We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

Too many people are out of work long-term due to sickness. If the NHS was functioning it seems likely that the workforce would be larger and the jobs market not so tight.

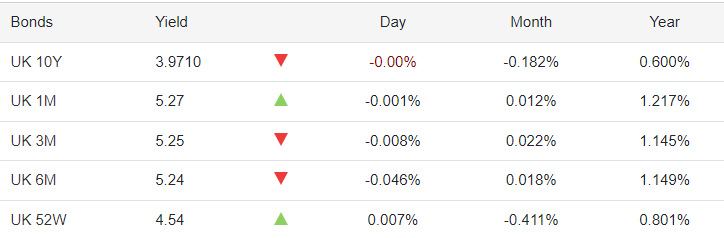

I can console myself about high interest rates due to persistent inflationary pressures (although I maintain they're too high and will have to reduce from late spring or summer despite the data shown above), because I hold a pretty large mortgage debt. Inflation erodes the value of my debt, especially when matched by pay rises.1 -

Most people won`t get pay rises that keep up with their mortgage payments, interest rates have risen at the fastest pace in 40 years, many employers would go under if they had to match that? Also COL absorbs most people"s pay rises, that makes the mortgage even harder to pay for recent buyers.The chatter now on financial media is of more hikes from the FED. The BOE are not obliged to reduce rates, the overall economy is much more important than the small numbers of people who will get into serious trouble with their mortgage debt, as always they will just follow the FED or risk a run on the currency.Strummer22 said:Too many people are out of work long-term due to sickness. If the NHS was functioning it seems likely that the workforce would be larger and the jobs market not so tight.

I can console myself about high interest rates due to persistent inflationary pressures (although I maintain they're too high and will have to reduce from late spring or summer despite the data shown above), because I hold a pretty large mortgage debt. Inflation erodes the value of my debt, especially when matched by pay rises.1 -

And a lot of the money that was printed was used to support HPI, then lost to average house buyers as it was used to over pay for houses based upon HPI being a great thing and has then been skimmed off.Altior said:

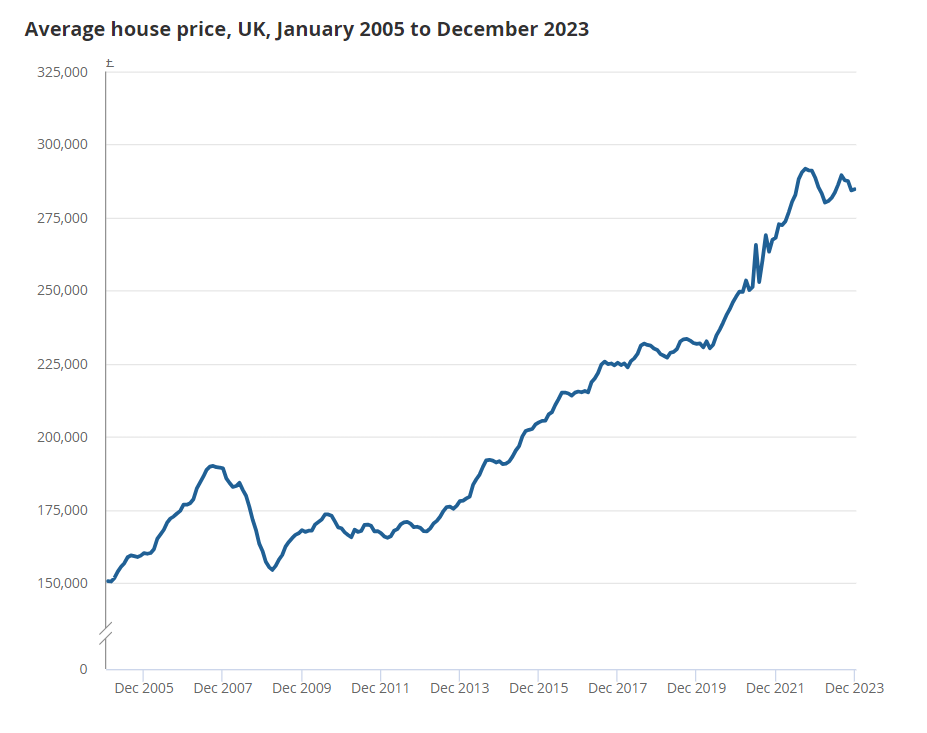

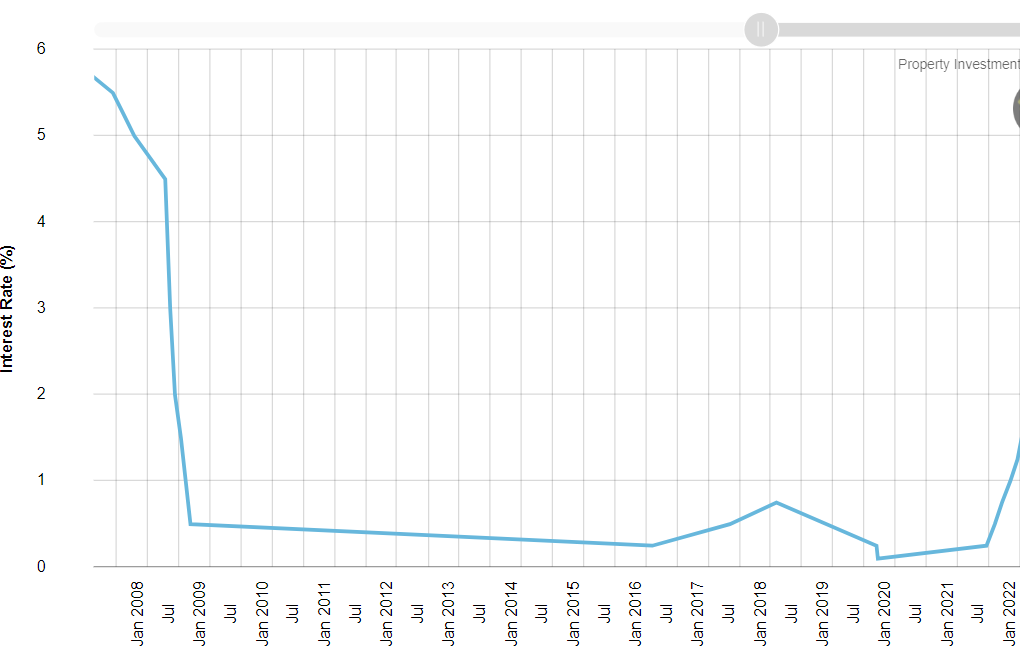

Here is the clear inverse relationship. The av house price explosion is almost purely down to money printing, combined with an extremely long era of effective negative interest rates. Money printing + cost free borrowing = asset inflation. Housing supply is (almost) irrelevant, and you can throw in population growth into double digit millions over a couple of decades.lojo1000 said:

1. When people who previously rented buy a house, they no longer are creating demand to rent a house. The market is clearly skewed toward creating higher house prices else the price/wage ratio would not have increased from around 3 to 8 now.MobileSaver said:lojo1000 said:

You're cherry picking from my posts so I will repeat in full my suggestion re BTL:MobileSaver said:lojo1000 said:

Govt should use tax policy to incentive BTL industry to bring in to use housing which is not in use (thereby raising supply of homes for rent). Waive stamp duty on houses not in use >1 year if brought in use within 1 year post purchase. The BTL landlord gets a stamp duty bill as normal on purchase but if the property was not previously in use this can deferred for 1 year if the buyer elects at time of purchase. Duty becomes due in 1 year unless BTL landlord evidences property is now brought into use.MobileSaver said:lojo1000 said:

The reason why there seems to be a shortage of houses to buy was that so many were bought by BTL (previously owner-occupied houses) to put into the rental sector thereby reducing housing available to buy.MobileSaver said:lojo1000 said:

I'm not sure whether you mean somewhere to buy, as opposed to somewhere to rent or buy?MobileSaver said:

Ignoring the inconvenient truth that a third of all property bought in the UK is bought with cash and no debt... what is the alternative for Joe Bloggs and his partner who need somewhere to live?lojo1000 said:

The price of assets rising is not the illogical result, it's peoples willingness to enter into debt to buy those assets.I don't see that it really makes much difference? Everyone needs somewhere to live and "debt" is simply owing someone money.You either buy and then you owe money to the bank every month or you rent and you owe money to the landlord every month... both are a necessary debt.lojo1000 said:it is very hard not to over commit to debt. Renting, whilst all around you are paying incredible multiples of their income on housing and seeing them 'get on the property ladder', is hard for most people.Typically monthly rents are higher than monthly mortgages and fundamentally mortgages are normally paid off after so many years while rent has to be paid every single month for pretty much the rest of your life. Simply by looking at renting v buying from a debt point of view, it's clear that buying is almost always the smarter option as at the end of the day it's the lesser "debt".lojo1000 said:Also, I understand many people view ownership differently from rent in terms of the security it gives them.That would be because they obviously are completely different. If you buy and pay your mortgage every month then it's your house so you can stay there forever if you want and pretty much do whatever you want within your own home.Conversely if you rent then you don't have either of those luxuries; it's not your house so you can be made to leave if the landlord no longer wants to rent to you and you're limited in what you can do in your own home.lojo1000 said:My practical solution is to limit the amount of leverage allowed in buying a house. Reducing debt, reduces returns to equity in the purchase and hence BTL becomes less attractive.

the ever-upward spiral of prices in excess of incomes is not good for our society and the future of our children?The government has been implementing anti-BTL measures for years, remind me again what's happened to both house prices and rental prices since they started doing this?We live in a capitalist market economy ruled by supply and demand. You can tinker at the edges to reduce demand but ultimately more people than ever want/need a house and there are not enough of what they want and where they want them to go around.So the only solution left is to increase supply, basically we need to be building loads more houses in the areas that people want them. However even this isn't a magic bullet as it's not just house prices that have risen but similarly labour and materials are much higher now than they used to be so these mass-produced new houses are probably not going to be as cheap as some people might like; the eternal HPC dream of half-price houses is just never going to happen. If we discourage investors (returns), it will bring down demand for housing whilst freeing up supply to buy and thereby bring prices down.Let's say your cunning plan works and you do a better job than the government of getting rid of BTL properties... where will all those people who want or need to rent live?Wow, in less than 24 hours you've gone from discouraging BTL completely to now incentivising BTL but on "not in use" property... that's a quicker U-turn than even the government of the day can manage!

If we discourage investors (returns), it will bring down demand for housing whilst freeing up supply to buy and thereby bring prices down.Let's say your cunning plan works and you do a better job than the government of getting rid of BTL properties... where will all those people who want or need to rent live?Wow, in less than 24 hours you've gone from discouraging BTL completely to now incentivising BTL but on "not in use" property... that's a quicker U-turn than even the government of the day can manage! There are a couple of reasons why your new cunning plan won't work...The issue regarding "not in use" properties isn't because people don't want to buy them, it's down to sellers not wanting to sell them for whatever reason; so tax incentives to buy them will have practically no effect.The fundamental flaw though is that if a BTL investor does buy an incentivised empty property then as soon as it's back in use and being rented the investor is hit with all the other anti-BTL rules and regulations that have been imposed in recent years. I.e. the very reason that so many landlords are getting out of BTL in the first place and why renting for tenants is getting harder and more expensive as every year goes by.

There are a couple of reasons why your new cunning plan won't work...The issue regarding "not in use" properties isn't because people don't want to buy them, it's down to sellers not wanting to sell them for whatever reason; so tax incentives to buy them will have practically no effect.The fundamental flaw though is that if a BTL investor does buy an incentivised empty property then as soon as it's back in use and being rented the investor is hit with all the other anti-BTL rules and regulations that have been imposed in recent years. I.e. the very reason that so many landlords are getting out of BTL in the first place and why renting for tenants is getting harder and more expensive as every year goes by.

1. Cap leverage to reduce returns to BTL investors freeing up housing for owner-occupiers

2. Reduce stamp duty on properties not in use and brought into use by BTL on otherwise not in use properties, to increase returns to BTL investors.As previously stated both suggestions are fundamentally flawed!1) By "freeing up" housing for owner-occupiers you're just reducing the availability of housing for renters so you've gained an owner-occupier house but lost a rental house, what's the benefit to the housing market of that?!?!2) Properties "not in use" are generally always also "not for sale" so incentivising buyers is pointless and as @MeteredOut pointed out would probably just result in sellers knowing you could now afford to pay an extra 3% anyway since you no longer have to pay stamp duty!

2. Not sure where you've got your information from about "generally always"? And you seem conflicted between whether such houses would be for sale or would not be for sale.

1

1 -

They said that about commercial property, but it still failed due to the unexpected "psychology" of the masses towards working in an office again after Covid, that took most people by surprise I think? If the psychology/sentiment changes they can`t save it.lojo1000 said:

Yes, completely agree the Fed drives global asset flows and risk tolerance.Hoenir said:Over time markets will naturally self correct. Suspect this is now one of those occasions. Normal interest rates are still filtering through to the real economy. The BOE will react soon enough if the underlying data suggests undue stress and a disorderly market as a result.

Meanwhile all eyes remaon on the US Fed. The impact of their actions cannot be underestimated in terms of global monetary flows. A high % of UK mortgages being funded from overseas.

But would a market correction be a "disorderly market"? If you mean panic selling then, agreed. But the market should be left to find its own price. The reason why house prices are 5x incomes is because the govt/central banks keep it alive. It is too big to fail.0 -

Some people are off work on long term sick, but the participation rate shows that many people have simply disengaged with the world of work. We also have a lot more people off work with conditions that would not remove people from the workforce in other comparable countries. Highest rate of non-specific lower back problems in Europe, more people off with stress and anxiety etc. Whilst we also have lower benefits overall most European countries tend to have higher benefits in the short term but lower long term, making it much harder to choose to not work in Europe vs the UK.Strummer22 said:Too many people are out of work long-term due to sickness. If the NHS was functioning it seems likely that the workforce would be larger and the jobs market not so tight.

The other problem with the UK is skills, many people feel they are entitled to higher paying jobs despite having very few transferable skills, people seem reluctant to retrain and upskill and outside of a few sectors continuous improvement is an utterly alien concept. We have a need for medium and high skilled workers but the ones out of work are low skilled and unwilling or unable to learn the skills required.2 -

That is too general a statement, you can`t know what training most people are or are not willing to undertake?MattMattMattUK said:

Some people are off work on long term sick, but the participation rate shows that many people have simply disengaged with the world of work. We also have a lot more people off work with conditions that would not remove people from the workforce in other comparable countries. Highest rate of non-specific lower back problems in Europe, more people off with stress and anxiety etc. Whilst we also have lower benefits overall most European countries tend to have higher benefits in the short term but lower long term, making it much harder to choose to not work in Europe vs the UK.Strummer22 said:Too many people are out of work long-term due to sickness. If the NHS was functioning it seems likely that the workforce would be larger and the jobs market not so tight.

The other problem with the UK is skills, many people feel they are entitled to higher paying jobs despite having very few transferable skills, people seem reluctant to retrain and unskill and outside of a few sectors continuous improvement is an utterly alien concept. We have a need for medium and high skilled workers but the ones out of work are low skilled and unwilling or unable to learn the skills required.1 -

The jobs market shows a lot of medium and highly skilled jobs available, the jobs market also shows a lot of unemployed and economically inactive people, surveys show people wanting higher paid jobs. Data also shows very few people learning new skills, obtaining new qualifications or retraining. The evidence that people are not willing to upskill or retrain is in their actions.ReadySteadyPop said:

That is too general a statement, you can`t know what training most people are or are not willing to undertake?MattMattMattUK said:

Some people are off work on long term sick, but the participation rate shows that many people have simply disengaged with the world of work. We also have a lot more people off work with conditions that would not remove people from the workforce in other comparable countries. Highest rate of non-specific lower back problems in Europe, more people off with stress and anxiety etc. Whilst we also have lower benefits overall most European countries tend to have higher benefits in the short term but lower long term, making it much harder to choose to not work in Europe vs the UK.Strummer22 said:Too many people are out of work long-term due to sickness. If the NHS was functioning it seems likely that the workforce would be larger and the jobs market not so tight.

The other problem with the UK is skills, many people feel they are entitled to higher paying jobs despite having very few transferable skills, people seem reluctant to retrain and unskill and outside of a few sectors continuous improvement is an utterly alien concept. We have a need for medium and high skilled workers but the ones out of work are low skilled and unwilling or unable to learn the skills required.3 -

CRE collapse looked like it was going to bring down the regional banks in Q1 2023 but the Fed stepped in and lent money in unlimited amounts with sub-par collateral taken at 100%.ReadySteadyPop said:

They said that about commercial property, but it still failed due to the unexpected "psychology" of the masses towards working in an office again after Covid, that took most people by surprise I think? If the psychology/sentiment changes they can`t save it.lojo1000 said:

Yes, completely agree the Fed drives global asset flows and risk tolerance.Hoenir said:Over time markets will naturally self correct. Suspect this is now one of those occasions. Normal interest rates are still filtering through to the real economy. The BOE will react soon enough if the underlying data suggests undue stress and a disorderly market as a result.

Meanwhile all eyes remaon on the US Fed. The impact of their actions cannot be underestimated in terms of global monetary flows. A high % of UK mortgages being funded from overseas.

But would a market correction be a "disorderly market"? If you mean panic selling then, agreed. But the market should be left to find its own price. The reason why house prices are 5x incomes is because the govt/central banks keep it alive. It is too big to fail.

What does this do to the value of the USD? And you wonder why asset prices are rising!To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

Regional banks are far from being out of the woods as recent news has shown. Unwinding is going to take a long time. Over a decade of cheap money supply has left many challenges to be resolved.lojo1000 said:

CRE collapse looked like it was going to bring down the regional banks in Q1 2023 but the Fed stepped in and lent money in unlimited amounts with sub-par collateral taken at 100%.ReadySteadyPop said:

They said that about commercial property, but it still failed due to the unexpected "psychology" of the masses towards working in an office again after Covid, that took most people by surprise I think? If the psychology/sentiment changes they can`t save it.lojo1000 said:

Yes, completely agree the Fed drives global asset flows and risk tolerance.Hoenir said:Over time markets will naturally self correct. Suspect this is now one of those occasions. Normal interest rates are still filtering through to the real economy. The BOE will react soon enough if the underlying data suggests undue stress and a disorderly market as a result.

Meanwhile all eyes remaon on the US Fed. The impact of their actions cannot be underestimated in terms of global monetary flows. A high % of UK mortgages being funded from overseas.

But would a market correction be a "disorderly market"? If you mean panic selling then, agreed. But the market should be left to find its own price. The reason why house prices are 5x incomes is because the govt/central banks keep it alive. It is too big to fail.

What does this do to the value of the USD? And you wonder why asset prices are rising!0 -

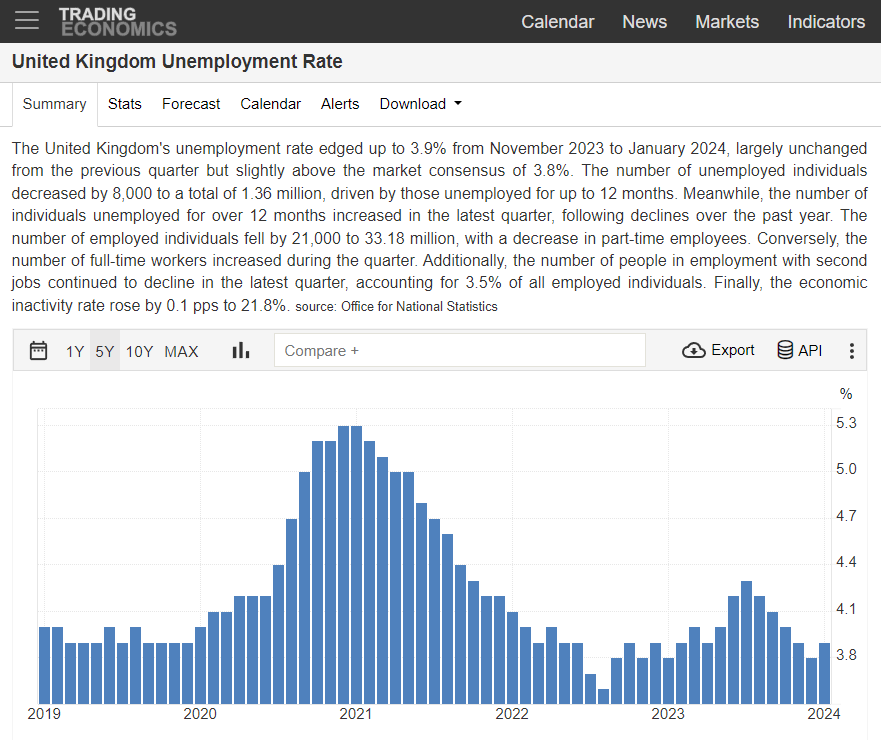

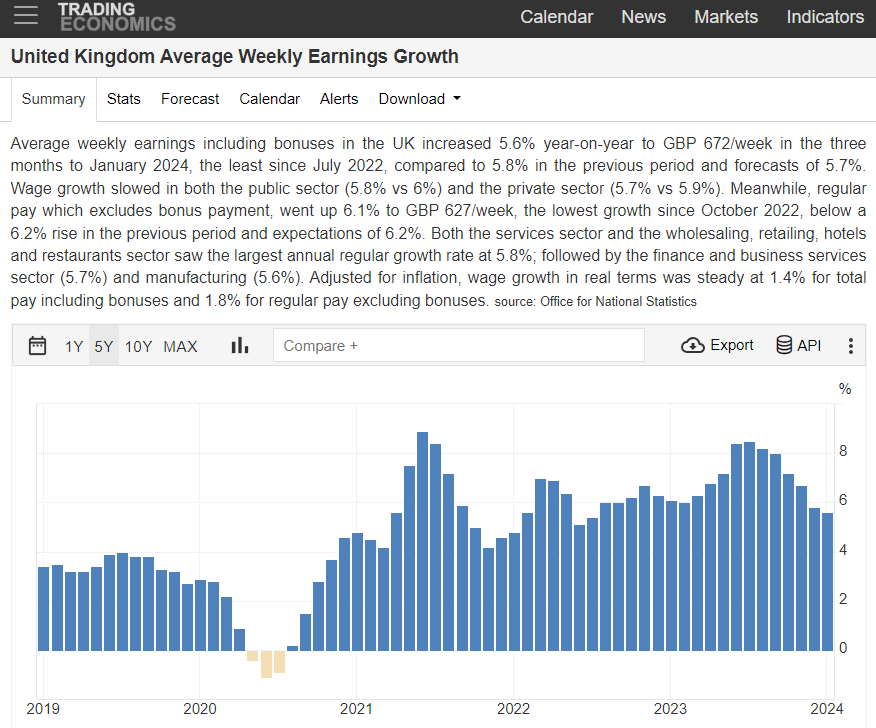

some relief for the BoE today with the employment market loosening mildly as unemployment rate ticks up to 3.9%.

But with average earnings still well above inflation and proving slow to come down, it is unlikely we see an interest rate cut inside 6 months unless the economy falters.

And that is what the bond markets are signaling with a clear 3 cuts some time between 6m and 12m out from here.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards