I am a Mortgage Adviser

You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Erroneously charged via direct debit by old mortgage provider after remortgage

northernmonk

Posts: 2 Newbie

Hi,

We have recently remortgaged after out fix came to an end, with the full mortgage from our old provider being fully repaid with no exit fees. However the day after remortgaging our old mortgage provider have charged us as if nothing has changed and as if we were still paying off the old mortgage. Worst still this is a significantly higher repayment than our previous ones due to the big hike in interest you get given when a fix ends. This combined with our new repayment from our new lender means this month we have had to pay around 3x the amount we did last month.

We have spoken to our old lender (TSB) and they have admitted it was a mistake but have said that it will take two weeks to return the money to us. While it is good that we are getting the money back, we have had to go into our savings to cover it and there is no offer of interest or compensation from TSB. I have contacted a mortgage broker and apparently this is quite common(!)

I can't believe this is legit - as the this means banks can just take free loans from their customers whenever they want and claim it was a mistake. Has anyone heard of this before or had any luck getting compensation?

Thanks!

Gareth

We have recently remortgaged after out fix came to an end, with the full mortgage from our old provider being fully repaid with no exit fees. However the day after remortgaging our old mortgage provider have charged us as if nothing has changed and as if we were still paying off the old mortgage. Worst still this is a significantly higher repayment than our previous ones due to the big hike in interest you get given when a fix ends. This combined with our new repayment from our new lender means this month we have had to pay around 3x the amount we did last month.

We have spoken to our old lender (TSB) and they have admitted it was a mistake but have said that it will take two weeks to return the money to us. While it is good that we are getting the money back, we have had to go into our savings to cover it and there is no offer of interest or compensation from TSB. I have contacted a mortgage broker and apparently this is quite common(!)

I can't believe this is legit - as the this means banks can just take free loans from their customers whenever they want and claim it was a mistake. Has anyone heard of this before or had any luck getting compensation?

Thanks!

Gareth

0

Comments

-

Yes, it's commonplace, as it takes a bit of time for the redemption amount to actually clear your mortgage account, and in any event the direct debits are requested in advance of their payment date - your remortgage probably hadn't completed at the time. Ideally somebody should have warned you that these things often overlap, but I wouldn't say your old lender has done anything wrong.

How much interest does x days' investment of a month's mortgage payment amount to anyway? Hardly worth claiming "compensation" for.2 -

Completely standard practice. There is another thread running now about exactly the same thing.

You will get your money back, you just need to wait for it.1 -

I can't believe this is legit - as the this means banks can just take free loans from their customers whenever they want and claim it was a mistake. Has anyone heard of this before or had any luck getting compensation?It is quite normal and been like this for generations. Indeed, mortgage providers warn this can happen in their redemption letter.

There is nothing to compensate. It isnt a mistake. TSB were just humouring you or the person didnt really know what they were talking about. Its just how it works.

The banks cant take money from your bank whenever they want. You agreed a direct debit with them and you didnt cancel it.However the day after remortgaging our old mortgage provider have charged us as if nothing has changed and as if we were still paying off the old mortgage.

Direct debit requests are submitted upto three weeks in advance. So, that DD was already in the system. If you had cancelled the direct debit, it would have been returned unpaid with reason "mandate cancelled". But as you didnt cancel the direct debit, you will have to wait around 8 days for it to be automatically returned.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

I literally posted the same message on this topic today:

https://forums.moneysavingexpert.com/discussion/6409026/halifax-still-charging-me-for-a-mortgage-that-has-been-paid-off

Seem's like a common issue that banks should make customers more aware of. I for one am still considering taking my complaint further.

0 -

or just do a direct debit indemnity claim if you dont want to wait for it to be returned?1

-

You lender will have provided you with a copy of the direct debit paperwork you were provided with when you took out the mortgage.qwerty987 said:I literally posted the same message on this topic today:

https://forums.moneysavingexpert.com/discussion/6409026/halifax-still-charging-me-for-a-mortgage-that-has-been-paid-off

Seem's like a common issue that banks should make customers more aware of. I for one am still considering taking my complaint further.

You can not blame your lender for you not reading the documentation they provided you with!0 -

They have to put you in the position you would have been had the mistake not happened.

So if you had been charged they would put that right. If you have lost interest, they will cover it.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

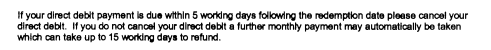

here you go. I just looked at a redemption letter from a lender. They are pretty similar across the board:

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

Funny how threads go quiet when the actual problem was the person didn't read the letter that was sent to them telling them what to do.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards