We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

Sg28 said:Mortgage payments aren't included in CPI inflation. Which is the measure the boe uses.

Plus if people have to pay more in mortgage interest then it reduces disposable income and reduces demand in the wider economy. So "should" help to reduce inflation.This is why Governments prefer CPI over RPI, RPI is now 11.3%

1 -

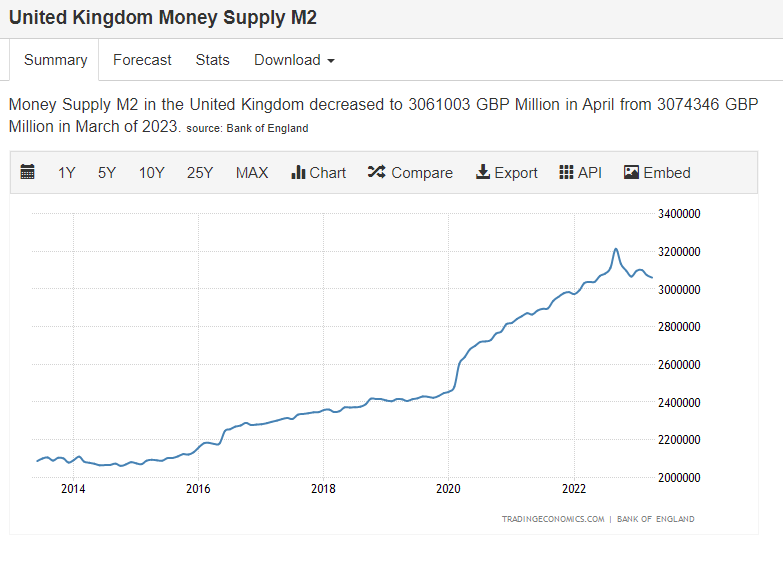

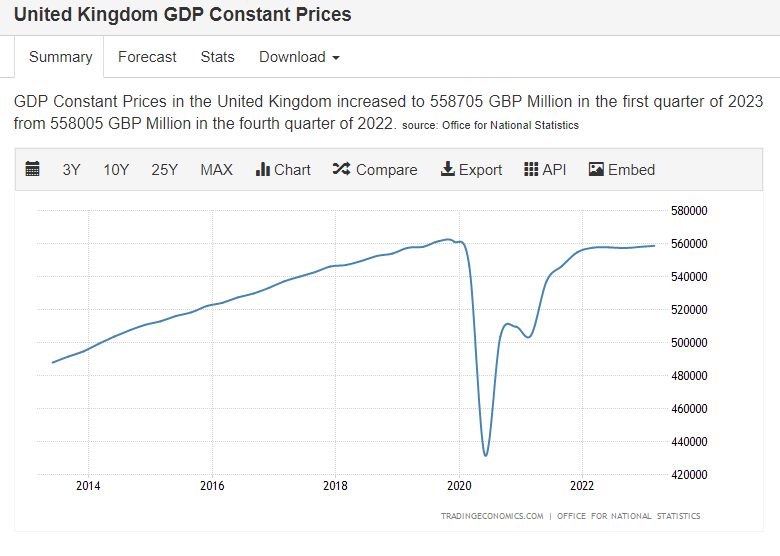

Please consider the charts below. It shows money (demand) in the economy (chart 1) and GDP at constant prices (i.e. volume/supply) in the economy (chart 2).Myrrdinthemage said:If the aim is to reduce inflation, given that inflation is supply side, not demand side (and therefore the solution should be to lower rates to cause investment in energy efficiency /productivity increase) or driven by Brexit than raising interest rates isn't going to work (as we're already seeing) If they don't realise this, they're going to keep putting rates up - so they will go much higher than predicted (unless someone can talk some sense into government/BoE)

There was a supply vs demand issue in 2020-2021 as supply fell but demand actually rose sharply (govt handouts plus easy monetary policy led to excess debt). This ignited inflation. Too much money chasing too few goods.

But since 2022, supply has recovered (sharply) to pre-covid levels (and is now flatlining) but demand continued to rise and is only now falling.

The issue, on a macro level, is always supply vs demand.

As the higher bank rates take effect, demand is falling. It has had some effect on inflation and will likely continue to have a downward effect.

The challenge for the BoE is knowing where supply is going next. It looks like it will continue to go sideways.

So perhaps the BoE should stop raising rates. But also if inflation overshoots to the downside, don't cut them in another panic and start the same merry-go-round all over again. They always just react to media attention which is often years behind what is actually going on.

Raising supply is within the govts remit but is v. difficult to influence on any short term basis.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

Suppose we see a 20% correction in house prices but mortgage rates have doubled - hopefully you can do the maths to see that housing costs are actually higher not lower.Sarah1Mitty2 said:

Existing mortgages are only a small part of it, comment today on bbc politics show said that there are not enough people with "problematic" (i.e overborrowed) mortgages for this interest rate approach to work, people who are comfortable with their mortgage or have no mortgage are still spending, so why keep raising? A few answers come to mindSg28 said:

Mortgage payments aren't included in CPI inflation. Which is the measure the boe uses.wheldcj said:Slightly off topic but Sunak keeps saying that mortgage support isn't sensible and the plan has to be to reduce inflation. However wont the current and continued increase in mortgage payments fuel inflation? Or do none of the factors we use to measure our inflation include mortgage/rent in the basket?

Plus if people have to pay more in mortgage interest then it reduces disposable income and reduces demand in the wider economy. So "should" help to reduce inflation.

1) Inflation has never been tamed with interest rates below the level of inflation?

2) Higher debt costs prevent companies borrowing to expand and employ more people leading to a slowdown in the economy.

3) Higher cost of borrowing puts the brakes on people taking out NEW mortgages and lowers the cost of housing (people`s biggest COL outlay)

Any more?I think....2 -

I can't see what all the fuss is about, as far as inflation is concerned I control my own. I'm no worse off now than 2 years ago.

I'm 82 and live alone on the state pension plus 2 tiny private pensions that have been eaten up now my personal allowance has been frozen.

I sold my home and rent a nice modern flat and pay £30 more than I did 4 years ago albeit a 1 bed instead of a 2 bed.

I do all my shopping at Tesco and mostly buy Tesco brand. If something branded I like goes up more than I think it should >10% I stop buying it simple. If enough shoppers did that goods would have to come down or come off the shelves. Producers would soon get the message.

2 years ago I gave half my savings away, decided to give my 2 kids and 4 grandkids £10,000 each for Christmas as I didn't need it for the years I have left.

I have some savings that now help but I have no debts and drive a Jaguar. I do everything I want to do.

I have everything I need and nothing I don't

I live in a fairly rich town population 17,000, full of cafes for the older generation and a number of pubs, they are all heaving with mostly the young. I wonder where the cost of living crisis is.

My granddaughter and partner bought a new build in October 2021 £270,000 low deposit on a low rate of interest and 2 year fix, thats gone up about £250 a month so he does extra shifts, they never seem short of money.

There's been a couple of festivals on the park round the corner, sold out in advance. I guess Glastonbury was too even at those prices.

From my perspective prices go up because people are willing to pay. House prices are high partly because of government intervention. Help to buy and zero stamp duty. Obvious to me if the government reduces the normal price of a new build the builder will increase the price.

Everyone makes their own choices.

5 -

If mortgage rates doubled from here the correction would be nearer 60%, but the less debt you start with the more protected you are against interest rate swings and the easier it is to overpay and make a difference to your debt, so it makes sense for the purchase price to be as low as possible.michaels said:

Suppose we see a 20% correction in house prices but mortgage rates have doubled - hopefully you can do the maths to see that housing costs are actually higher not lower.Sarah1Mitty2 said:

Existing mortgages are only a small part of it, comment today on bbc politics show said that there are not enough people with "problematic" (i.e overborrowed) mortgages for this interest rate approach to work, people who are comfortable with their mortgage or have no mortgage are still spending, so why keep raising? A few answers come to mindSg28 said:

Mortgage payments aren't included in CPI inflation. Which is the measure the boe uses.wheldcj said:Slightly off topic but Sunak keeps saying that mortgage support isn't sensible and the plan has to be to reduce inflation. However wont the current and continued increase in mortgage payments fuel inflation? Or do none of the factors we use to measure our inflation include mortgage/rent in the basket?

Plus if people have to pay more in mortgage interest then it reduces disposable income and reduces demand in the wider economy. So "should" help to reduce inflation.

1) Inflation has never been tamed with interest rates below the level of inflation?

2) Higher debt costs prevent companies borrowing to expand and employ more people leading to a slowdown in the economy.

3) Higher cost of borrowing puts the brakes on people taking out NEW mortgages and lowers the cost of housing (people`s biggest COL outlay)

Any more?1 -

You are controlling your spending not your inflation. If you were already buying a limited selection of groceries from budget brands 12-18 months ago you don't have the same ability to opt out and have to accept the inflation.MikeJXE said:I can't see what all the fuss is about, as far as inflation is concerned I control my own. I'm no worse off now than 2 years ago.

I'm 82 and live alone on the state pension plus 2 tiny private pensions that have been eaten up now my personal allowance has been frozen.

I sold my home and rent a nice modern flat and pay £30 more than I did 4 years ago albeit a 1 bed instead of a 2 bed.

I do all my shopping at Tesco and mostly buy Tesco brand. If something branded I like goes up more than I think it should >10% I stop buying it simple. If enough shoppers did that goods would have to come down or come off the shelves. Producers would soon get the message.

2 years ago I gave half my savings away, decided to give my 2 kids and 4 grandkids £10,000 each for Christmas as I didn't need it for the years I have left.

I have some savings that now help but I have no debts and drive a Jaguar. I do everything I want to do.

I have everything I need and nothing I don't

I live in a fairly rich town population 17,000, full of cafes for the older generation and a number of pubs, they are all heaving with mostly the young. I wonder where the cost of living crisis is.

My granddaughter and partner bought a new build in October 2021 £270,000 low deposit on a low rate of interest and 2 year fix, thats gone up about £250 a month so he does extra shifts, they never seem short of money.

There's been a couple of festivals on the park round the corner, sold out in advance. I guess Glastonbury was too even at those prices.

From my perspective prices go up because people are willing to pay. House prices are high partly because of government intervention. Help to buy and zero stamp duty. Obvious to me if the government reduces the normal price of a new build the builder will increase the price.

Everyone makes their own choices.

2 -

I stooze my mortgage, should earn me about 3k next year that I wouldn't have had I paid it off. Normally when house prices fall even by a few percent volume dries up. Given the recent run up in prices mortgage companies can mostly risk forbearing as there is sufficient equity and so far employment remains strong. There are not going to be forced sellers so the market will gum up again and it is first time buyers who will be hit due to lack of supply (plus no better affordability due to the higher rates and increased deposit requirements and tighter underwriting criteria).Sarah1Mitty2 said:

If mortgage rates doubled from here the correction would be nearer 60%, but the less debt you start with the more protected you are against interest rate swings and the easier it is to overpay and make a difference to your debt, so it makes sense for the purchase price to be as low as possible.michaels said:

Suppose we see a 20% correction in house prices but mortgage rates have doubled - hopefully you can do the maths to see that housing costs are actually higher not lower.Sarah1Mitty2 said:

Existing mortgages are only a small part of it, comment today on bbc politics show said that there are not enough people with "problematic" (i.e overborrowed) mortgages for this interest rate approach to work, people who are comfortable with their mortgage or have no mortgage are still spending, so why keep raising? A few answers come to mindSg28 said:

Mortgage payments aren't included in CPI inflation. Which is the measure the boe uses.wheldcj said:Slightly off topic but Sunak keeps saying that mortgage support isn't sensible and the plan has to be to reduce inflation. However wont the current and continued increase in mortgage payments fuel inflation? Or do none of the factors we use to measure our inflation include mortgage/rent in the basket?

Plus if people have to pay more in mortgage interest then it reduces disposable income and reduces demand in the wider economy. So "should" help to reduce inflation.

1) Inflation has never been tamed with interest rates below the level of inflation?

2) Higher debt costs prevent companies borrowing to expand and employ more people leading to a slowdown in the economy.

3) Higher cost of borrowing puts the brakes on people taking out NEW mortgages and lowers the cost of housing (people`s biggest COL outlay)

Any more?

Prices will drift down in nominal terms which is actually a proper correction in real terms but no '50% off by xmas' unless we get a proper pandemic which decimates the population, otherwise we continue with more people than homes and thus the need to drop whatever disposable income you do have onto housing to get ahead of all the other would be buyers.I think....1 -

House prices have fallen significantly. People just haven't noticed because of not that great numeracy and the increasing burden of mortgages.poppy10_2 said:

People keep trotting out that line, but it's simply not borne out by the facts. Core inflation (stripping out energy and food) is the highest it has been for over 30 years, led by massive rises in recreation and leisure, hospitality and discretionary spending.Myrrdinthemage said:inflation is supply side, not demand side (and therefore the solution should be to lower rates to cause investment

The data shows that retail sales remain high. Car sales on finance remain high. House prices remain high. Pubs and restaurants are packed. Builders and tradespeople are booked up months in advance as everyone gets home improvements and extensions done. There is massive demand out there. It needs to be dampened down for inflation to call

If a house worth £277k in April 2022 is worth £286k in April 2033 (3.5% increase) it may look as if house prices have increased. However it's actually a 5.2% decrease when you consider inflation (April CPI 8.7%). That house needs to be worth £301k in April 2023's money - just to stay level.

1 -

How can you know this ahead of the event? The people who will suffer the most are people with big mortgage debts, FTB will just stay where they are if the market "gums up".michaels said:

I stooze my mortgage, should earn me about 3k next year that I wouldn't have had I paid it off. Normally when house prices fall even by a few percent volume dries up. Given the recent run up in prices mortgage companies can mostly risk forbearing as there is sufficient equity and so far employment remains strong. There are not going to be forced sellers so the market will gum up again and it is first time buyers who will be hit due to lack of supply (plus no better affordability due to the higher rates and increased deposit requirements and tighter underwriting criteria).Sarah1Mitty2 said:

If mortgage rates doubled from here the correction would be nearer 60%, but the less debt you start with the more protected you are against interest rate swings and the easier it is to overpay and make a difference to your debt, so it makes sense for the purchase price to be as low as possible.michaels said:

Suppose we see a 20% correction in house prices but mortgage rates have doubled - hopefully you can do the maths to see that housing costs are actually higher not lower.Sarah1Mitty2 said:

Existing mortgages are only a small part of it, comment today on bbc politics show said that there are not enough people with "problematic" (i.e overborrowed) mortgages for this interest rate approach to work, people who are comfortable with their mortgage or have no mortgage are still spending, so why keep raising? A few answers come to mindSg28 said:

Mortgage payments aren't included in CPI inflation. Which is the measure the boe uses.wheldcj said:Slightly off topic but Sunak keeps saying that mortgage support isn't sensible and the plan has to be to reduce inflation. However wont the current and continued increase in mortgage payments fuel inflation? Or do none of the factors we use to measure our inflation include mortgage/rent in the basket?

Plus if people have to pay more in mortgage interest then it reduces disposable income and reduces demand in the wider economy. So "should" help to reduce inflation.

1) Inflation has never been tamed with interest rates below the level of inflation?

2) Higher debt costs prevent companies borrowing to expand and employ more people leading to a slowdown in the economy.

3) Higher cost of borrowing puts the brakes on people taking out NEW mortgages and lowers the cost of housing (people`s biggest COL outlay)

Any more?

Prices will drift down in nominal terms which is actually a proper correction in real terms but no '50% off by xmas' unless we get a proper pandemic which decimates the population, otherwise we continue with more people than homes and thus the need to drop whatever disposable income you do have onto housing to get ahead of all the other would be buyers.0 -

That calculation is only true if wages are rising in line with inflation.Seraphi said:

House prices have fallen significantly. People just haven't noticed because of not that great numeracy and the increasing burden of mortgages.poppy10_2 said:

People keep trotting out that line, but it's simply not borne out by the facts. Core inflation (stripping out energy and food) is the highest it has been for over 30 years, led by massive rises in recreation and leisure, hospitality and discretionary spending.Myrrdinthemage said:inflation is supply side, not demand side (and therefore the solution should be to lower rates to cause investment

The data shows that retail sales remain high. Car sales on finance remain high. House prices remain high. Pubs and restaurants are packed. Builders and tradespeople are booked up months in advance as everyone gets home improvements and extensions done. There is massive demand out there. It needs to be dampened down for inflation to call

If a house worth £277k in April 2022 is worth £286k in April 2033 (3.5% increase) it may look as if house prices have increased. However it's actually a 5.2% decrease when you consider inflation (April CPI 8.7%). That house needs to be worth £301k in April 2023's money - just to stay level.

As it is, wage rises have been well under the rate of inflation. So house prices have become more expensive relative to wages. Yes they might be cheaper to an international investor who is converting from dollars to sterling but that doesn't apply to the majority of purchasers, who have seen their value of their salaries eroded by inflation more than house prices have been eroded by inflation. Thus making that house more expensive in real terms for them to buy.poppy103

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards