth needed to buy a house without borrowing from the future.

Every generation has claimed that housing is unaffordable, yet people have still gotten on with life, bought their homes and carried on.

First it was a 30% deposit, then 10%, 5%, then no deposit.

100% mortgages were seen as too risky so in order to keep GDP high, Help to Buy and the 'bank of mum and dad' were introduced. No doubt many people borrow unsecured to help find the deposit.

If you allow people to get into more debt and put more capital into the house versus their incomes to support repayments, then over time houses become less affordable.

Houses are not affordable, people just take more financial risk to find the capital needed.

Why do they do that?

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

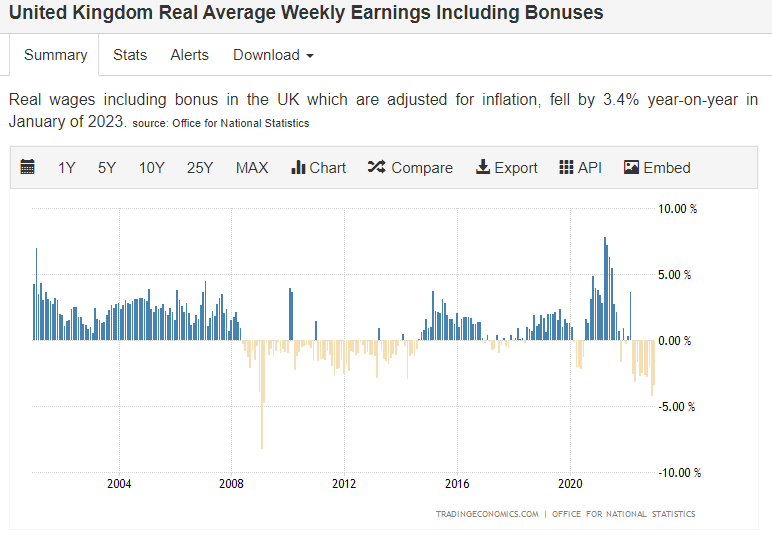

At least pre-2008 when prices last crashed, people had positive growth in real incomes. With the current negative growth in real incomes, what is the conversation in the sales department of mortgage banks? How are they going to get their targets hit in the next 12 months? How are they dealing with affordability criteria mortgage applicants need to meet?

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.1 -

More people can afford them, but no more people can get them as there are no more homes. There is no incentive for developers to build them as there is less profit... which means lower wages to the trades because there are less jobs.lojo1000 said:

"It would reduce house prices, but then you have more people who can afford them." - that's the objective, more people can afford them without getting into excess debt.ACG said:

It wouldnt though.lojo1000 said:I don't think the government should allow anything over 50% debt/equity when buying a house.

Prices would fall to a new equilibrium and from there the financial risk would be lower on both the buyer and the lenders.

It would reduce house prices, but then you have more people who can afford them.

Then you have more people who are unhappy about the amount of deposit needed.

You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up.

"Then you have more people who are unhappy about the amount of deposit needed. " - I can live with some unhappy people who want to borrow more since prices will be lower, the interest paid will be less and financial risk to the buyer, bank and taxpayer will be less.

"You also have more people having to wait until they can buy homes, putting more pressure on rental properties and in turn... putting rent up. " - if rents go up whilst house prices are coming down then the yield is increasing significantly creating an incentive to add supply to the rented sector.

Allowing 100% mortgages is reflective of the issue that house prices are too high relative to incomes. There is not enough income to generate the wealth needed to buy a house without borrowing from the future.

YOU can live with some happy people. Great. So long as you can live with it, forget all of the unhappy people?

If rents go up, landlords buy more property because they can afford to go to a higher price and still put down a 50% deposit because then they can charge more rent as there are less homes for homeowners. Landlords are unlikely to build more homes, why would they? It would cost more to build than it would to buy.

I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards