We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

Likely 5.5%0

-

I'm inclined to agree. There are two sets of monthly GDP, wage growth, and inflation figures due before the next BOE meeting.RelievedSheff said:Anyway back on topic.

Assuming inflation carries on its downwards trend when the latest figures are announced, I predict that there will be one more rate rise at the next BOE meeting to 5.5%.

I don't believe that they will go any higher than that.

Looking at the headline inflation rate, the forecast month-on-month (MoM) is 0.1%, same as last month. However, for the next three updates the values being replaced aren't that high, at 0.6%, 0.5%, and 0.5%. Therefore, falls in headline inflation over the next few months will be modest unless we actually get a month or two of deflation. I would hope that the BoE is smart enough to slow or pause interest rate rises if MoM inflation remains 0.1-0.3%, as if this is the case annualised headline rate will drop fairly slowly across the next 3 months.

There is then a 2.0% MoM dropping out in October due to the energy price increase in October 2022. So by November headline inflation should be much lower, potentially below the 5% gov target for the end of the year.

Turning to core inflation, the highest MoM increases in the last year were Feb - Apr 2023. While these are still in the annual figures, the annualised core inflation rate will probably look a bit scary. Again, the MoM figures will be more telling. Last month was 0.2% and 0.2% is forecast again for next week's update. We will soon see how accurate that forecast is.0 -

If I had to guess, I would say up to 5.5% on 21/09 followed by the change in inflation rates slowing (for a few reasons, including the effect of public sector pay rise implementation) and in response the BoE raises interest rates to 5.75% as their peak on 02/11. I think in December, with the pain of energy prices brought back to the forefront as the heating comes on, with purses strained to their absolute limits, increasingly reduced spending will accelerate bringing prices down and in response the BoE will reduce the rate to 5.5% in their last meeting of the year.

All speculation of course Know what you don't0

Know what you don't0 -

Can't see them doing such an immediate about course - makes them look stupidExodi said:If I had to guess, I would say up to 5.5% on 21/09 followed by the change in interest rates slowing (for a few reasons, including the effect of public sector pay rise implementation) and in response the BoE raises interest rates to 5.75% as their peak on 02/11. I think in December, with the pain of energy prices brought back to the forefront as the heating comes on, with purses strained to their absolute limits, increasingly reduced spending will accelerate bringing prices down and in response the BoE will reduce the rate to 5.5% in their last meeting of the year.

All speculation of course

Not sure if we will see 5.5% next meeting - probably 70 - 30 odds on but then I don't think it will go any higher. I think they will be looking at core and wages/unemployment more than headline. Food and energy are still at risk of upsides from global markets.I think....0 -

Can easily see 7% now, Japan, China, Russia all present the potential for massive volatility in credit markets, for different reasons.0

-

Sure 7% is possible, but do you think that's the likely in the next year, or more at the upper end of the likely range?Sarah1Mitty2 said:Can easily see 7% now, Japan, China, Russia all present the potential for massive volatility in credit markets, for different reasons.0 -

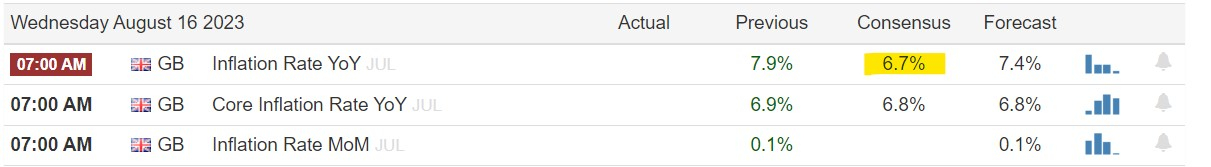

This doesn't seem right, does it?

0 -

Since I took that screenshot, TE has updated the forecast value to 6.9% and MoM to -0.3%.

So assuming a negative MoM figure is correct, when the BBC reports (as they have every month) that inflation falling does not mean prices are falling, just rising less slowly, they will be wrong. Prices in July will have been very slightly lower than in June.0 -

Interesting……

The FTSE 100 has slumped amid concerns that the Bank of England will be forced to raise interest rates higher.

The UK’s blue chip index has fallen 1.2pc after data showed the British economy expanded by 0.2pc in the three months to June - faster than the zero growth predicted by economists.

Meanwhile, the yield on 10-year UK government bonds has risen 10 basis points to 4.46pc amid worries that employers will be able to give staff pay rises, potentially fuelling inflation, which remains nearly four times the Bank of England’s 2pc target at 7.9pc.

Money markets predict there is an 86pc chance that interest rates will move higher in September but have raised bets that the Monetary Policy Committee will keep them around 5.5pc for longer - with traders forecasting a 5.75pc terminal rate by March.

0 -

I wouldn`t put it at the upper end of the likely range now, more like very easily reached if the effects from the countries I mentioned materialise, China is in the spotlight today on financial news for example.Strummer22 said:

Sure 7% is possible, but do you think that's the likely in the next year, or more at the upper end of the likely range?Sarah1Mitty2 said:Can easily see 7% now, Japan, China, Russia all present the potential for massive volatility in credit markets, for different reasons.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards