We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

CGT: exemption reduction next year and 2024

TMSG

Posts: 236 Forumite

in Cutting tax

So far, I've never really needed to look into CGT as any gains were below the exemption. Now, with the exemption going down to £6000 next year and to £3000 the following, I am beginning to think about strategies to minimise the tax due. If I have £50k in some bond with £10k in gains, I'd have to pay CGT if I sell it in one go. So the idea would be to sell only a part of an investment per one tax year such that the gain is just below £6000 (or £3000 later) and do the same the following year.

However, under the 30-day rule I'd want to wait 31 days to buy back the same investment. I am free though to buy another investment immediately afterwards. The question now is what counts as "different"? Say I hold two very similar, long-running gilts (or bonds) A and B (but different investments with different ISINs). If I sell a part of A and buy B for the proceeds is that OK under those rules? And perhaps do the same next year, just in reverse?

Any other ideas as to how I can make good use of the yearly CGT exemption are very welcome indeed!

However, under the 30-day rule I'd want to wait 31 days to buy back the same investment. I am free though to buy another investment immediately afterwards. The question now is what counts as "different"? Say I hold two very similar, long-running gilts (or bonds) A and B (but different investments with different ISINs). If I sell a part of A and buy B for the proceeds is that OK under those rules? And perhaps do the same next year, just in reverse?

Any other ideas as to how I can make good use of the yearly CGT exemption are very welcome indeed!

0

Comments

-

What kind of gilts and bonds are they? I was under the impression that gilts are generally exempt from CGT.0

-

So are most corporate bonds if in UK companies.0

-

Possibly confusing capital gains and chargeable events (gains)?Jeremy535897 said:So are most corporate bonds if in UK companies.0 -

It crossed my mind, yes, although the usual term "investment bond" was not in the OP.[Deleted User] said:

Possibly confusing capital gains and chargeable events (gains)?Jeremy535897 said:So are most corporate bonds if in UK companies.0 -

Hm... I tried to keep it simple and oversimplified

. The bonds in questions are not real gov.uk gilts (yeah, that was rash) but Irish gov Euro bonds and gains on these are almost certainly not tax free... correct me if I'm wrong?!

. The bonds in questions are not real gov.uk gilts (yeah, that was rash) but Irish gov Euro bonds and gains on these are almost certainly not tax free... correct me if I'm wrong?!

I bought some of those a good while back and now have significant gains on them. I do not need to sell any of these ATM but then again I don't want to have to sell them sometime in the future and then possibly run into a big CGT bill if I can somehow "distribute" those gains beforehand over some years and w/o too much loss.

Sorry for the confusion.

0 -

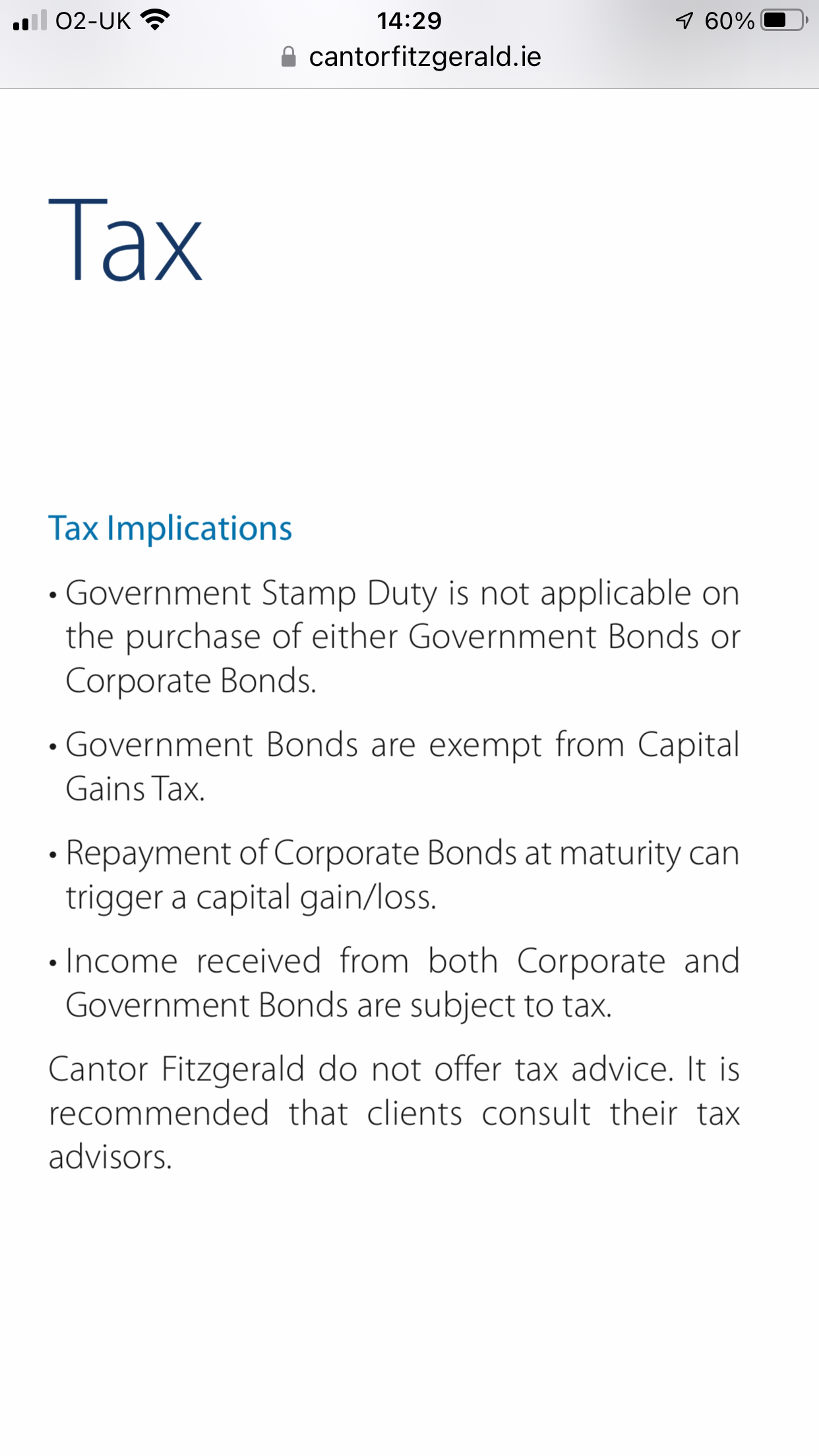

It appears that they are exempt from CGT

https://cantorfitzgerald.ie/wp-content/uploads/2016/11/pdf_bonds_guide.pdf

0 -

It is not my area of expertise, but I would note that your post appears to be advising that Irish government bonds are exempt from Irish capital gains tax?

The UK position appears to be that, as Eurobonds are not bonds expressed in sterling, they cannot be qualifying corporate bonds. Nor are they exempt gilts, not being issued by the UK government and therefore not on the relevant list. Consequently they are subject to UK capital gains tax when realised by a UK resident?0 -

Yes - I think they were issued as part of the Irish bank bail out in the financial crisis of 2008 and that rung a bell regarding their tax free status.Jeremy535897 said:It is not my area of expertise, but I would note that your post appears to be advising that Irish government bonds are exempt from Irish capital gains tax?

The UK position appears to be that, as Eurobonds are not bonds expressed in sterling, they cannot be qualifying corporate bonds. Nor are they exempt gilts, not being issued by the UK government and therefore not on the relevant list. Consequently they are subject to UK capital gains tax when realised by a UK resident?As to the U.K. position - I will bow to your superior knowledge.0 -

As I said, I am by no means confident of the answer, as it is not my area of expertise, but I cannot see anything that exempts them.0

-

@[Deleted User] Hm... I've read through the PDF you linked (thanks!) and, like @Jeremy535897 I'm under the impression that this is meant for Irish tax payers but not for UK tax payers. I may be wrong though.

OK, let me just assume for the moment that @Jeremy535897 is right and these bonds are indeed not exempt for UK tax payers... would two different bonds with different maturity dates and different ISINs be "different" in the sense I described in my OP? I assume they would... but my intuitive assumptions about tax stuff have often been utterly and totally wrong .

.

(I also have reporting ETFs with a similar setup, ie where I could sell one ETF and buy another one which tracks the same index, so this question is not only related to the bonds.)

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards